© 2026 Followme

NZD/USD suy yếu xuống gần 0,5950 do RBNZ giữ nguyên lập trường ôn hòa, trọng tâm chuyển sang dữ liệu kinh tế của Mỹ

Cặp NZD/USD giảm xuống gần 0,5960 trong phiên giao dịch châu Á đầu ngày thứ Sáu. Ông Breman của RBNZ cho biết con đường phía trước gập ghềnh, nhưng lạm phát được dự kiến sẽ trở lại trong phạm vi mục tiêu vào quý 1. Các nhà giao dịch chuẩn bị cho dữ liệu kinh tế quan trọng của Mỹ vào cuối ngày thứ Sá

Breman của RBNZ cho biết con đường sẽ gập ghềnh, lạm phát được dự kiến sẽ trở lại trong khoảng mục tiêu vào quý 1

Thống đốc Ngân hàng Dự trữ New Zealand (RBNZ) Anna Breman cho biết vào thứ Năm rằng con đường đến lạm phát 2% đã gặp nhiều khó khăn, nhưng chúng tôi kỳ vọng lạm phát sẽ quay trở lại trong phạm vi mục tiêu của chúng tôi vào quý đầu tiên của năm nay. Trích dẫn chính Con đường đến lạm phát 2% đã gặp nh

WTI giao dịch gần 66,50$ sau khi giảm từ mức cao nhất trong sáu tháng

WTI đã giảm sau khi chạm mức 66,82$, mức cao nhất trong sáu tháng, giữa lúc căng thẳng cung cấp giữa Mỹ và Iran gia tăng.Tổng thống Trump cảnh báo Iran phải đạt được thỏa thuận hoặc đối mặt với hậu quả quân sự, gây áp lực lên các cuộc đàm phán hạt nhân mong manh.Tồn kho Dầu thô EIA giảm 9,014 triệu

