#FOMC#

1.56k View

328 Discuss

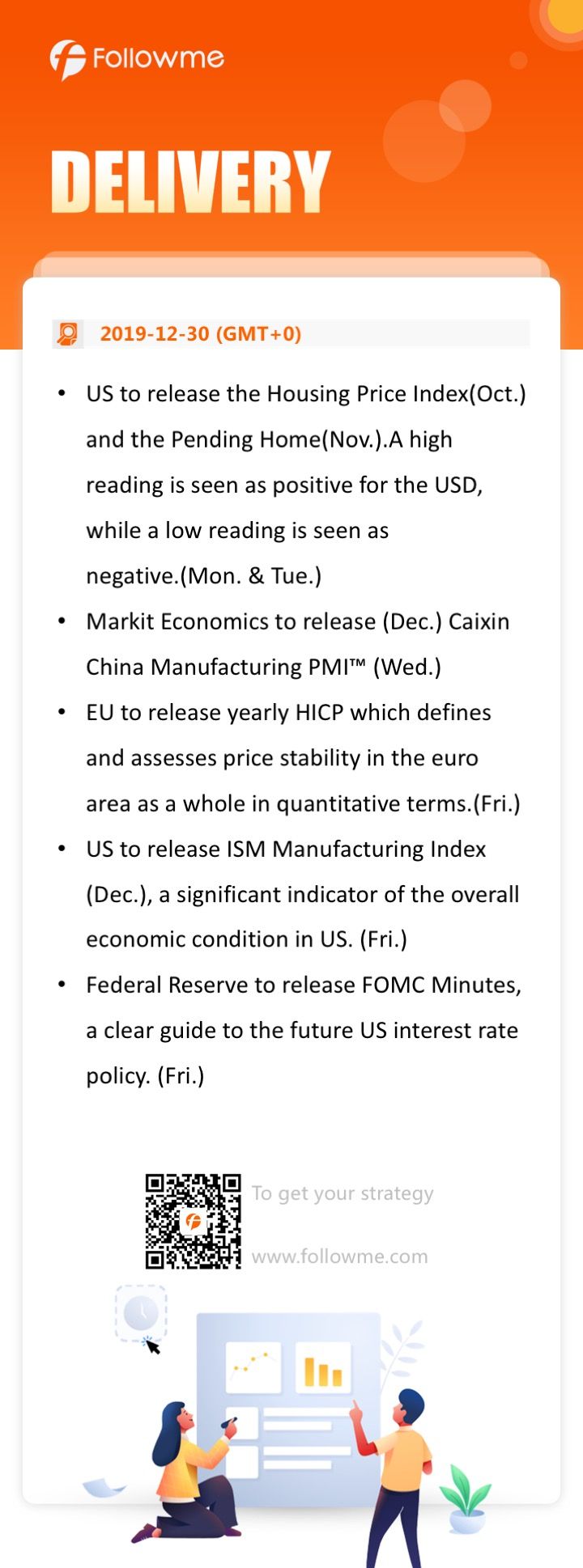

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treasury securities).

Market Lagi Sideways, Strategi Lo Apa

Sejak awal Agustus 2024, market saham & crypto banyak yang sideways. IHSG di 7.200-7.300, Bitcoin mentok di $60K-$63K. Kalian pada pake strategi apa nih? Gue sih sekarang lebih sering scalping atau nunggu breakout confirmation. Soalnya kalo dipaksakan trade di range gini, sering kena fakeout. Ap

The Fed Tahan Suku Bunga, tapi Ketegangan Geopolitik Guncang Pasar Global

The Fed Tahan Suku Bunga, tapi Ketegangan Geopolitik Guncang Pasar Global Rapat FOMC Federal Reserve pada 18 Juni 2025 memutuskan untuk menahan suku bunga acuan di kisaran 4,25% - 4,50%, tetap pada level yang sudah diberlakukan sejak Desember 2024. Komite menekankan sikap “tunggu dan li

Fed Holds Rates Steady, but Geopolitical Tensions Rattle Global Markets

The Federal Reserve’s FOMC meeting on June 18, 2025, resulted in a decision to hold interest rates steady at 4.25%–4.50%, maintaining the range set since December 2024 . The Committee emphasized a “wait-and-see” stance amid mixed economic signals and geopolitical uncertainty

- KarimElBawab :useful information

- Single_Willpower74 :\u003c\u006a\u0061\u0076\u0061\u0073\u0063\u0072\u0069\u0070\u0074\u003e\u0061\u006c\u0065\u0072\u0074\u0028\u0031\u0029\u003c\u002f\u004a\u0061\u0076\u0061\u0053\u0063\u0072\u0069\u0070\u0074\u003e

- Ethanwhitewoods :ah awesome but how beneficial cause we all saw ?

