© 2026 Followme

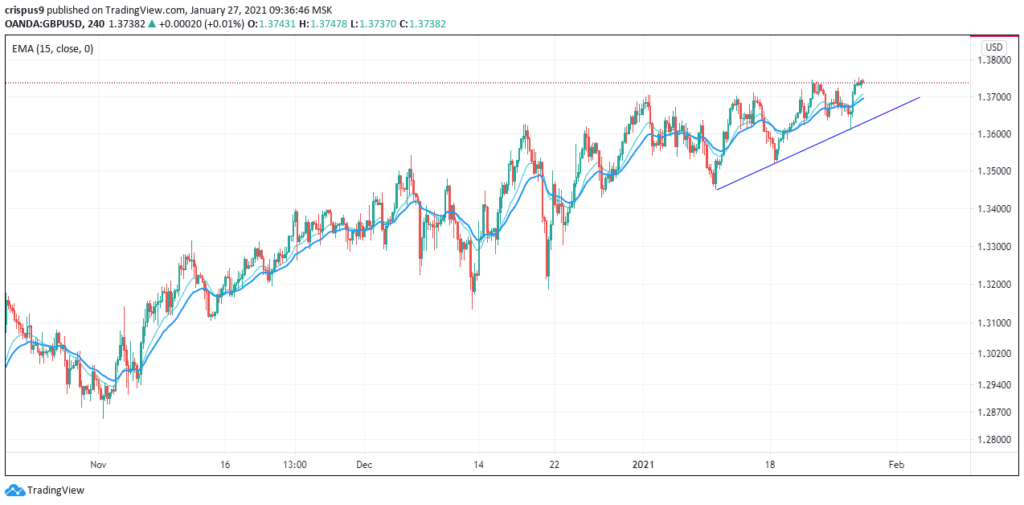

- (DAILY NOTION) GBP/USD Possible Soared to 1.3800 Level, Next Mover: UK Unemployment Rate

- (DAILY NOTION) EUR/USD Possible Surged to the Resistance Level at 1.2200, Next Mover: Joe Biden Inauguration

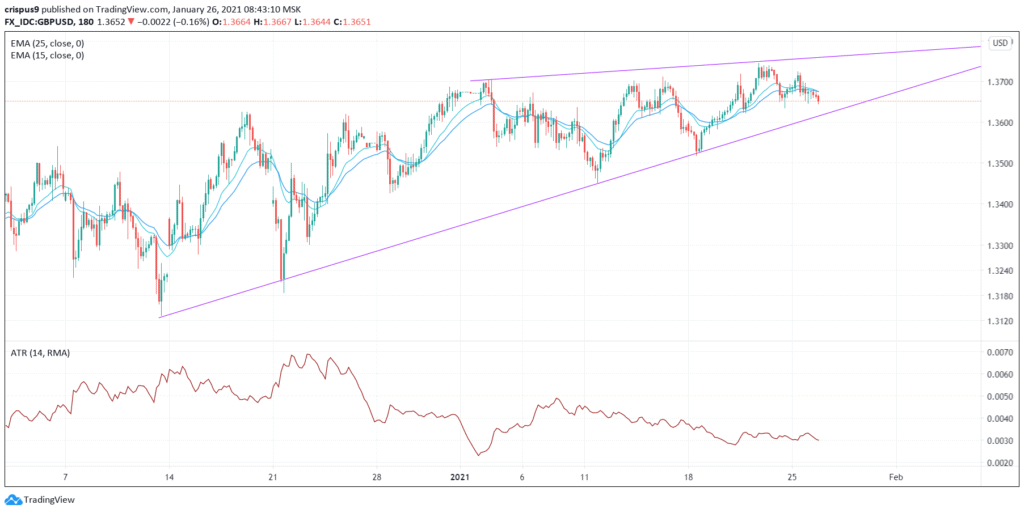

- (DAILY NOTION) GBP/USD Possible Settle Above the Resistance Level at 1.3700, Next Mover: Joe Biden Inauguration

