© 2026 Followme

Liked

The market thinks BlackRock's Rick Rieder will be the next Fed chair. Here's what's at stake

A five-month process of finding the next Federal Reserve chair appears to be down to its final days, with one candidate emerging as the betting favorite even as others remain in the mix. BlackRock fixed income chief Rick Rieder is seen by prediction markets as the frontrunner to replace Jerome Powel

What This €23 Million Fraud Teaches Me About Why I Must Always Verify Before Trusting Any Trading Platform

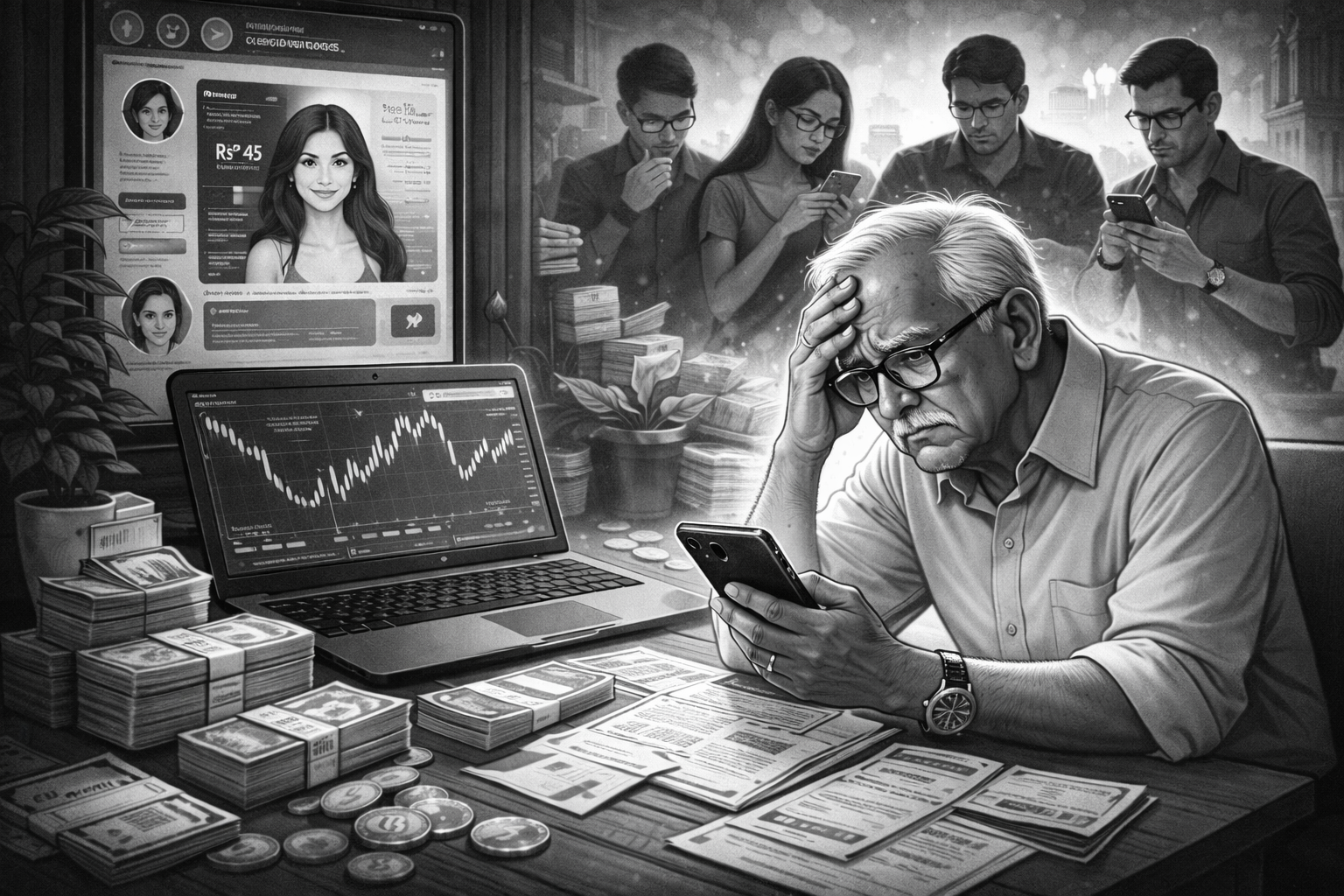

As someone who has only been in the forex world for about six months, reading about this €23 million investment scam really shook me. When you’re new, the excitement of learning about trading and the potential for high returns can sometimes cloud judgment, and these types of frauds target

Why Learning to Verify and Question Is Crucial Before Trusting Any Trading Opportunity

As someone who's been in forex trading for about six months, reading this story about the 85-year-old investor who lost over ₹22 crore to a fake trading app really opened my eyes. When you’re new, it’s easy to get excited by success stories, especially when apps and people in socia

This Teaches Me How Emotions Can Be Manipulated in Trading

As someone still learning about trading, reading about this crypto scam in Taiwan honestly scares me, but it’s also a big wake-up call. When you're new, it's easy to get caught up in the excitement of crypto trading — especially when people online seem to have everything figured o

As a New Trader, This Shows Me How Quickly a “Small Test” Can Turn Into a Family Disaster

As someone still early in my trading journey, reading this story honestly scares me. Sending what feels like a “manageable” amount to test a platform sounds reasonable when you’re new, especially if the account balance keeps going up on screen. But realizing that those