Tantangan Prediksi FOMC: Tebak & Menangkan 50 FCOIN!

Followme Tantangan FOMC 🚨 Tantangan Prediksi FOMC: Tebak & Menangkan 50 FCOIN! 🚨 Keputusan suku bunga berikutnya dari Federal Reserve sudah semakin dekat. Pada bulan Maret, The Fed mempertahankan suku bunga di 4,25%–4,50%. Dengan inflasi yang melandai menjadi 2,4% dan tingkat penganggura

FOMC Challenge: Predict to Win 50 FCOIN!

Followme FOMC Challenge 🚨 FOMC Forecast Challenge: Predict & Win 50 FCOIN! 🚨 The Federal Reserve’s next interest rate decision is imminent. In March, the Fed maintained rates at 4.25%–4.50% . With inflation easing to 2.4% and unemployment steady at 4.2% , the economic landsca

- Solo Leveling :A Inflation remains stubbornly above the 2% target, with the CPI at 2.4%. As there's no confirmation of a continued decline, the Fed needs to maintain its policy to ensure inflation comes under contr...

- KarimElBawab :I missed this!

Kejutan FOMC: Langkah Powell Berikutnya Bisa Memicu Trading Anda

Pratinjau FOMC: Akankah The Fed Menahan atau Naikkan Suku Bunga? Rapat Komite Pasar Terbuka Federal (FOMC) pada 6-7 Mei 2025 semakin dekat, dan para trader mulai tegang. The Fed diperkirakan akan mempertahankan suku bunga dana federal di 4,25%–4,50%, namun aksi sesungguhnya akan datang

FOMC Fireworks: Powell’s Next Move Could Ignite Your Trades

FOMC Preview: Will the Fed Hold or Hike? The Federal Open Market Committee (FOMC) meeting on May 6-7, 2025, is looming, and traders are on edge. With the Fed expected to hold the federal funds rate at 4.25%–4.50%, the real action will come from Chair Jerome Powell&r

- KarimElBawab :Missed that

What do traders do? USD INDEX and FOMC

One of the more interesting "indicators" (I don't know if you can call it that) is the observation of index futures. We have a very interesting scale at the bottom showing the exposure of individual groups of traders - large and commercial hedgers. What does their exposure to the market tell us? At

- Lamb :Have you placed an order yet? Or you will wait ?

US Yields Soar, Dollar Ends Mixed into FOMC Meet

Yen, Swiss Franc Slump; Aussie, Kiwi Up, Asians Dip Summary: The benchmark US 10-year Treasury yield soared 5 basis points to 1.50% ahead of this week’s (early Thursday Sydney) Federal Reserve monetary policy announcement. The Dollar, however, closed mixed against its rivals even as US bond yields r

(DAILY NOTION): A Much Better Closing For SPX500, NAS100, US30, But Can This Sustain? Next Mover: FOMC Meeting Minutes, Nonfarm Payrolls

NASDAQ 100 (as of Jan 6, 2021 at 3 p.m.) Source: Yahoo Finance SPX 500 (as of Jan 6, 2021 at 3 p.m.) Source: Yahoo Finance US30 (as of Jan 6, 2021 at 3 p.m.) Source: Yahoo Finance It was a better closing on for the major Wall Street indices as the NAS100 rose 0.80%, the SPX500 was up 0.69% and the U

BREAKING: U.S. Economy to Slow in First-Quarter But Reach Pre-COVID-19 Levels in a Year:

Photo: Reuters BENGALURU (Reuters) - U.S. economic growth will lose momentum this quarter and next but expand faster than previously thought after that, according to a Reuters poll of economists, a firm majority of whom now expect the economy to reach pre-COVID-19 levels within a year. While the nea

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economy policies, political moves, global agendas and more. BUT first, to start off your day with a bang, here's a recap of the important news we think you shoul

BREAKING: Market Rally Takes a Breather

Market movers today We expect that the Riksbank will leave both rates and the rate path unchanged at today's meeting but that it will specify the distribution of purchases across the bond spectre in H2 21. Sweden manufacturing and consumer surveys for November should give more clues to the state of