#Market&Mind#

828 View

119 Discuss

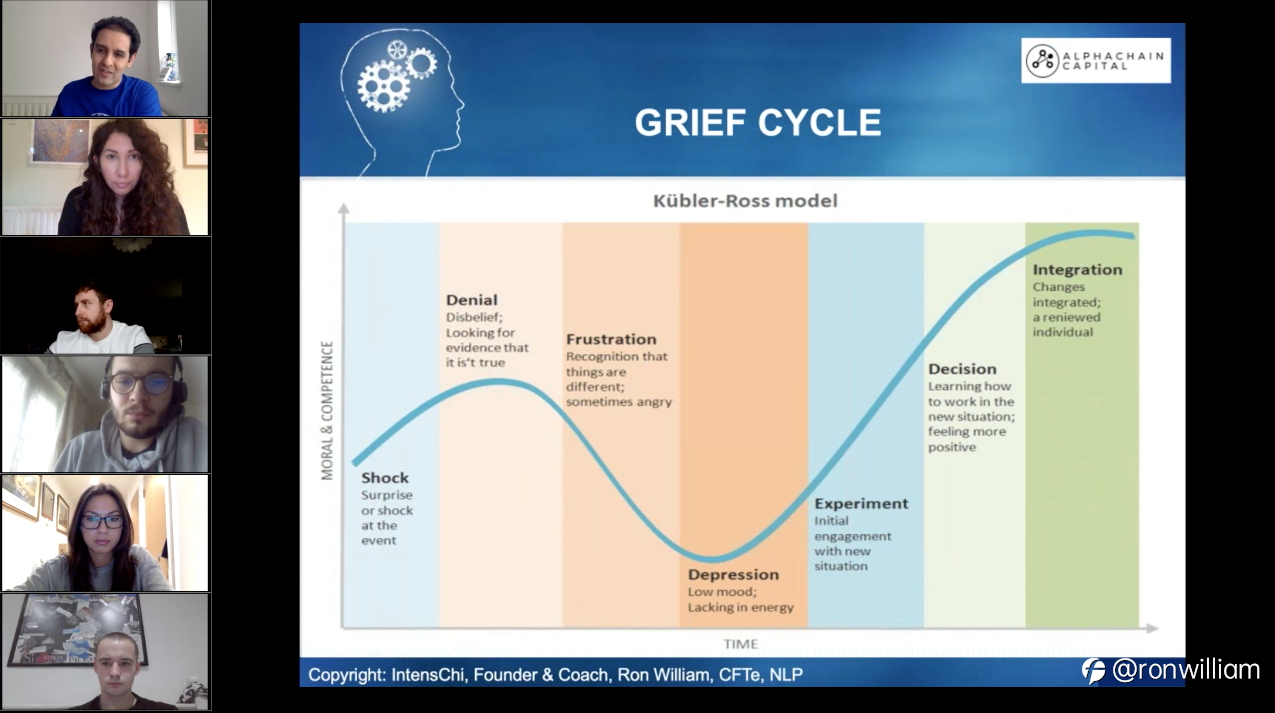

Market&Mind is a column developed by Ron William who devotes himself in researching trading psychology. As a trading educator, he will present you excellent market strategies and psychological advices.

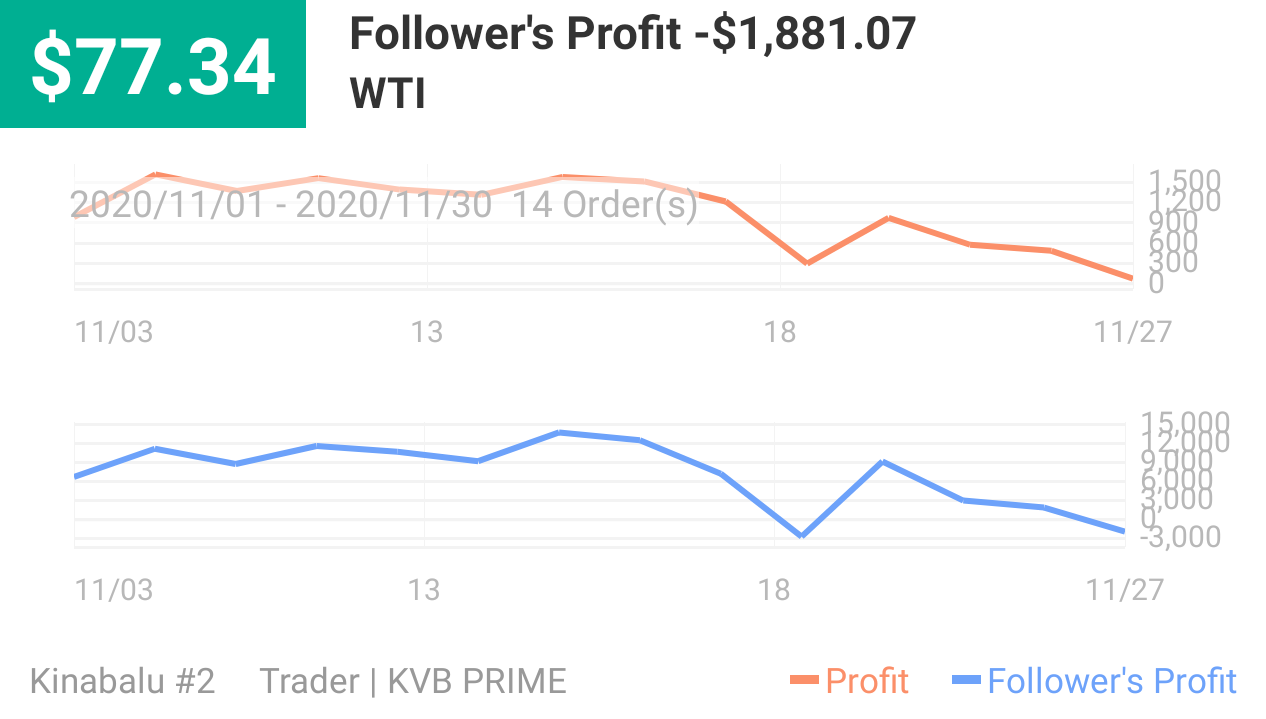

Podcast Premiere: Strategi & Mindset Trader 2025

Podcast Premiere: Strategi & Mindset Trader 2025 Sudah siap upgrade strategi dan mindset trading kamu jelang 2026? Pasar keuangan global kini makin cepat dan kompleks. Untuk membantu para trader Indonesia menghadapi tantangan tersebut, Followme Indonesia berkolaborasi dengan Pelatihan Profit Int

- JokoCFD99 :🔥 niceee

- Brian.Kurnia :kerennn 😍

- Intan06 :nungguin bgt ini 👏