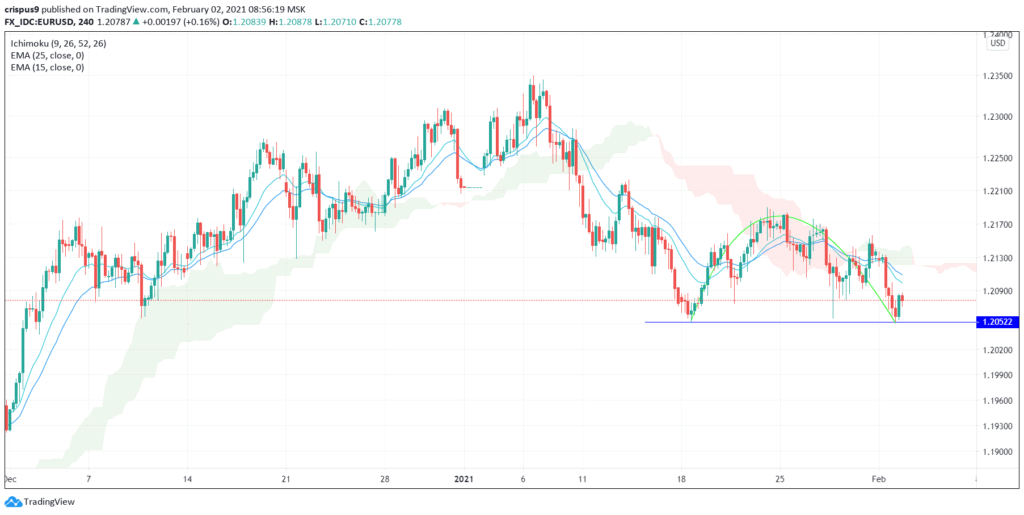

(DAILY NOTION) EUR/USD Inverted Cup and Handle Forms Ahead of EU GDP Data, Next Mover: EU GDP Data

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is wavering ahead of the important EU GDP data that will come out at 10:00 GMT. The EUR/USD is trading at 1.2075, which is slightly above this week’s low of 1.2053. The top catalyst for the EUR/USD will be the EU

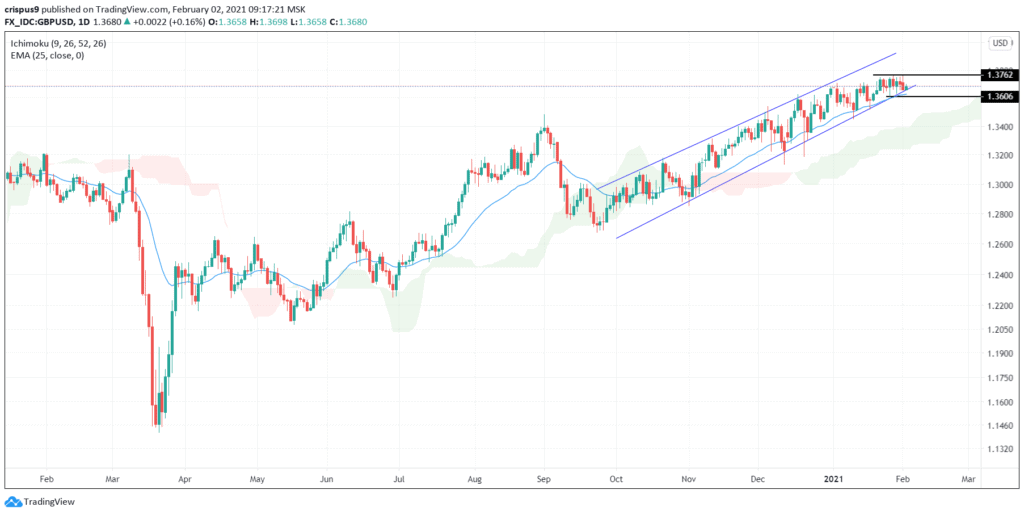

(DAILY NOTION) GBP/USD Possible Drop to 1.3600, Next Mover: BOE interest rate

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD price is in a tight range as traders shift their focus to the upcoming Bank of England (BOE) interest rate decision. The GBP/USD is trading at 1.3683, which is close to its two-and-a-half high. Data from the UK showed that t