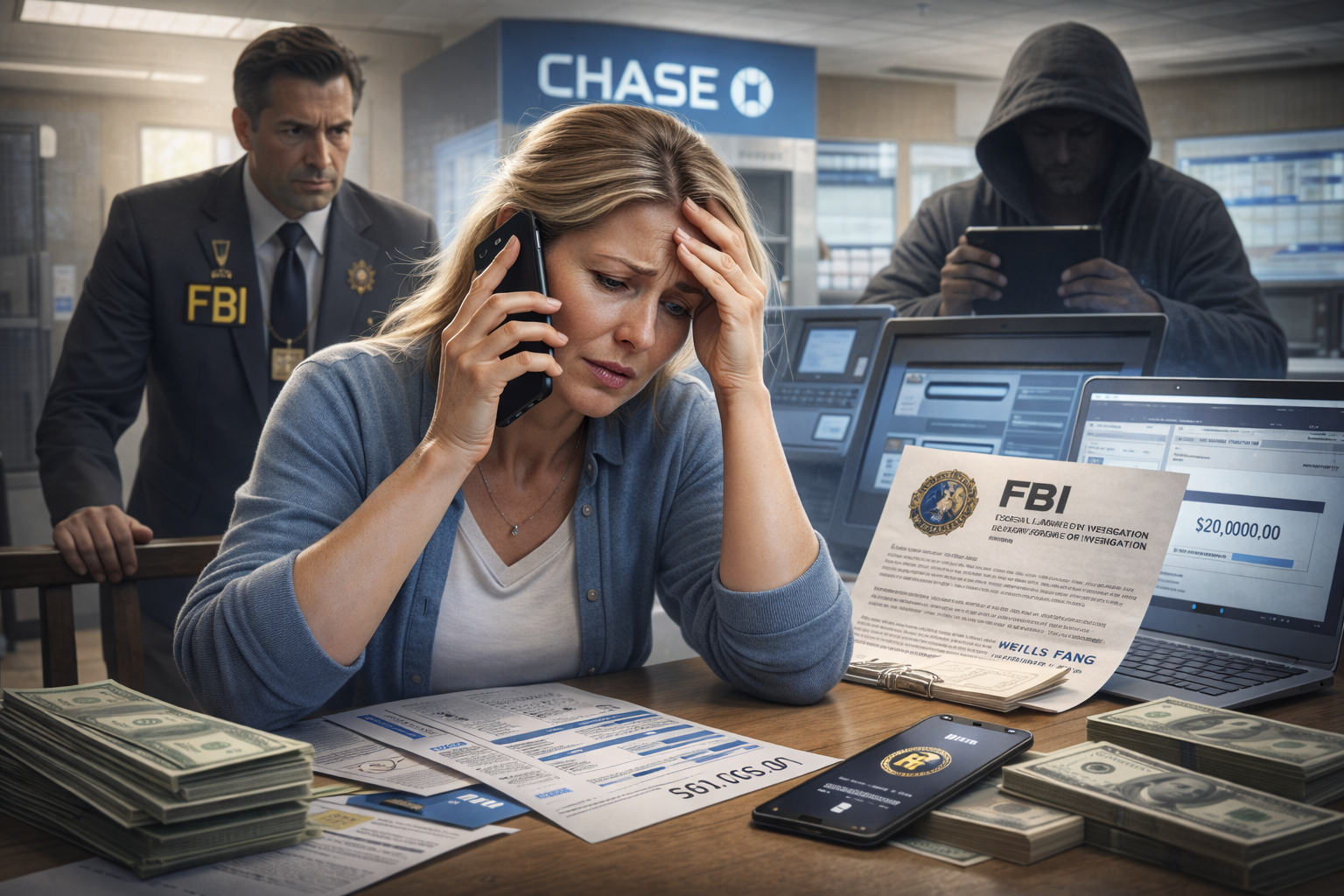

If They Rush You to Transfer Money, It’s a Scam

I’ve only been trading for two months, but I’ve been studying risk management, and this scam made me realize something: legitimate financial transactions never feel urgent. In this case, the victim was pressured by scammers who used threats of an FBI investigation to force her int

Two Months In, My Lesson: If They Ask for Extra Fees, Walk Away

I’ve only been trading for two months, but I’ve learned quickly that real investing doesn’t come with hidden fees, secretive calls, or rushed transactions. This story about the Indian investors losing millions in fake SEBI-registered schemes is a huge eye-opener for me. What struck

Liked

Liked

Profit by Following

122.66

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,589.91/4,601.05

- Volume Buy 20 Flots

- Profit 22,280.00 USD

If the “Broker” Lives on Telegram and a Cloned Website, It’s Not Investing, It’s a Funnel

I’ve only been trading for two months, but I’ve been studying scam patterns alongside risk management, and this story shows how scams are engineered like a system, not a one-off lie. The cloned foreign-company website is meant to make people drop their guard, and Telegram is used because

Two Months In, My Lesson: If You Can’t Verify It From Multiple Trusted Sources, Don’t Treat It as a Trading Signal

I’ve only been trading for a couple of months, but I’ve been diving into how prediction markets behave and this Venezuela-related payout really drove home a key lesson: just because something moves quickly doesn’t mean it’s tradable in a healthy way. Watching that anon

If You Can’t Verify the News, You Don’t Trade It

I’ve been studying market scams and manipulation alongside basic risk management, and this case makes me realize how easily “news” can be weaponized. The idea that someone can hack a forum account or spoof a company website and trigger a big price jump is scary, because as a beginn

One Rule: Never Let a “Broker” Remote Into Your Computer

I’ve only been trading for two months, but I’ve been studying scam patterns alongside risk management, and this case has all the red flags I’ve learned to stop at immediately. The call-center structure and scripts make it feel legitimate, but the remote-access software is th