#Fed#

3.73k View

2.12k Discuss

The Federal Reserve System is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsi

Ketua The Fed Jerome Powell Diselidiki Secara Kriminal oleh DOJ

Ketua Federal Reserve Jerome Powell mengonfirmasi bahwa dirinya menjadi target penyelidikan kriminal Departemen Kehakiman AS (DOJ), sebuah langkah hukum langka yang langsung mengguncang kepercayaan terhadap bank sentral paling berpengaruh di dunia. Penyelidikan ini berkaitan dengan kesaksian Powell

- HafizRamadhan :Drama politik + pasar = seru nih

- Intan06 :Watch dulu deh, risk tinggi sekarang

- Brian.Kurnia :tebak reaksi trump wkwk

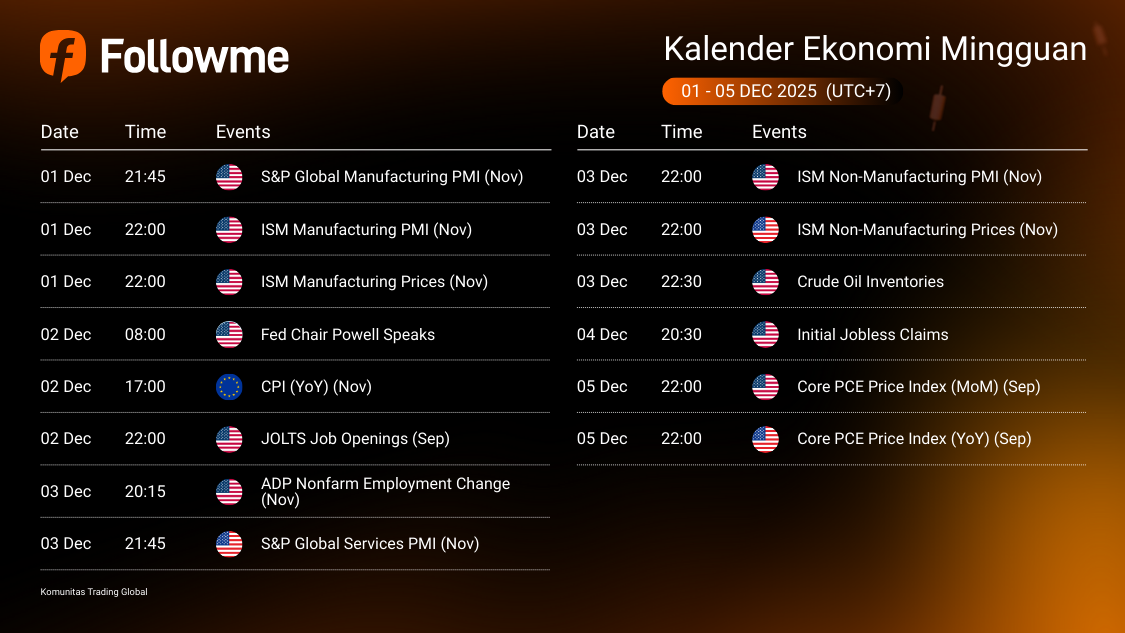

Kalender Ekonomi : 01 - 05 Dec 2025

Kalender Ekonomi: 1 - 5 Desember 2025 Minggu ini pasar akan fokus pada data inflasi, tenaga kerja, dan sektor manufaktur dari AS serta rilis CPI dari Eropa. Pergerakan USD berpotensi meningkat terutama menjelang data tenaga kerja dan komentar Ketua The Fed. Pastikan perhatikan jam rilis untuk mengat

The Fed dan Dampak Kebijakan Suku Bunga Akhir 2025 ke Pasar Forex

Pasar kini menghadapi ketidakpastian tajam menjelang keputusan suku bunga The Fed Desember 2025. Data ekonomi yang tidak lengkap akibat government shutdown AS, tekanan inflasi yang masih tinggi, dan perbedaan pandangan di internal Federal Reserve menciptakan dilema kebijakan nyata bagi investor dan

"Berkah" dari The Fed yang Bikin Trader Sakit Hati

The Fed akhirnya memotong suku bunga! Tapi bagi trader, momen pengumuman adalah chaos total Kenapa Bisa Gitu? Pasar sudah lebih dulu naik karena anticipasi kabar baik (buy the rumor). Pas kabar beneran keluar, malah pada jual semua buat ambil untung (sell the news). Alhasil, harga jeblok dan

- Crypto recovery services :Are you a victim of loss crypto Text me directly to recover immediately

Kalender Ekonomi : 15-19 September 2025

⚠️ Super Week: Fed, BoE, BoJ, dan Inflasi Eropa Siap Guncang Pasar Minggu ini kalender ekonomi dipenuhi rilis data kelas berat: tiga bank sentral utama (Fed, BoE, BoJ) akan mengumumkan suku bunga, ditambah inflasi Inggris & Eropa, serta penjualan ritel AS. Trader perlu waspada karena volatilitas

- TikaScalper99 :minggu ini padat bgt

【Berita】Powell Tahan Bunga, Lawan Tekanan Trump

The Fed kembali mempertahankan suku bunga di level 4,25% - 4,50%. Tapi yang jadi sorotan bukan itu. Ketua The Fed, Jerome Powell, menegaskan: Belum ada keputusan soal pemangkasan suku bunga pada rapat bulan September. Masih Butuh Bukti Tambahan Menurut Powell, inflasi memang mulai turun dalam bebera

- dinianggita :Liat CPI aja dulu

- rioseptian :Tetap, inflasi masih bandel

Fed Holds Rates Steady, but Geopolitical Tensions Rattle Global Markets

The Federal Reserve’s FOMC meeting on June 18, 2025, resulted in a decision to hold interest rates steady at 4.25%–4.50%, maintaining the range set since December 2024 . The Committee emphasized a “wait-and-see” stance amid mixed economic signals and geopolitical uncertainty

- KarimElBawab :useful information

- Single_Willpower74 :\u003c\u006a\u0061\u0076\u0061\u0073\u0063\u0072\u0069\u0070\u0074\u003e\u0061\u006c\u0065\u0072\u0074\u0028\u0031\u0029\u003c\u002f\u004a\u0061\u0076\u0061\u0053\u0063\u0072\u0069\u0070\u0074\u003e

- Ethanwhitewoods :ah awesome but how beneficial cause we all saw ?

