© 2026 Followme

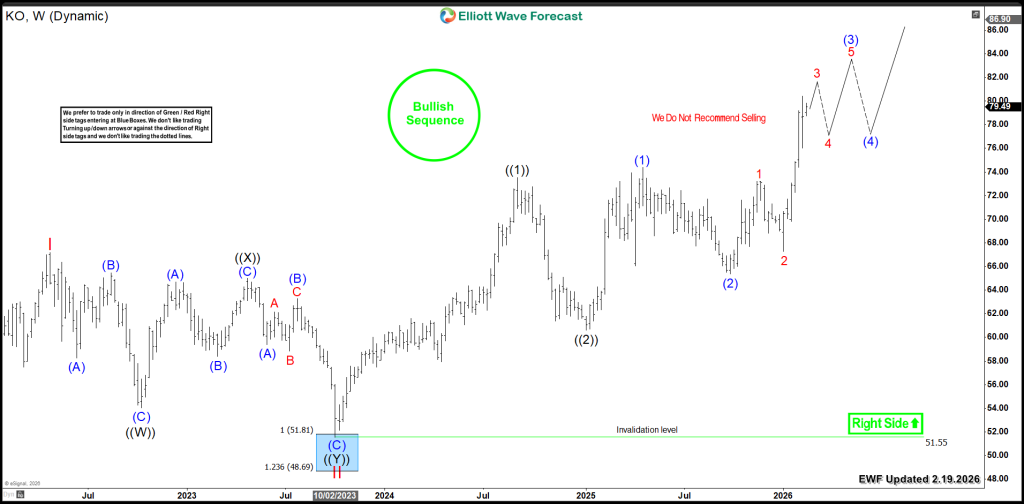

Coca-Cola (NYSE: KO) Aiming for Triple-Digits ($100)

Coca-Cola Co (NYSE: KO) continues setting new record highs weekly. In this article, we analyze its weekly Elliott Wave structure. Our analysis reveals the current bullish breakout path and key upside targets. Elliott Wave Analysis KO is advancing within a nesting structure from its 2023 low. Wave ((

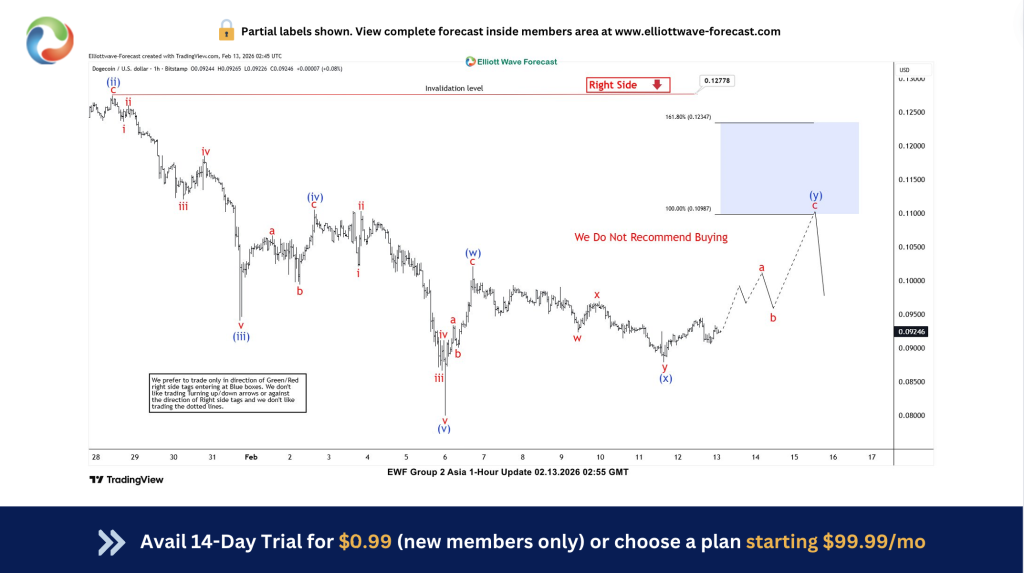

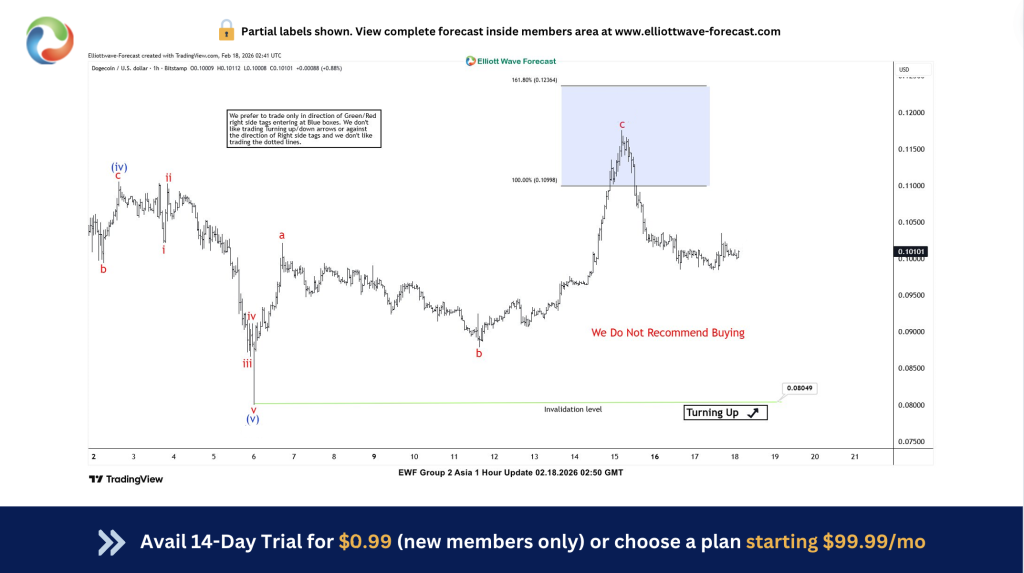

Elliott Wave Analysis - Doge Extends Bearish Cycle From Blue Box

Hello traders. Welcome to a new blog post where we discuss past and recent trades from the blue box. In this one, the spotlight will be on the DOGEUSD cryptocurrency pair. The crypto market has been in a bearish cycle since Q4 2025 and is likely to extend further. Doge initiated wave (III) of its al