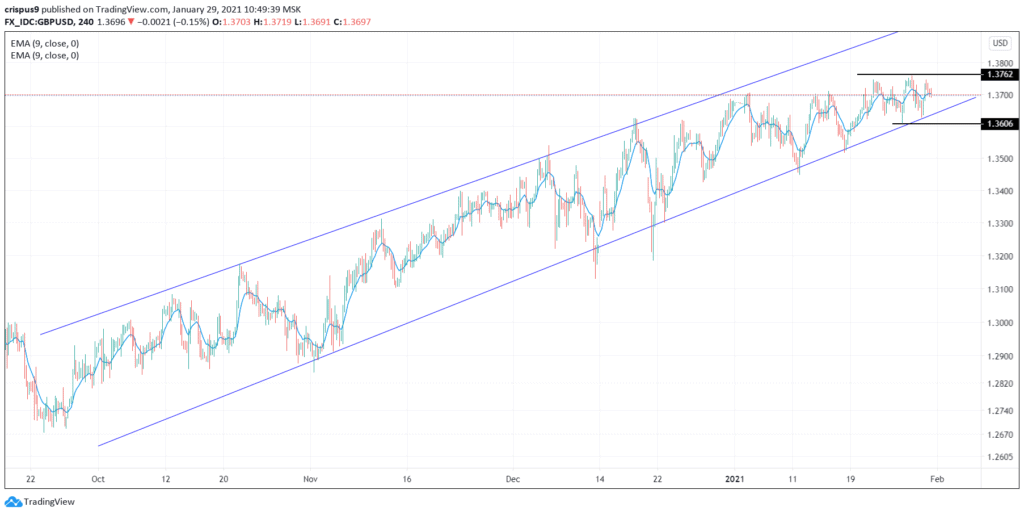

(DAILY NOTION) GBP/USD Possible Soared to 1.3500, Next Mover: BOE Negative Interest Rates

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD continued its uptrend in January even as the U.S. dollar index rose. The pair is trading at 1.3697, which is close to the highest level since April 2018. In this article, let’s look at what to expect in February. The GB

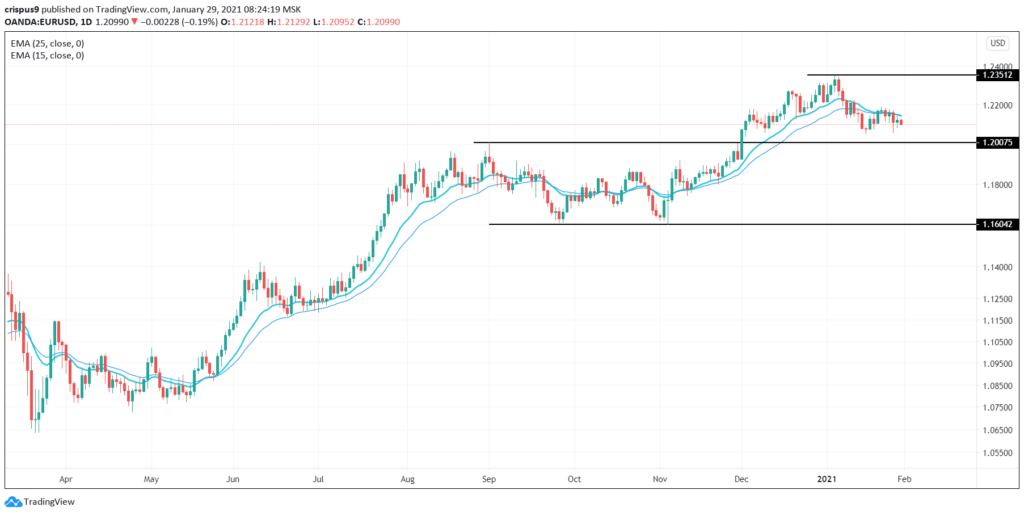

(DAILY NOTION) EUR/USD Possible Trading Below 1.200 Support Level, Next Mover: German GDP Data

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is under pressure ahead of the important German GDP data and U.S. personal income and spending data. The EUR/USD is trading at 1.2098, which is below the important resistance level of 1.2188. The EUR/USD is reacting to

