© 2026 Followme

AUDJPY

Australian Dollar / Japanese Yen

106.664

-0.087

(-0.08%)

Prices By FOLLOWME , in USD

Statistics

LOW

HIGH

106.630

106.795

1W

-0.63%

1 MO

+2.06%

3 MO

+5.80%

6 MO

+10.20%

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- News fake :wow

- @Alex33 :nice

- Main_Horse5468 :Hello Honey how are you please click on my profile and send me direct message so that we can know each other very well thank you i love you❤️

Best Forex Broker in USA 2022: Top US Forex Brokers List

The foreign exchange market, also known as the Forex market or the FX market, is also one of the global markets that witnesses a trading volume of almost $6.6 trillion every day. Foreign exchange refers to exchanging one currency trading with another for different reasons that include tourism, inter

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

- Important_Rain77 :thank you for being a great fan of mine send me friend request I promise to accept it.........

FOLLOWME Community Trading Report the third quarter of 2020

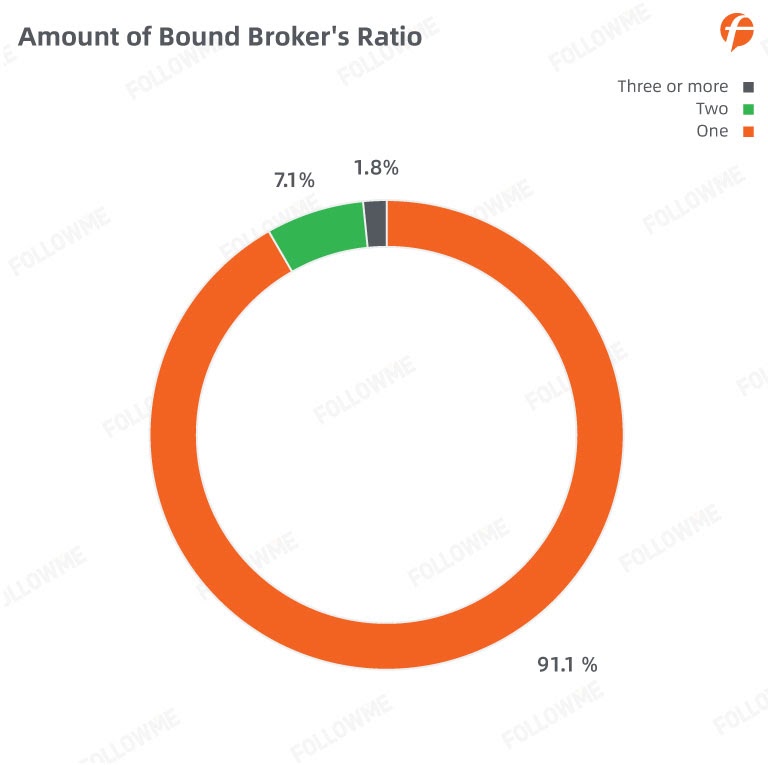

Introduction: Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject li

- LittleRabbit :wow very informative! thanks a lot!

- Tony Stark :wow cool😎

- elleefx :Thanks for the info

- Becky Kate :sharing is caring

Stock Markets Dive Further, But Others Steady

#OPINIONLEADER##OPINIONLEADER# Markets are staying in risk aversion today with heavy selling in stocks. Expectations on the negotiation between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin are low. Meanwhile, other markets are relatively

- AbuSalaam :hi

- 钉子侠 :💪

Trading Safe Haven Assets

#OPINIONLEADER# Where does money flow in times of financial stress and why? Safe haven assets are financial instruments or commodities that investors turn to in times of stress. We’re not talking about personal stress, not in this article, anyway, but the type of stress seen in the wi

- Fernandez Morgan :Invest $100 and earn $8500 weekly with Henriella Geoffrey fxtrade @Instagrám and recover your funds as well

- jesh49 :To Get Professional Trading services with good trading signals, ℭOMMUNℑℭATE. 𝗸𝗮𝘁𝗵𝗿𝘆 on ⒾⓃⓈⓉⒶⒼⓇⒶⓂ 𝗸𝗮𝘁𝗵𝗿𝘆𝗻 𝗰𝗮𝗿𝗹𝘀𝗼𝗻0

- 雄鹿之角 :🍺

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

- ft.con :hi

- ronav52868 :Hello 👋

- hannah barron :This will help a lot of individuals, I saw so many people talking about a young man called Mr Bernie Doran and i kept wondering if he is really an expert trader like they say , then i contacted him an...

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, and more. BUT first, to start off your day with a bang, here's a recap of the important news we think you sho

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

Week Ahead – Big Tech Earnings Eyed

#OPINIONLEADER# Writer: Muhammad Laraib Nasir Experienced trader and freelance writer. US Wall Street will pay close attention to the first look at third-quarter GDP. After two consecutive quarters of negative readings, growth is expected to bounce back into expansion territory with a

- Special_Loyalty6000 :Freelancer are needed for the following project.. *Typing *Writing *Translation *logo design Payment: $2000 Kindly inbox me if you'er interested

Mixed earnings, hawkish Fed, growing pressure on Truss and USD/JPY

Equities give back early-week gains on hawkish Fed talk, and mixed earnings. Netflix soared 13% yesterday, but Tesla lost more than 6% after the bell, after announcing a slight revenue miss in Q3. The UK’s political turmoil gets worse by the day, and the dollar-yen tests the 150 level amid mounting

- febian :nice profit bro

- Average_Attitude3014 :Ich würde gerne mit Ihnen Geschäfte machen.