#NewYearsweek#

940 View

103 Discuss

Does New Year Mean New Breakouts in FX? Looking ahead, New Years week is typically a more eventful one for currencies.

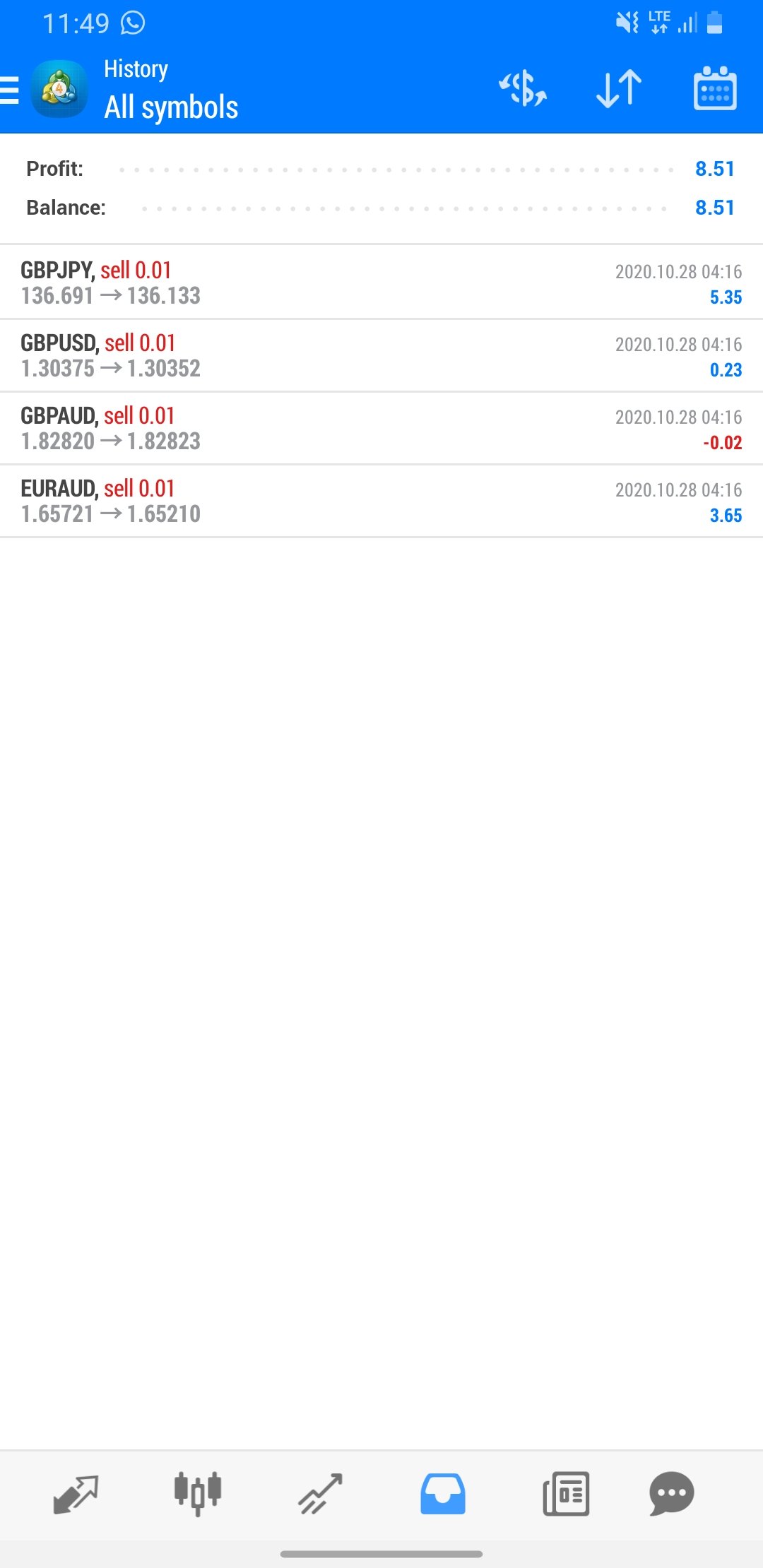

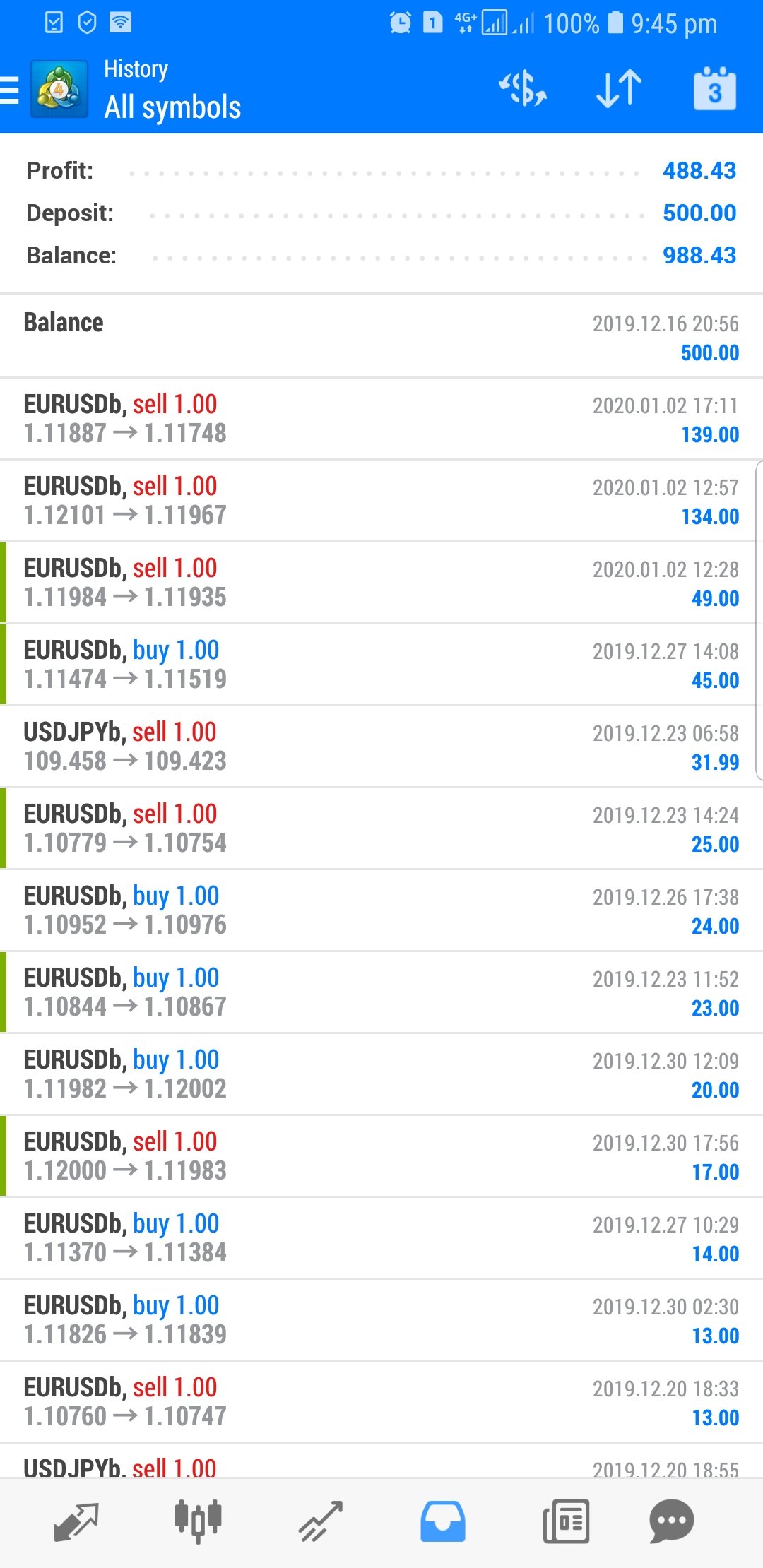

FollowCoin Reward List from Dec.28th to Jan.3rd

Congratulations on the FollowCoin winners this week. We saw some new faces on the list. Keep it going!! Followme is developing a new feature: Trade Comment and it will be meeting you guys very soon!

In addition, the FollowCoin will be ungraded to FollowCash which can be used to for subscription. Mor

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9676; (P) 0.9705; (R1) 0.9740;

Intraday bias in USD/CHF remains neutral for consolidation above 0.9646. Further decline is in favor as long as 0.9770 support turned resistance holds. Break of 0.9646 will target 0.9541. Nevertheless, on the upside, break of 0.9770 will indicate s

Risk Aversion Continues on US-Iran Conflicts

Risk aversion is the dominant theme today, with deep selloff in global equity markets. Treasury yields took a dive while gold and oil prices surge. Sentiments are rocked by abrupt escalation in Middle East tensions, after US military had killed Qasem Solemaini, the head of Iran’s Islamic Revolutiona

Middle East Tensions Push Yen, Franc and Oil Higher

Yen and Swiss Franc jump sharply as markets turned from strong risk appetite to risk aversion. Despite record closes in US stocks, Asian markets tumble on fresh geopolitical tensions in Middle East. Oil prices also skyrocket together with gold, while treasury yields tumble. In the currency markets,

NZD/USD Technical Analysis: Thursday's drop confirmed bearish Doji reversal

NZD/USD's daily chart is reporting a bearish Doji reversal pattern.

Key indicators are beginning to roll over in favor of the bears.

NZD/USD is looking south, having carved out a bearish candlestick pattern over the previous two trading days.

The pair created a Doji candle on Dec.31, signaling bu