#FOLLOWMEReport#

5.18k View

358 Discuss

Our users - both traders and brokers continue to reap benefit by leveraging on FOLLOWME's unique features. Get a detailed analysis of the latest trading activity on our platform here.

FOLLOWME Industry Report

Broker Ranking

Community Trading Report-Monthly

FOLLOWME Community Trading Report the third quarter of 2020

Introduction: Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject li

- LittleRabbit :wow very informative! thanks a lot!

- Tony Stark :wow cool😎

- elleefx :Thanks for the info

Season 15 Competition Rules 【Must Read】

FOLLOWME Trading Competition is an event aimed at global traders. The competition adheres to the concept of "discovering excellent traders and spreading quality trading strategies," upholding the principles of openness, fairness, and justice, and aims to provide a platform for participants to showca

- 1aaaaa :It me can u open for me

- kas944 :hola

- Evelyn Gabriel :I need to update my thread

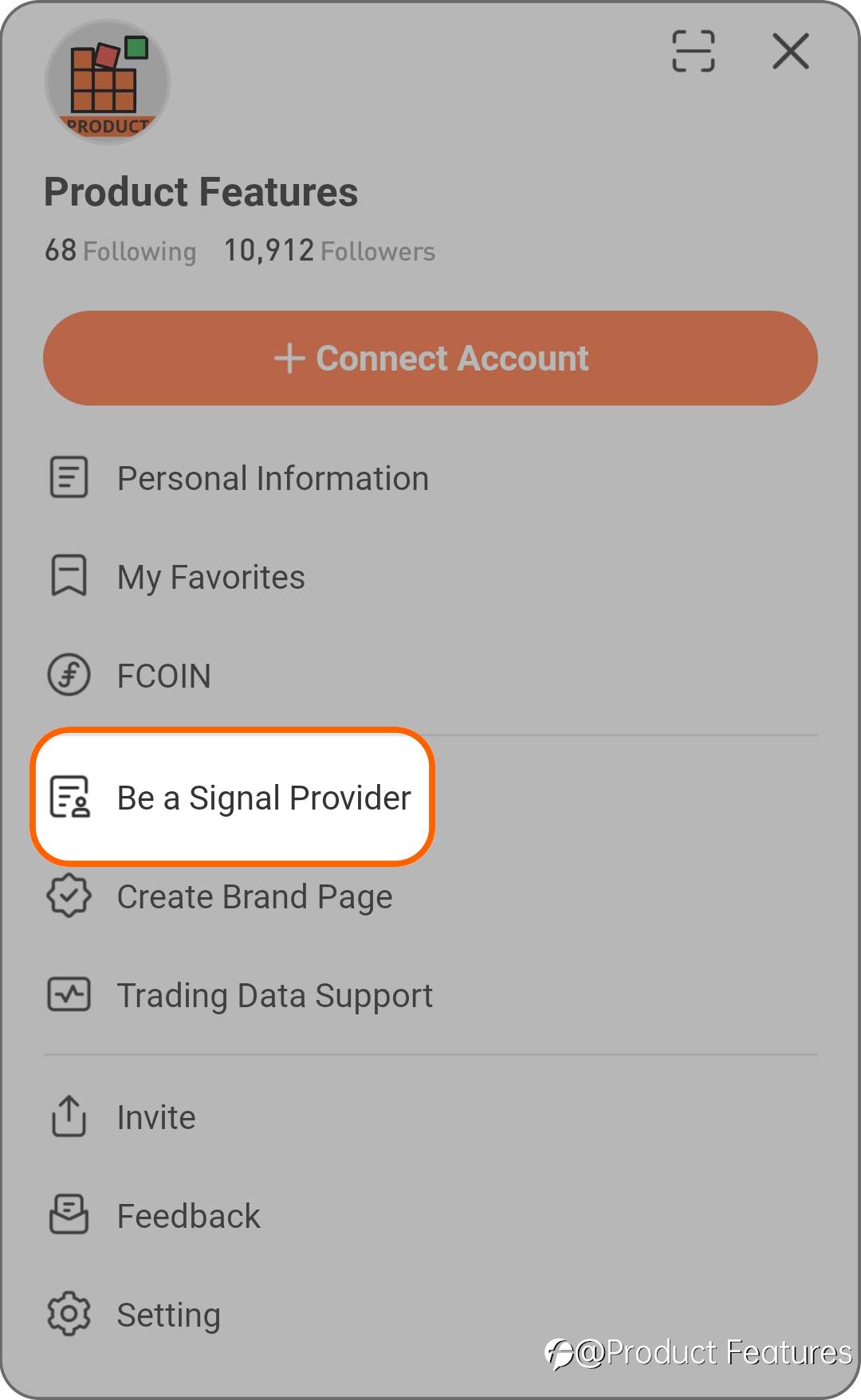

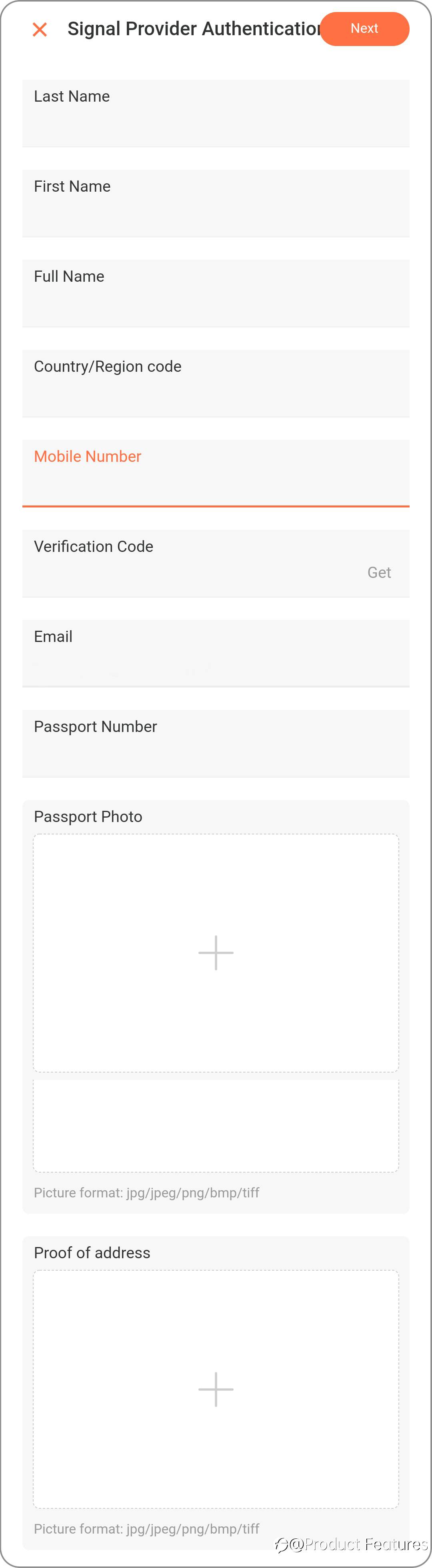

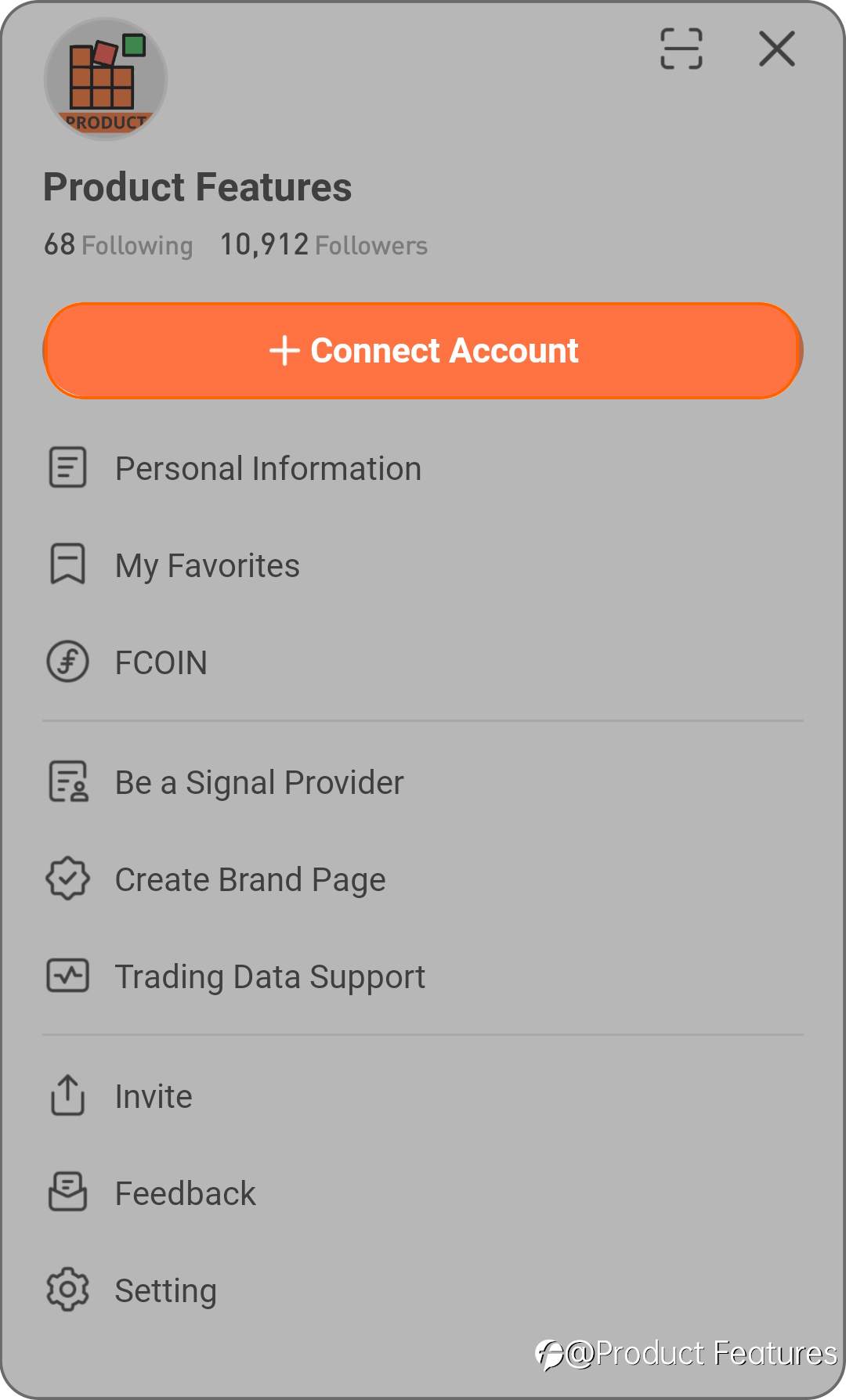

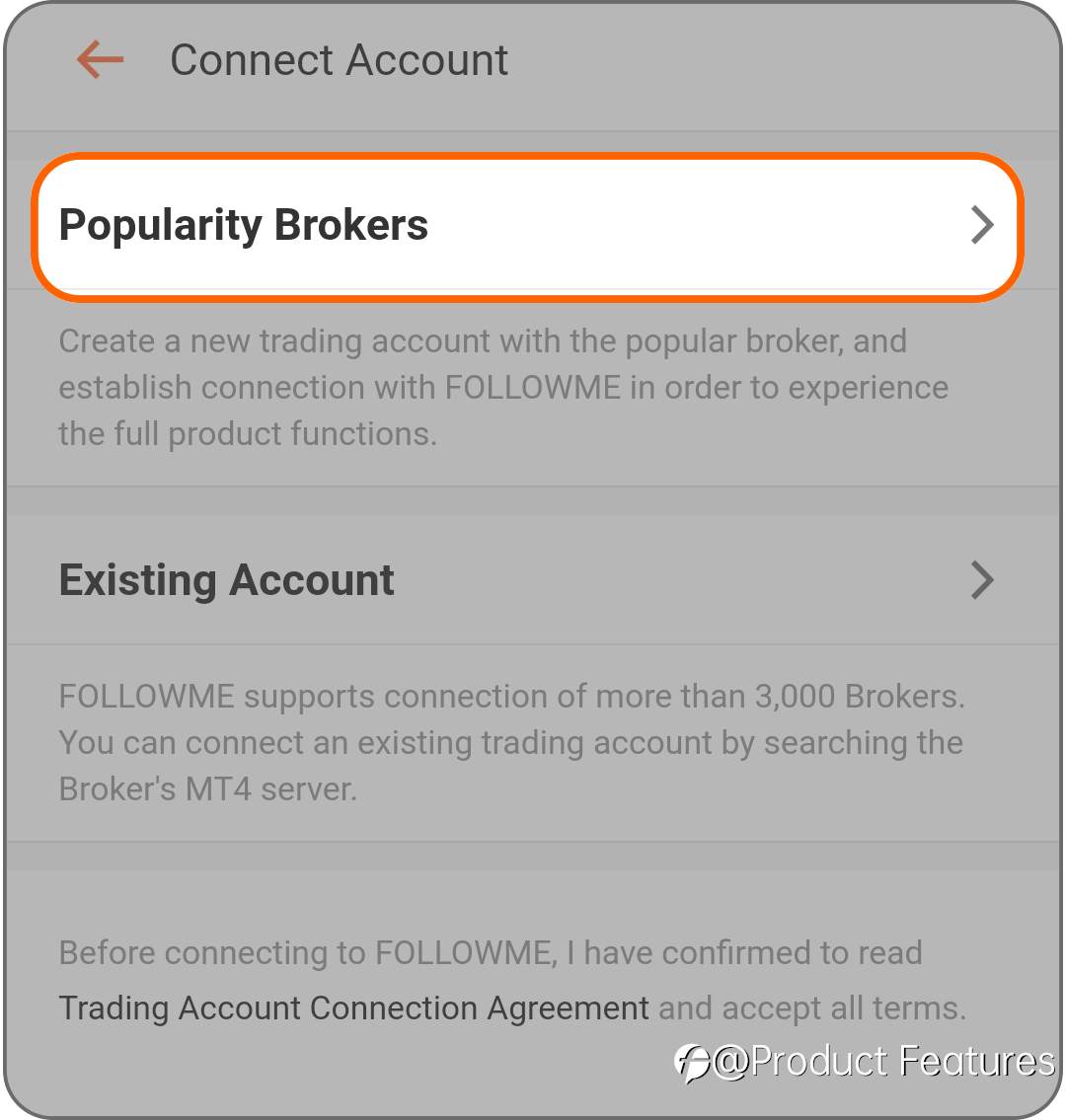

How To Become a Signal Provider on FOLLOWME?