Xcel Energy (XEL) In Early Stages of a Powerful Wave (III) Rally

NASDAQ-listed XEL completes corrective wave (II) at $43.64 and turns higher, signaling the beginning of a potentially explosive impulsive advance. Xcel Energy Inc (XEL), listed on the NASDAQ, is showing a compelling bullish Elliott Wave structure on the long-term chart. The technical outlook suggest

Elliott Wave Impulse in DAL Since April 07, 2025 — Structural Warning to World Indices

Since April 07, 2025, Delta Air Lines (NYSE: DAL) has traced a textbook five-wave impulsive advance under classical Elliott Wave Theory. The structure satisfies all core impulsive criteria and suggests that the advance from the April cycle low represents a mature motive phase. When a transport leade

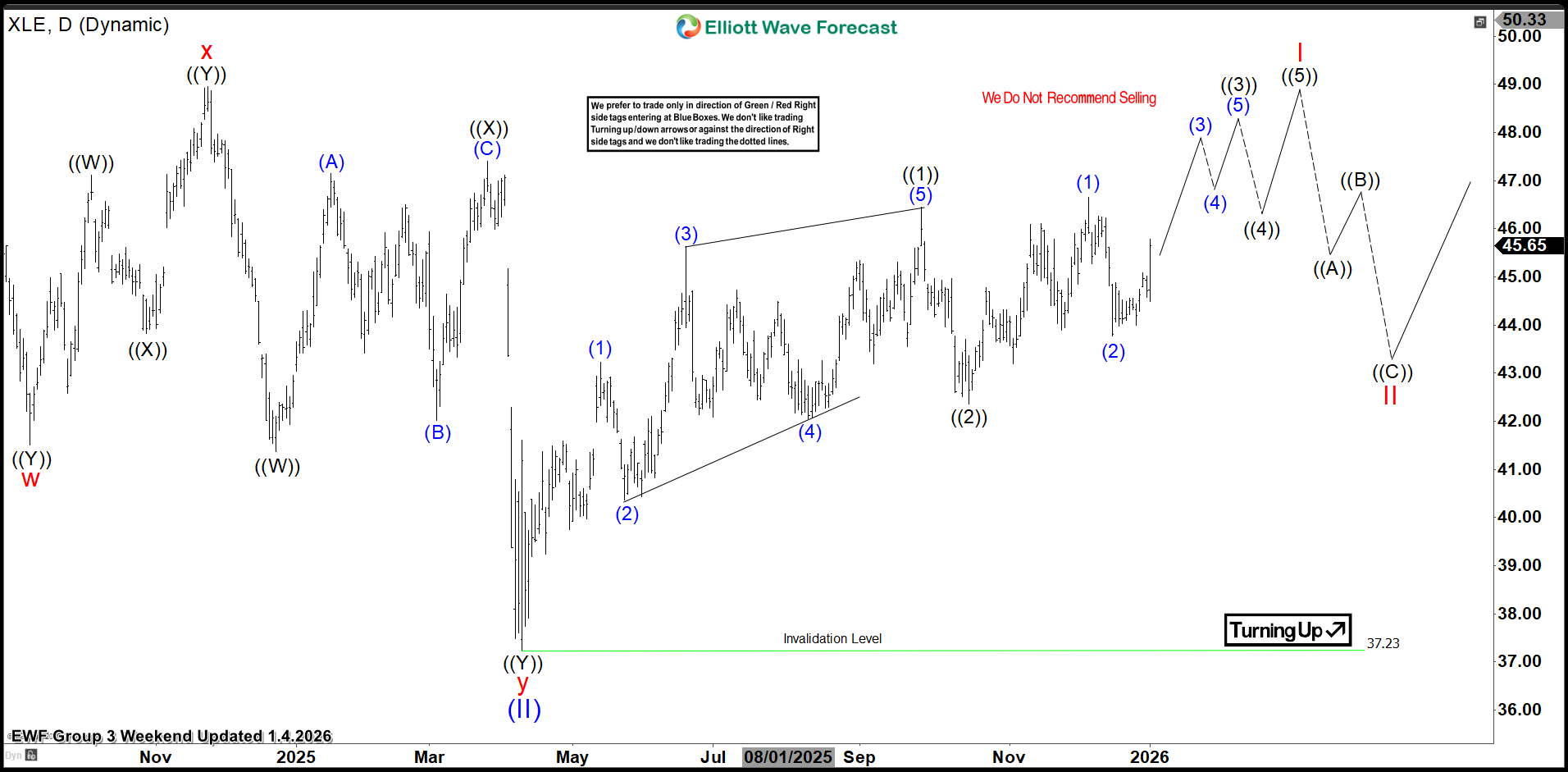

Energy Sector ETF $XLE Incomplete Bullish Sequence, With $75 Target Still Ahead

Hello everyone! In today’s article, we’ll examine the recent performance of Energy Sector ETF ($XLE) through the lens of Elliott Wave Theory. We’ll review how the rally from the April, 2026, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into t

Johnson Controls (JCI) Favors Rally Up To 151.5 Before Correcting Next

Johnson Controls International plc, (JCI) engages in engineering, manufacturing, commissioning & retrofitting building products & systems in United States & globally. It operates in four segments like Building Solutions in North America, Building Solutions EMEA/LA, Building Solutions Asi

