© 2026 Followme

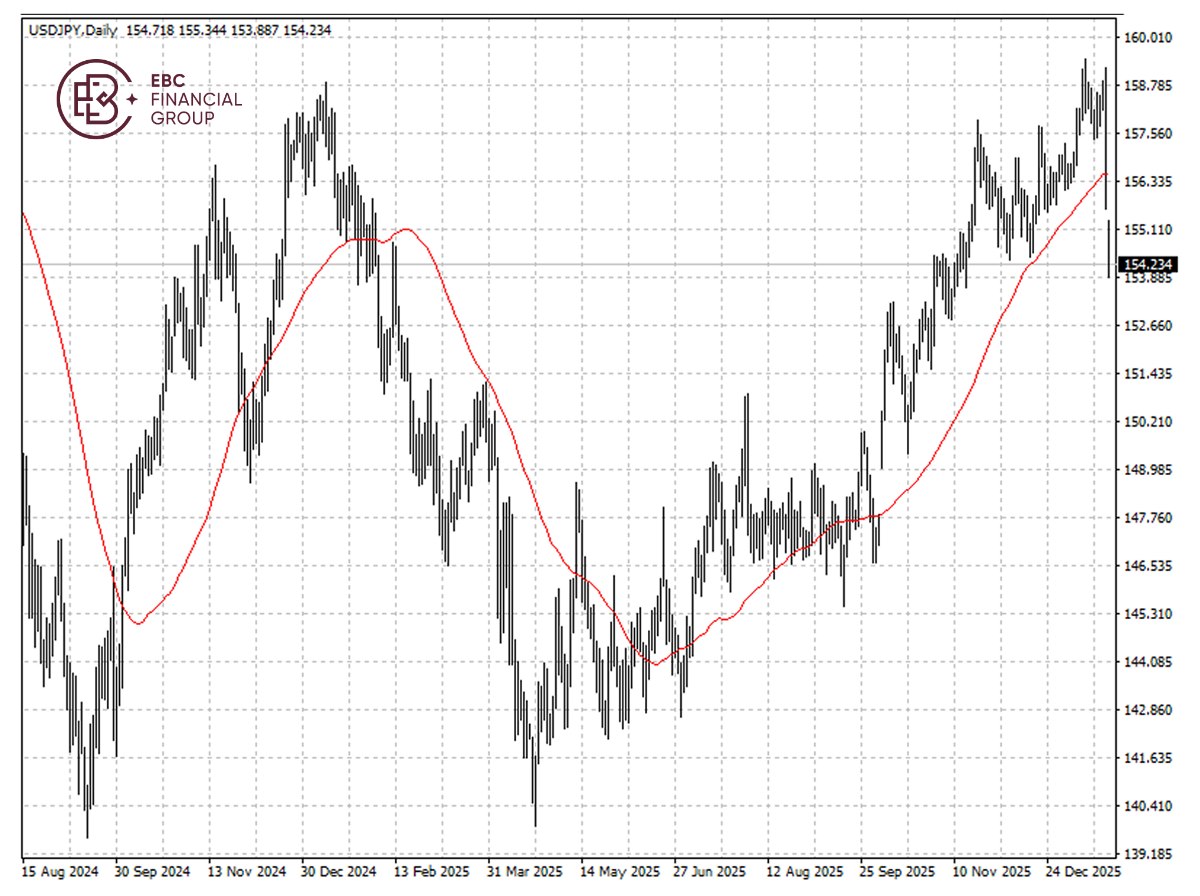

USDJPY

US Dollar / Japanese Yen

152.138

-0.190

(-0.12%)

Prices By FOLLOWME , in USD

Statistics

More

LOW

HIGH

152.131

152.428

Short

Long

64.83%

35.17%

1W

-2.39%

1 MO

-2.85%

3 MO

-1.26%

6 MO

+0.97%

EBC Markets Briefing | Yen higher on intervention fears; Intel nosedived

The yen jumped to more than a two-month high on Monday on speculation that forex intervention could be imminent. The BOJ raised economic growth forecasts in last week's meeting. Japan's December inflation data showed headline price growth coming in at 2.1%, its lowest since March 2022, but still run

