© 2026 Followme

Liked

- Donetta Matchen :If I say I am disappointed that will just be an understatement, I was made to go through hell in the past 6 months I tried everything I could to get my money back, but they will not let me take it out...

- Arvind Raaj :Inbox me to get all your lose money back

Liked

Liked

Fed report finds higher fears of inflation and potential recession

A Federal Reserve economic survey released Wednesday pointed to elevated recession fears along with a belief that soaring inflation will last at least through the end of the year. The central bank's "Beige Book," a collection of views from across its 12 districts, noted the economy is growing at jus

Liked

Event Preview: U.S. Inflation Report (June 2022)

Partner Center Find a Broker On Wednesday (July 13) at 12:30 pm GMT the U.S. will print its July inflation reports. Will the numbers seal the deal for a 75-basis point hike from the Fed? More importantly, how may the U.S. dollar react? Here are points to consider if you’re trading the data release:

Liked

Profit by Following

337.59

USD

- Symbol USD/JPY

- Trading Account #5 86610037

- Broker USKMarkets

- Open/Close Price 136.565/136.879

- Volume Buy 51.94 Flots

- Profit 11,915.02 USD

Liked

Bitcoin miners struggle with crypto’s price decline, rising energy costs and increase in mining difficulty

Many bitcoin miners, who expanded operations in 2021 to capture more profits, are now struggling as the crypto’s price crashed. The bitcoin mining industry’s daily revenue plummeted to $18 million from a peak of $62 million in November, when the largest crypto reached an all-time high, according to

Liked

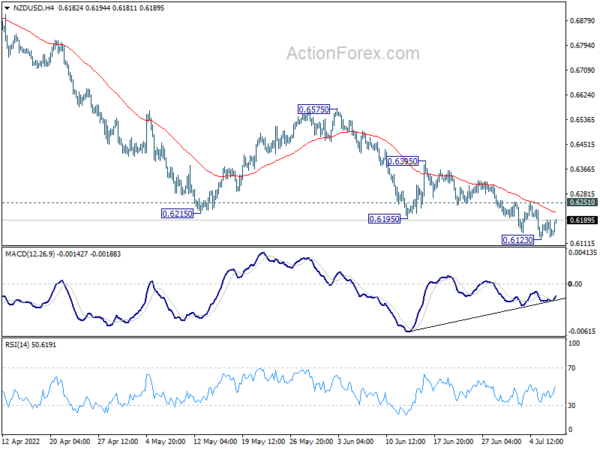

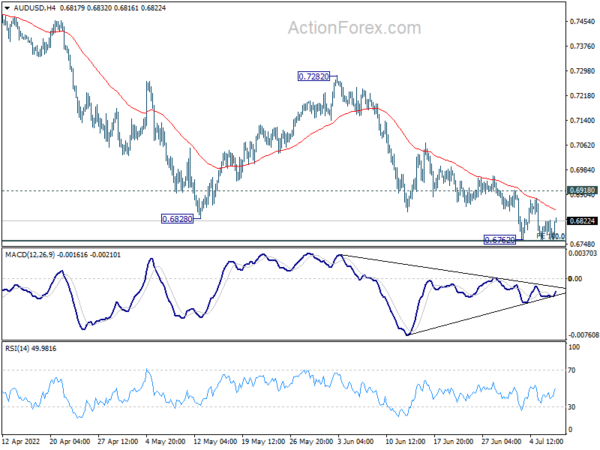

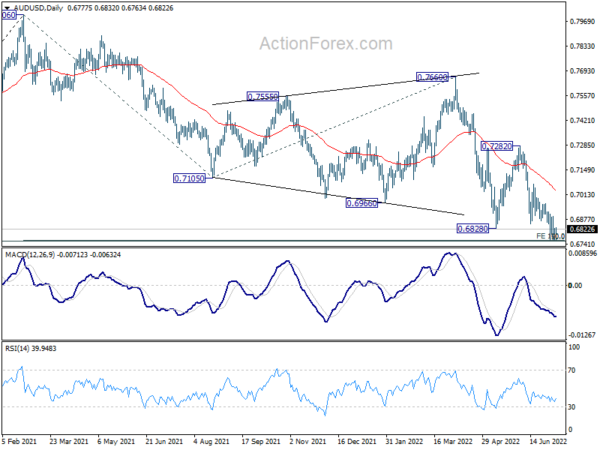

Aussie Displaying Resilience, Dollar and Yen Staying Firm

#OPINIONLEADER# The stock markets are starting to display some resilience, despite hawkish FOMC minutes. US stocks managed to close higher after initial selloff. Nikkei is also showing some strength in Asian session. Dollar and Yen are retreating mildly while Aussie and Kiwi are tradi

Liked

Nonfarm Payrolls is coming, get 50 FCOIN with your prediction!

A good deal would not be available anywhere on earth, but only in FOLLOWME, #GuessNFP# is finally back with greater rewards than ever! Through two options, make a wild guess according to your hunch or study the market analysis and guess the NFP result, the user with the closest predic

Liked

Liked

Crypto exchange CoinFlex says one of the most prominent names in the industry defaulted on $47 million USDC debt

Crypto exchange CoinFlex’s chief executive Mark Lamb said Tuesday that it issued a notice of default to Roger Ver, an early crypto investor and founder of Bitcoin.com, alleging that Ver failed to meet a margin call and owes the exchange $47 million USDC. Lamb made the comments on Twitter after Ver t

Liked

Liked