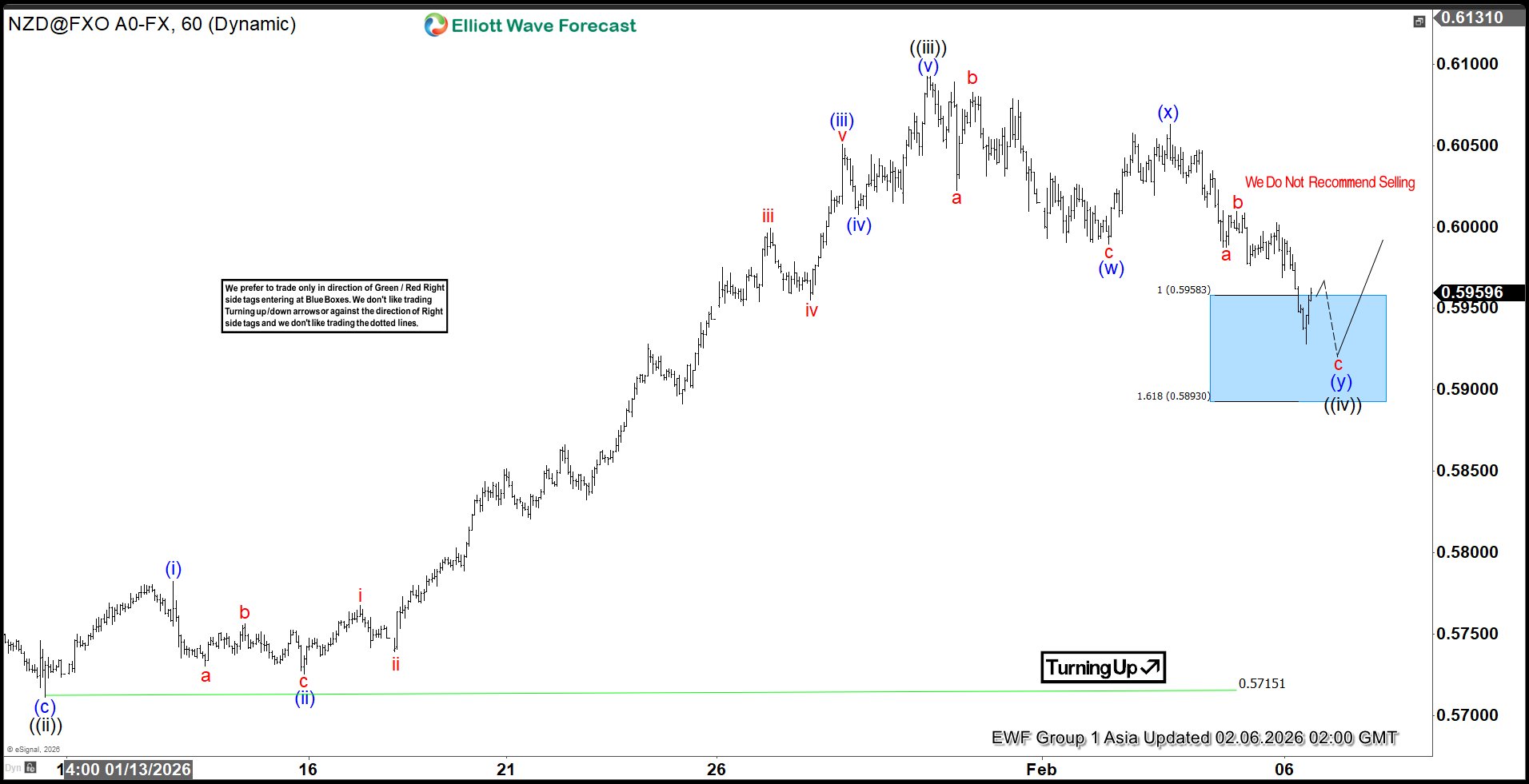

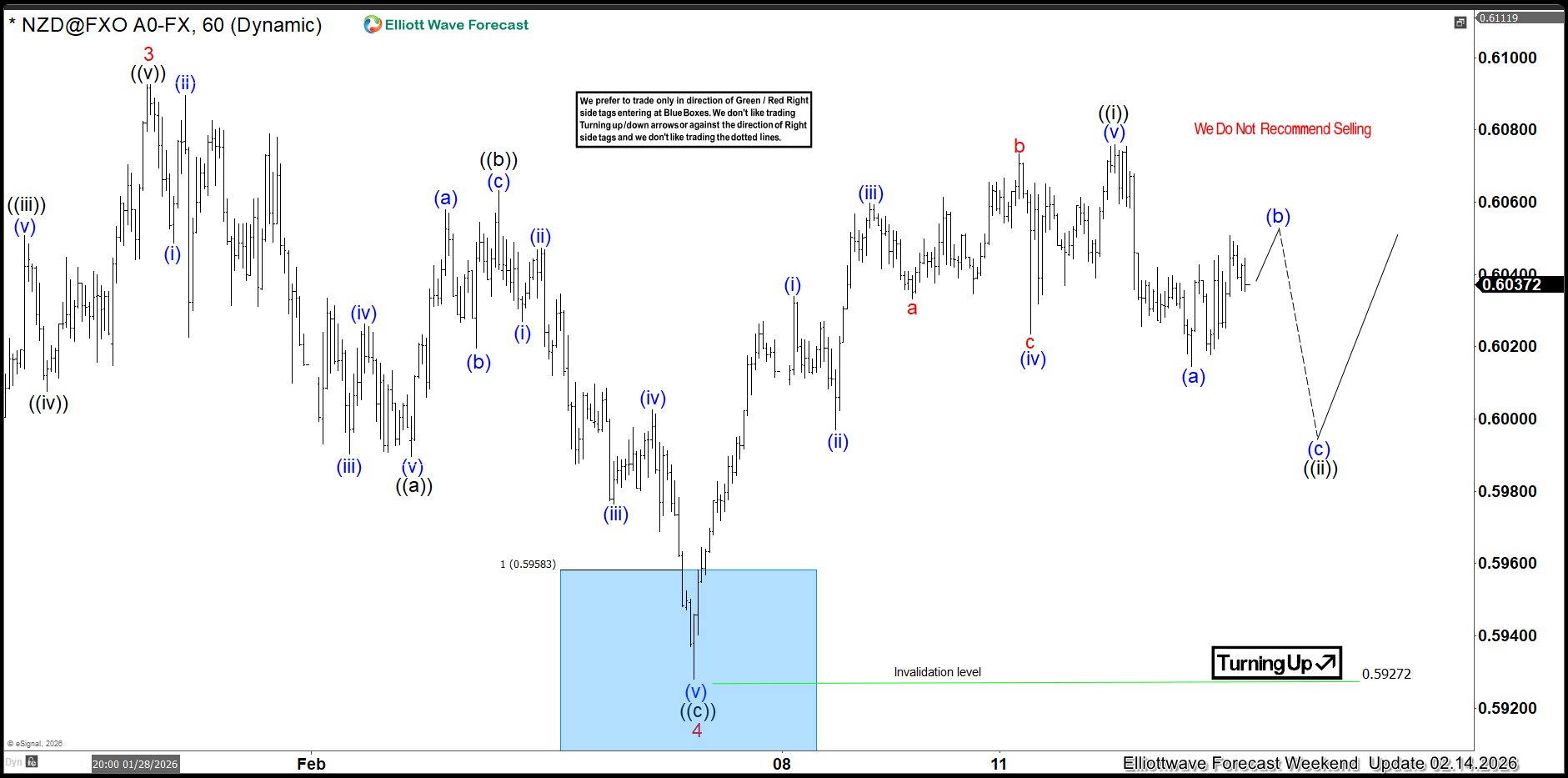

NZDUSD Validates Blue Box Strategy, Offers Buy Setup

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of NZDUSD. In which, the rally from 21 November 2025 low is unfolding as an impulse & showed a higher high sequence therefore, called for an extension higher to take place. We knew that the structure i