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

Top 5 Indicators Every Beginner Trader Should Know

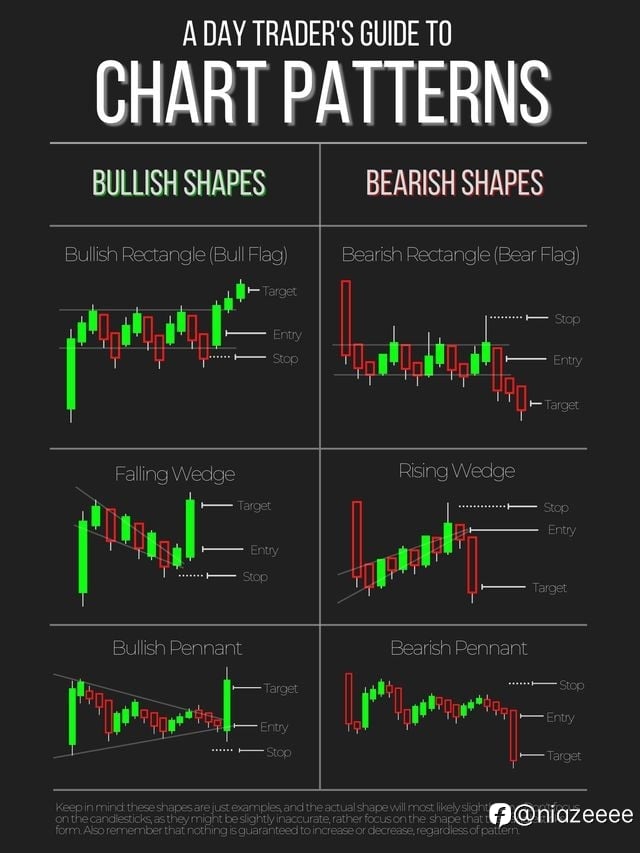

💡 Indicators are your toolkit in the markets. They cut through the noise, highlight key patterns, and help you make more confident, informed decisions — especially when you’re starting out. 🔢 Moving Averages (MA) 🔵 What it does: Smooths price action to reveal the overall trend. ✅ Use it for: Iden

Best Forex Broker in USA 2022: Top US Forex Brokers List

The foreign exchange market, also known as the Forex market or the FX market, is also one of the global markets that witnesses a trading volume of almost $6.6 trillion every day. Foreign exchange refers to exchanging one currency trading with another for different reasons that include tourism, inter

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

- Important_Rain77 :thank you for being a great fan of mine send me friend request I promise to accept it.........