(DAILY NOTION) GBP/USD Possible Break Above 1.3750, Next Mover: Fed Rate Decision

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD price momentum is accelerating even as the UK economic situation continues to get worse. The GBPUSD rose to 1.3750, which is the highest level in more than two-and-a-half years. Today, the focus will be on the tone of the Fe

(DAILY NOTION) EUR/USD Possible Move Break Below the Level at 1.1800, Next Mover: FED Rate Decision

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD pair remains elevated for all the troubles in the European economies and the problems with the rollout of the vaccine. As it turns out, the European Union lacks enough vaccines for the vaccination to continue, as some of the cont

(DAILY NOTION) GBP/USD Possible Move Below 1.3650, Next Mover: UK unemployment Rate

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD is pointing lower ahead of the important UK employment numbers that will come in the morning session. The GBP/USD is trading at 1.3650, which is lower than yesterday’s high of 1.3725. There are three main catalysts push

(DAILY NOTION) EUR/USD Possible Soared Above the Resistance Level at 1.2200, Next Mover: ECB rate decision

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is tilting lower ahead of the important Fed interest rate decision. The EUR/USD is trading at 1.2130, which is 1.80% below the year-to-date high of 1.2357. The EUR/USD is falling partly because of the weak German

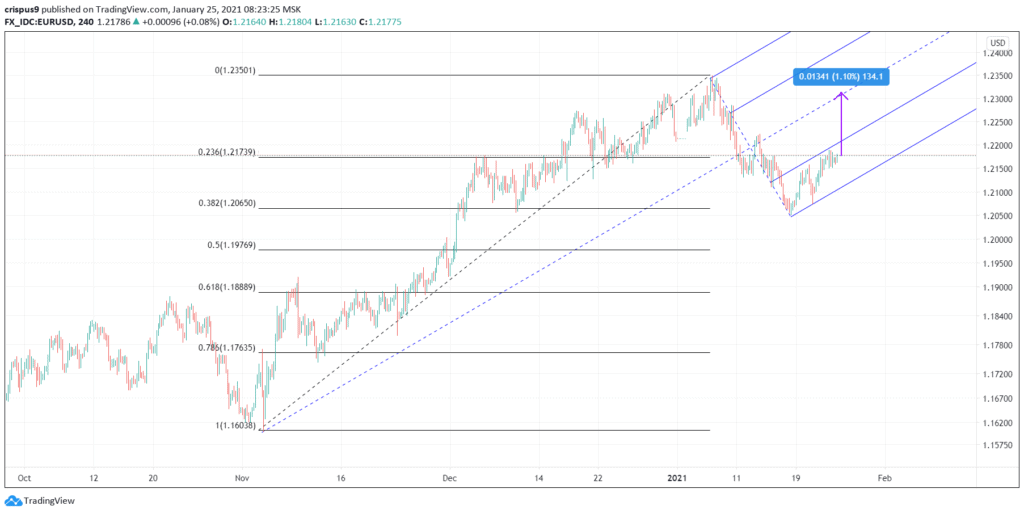

(DAILY NOTION) EUR/USD Possible Soared to 1.2310, Next Mover: U.S. GDP Data

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is relatively unchanged today as attention shifts to the Federal Reserve interest rate decision and U.S. GDP data scheduled for Wednesday and Thursday, respectively. The EUR/USD pair is trading at 1.2178, which is sligh

