© 2026 Followme

Liked

FOLLOWME Community Top Trading Report - First Week of October

2020/10/05-2020/10/09 Total Trading Orders

268,314

Compared with the previous week’s 309,362, the amount has decreased by 13.3% or 49,429 orders for the latest week.

For this week, the total profit of the Top 10 Traders was $259,000. Among these traders, one of our community traders @狂野的猪 achieved t

USD/CNH

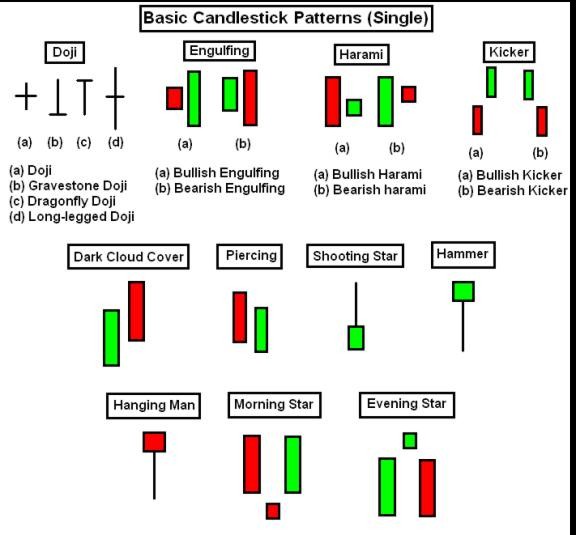

After long holiday termed the Golden Weekend – China markets are finally reopening today! Caixin Services PMI are also due out today. Forecast is 54.3 for Sept vs 54.0 in August. For the USD/CNH, key daily chart shows a bullish divergence and a bullish inside day candle was also spotted on Tuesday.

WANTED: A catalyst for gold price

In the aftermath of Trump’s tweet, gold has still not recovered as it backed out technical resistance around the $1,921 mark. It now remains below Tuesday’s high and within a descending wedge pattern. While it awaits a catalyst to break off the sluggishness, the yellow metal could now be trading sid

GOLD.

Review on gold:1) Indicators are slightly bullish2) MACD signal lines are above zero but histogram is very flat3) RSI is above 50 but looks slightly sideways4) Recent risk rest seemed to cheering on the bulls. 5) It is refreshing intraday high while breaking a $2 range below $1,915. 6) However, this

A rise for gold?

Over the last week, the price of the yellow metal was seen to track an upward rise - approaching $1,900, on the back of USD weakness and sluggish US equities.Should the stimulus package be approved, it will further add on to the US public debt which is currently climbing at a historic pace– which in

A new quarter begins..

Today, we begin a new quarter – and the last quarter of the year! Bring it on! What are some your goals and ambition for this last quarter? How quickly time flies, isn’t it? I felt like we had just begun the year 2020. This historic year of 2020 would certainly be remembered by everyone. No one woul

Of Gold.

Gold has been on the sidelines as the USD gained much strength throughout this week. The USD has currently retreated from two months high. A Doji candle was observed at the yellow metal price yesterday – pointing towards an indecision. However, as a correction is looming for the USD, would it give a