PabloAhmad

European Economics Preview: Germany Foreign Trade Data Due

Foreign trade data from Germany is due on Thursday, headlining a light day for the European economic news.

At 1.45 am ET, the State Secretariat for Economic Affairs is scheduled to issue Swiss jobless rate for September. The jobless rate is seen at seasonally adjusted 3.4 percent, unchanged from Aug

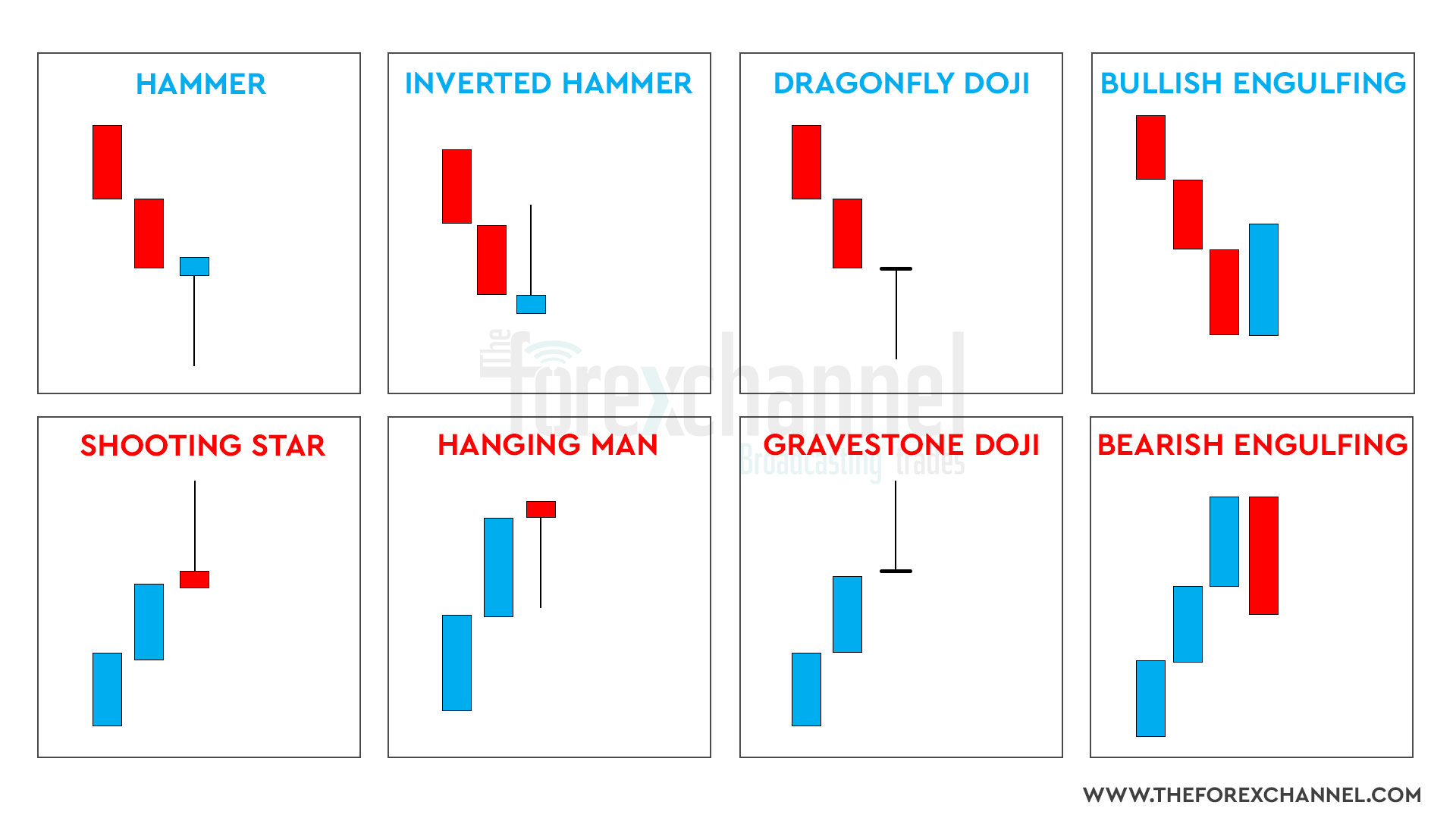

EUR/USD Price Analysis: Weekly chart indicator turns bearish for first since May

EUR/USD's weekly MACD shows a bullish-to-bearish trend change.