USDJPY, EURUSD, GBPUSD, and Bitcoin Monthly Overview

USDJPY: Navigating Key Psychological Levels The USDJPY pair has been trading within a descending channel, reflecting a cautious market sentiment influenced by US-Japan trade tensions and central bank policies. A critical psychological level to watch is 150.00, which has historically acted as both su

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 30 FOCIN that can withdraw. Click to know more details about //socia...

Time for the Fed to taper?

There has been some considerable talk from the Fed around tapering the current pace of bond purchases. The most likely outcome of this is a steepening of the Treasury yield curve which could support some further USD gains in the near term. Federal Reserve members Evans, Kaplan & Bostic are all w

Fed comments and good treasury demand push US yields lower

Market movers today Today, we get the euro area industrial production for November as well as the US CPI core. It is a busy day in terms of central bank speeches. In the US we have Fed's Brainard, Harker and Clarida on the wires while ECB's President Lagarde is speaking. Lagarde will speak ahead of

EUR/USD: Dolar Akan Lanjutkan Kembali Kenaikan Sampai Fed Berubah Pikiran

EUR/USD telah mampu stabil karena dolar AS mengambil nafas. Namun, penurunan greenback baru-baru ini terlihat hanya sementara – dead dat bounce EUR/USD bisa berakhir dengan penurunan baru. Kutipan Utama “Pejabat di bank sentral paling kuat di dunia menyangkal perlunya mengurangi pembelian

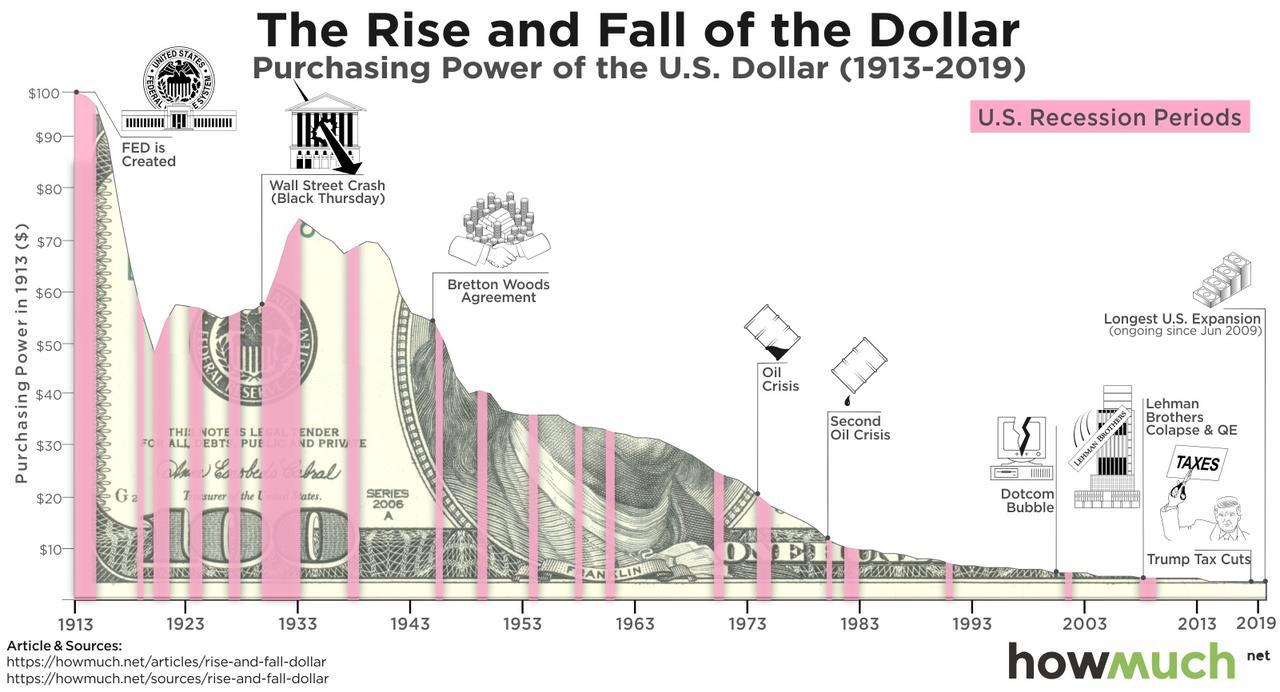

Will the FED destroy the dollar?

Just thinking about that question should put dread in your heart. Shouldn’t the goal of the Central Bank of a country protect the currency of that country? Well, the answer is that, it’s not actually destroying the dollar itself, but the purchasing power of said dollar. You see the Federal Reserve h

Fed's Powell Wins Forbes' Crypto Person of the Year Honors; Do They Give Awards for Snark?

Photo: Coindesk U.S. Federal Reserve Chairman Jerome Powell is the winner of Forbes’ inaugural “Person of the Year in Crypto” award, an honor for which the central bank chairman is unlikely to make room on his mantel. Because Powell's Fed effectively printed more than $3 trillion in new money, almos