© 2026 Followme

Liked

Liked

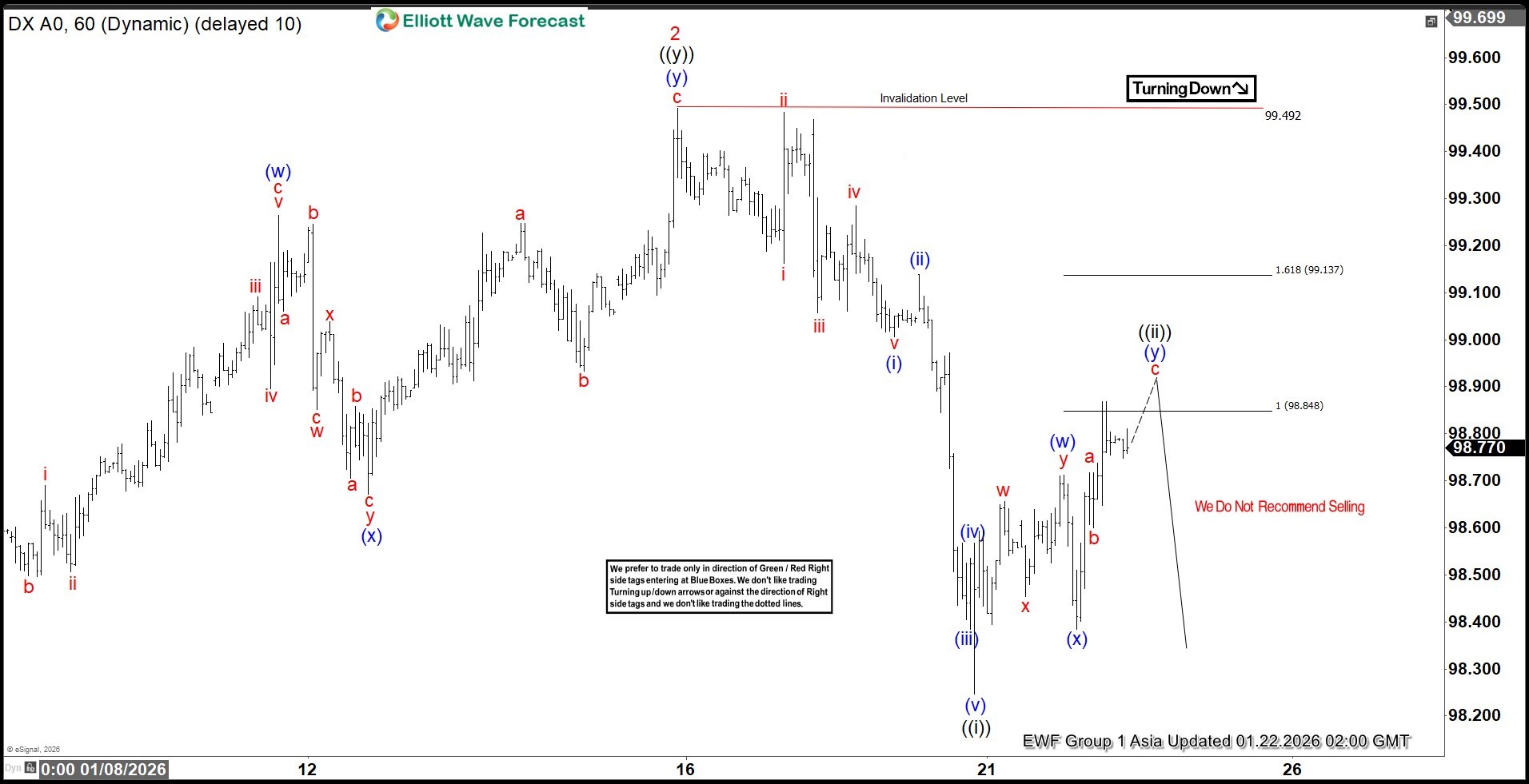

DXY Faces Persistent Selling at Extreme Equal Legs Zone

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of DXY. We presented to members at the elliottwave-forecast. In which, the decline from 21 November 2025 high unfolded as an impulse structure. And showed a lower low favored more downside e

Liked

Liked

Understanding Backtesting and Optimization: How to Test and Improve Your Trading Strategy

Have you ever written an exam? If you have, it’s safe to say you prepared using past question papers. Most people attempt them under exam conditions. The goal is to determine if the approach and strategy you have been using to study are actually effective. By going through past papers, you can see w

Liked

Liked

Raise the Cost of Crime: Break the Scam Supply Chain, Not Just the Victims

As a retired professional trader, I’m not shocked Singapore is escalating penalties, because scams are no longer petty crimes, they are industrial operations that scale faster than any regulator can manually chase. Mandatory caning for serious scam offences sends a clear signal that soc

Liked

CPI Shock in 30 Seconds: Why Most Traders Only See the Afterglow

Every inflation print is now a potential macro bomb: one number, and suddenly equities, FX, bonds, and even crypto light up at the same time. But if you only see the move once your candles close or your data catches up, you are not trading CPI, you are trading its shadow. What Really Happens in the

Liked

Liked

Pre-Market Snapshot Monitoring Key Levels Ahead of Session Open

Pre-Market Snapshot: Monitoring Key Levels Ahead of Session Open Chart Data as of 04:00:55 UTC (Pre-Market) This morning’s pre-market chart shows a clear descending price structure, with the asset trading in a defined downward channel. Key observations from the snapshot: 📉 Price Structure & Key

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 20 Points that can withdraw. Click to know more details about //soci...

Liked

I Never Thought Job Data Mattered… Until Today

I’m still pretty new to trading, so I used to scroll past reports like this ADP payroll update without thinking twice. But seeing that private payrolls dropped by 32,000 and small businesses got hit so hard honestly shocked me. I didn’t realize how these numbers can hint at where the mar