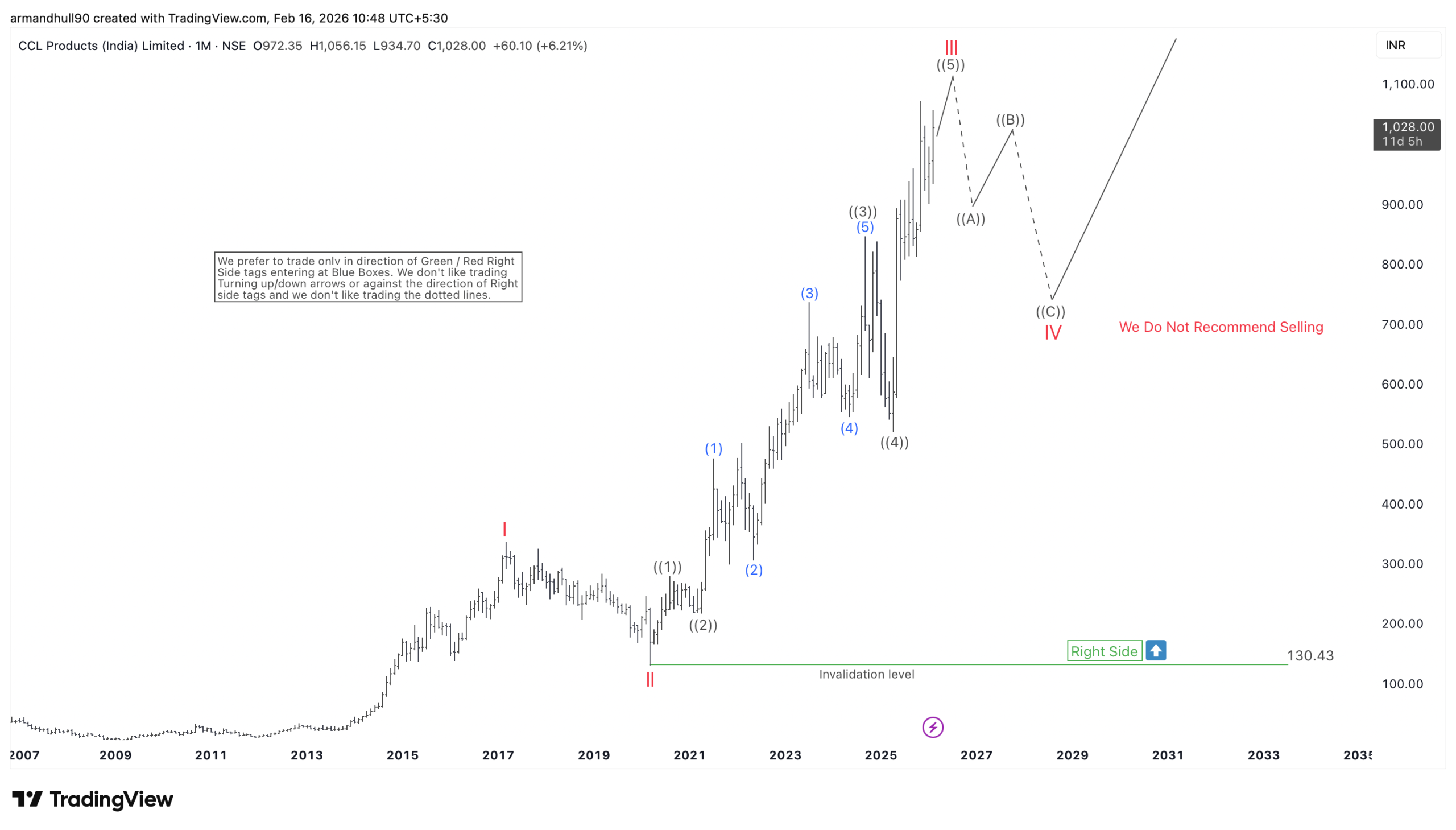

CCL Products Elliott Wave Forecast: Wave III Ending, Wave IV Pullback Ahead

Momentum is nearing exhaustion in Wave III, setting up a corrective pullback that could create the next high-probability buying opportunity for the Wave V advance. CCL Products (India) Limited continues to follow a strong bullish Elliott Wave structure on the monthly chart. The long-term trend began

Dixon Technologies Elliott Wave Forecast: Wave V Rally Targeting 21,500+

Bullish reversal from the blue box support signals the next impulsive rally phase Dixon Technologies (India) Ltd has delivered a technically clean reaction from a major Elliott Wave support region. The weekly structure now suggests the corrective phase has likely ended and the next impulsive advance

