Gold Forecast – Cycles Support a September Breakdown

Metals and miners continue to consolidate ahead of Friday’s employment report. Our cycle work supports a breakdown in gold below $1900 and a subsequent buying opportunity.

In my 2019 Metal Recap, I noted how record low gold eagle coin sales likely signaled a shift from record low demand to record high demand over the next decade. That forecast was timely as fear gripped the markets 3-months later, and coin sales skyrocketed.

Now I am beginning to think shortages and inadequate supply could send premiums on certain coins to unbelievable heights. For example, I believe 1-ounce silver eagles could fetch double the spot price, and possibly much higher as acquiring physical coins becomes difficult.

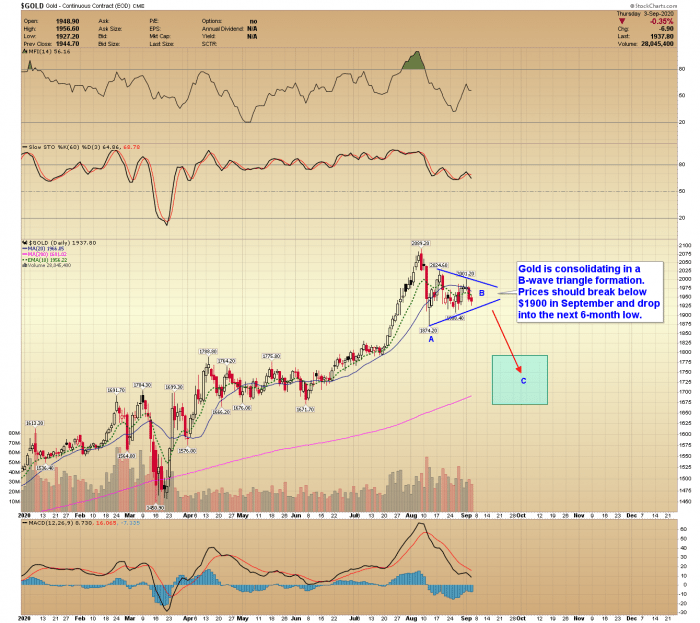

Current Gold Forecast

–GOLD– Gold is consolidating in a B-wave triangle formation. Prices should break below $1900 in September and drop into the next 6-month low.

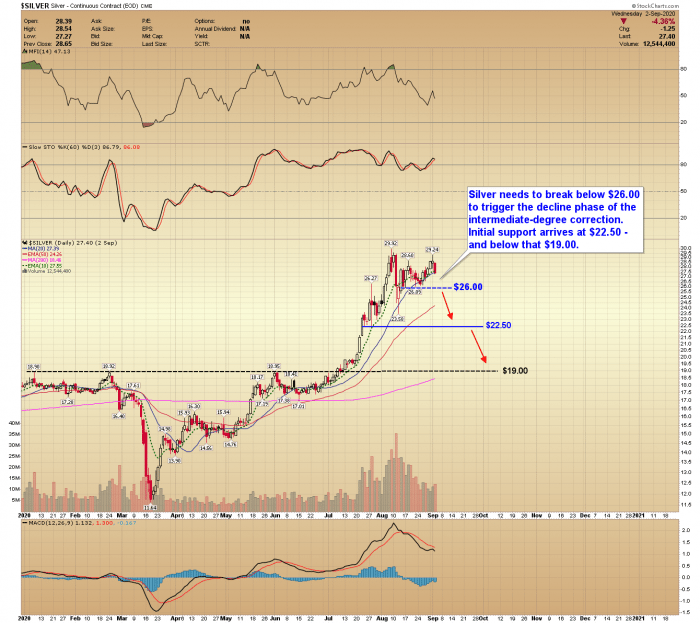

–SILVER– Silver needs to break below $26.00 to trigger the decline phase of the intermediate-degree correction. Initial support arrives at $22.50 – and below that $19.00.