Signal Provider Application Conditions 1, Before applying for a signal provider, real-name authentication must be completed, and the real-name information of the trading account must match the real-name authentication information. 2, No subscribing orders. 3, For API accounts, once the real-name ver

- Valentina :This is really good

- Martin1997 :they said this is to protect followers right , because some traders may remove bad performance account , and only remain profitable one. I think this is reasonable.

- unlax :This is the only copy trading platform I know that don't allow non-USD accounts, which is weird bcos it is not technically difficult to do it. I have a huge SGD account that would score 10 points on C...

Season 14 FOLLOWME Contest Rules 【Must Read】

FOLLOWME Contest (the "Contest") is a trading event for global trading users. FOLLOWME adheres to the concept of “discovering outstanding traders and disseminating high-quality trading strategies”, sticking to the principles of openness, fairness, and impartiality and aiming to hold a st

- faiz676fk :FAiZ

- Shahbaz Mangrio :Shahbaz mangrio

S14 FOLLOWME Global Trading Contest Begins | Join Now to Compete for the Ultimate Grand Prize

Contest ends on 21 July, 2024 Register Now https://www.followme.com/conte... S14 Starts! The S14 FOLLOWME Global Trading Contest officially starts today. We hope that all participants can fully enjoy this contest, exert their best strength, continue to move towards victory, obtain full harvest

- Balinais Trader :pokokne jeg nais!

Season 16 Competition Rules 【Must Read】

Global Trading Competition Season 16 Followme Trading Competition is an event aimed at global traders. The competition adheres to the concept of "discovering excellent traders and spreading quality trading strategies," upholding the principles of openness, fairness, and justice, and aims to provide

Weekly Data Report| Spotlight on Top Performers 23 - 29 September 2025

This Week's Trading Frenzy: $189,887 in Total Profit! The Followme trader community has been on fire. This week's profit isn't just high, it's phenomenal. With market moves this active, our top traders have truly outdone themselves. Let's dive into the leaderboard and follow the stars of the w

The Ultimate Guide to Broker Licenses for Social Traders in 2025

In the fast-evolving world of social trading, choosing the right broker can make or break your trading journey. With thousands of platforms promising easy profits, how do you know which ones are safe, regulated, and trustworthy? This guide is your 2025 roadmap to understanding broker licenses—

Season 15 Competition Rules 【Must Read】

FOLLOWME Trading Competition is an event aimed at global traders. The competition adheres to the concept of "discovering excellent traders and spreading quality trading strategies," upholding the principles of openness, fairness, and justice, and aims to provide a platform for participants to showca

Registration of S14 Starts Today | Gorgeous rewards await you!

Registration ends on 06 July, 2024 Register Now https://www.followme.com/conte... The registration for the S14 FOLLOWME Global Trading Contest officially starts today! Unlike previous seasons, this season introduces new Groups including Instruments Group, Global Group, and Indonesia Group. Add

- inonso :ji

Is Your Broker Playing Fair? Red Flags to Watch For.

Entering the world of forex or crypto trading can be exciting—but it also comes with risks beyond market volatility. One of the biggest threats to new traders isn’t a bad trade—it’s a bad broker. Whether you're trading forex, crypto, or other assets, choosing the right