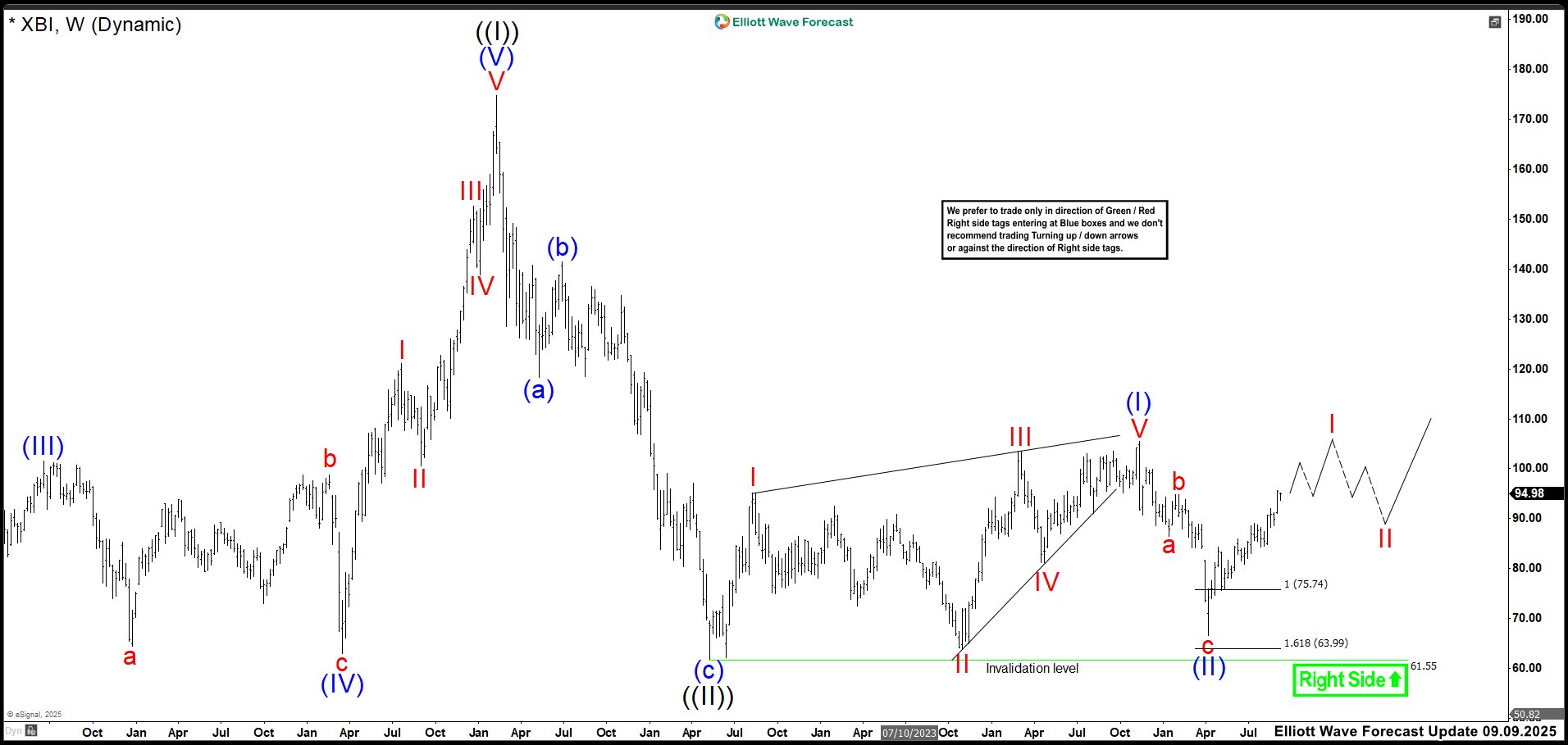

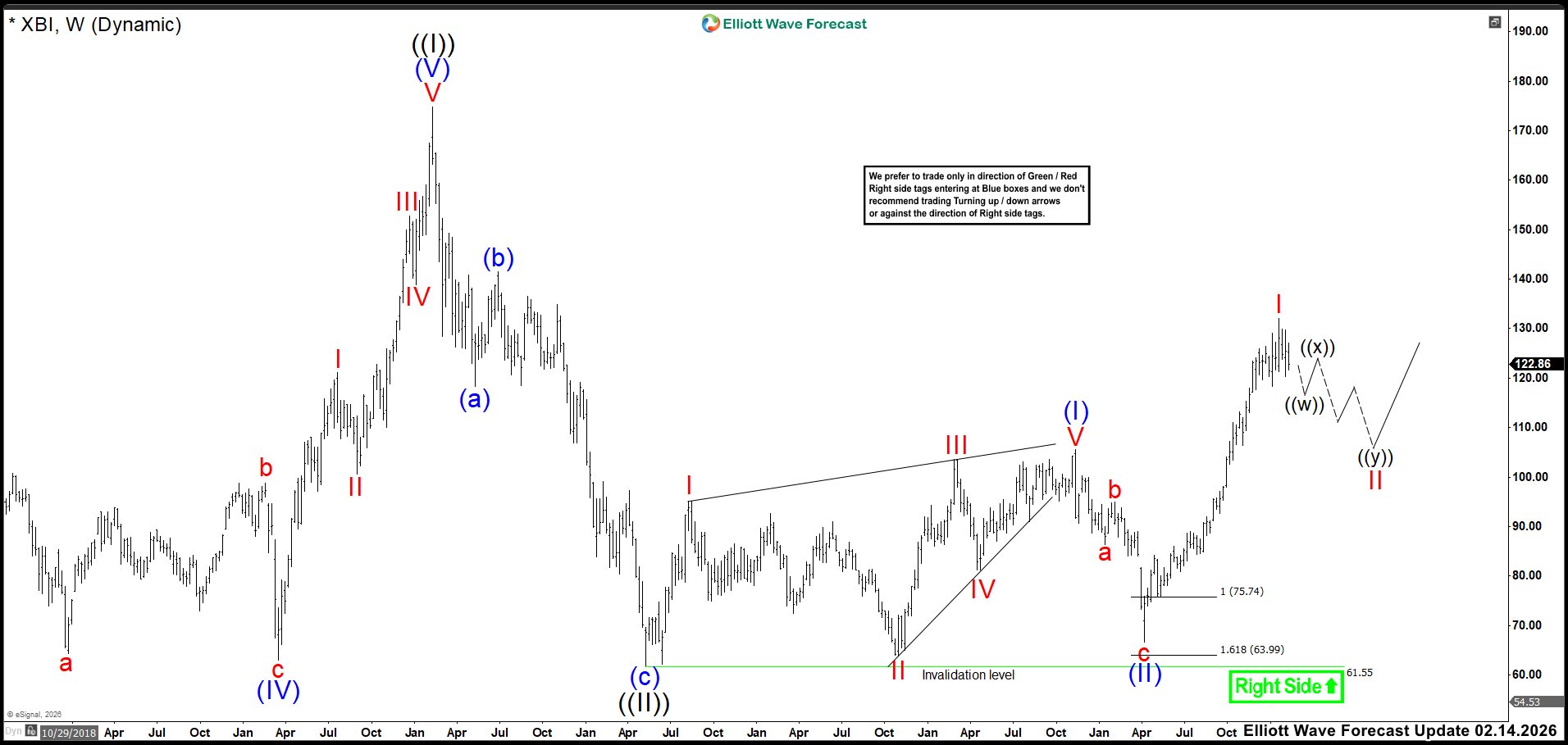

XBI Signals a Wave II Pullback After a 62% Rally

The XBI enters the first quarter of 2026 with a stable but cautious tone. Investors see improving liquidity, yet risk appetite remains selective. Moreover, late‑stage companies attract more attention as early‑stage names still face tighter funding. This dynamic creates a mixed environment across the

