© 2026 Followme

A Trade or a Gamble?

I love to trade a lot – which is of course a euphemistic way of saying I love to gamble. Although I have been to Vegas more than a dozen times I never laid down so much as a dollar bet in any casino. I have absolutely no interest in blackjack, craps, slot machines or any other games of chance and I

- meon32 :how am I going to receive my trade

- Onisojikume John :I need freelancers for my project retyping document MS word into PDF file Budget: €5,500 Inbox me

- bobomo4036 :I was able to withdraw all my lost. you can Mail jeff private ( Jeffsilbert 39 g mail com

Can I Leave Orders Open over Weekends?

Friday is the end of the working week for traders as well. Ahead is the weekend and rest, after which again Monday comes, and the new working week herewith. Many traders are concerned about the question “What to expect from the new Monday?” What happens over the weekend? Should I leave trades open o

Why Do Spreads Widen?

The difference between a bid (buy) and offer (sell) price is the spread. We understand that the cost to trade is a major consideration for our clients, so we work hard to ensure we offer some of the most consistent and competitive spreads in the market. It’s our mission to source the best possible b

Pepperstone 激石

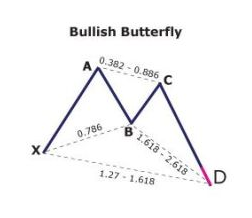

Butterfly Patterns and How Catching One Help You Profit In The Forex Market

Now despite its pretty name, this pattern can help you catch some deadly market reversals. As ever there are a few different measurements and parameters that we need to learn for identifying this pattern so stick with me here as we go through those. We’ll take a look at a diagram of what the pattern

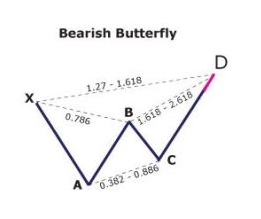

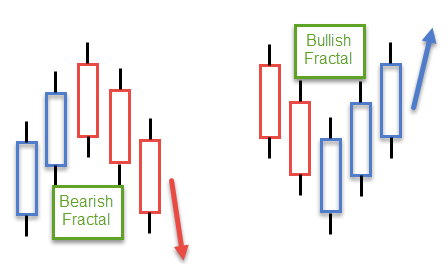

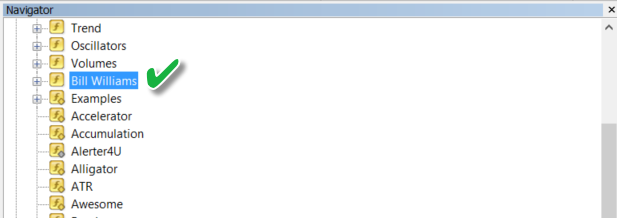

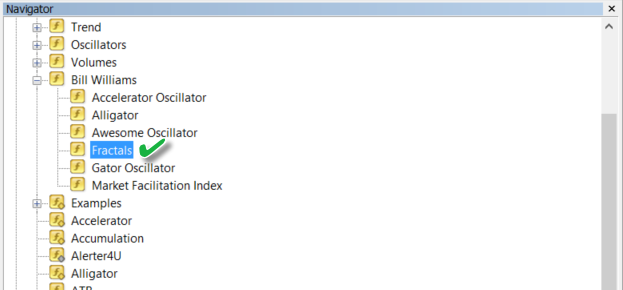

An Introductory Guide to Using Fractals in the Forex Market

The laws governing the creation of fractals are found throughout nature. Fractal patterns are recursive as no matter how complex the whole, it’s built from many repetitions of the same process. Romanesco broccoli, spirals of pinecone seeds, ice crystals, trees, rivers, leaves and even water drops ex

Everything You Need To Know About The European Central Bank (ECB)

What is the European Central Bank? The European Central Bank (ECB) is the central bank for the euro and the Eurozone. It’s responsible for administering monetary policy within the Eurozone. All the central banks of each EU (European Union) member state own the bank’s stock. The ECB directly supervis

Everything You Need To Know About The Bank Of England

What is the Bank of England (BoE)? The Bank of England is the United Kingdom’s central bank. The BoE is tasked with setting monetary policy and issuing currency, as well as regulating banks and being the lender of last resort – meaning it provides loans to banks and other institutions that are in fi

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

GBP/USD Weekly Outlook

GBP/USD edged higher to 1.3702 last week but retreated against quickly. Initial bias stays neutral this week for consolidations first. Further rise is expected as long as 1.3428 support holds. Break of 1.3702 will resume whole rise from 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1

USD/CAD Weekly Outlook

USD/CAD edged lower to 1.2629 last week as down trend resumed. But it quickly lost momentum and recovered. Initial bias is neutral this week for some consolidations first. Outlook will stays bearish as long as 1.2797 resistance holds. On the downside, break of 1.2629 will resume the larger down tren

EUR/GBP Weekly Outlook

EUR/GBP stayed in sideway consolidation last week and outlook is unchanged. Initial bias remains neutral this week first. With 0.8861 support intact, choppy rise from 0.8670 is in favor to extend. On the upside, decisive break of 0.9291 will target 0.9449 high. On the downside, however, break of 0.8

EUR/AUD Weekly Outlook

EUR/AUD’s down trend continued last week and there is no sign of bottoming yet. Initial bias remains on the downside this week. Firm break of 100% projection of 1.6827 to 1.6122 from 1.6420 at 1.5715 will target 161.8% projection at 1.5279 next. On the upside, break of 1.5863 minor resistance will s

EUR/CHF Weekly Outlook

EUR/CHF recovered last week but stayed below 1.0890 resistance. Initial bias is neutral this week first and some more consolidative trading could be seen. On the upside, break of 1.8920 resistance will target 1.0915. On the downside, below 1.0787 will target 1.0737 support first. Break there will ex

Dollar Relatively Resilient in Strong Risk-on Market, Setting the Base for a Rebound?

Global investors were all in risk seeking mode in the first full week of 2021. That came despite all the headlines of surges in coronavirus infection and death, return to strict lockdowns, chaos in Washington and Joe Biden’s certification as US President-Elect. Dollar didn’t perform too well but the

Weekly Economic and Financial Commentary: Slow Start to 2021

U.S. Review Slow Start to 2021 The manufacturing sector is showing a great deal of resilience, with the ISM Manufacturing survey exceeding expectations, at 60.7, and factory orders remaining strong. The service sector is also showing a great deal of strength, although activity has clearly slowed in