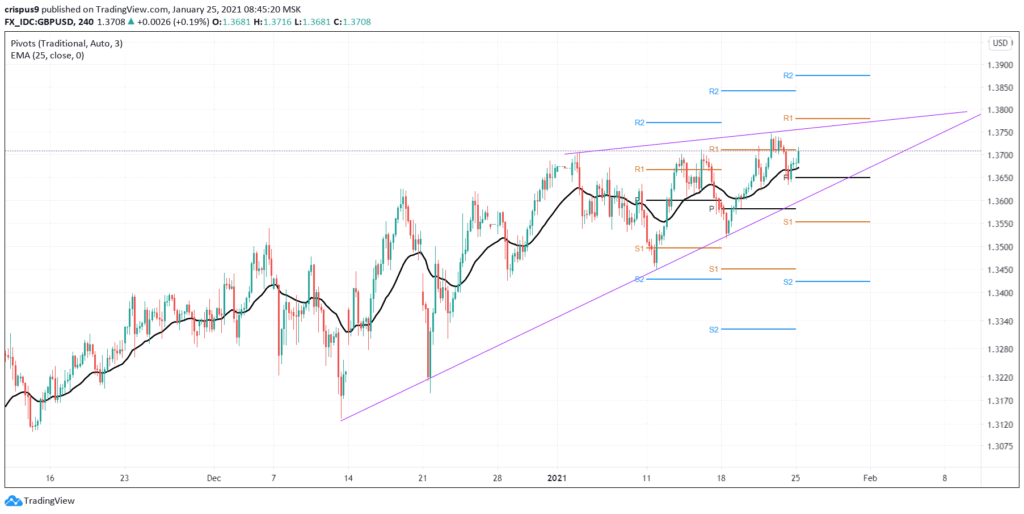

(DAILY NOTION) GBP/USD Possible Soared to 1.3800 Level, Next Mover: UK Unemployment Rate

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD is rising today ahead of the UK employment numbers scheduled for tomorrow and the Fed interest rate decision set for Wednesday. The GBP/USD is trading at 1.3713 which is higher than last week’s low at 1.3518. The UK and

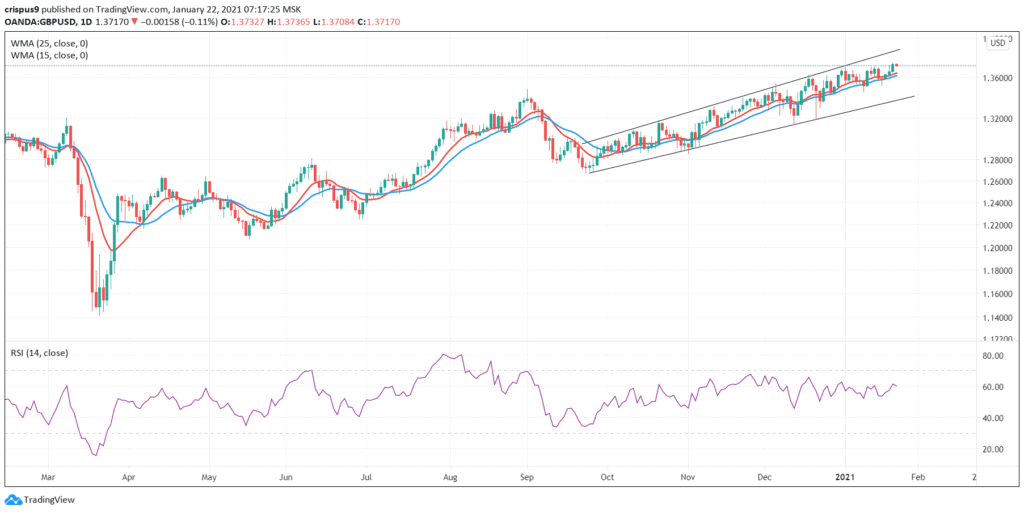

(DAILY NOTION) GBP/USD Settle at 1.3718 Level, Hit Highest Since April 2018. Next Mover: BOE Negative rates

Illustration photo of GBP/USD daily chart from Tradingview The GBP/USD is holding steady ahead of the UK retail sales numbers that will come out in the morning session. The GBP/USD pair is trading at 1.3718, which is the highest it has been since April 2018. The GBP/USD has been on u

