© 2026 Followme

Liked

Liked

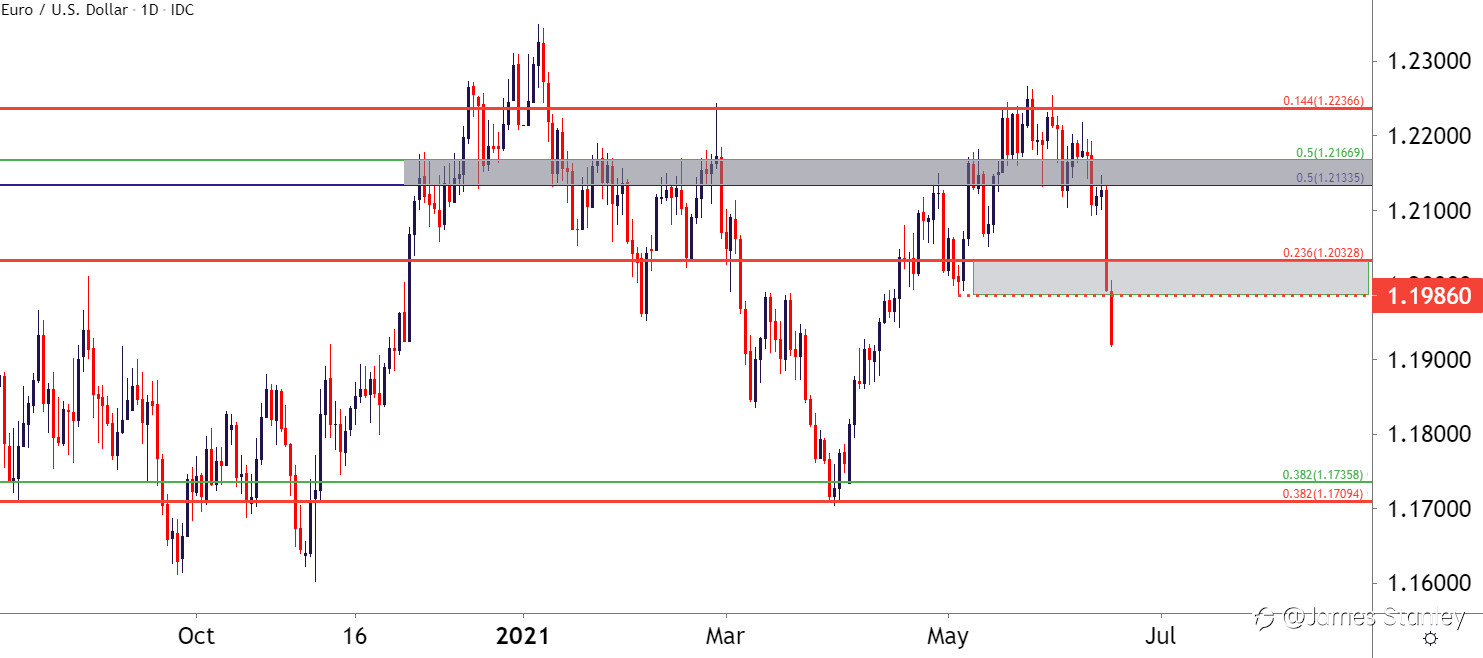

EUR/USD Price Analysis: Bears on the next leg towards 1.1805/12

EUR/USD bears are taking control below the 4-hour resistance. EUR/USD would be expected to let towards 1.1805/12 and prior daily structure. As per the prior analysis, EUR/USD bears seeking break of 4-hour support, the euro has indeed melted to the downside following a breach of the 4-hour support. P

Liked

Gold Price Forecast: XAU/USD rebounds from multi-month lows, holds above $1,760

Gold broke below last week's horizontal range on Tuesday. XAU/USD seems to have formed near-term support at $1,750. Broad-based USD strength makes it difficult for gold to stage a decisive rebound. Following last week's consolidation, gold traded in a relatively tight range on Monday. However, risin

