© 2026 Followme

Liked

USD Direction and Major Currency Movements: Market Structure in a Headline Driven Environment

Global FX markets are currently operating under a highly headline sensitive regime, where price movements are less driven by traditional economic data and more influenced by confidence, policy expectations, and shifts in global risk sentiment. In this environment, the U.S. dollar (USD) remains the c

Liked

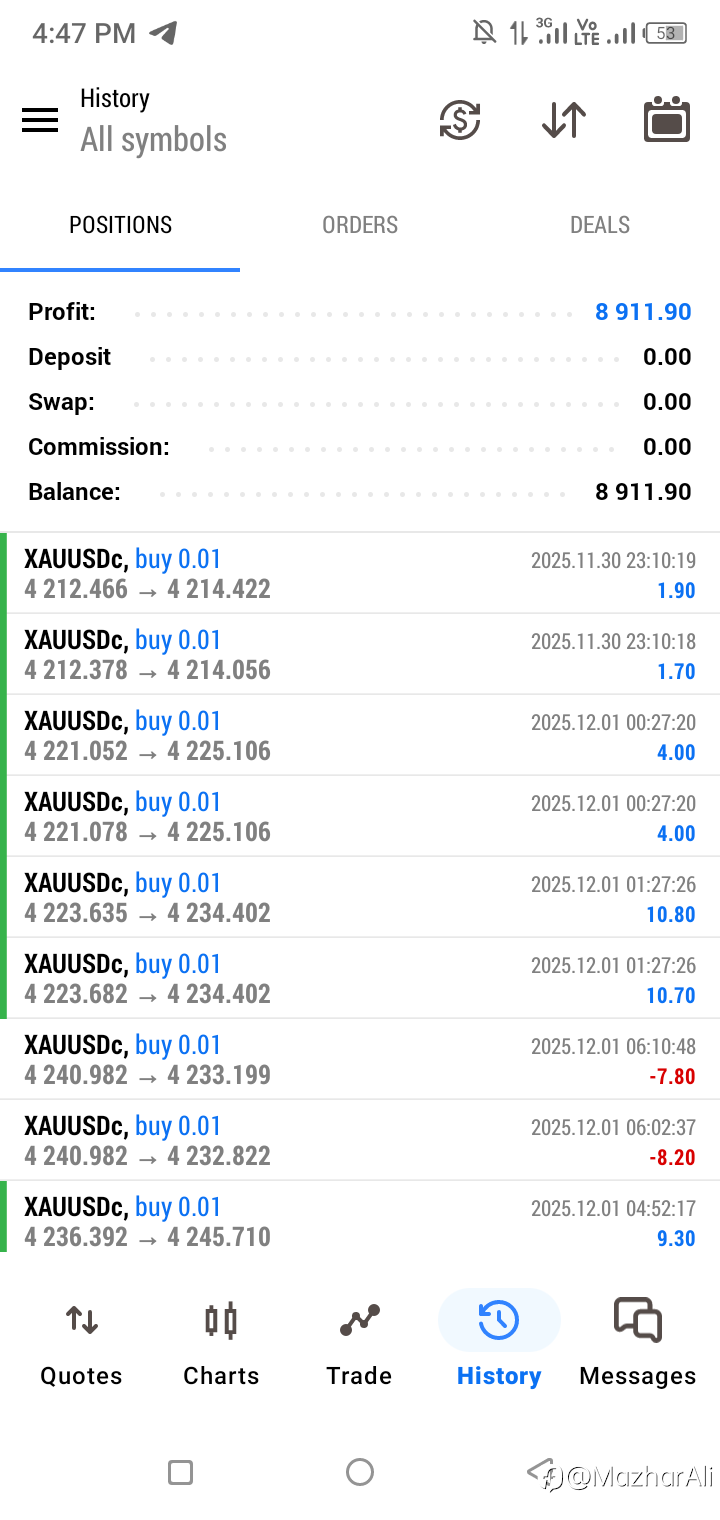

How a $3 Million Scam Reminds Me to Never Let Trust Override Due Diligence in Trading

As someone who’s been in the markets for years, reading about this 85-year-old investor falling victim to a sophisticated WhatsApp group scheme hits close to home. The rise of fake trading apps, combined with social media manipulation, shows just how much technology has given scammers th

Liked

Liked

Liked

Liked

Why Bitcoin Stalls While Silver Surges 155% - The Cross-Asset Data Problem Traders Must Solve

Have you ever watched bitcoin grind sideways in a tight range, dismissed it as “nothing happening,” only to later discover altcoins were leading and silver had quietly become the world’s third-largest asset by market cap? That’s not a timing issue. It’s a data gap. Over the past 24 hours, BTC traded

Liked

Global Liquidity Cheat Sheet

Partner Center Congratulations! You’ve completed the “Beginner’s Guide to Global Liquidity” course. This is your operational cheat sheet, the same type of metrics that many institutional macro portfolio managers monitor. How to use this guide: Bookmark this page. Check it every Monday morning (10 mi

What the Fed’s Next Move Could Mean for Global Forex Markets

Looking ahead, the Fed’s next steps could define the next major phase in Forex trading. If economic data continues to soften and inflation trends lower, markets may push harder for rate cuts. In that scenario, the Dollar could remain under pressure, supporting other major currencies and precio

Rate Cut Expectations Are Shaping the US Dollar’s Direction

One of the biggest trends in the market right now is rising discussion around future rate cuts. Even without a confirmed timeline, expectations alone are enough to move currencies. The US Dollar has become especially sensitive to changes in interest rate outlooks. When traders believe rate cuts are

Why the Federal Reserve Is Still the Center of the Forex Market

No institution influences the Forex market more than the Federal Reserve. Even when the Fed does not change interest rates, its tone, signals, and future guidance can move currencies around the world. Right now, markets are closely watching the Fed because expectations are shifting, not actions. Tra