© 2026 Followme

Liked

Forex and Cryptocurrency Forecast for January 26–30, 2026

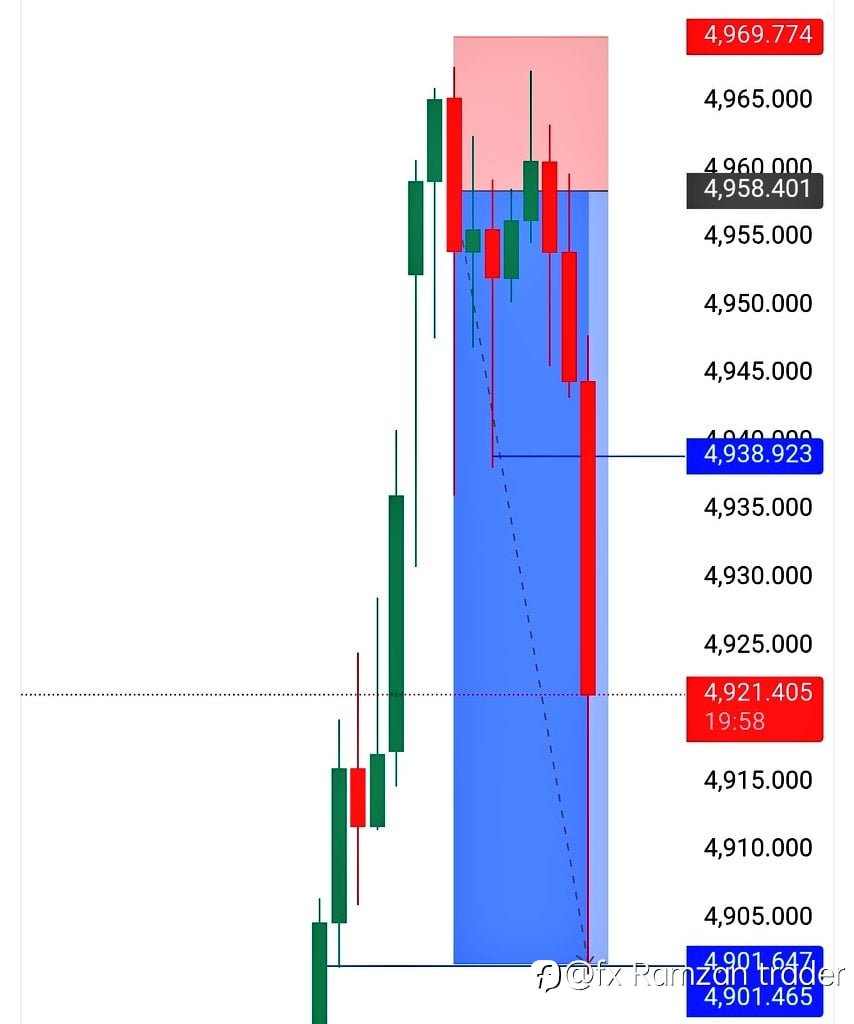

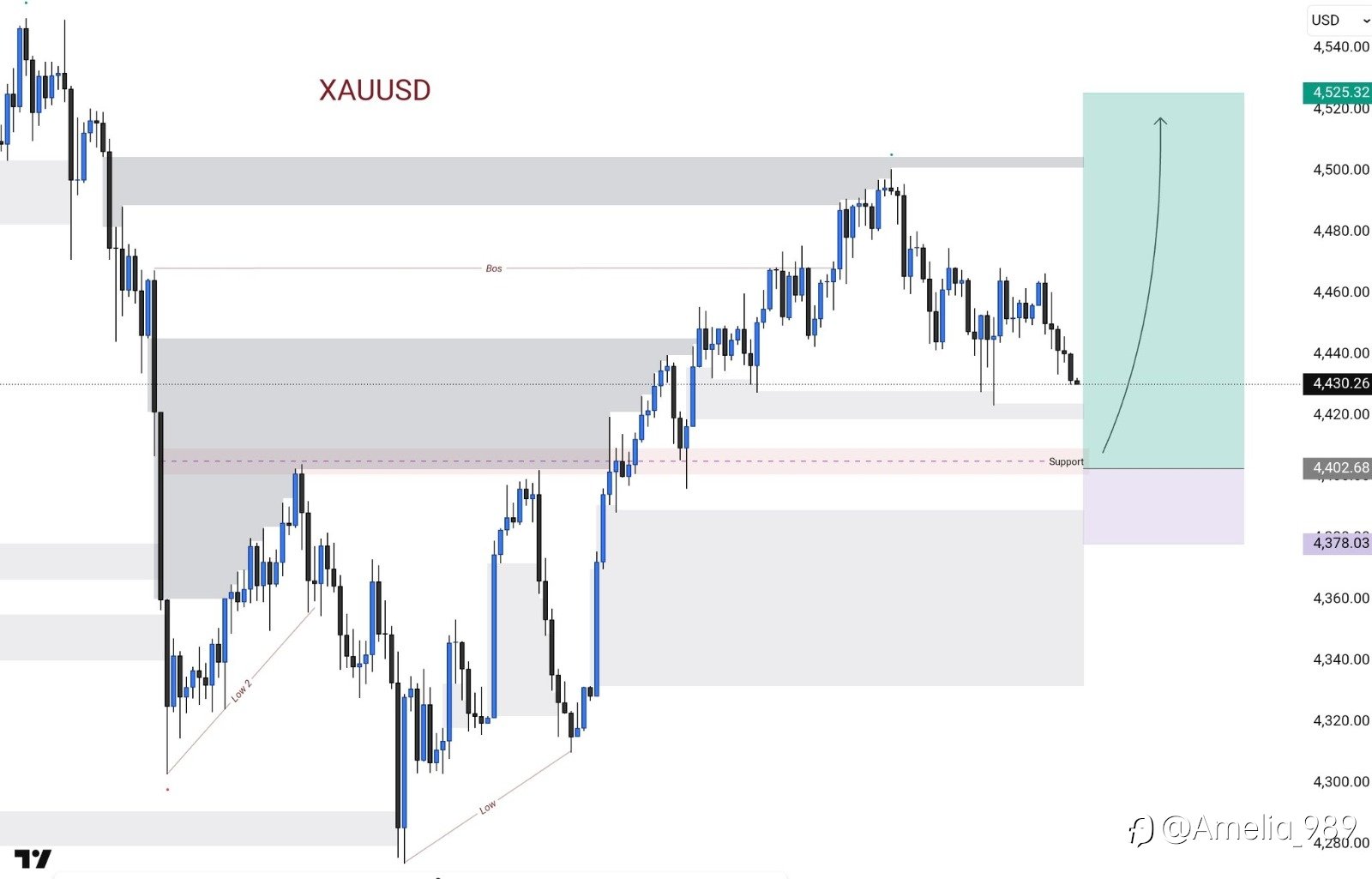

By the close of trading on Friday 23 January 2026, EUR/USD finished near 1.1828. Bitcoin (BTC/USD) ended the week around 89,580–89,700. Brent crude oil traded around 65.88 USD per barrel, and gold (XAU/USD) remained elevated near 4,900–4,985. The final week of January is positioned to reflect invest

Why the Rise in Investment Fraud Losses Shows That Trust and Speed Are the Real Dangers in Trading

As someone who’s been tracking forex and trading news for years, the report from the Belgian FSMA about the €23 million in investment fraud losses in H2 2025 is no surprise, but it’s definitely alarming. Scams like those involving fake cryptocurrency trading platforms and Wha

Liked

How a $3 Million Scam Reminds Me to Never Let Trust Override Due Diligence in Trading

As someone who’s been in the markets for years, reading about this 85-year-old investor falling victim to a sophisticated WhatsApp group scheme hits close to home. The rise of fake trading apps, combined with social media manipulation, shows just how much technology has given scammers th

Liked

Why Cryptocurrency Scams Still Work: It’s All About Trust and Manipulation

As someone who’s witnessed countless scams come and go, Taiwan’s dismantling of the crypto-linked investment fraud ring feels familiar, but also deeply concerning. What strikes me about this case is the psychological manipulation involved. Scammers are no longer relying on c

I Wish I’d Learned Earlier That “Account Freezes” and “Bonus Unlocks” Are the Final Act of a Scam

As someone who has spent years in the trading world, the IBM-EA arbitrage story hits painfully close to home, and I wish this lesson had been louder earlier in my career. No legitimate platform freezes withdrawals and then demands more money to “unlock” access. That tactic exists