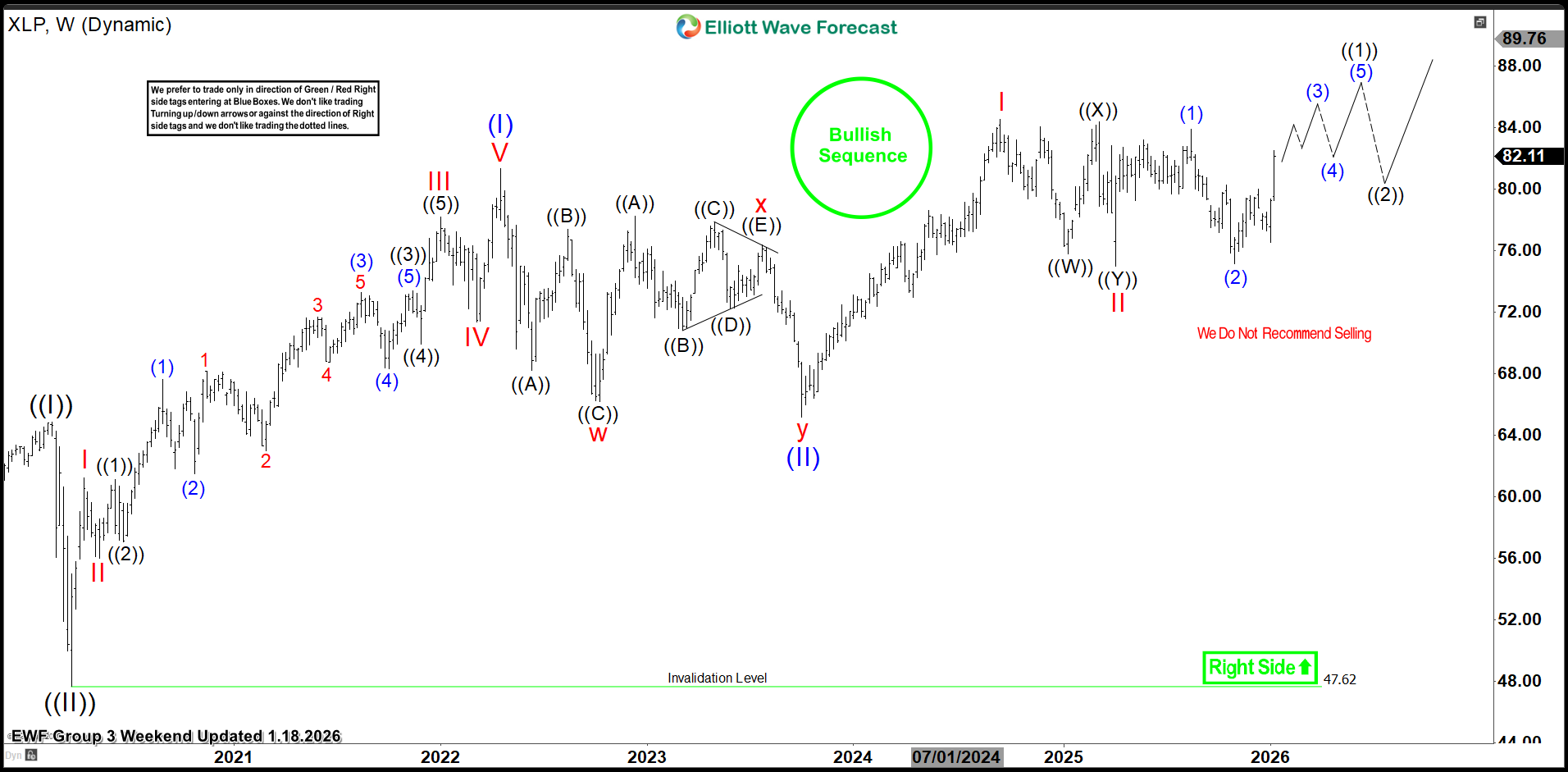

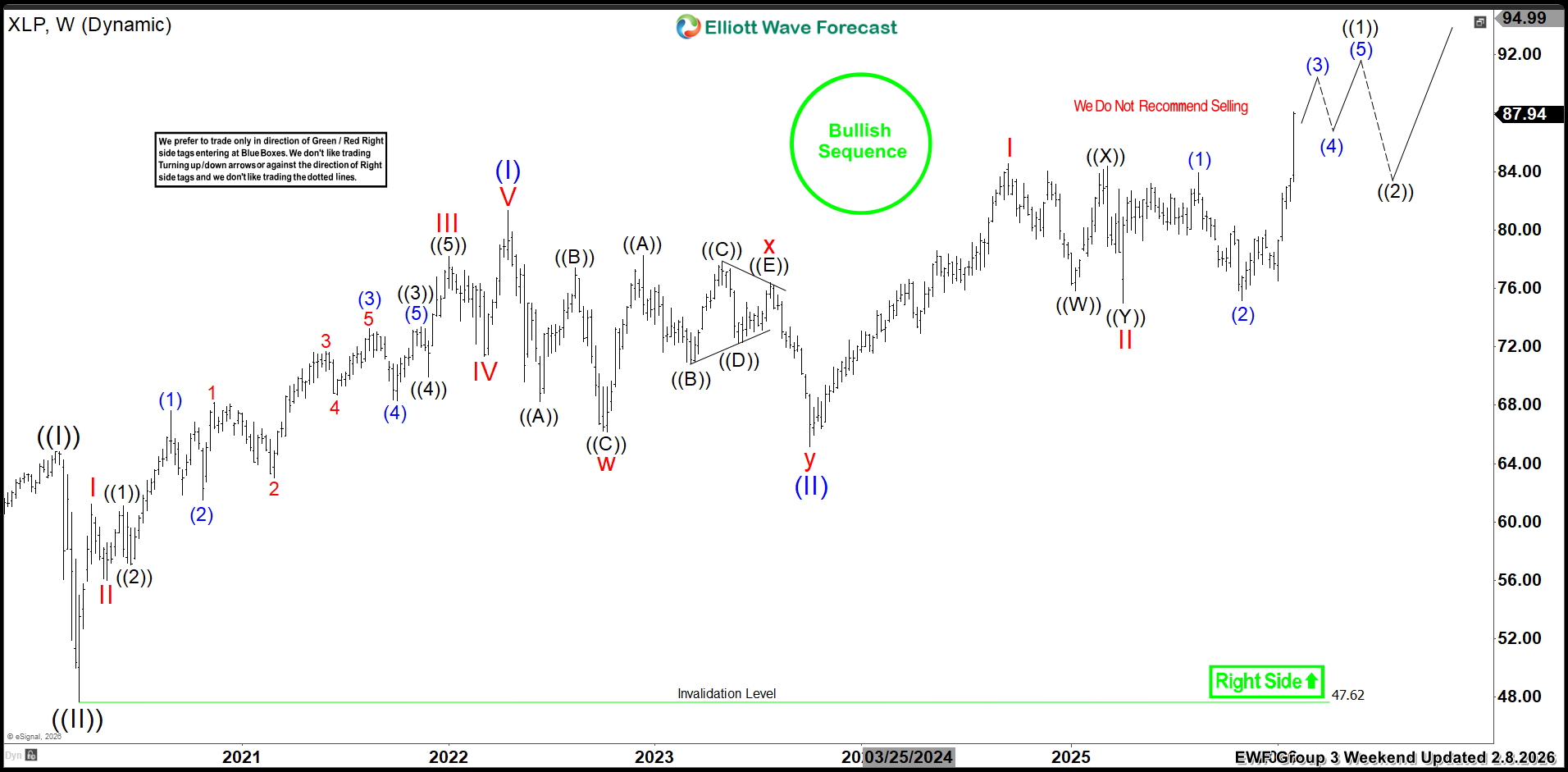

Consumer Staples ETF $XLP Incomplete Bullish Sequence, With $94 Target Still Ahead

Hello everyone! In today’s article, we’ll examine the recent performance of Consumer Staples ETF ($XLP) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 06, 2023, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’