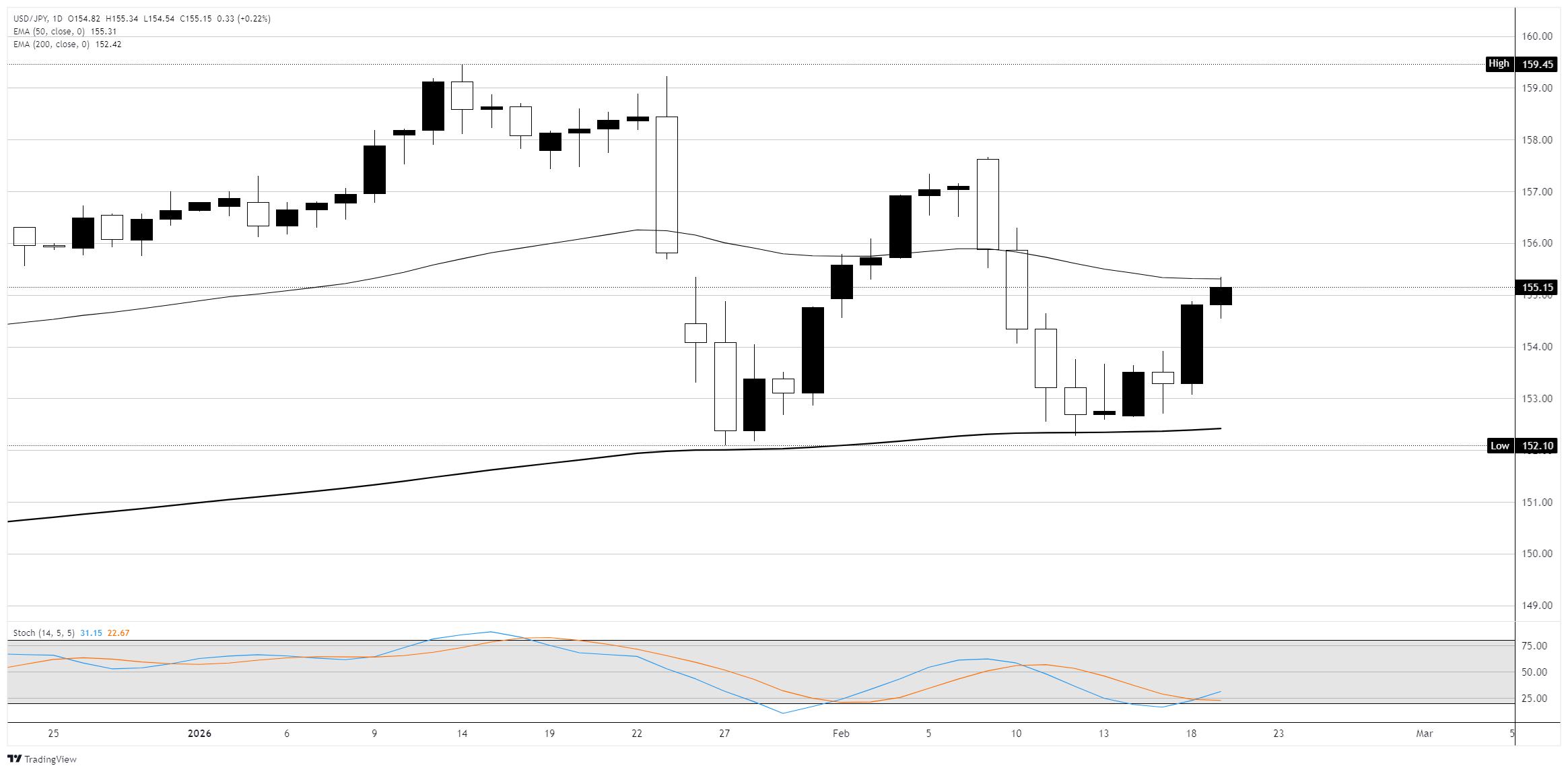

USD/JPY kiểm tra mức 155,00 khi FOMC có lập trường diều hâu gặp kỳ vọng tăng lãi suất của BoJ

Biên bản họp diều hâu của Fed nâng đỡ đồng đô la Mỹ khi chỉ số CPI chính của Nhật Bản giảm xuống 1,5%, làm giảm áp lực lên BoJ.Biên bản cuộc họp FOMC vào thứ Tư đã thể hiện một giọng điệu diều hâu, với một số thành viên cảnh báo rằng không thể loại trừ khả năng tăng lãi suất nếu lạm phát tái gia tốc

NZD/USD vẫn bị kẹt dưới 0,6000 sau khi RBNZ điều chỉnh giá ôn hòa

Đồng đô la New Zealand tiếp tục phải đối mặt với áp lực giảm giá khi RBNZ lùi thời gian tăng lãi suất, mở rộng sự khác biệt với Fed diều hâu.RBNZ đã giữ nguyên OCR ở mức 2,25% vào thứ Tư nhưng đã chuyển thời gian dự kiến cho lần tăng lãi suất đầu tiên sang cuối năm 2026, chậm hơn khoảng 40 điểm cơ b

USD/INR: Giao dịch trong phạm vi sau dữ liệu thương mại Ấn Độ – Commerzbank

Các nhà phân tích của Commerzbank báo cáo rằng thâm hụt thương mại của Ấn Độ trong tháng 1 đã mở rộng mạnh mẽ lên 34,7 tỷ USD, do sự gia tăng 349% trong nhập khẩu vàng khi giá toàn cầu tăng. Các nhà phân tích dự đoán cặp USD/INR sẽ giao dịch trong khoảng 90,00 và 91,00 trong thời gian tới khi dòng v

Forex hôm nay: Đồng đô la Mỹ gần mức cao nhất trong bốn tuần trước thềm công bố dữ liệu PCE lõi, GDP và PMI

Dưới đây là những gì bạn cần biết vào thứ Sáu, ngày 20 tháng 2: Số lượng công dân Hoa Kỳ (Mỹ) nộp đơn xin trợ cấp thất nghiệp mới đã giảm xuống 206K, thấp hơn nhiều so với ước tính ban đầu là 225K, và giảm từ mức 229K đã được điều chỉnh của tuần trước, theo Bộ Lao động Mỹ. Hiện tại, sự chú ý chuyển