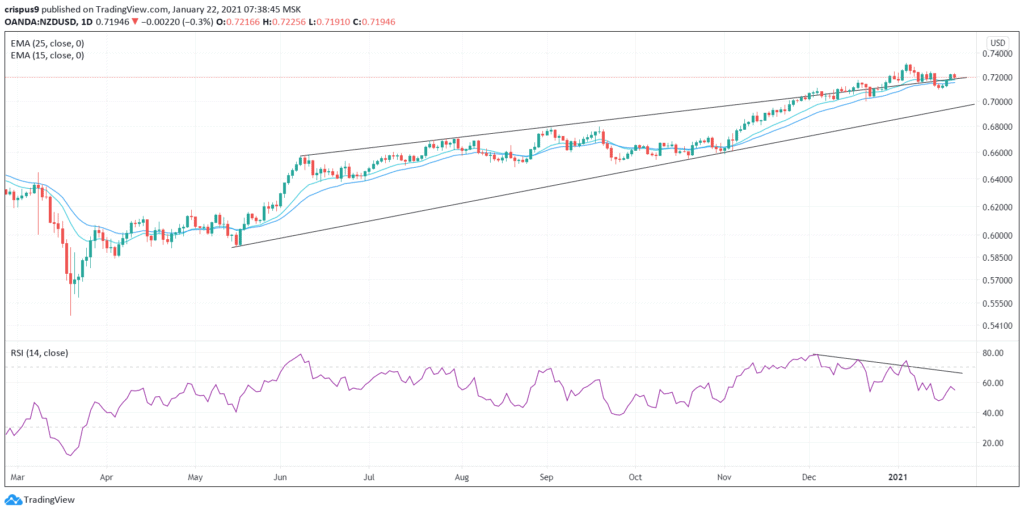

(DAILY NOTION) NZD/USD Possible Fall Below Level of 0.700. Next Mover: PMI Data & Retail Sales Number

Illustration photo of NZD/USD daily chart from Tradingview The NZD/USD is struggling today after relatively mixed economic data from New Zealand. The NZDUSD is trading at 0.7193, which is a few pips below its year-to-date high of 0.7317. In a report earlier today, the New Zealand bureau of

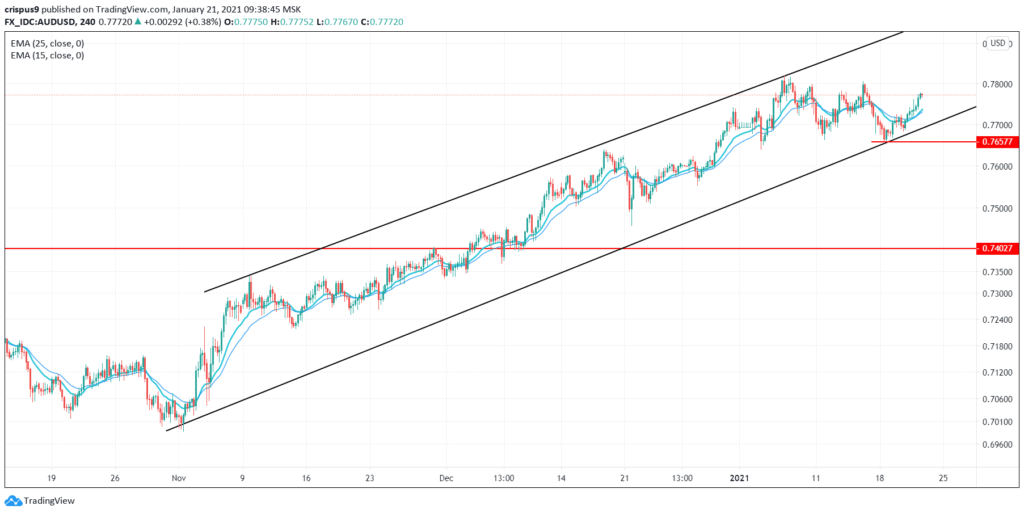

(DAILY NOTION) AUD/USD Possible Soared Above 0.7800 Level, Next Mover: Australian Retail Sales

Illustration photo of AUD/USD daily chart from Tradingview The AUD/USD is holding steady after the relatively strong economic data from Australia. The AUD/USD is trading at 0.7773, which is slightly higher than this week’s low of 0.7657. The AUD/USD is reacting to the strong employme

(DAILY NOTION) EUR/USD Possible Soared Above 1.2200, Next Mover: ECB Rate Decision

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is rising ahead of the ECB interest rate decision and the U.S. jobless claims numbers that will be released in the afternoon session. The EUR/USD is trading at 1.2130, which is slightly higher than yesterday’s low of 1.