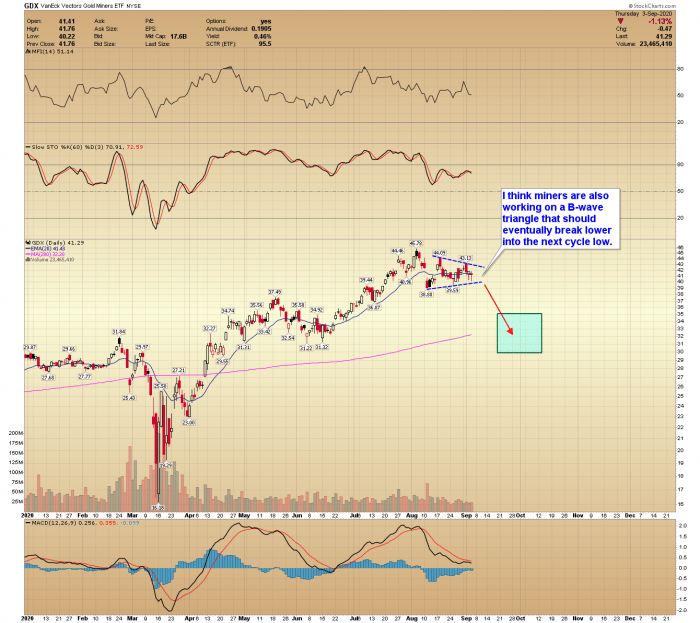

–GDX– I think miners are also working on a B-wave triangle that should eventually break lower into the next cycle low.

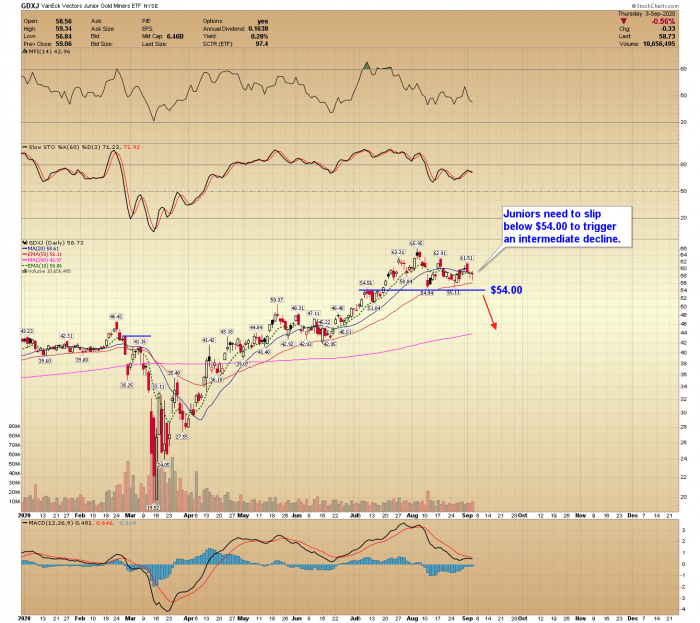

–GDXJ- Juniors need to slip below $54.00 to trigger an intermediate decline.

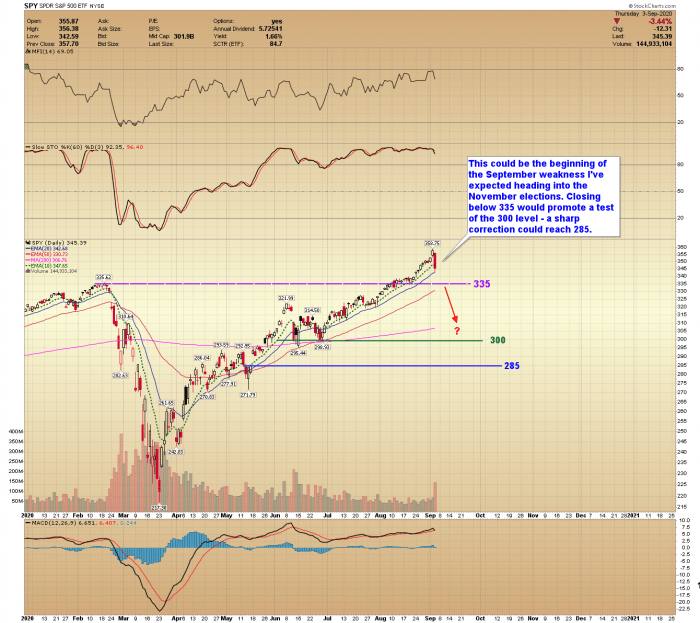

–SPY– This could be the beginning of the September weakness I’ve expected heading into the November elections. Closing below 335 would promote a test of the 300 level – a sharp correction could reach 285.

The stock market should remain under pressure into November – expect increased volatility. The dollar should stabilize as gold declines.

Our gold cycle indicator finished Thursday at 298. It should continue to work its way lower and eventually dip below 100 (cycle bottoming) in September. #gold##UnemploymentRate#

Reprinted from Fxempire,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-