While the pair bounced last week, it is not out of the woods yet.

EUR/USD jumped 0.74% last week, trimming the previous week's 1.77% decline.

However, the currency pair is not out of the woods yet, as a widely-tracked longer duration

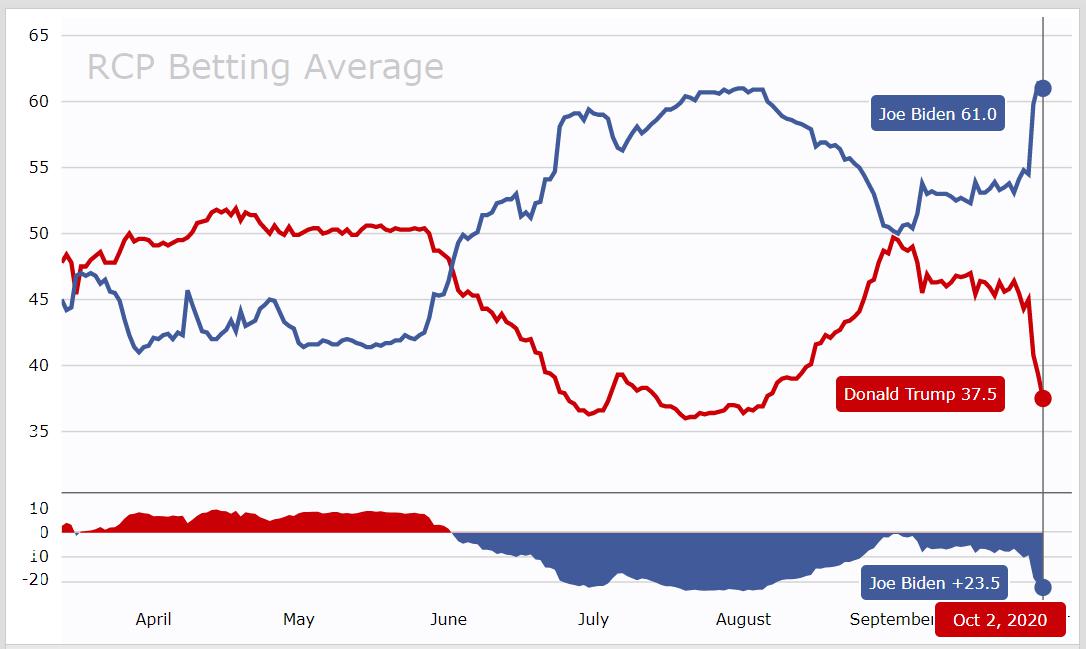

The betting markets are showing a Biden win, but awaiting an update

This is via Real Clear politics but I'm awaiting a clearer picture after weekend developments on, specifically, Trump's COVID-19 infection progress.

Currently the picture is stark - a Biden win and its not even close. Polling is showing similar. Back in 2016 Clionton's lead was not this big at thi

RBA monetary policy meeting Tuesday 5 October 2020 - preview

Reserve Bank of Australia decision will be announced at 2.30pm Sydney time, which is 0330 GMT

The consensus is for no change to policy at this meeting.

Via KiwiBank:

No change to policy setting is expected at this week's meeting.

However, the statement will be scrutinised for any change in tone

Coming up on Tuesday - Fed Chair Powell speaking

Federal Reserve System Chair Powell speaks to the National Association for Business Economics.

At 1440 GMT on Tuesday 6 October 2020

To speak from a prepared text, I haven't sighted the topic but given the venue it should be pertinent.

There will be a Q&A to follow

Pull-up Update