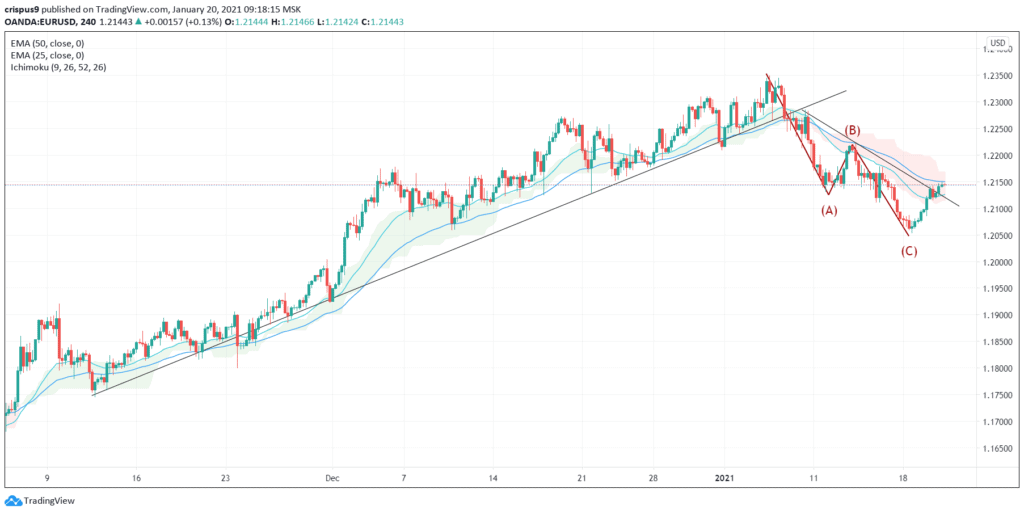

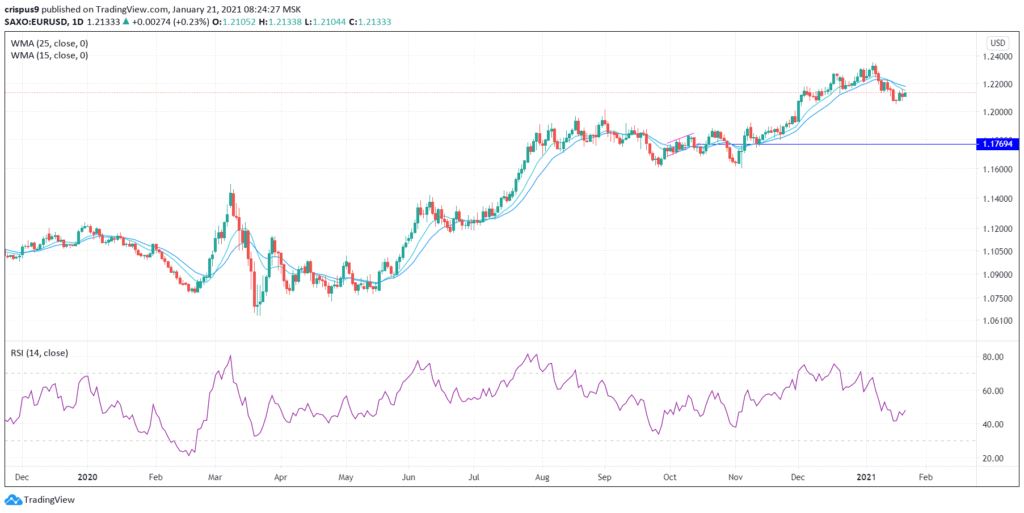

(DAILY NOTION) EUR/USD Possible Surged to the Resistance Level at 1.2200, Next Mover: Joe Biden Inauguration

Illustration photo of EUR/USD daily chart from Tradingview The EUR/USD is rising for the second day ahead of Joe Biden’s inauguration and the Eurozone inflation data. The EUR to USD pair is trading at 1.2145, which is slightly above this week’s low of 1.2055. The focus today will shi