Liked

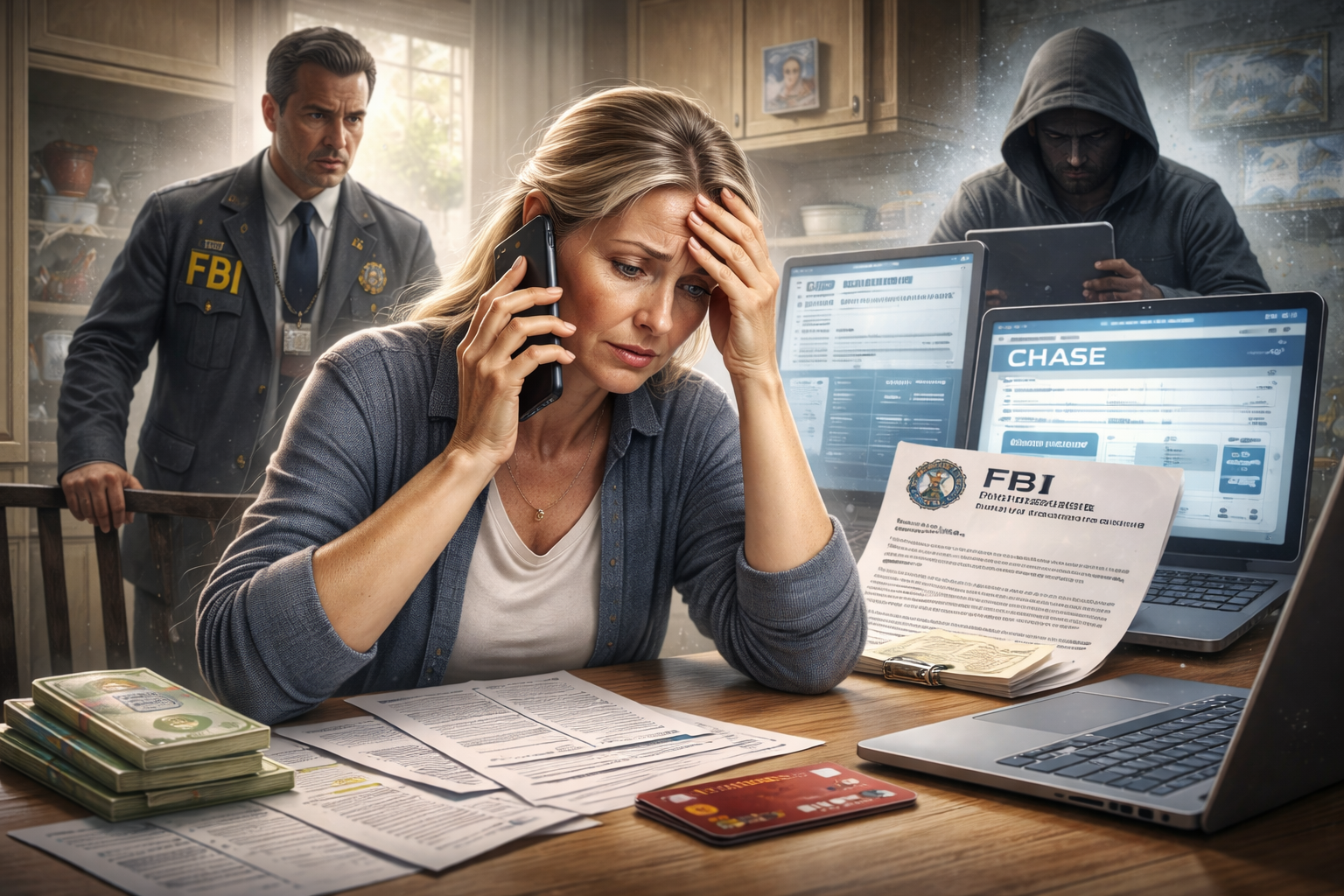

Impersonating the FBI is Not a Trading Strategy, It’s a Crime

As a retired professional trader, this Houston case highlights one of the darker aspects of financial manipulation that goes beyond just market moves — it exploits human trust. Scammers impersonating trusted institutions like banks and the FBI is an old trick but with new, sophis

If the “Broker” Lives on Telegram and a Cloned Website, It’s Not Investing, It’s a Funnel

This Bangladesh case is a classic retail-trap playbook dressed up with modern tools: a cloned website to borrow legitimacy, Telegram groups to mass-recruit, and a web of bank and crypto accounts to move money fast and disappear cleanly. Real investing does not require you to trust anonymous “r

If the “Broker” Lives on Telegram and a Cloned Website, It’s Not Investing, It’s a Funnel

This Bangladesh case is a classic retail-trap playbook dressed up with modern tools: a cloned website to borrow legitimacy, Telegram groups to mass-recruit, and a web of bank and crypto accounts to move money fast and disappear cleanly. Real investing does not require you to trust anonymous &

When “Events-Based Bets” Turn Into Information Arbitrage, It’s Not Just Luck, It’s a Red Flag

As a retired professional trader, watching an anonymous account net roughly $410,000 from a prediction bet tied to Venezuelan political developments feels less like an isolated oddity and more like a symptom of how loosely regulated event markets can be gamed. The timing and precision of plac

Liked

When the “Catalyst” Is a Lie, It’s Not a Trade, It’s a Crime Scene

As a retired professional trader, this alleged $41 million cross-border scheme is the dark mirror of what real markets are supposed to reward. Insider trading, hacked forums, spoofed websites, and fake press releases aren’t “edges,” they’re shortcuts that poison price discove