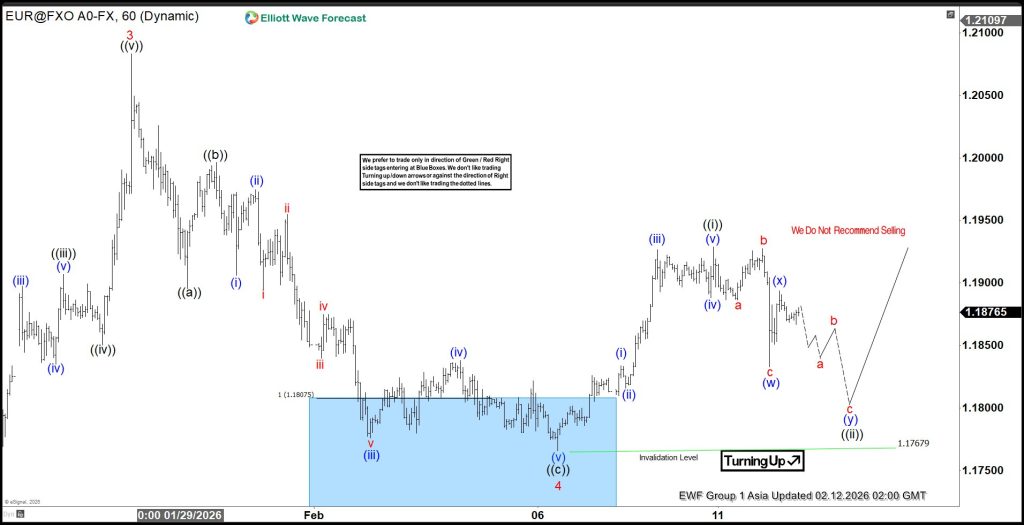

EURUSD Validates Elliott Wave with Perfect Blue Box Reaction

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of EURUSD. In which, the rally from 05 November 2025 low is unfolding as a diagonal & showed a higher high sequence therefore, called for an extension higher to take place. We knew that the structure i