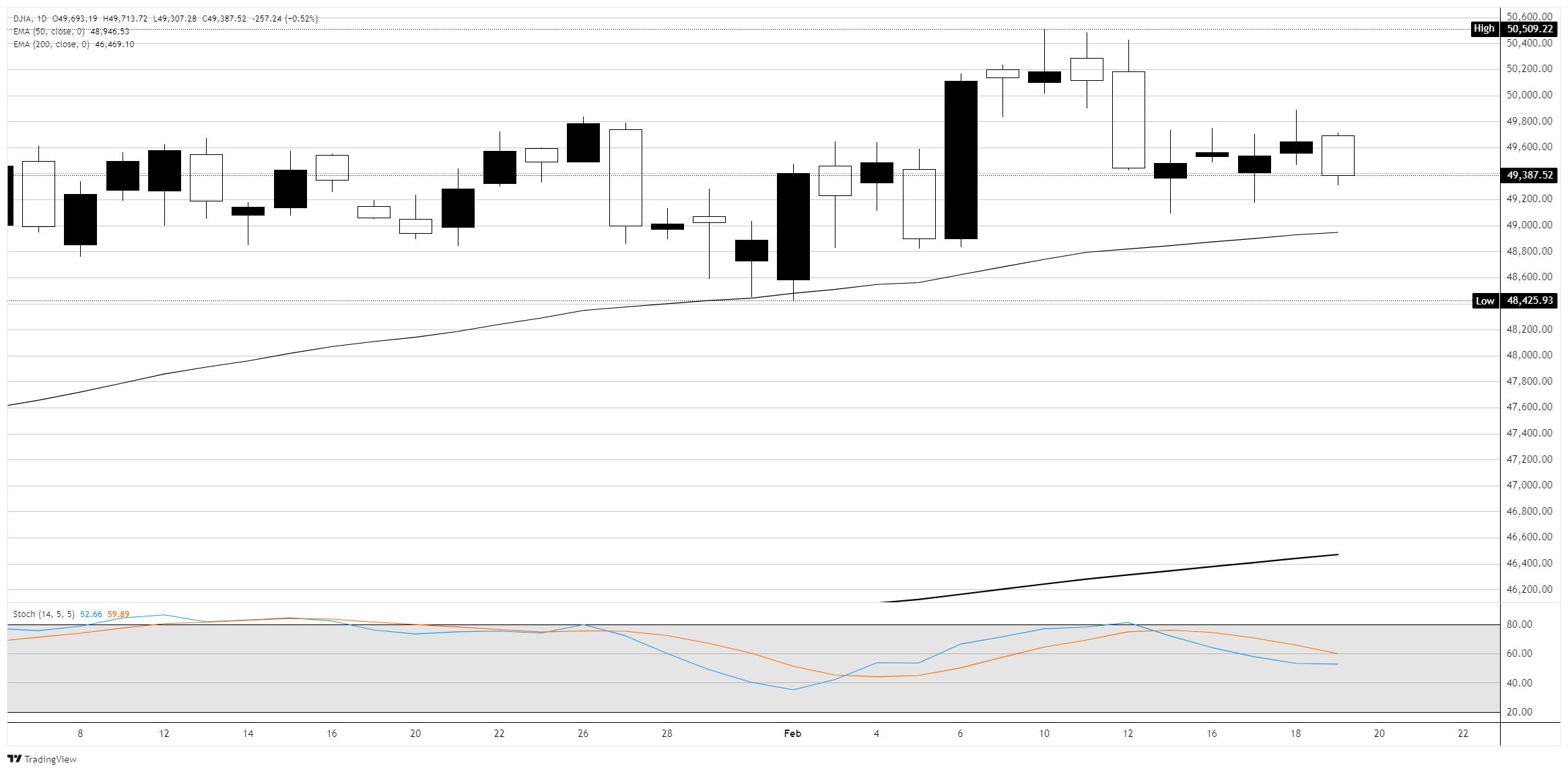

Chỉ số Dow Jones Industrial Average giảm khi căng thẳng với Iran, hướng dẫn của Walmart và Fed diều hâu gây áp lực

