© 2026 Followme

Liked

Liked

Liked

USD/JPY intraday: The downside prevails

EUR/USD: Towards 1.1760

Stay on top of the markets with Swissquote’s News & Analysis

Pivot (invalidation): 1.1665

Our preference Long positions above 1.1665 with targets at 1.1735 & 1.1760 in extension.

Alternative scenario Below 1.1665 look for further downside with 1.1630 & 1.1600

Liked

Liked

An odd week ahead

Some more awful GDP data is on the cards, but the Fed is in focus, and will likely say something supportive while we await the next fiscal package.

Monetary policy to the rescue?

While the US politicians continue to bicker about what to do in terms of additional fiscal policy (more of a question of

Liked

Liked

Liked

Liked

The rising momentum of the Australian dollar against the US dollar is facing exhaustion

The rising momentum of the Australian dollar against the US dollar is facing exhaustion, and the epidemic and geopolitical situation may become a roadblock. The Australian dollar strengthened slightly against the US dollar on Monday, mainly driven by the continued decline of the US dollar index in t

Liked

Liked

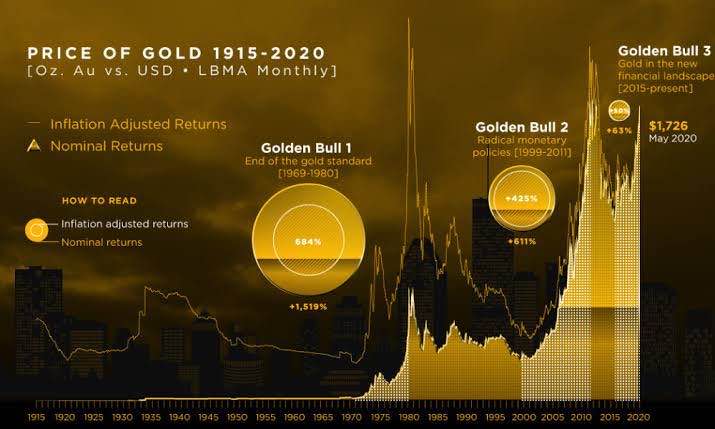

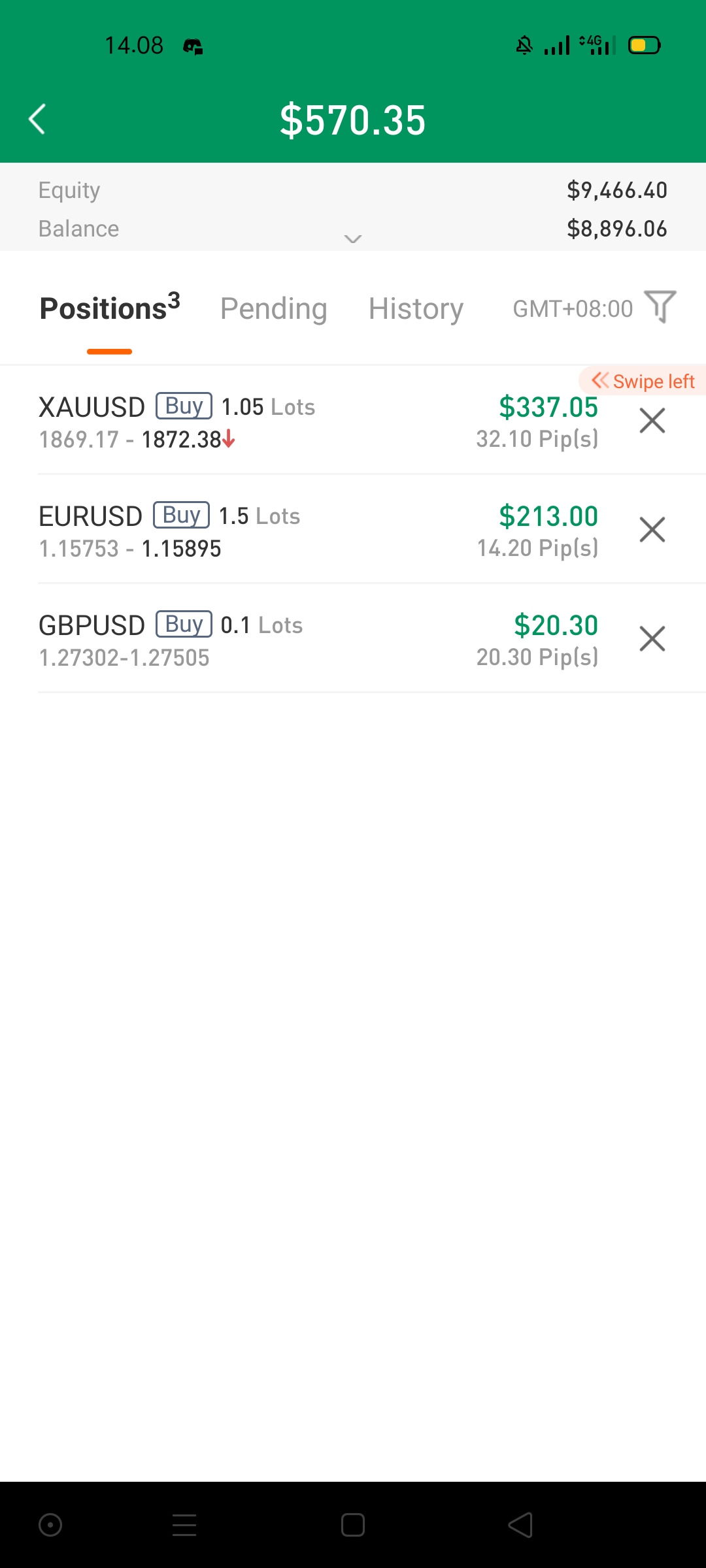

Market mood for the XAU/USD: Why is Gold rising? [Video]

Listen to the latest market mood for the XAUUSD pair.

The rise in gold to take out all-time highs has been supported by the following three things:

A weak dollar. Fears of a fiscal cliff this week from the US are keeping the dollar weak on the session and this has bolstered gold.

A technical

Liked

European Majors Supported By Strong PMIs, Risk Aversion Continues

Yen and Swiss Franc are trading as the strongest ones for today as stock markets are weighed down by escalating US-China tensions. Though, negative sentiments in Europe was partly offset by much stronger than expected Eurozone and UK PMIs. Signs of a V recovery are there even though the development