Liked

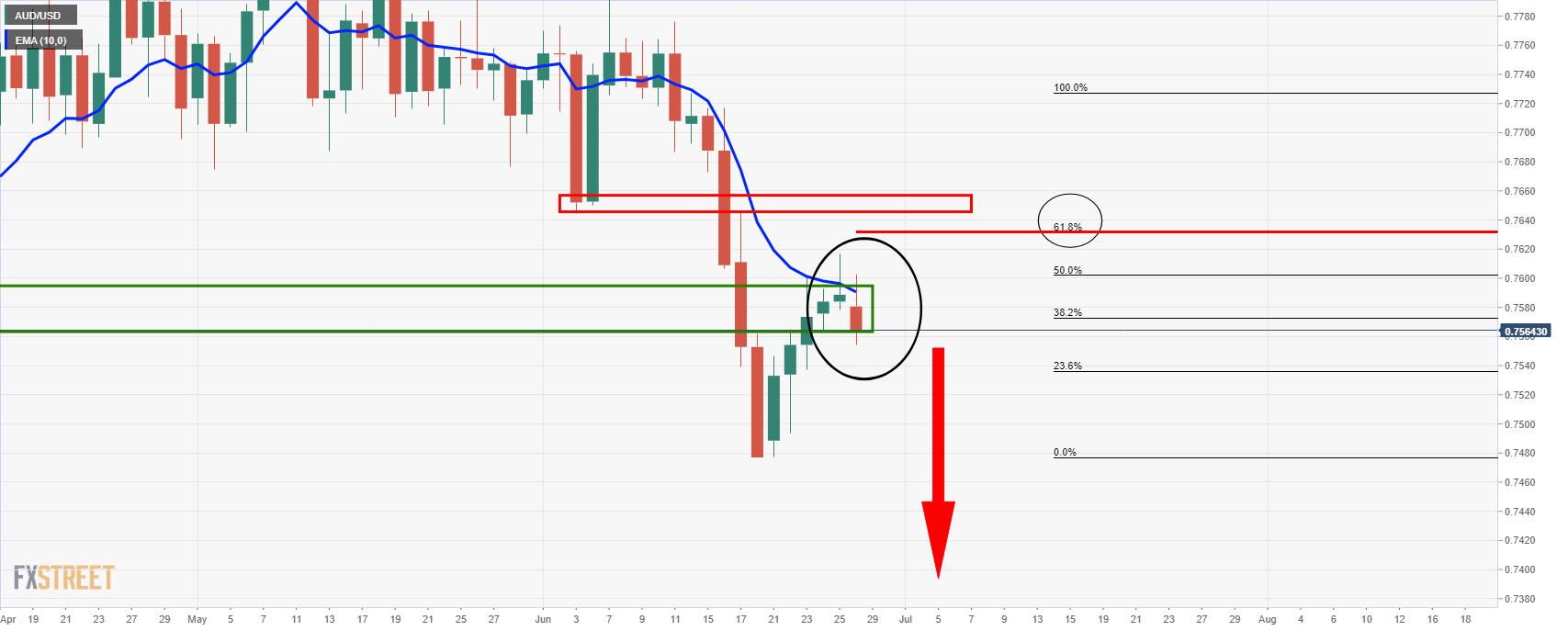

AUD/USD Price Analysis: Bears need to show-up at critical resistance

AUD/USD bulls are stepping in at a critical level of monthly support as the last defence. Bears will need to show up in strength at the 4-hour resistance. As per the prior analysis, AUD/USD Price Analysis: Bears need to contemplate monthly support, the price has indeed melted to test the bullish com

Liked

Liked

Liked

Liked

Fundamental Factors That Affect Currency Values

There are several fundamental factors that help shape the long-term strength or weakness of the major currencies and will affect you as a forex trader. We’ve included what we think are the most important for your reading pleasure: Economic Growth and Outlook We start easy with the economy and outloo

Liked

- Iranda Baskara :is XAUUSD worthed to trade right now?

Liked

Liked

Liked

Where next for markets after the Fed shocker

The Federal Reserve has surprised markets with an abrupt hawkish shift that has triggered substantial volatility in currency markets. Valeria Bednarik and Yohay Elam explain the surprise, discuss technical level and the next moves in FX and beyond. Yohay Elam: The Federal Reserve has shocked markets

Liked

Gold uptrend offers similar wave-4 pullbacks on two time-frames

Gold made a strong bullish bounce at the 38.2% Fibonacci retracement level. This is probably a wave 4 pullback, which means that more uptrend is still expected. The bullish impulse and breakout (blue box) above the 21 ema zone is strong. A retest of the previous top is likely (first green arrow). On

Liked

Weekly trading plans: USD/JPY, SPX500, bonds, DX [Video]

After the employment report last Friday, markets have significant and volatile movements. Without a clear trading plan will be hard to make money. But with a propper Elliott Wave analysis, the analyst can be one step ahead of price and have enough time to plan entries with a cold head. This week we

Liked

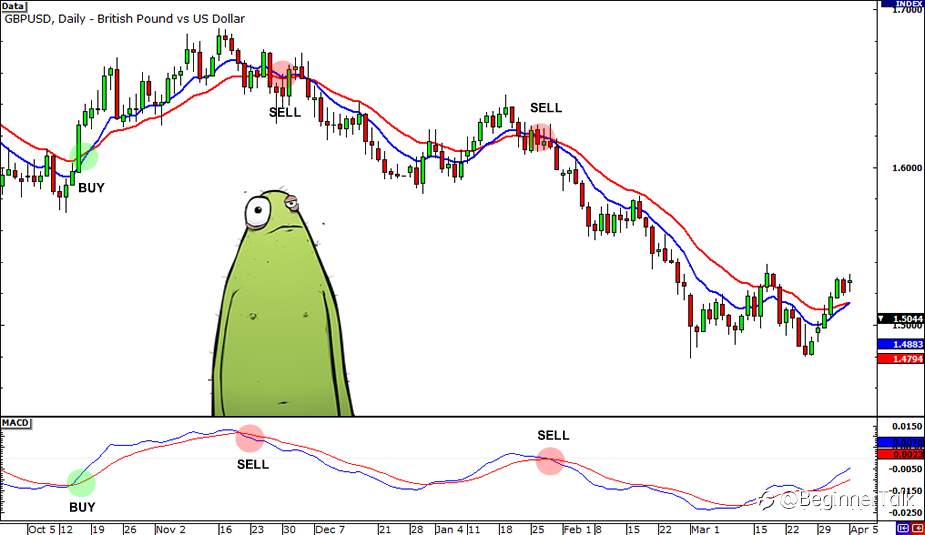

What is the Best Technical Indicator in Forex?

Now on to the good stuff: Just how profitable is each technical indicator on its own? After all, forex traders don’t include these technical indicators just to make their charts look nicer. Traders are in the business of making money! If these indicators generate signals that don’t transla