- aflimy :wooew keep it up

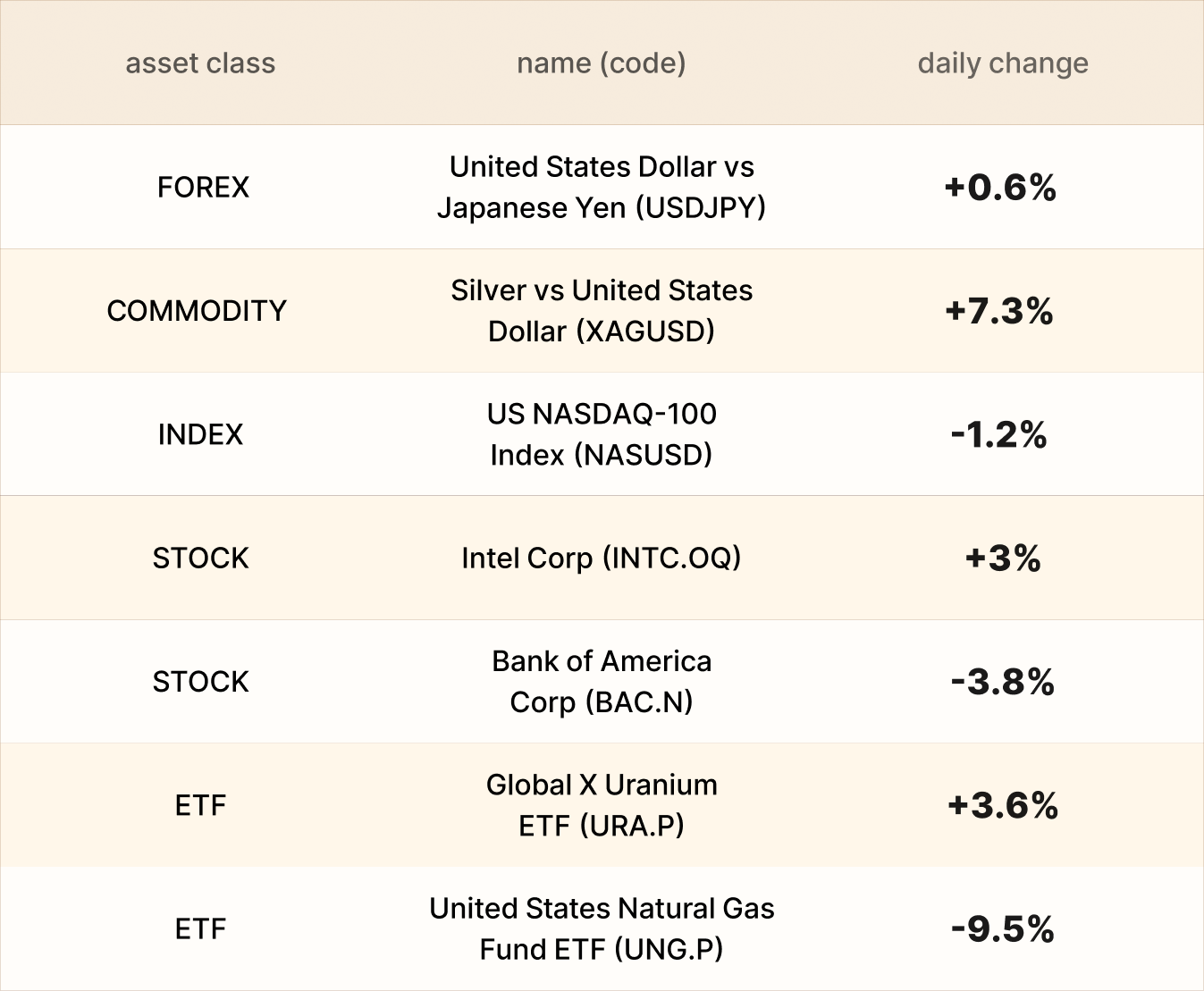

EBC Markets Briefing | Yen under pressures; PPI data pushed silver higher

The yen held onto overnight gains on Thursday but was pinned near 18-month lows as traders remained wary of intervention after strong warnings ahead of an election in Japan. Reports of a sudden election at a time when the Japanese leader enjoys huge popularity have fuelled the so-called "Takaichi tr

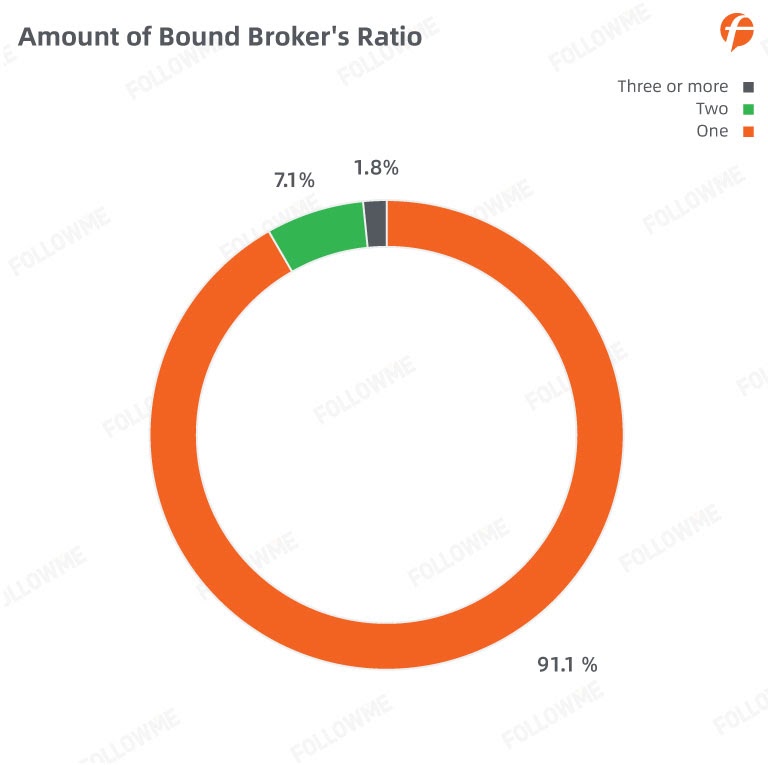

FOLLOWME Community Trading Report the third quarter of 2020

Introduction: Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject li

- LittleRabbit :wow very informative! thanks a lot!

- Tony Stark :wow cool😎

- elleefx :Thanks for the info

- Becky Kate :sharing is caring

Design Trends in Kitchen Rugs: Elevating Your Space with Contemporary Style

Contemporary kitchen rugs have evolved far beyond purely functional floor coverings, emerging as essential design elements that define your kitchen's personality and aesthetic direction. Understanding current trends helps you select kitchen area rugs that not only serve practical purposes but also e

Stock Markets Dive Further, But Others Steady

#OPINIONLEADER##OPINIONLEADER# Markets are staying in risk aversion today with heavy selling in stocks. Expectations on the negotiation between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin are low. Meanwhile, other markets are relatively

- AbuSalaam :hi

- 钉子侠 :💪