Chỉ số Dow Jones giảm gần 300 điểm vào thứ Năm khi giá Dầu thô tăng và hướng dẫn thận trọng từ các công ty làm rối loạn nhà đầu tư.Walmart vượt qua ước tính quý IV nhưng gây thất vọng với dự báo lợi nhuận cả năm thấp hơn nhiều so với kỳ vọng của Phố Wall.Blue Owl Capital giảm hơn 8% sau khi hạn chế

PLN: Sự chia rẽ trong liên minh duy trì rủi ro chính trị – Commerzbank

Tatha Ghose của Commerzbank cho rằng sự phân mảnh gần đây trong liên minh cầm quyền của Ba Lan đã làm gia tăng rủi ro chính trị trong nước, trở thành yếu tố chính kìm hãm đồng Zloty. Mặc dù Thủ tướng Tusk đã đảm bảo về sự ổn định của chính phủ và một "đồng zloty ổn định", nhưng đồng tiền này đã hoạt

Đồng: Kho dự trữ cao cản trở sự phục hồi – ING

Warren Patterson và Ewa Manthey của ING lưu ý rằng giá đồng đã phục hồi về mức 13.000$/t, nhưng lượng tồn kho giao dịch cao vẫn tiếp tục đè nặng lên tâm lý. Kho dự trữ trên toàn Shanghai, LME và Comex đã tăng lên trên một triệu tấn, và ngân hàng dự đoán rằng hành động giá đồng trong ngắn hạn sẽ vẫn

ECB: Cuộc trò chuyện về lãnh đạo và triển vọng chính sách – Deutsche Bank

Các nhà phân tích của Deutsche Bank lưu ý rằng có thông tin cho rằng Christine Lagarde có thể xem xét từ chức sớm với tư cách là Chủ tịch ECB như một phần của gói bổ nhiệm ban điều hành năm 2027. Mặc dù có thể có sự thay đổi nhân sự, quan điểm cơ bản của ngân hàng là chính sách của ECB sẽ giữ nguyên

RBA: Thị trường lao động chặt chẽ và rủi ro tăng lãi suất vào tháng 5 – TD Securities

Đội ngũ Chiến lược Toàn cầu của TD Securities lập luận rằng Ngân hàng Dự trữ Úc sẽ xem dữ liệu lao động tháng Giêng như một xác nhận về một thị trường vẫn đang chặt chẽ. Số lượng việc làm toàn thời gian tăng mạnh và tỷ lệ thất nghiệp vẫn dưới dự báo mới nhất của RBA. Ngân hàng dự kiến tăng lãi suấ

ECB: Rủi ro kế nhiệm chính trị và triển vọng chính sách – Rabobank

Bas van Geffen của Rabobank phân tích các báo cáo cho rằng Thống đốc Lagarde có thể rời ECB sớm, lập luận rằng điều này không cần thiết để bảo vệ sự độc lập của ECB nhưng có thể giúp Pháp duy trì ảnh hưởng trong Ban Điều hành. Ngân hàng dự đoán Đức và Pháp sẽ giữ ghế trong ban nhưng không giữ chức c

Đồng yên Nhật yếu đi xuống gần 155,00 do Biên bản cuộc họp của Fed diều hâu

Cặp USD/JPY tăng nhẹ lên gần 155,00 trong phiên giao dịch châu Á đầu ngày thứ Năm. Các tín hiệu diều hâu từ Fed hỗ trợ đồng đô la Mỹ. Các đợt tăng lãi suất tiếp theo của BoJ vào tháng 4 hoặc tháng 7 được kỳ vọng sẽ nâng cao đồng yên Nhật và tạo ra lực cản cho cặp này. Cặp USD/JPY đạt được lực kéo lê

Chỉ số đô la Mỹ (DXY) tích luỹ gần 97,70, mức cao hơn một tuần; tiềm năng tăng giá vẫn còn nguyên

Đồng USD tạm dừng để nghỉ ngơi sau đợt tăng giá hôm trước lên mức cao nhất trong hơn một tuần.Biên bản cuộc họp FOMC ít ôn hòa hơn làm giảm kỳ vọng cắt giảm lãi suất và tiếp tục hỗ trợ đồng USD.Các rủi ro địa chính trị làm giảm bớt tâm lý rủi ro tích cực và củng cố thêm vị thế trú ẩn an toàn của đồn