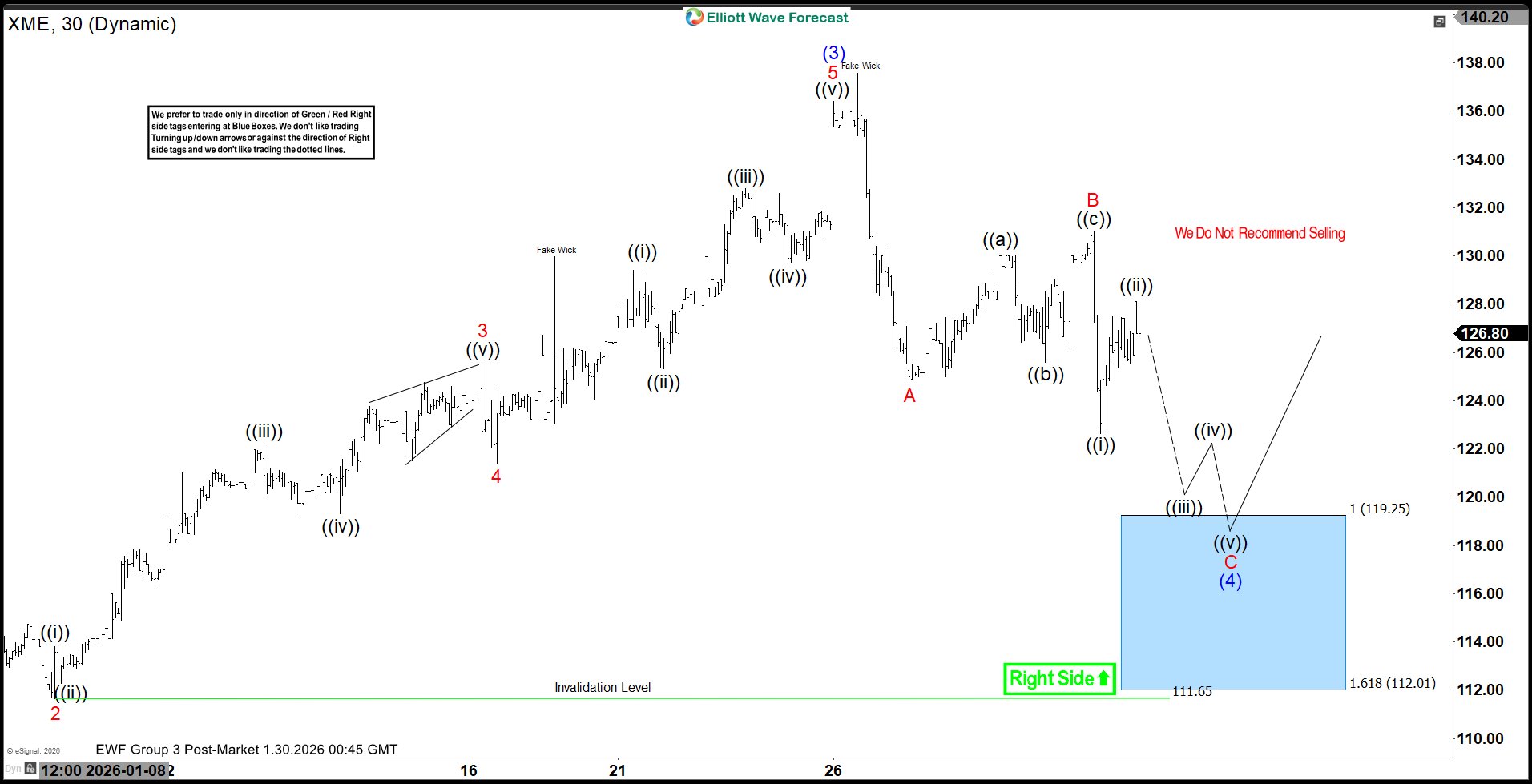

Metals & Mining ETF $XME Blue Box Area Offering a Buying Opportunity

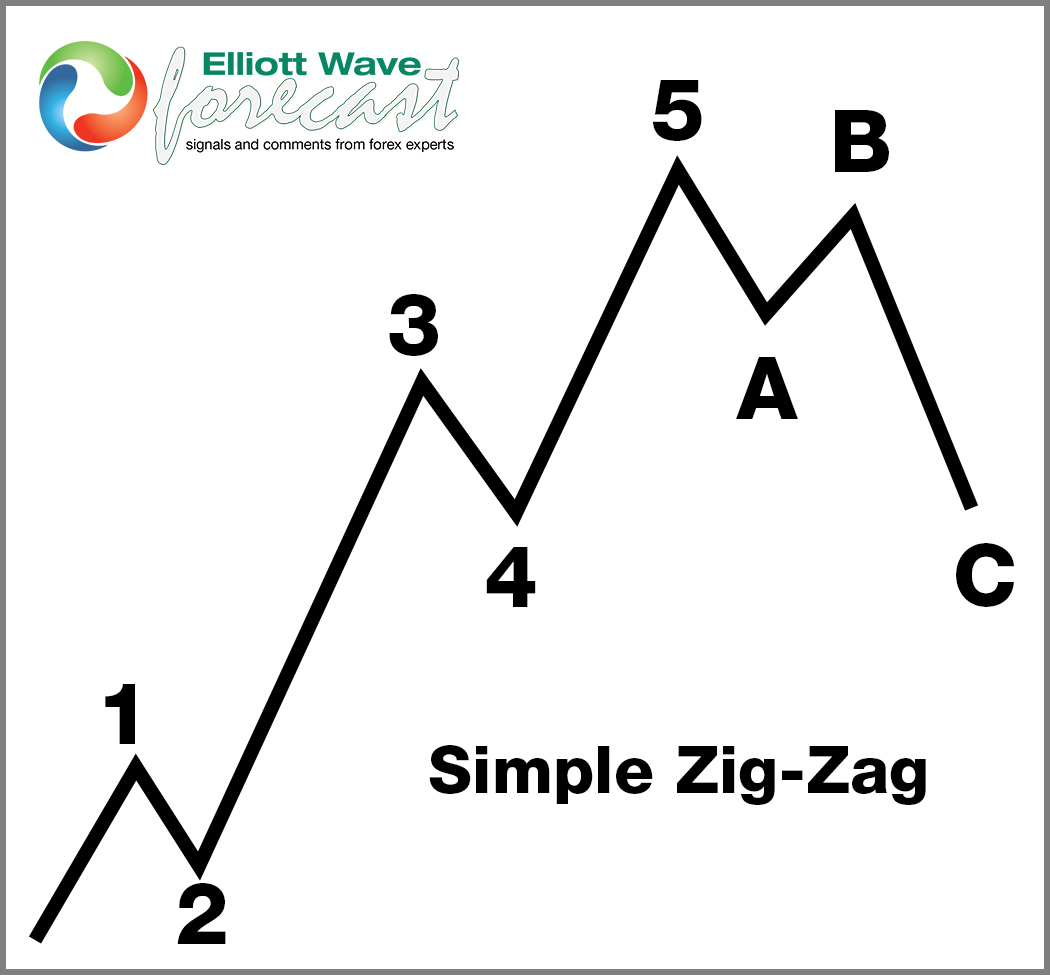

Hello everyone! In today’s article, we’ll review the recent performance of Metals & Mining ETF ($XME) through the lens of Elliott Wave Theory. We’ll look at how the pullback from all-time highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structur

Elliott Wave Outlook Suggests More Gains Ahead for Pan American Silver (PAAS)

Pan American Silver Corp. (NYSE: PAAS, TSX: PAAS) is one of the world’s leading silver producers, operating mines and exploration projects across the Americas. The company also produces gold and other base metals, positioning itself as a diversified precious metals miner with a strong long-term grow

Vertiv Holdings (VRT): Diagonal Extends Into 215.5 -232.1 Area

Vertiv Holdings Co., is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. VRT favors bullish sequence in weekly