© 2026 Followme

USDCHF

US Dollar / Swiss Franc

0.76589

0.00347

(0.46%)

Prices By FOLLOWME , in USD

Statistics

More

LOW

HIGH

0.76050

0.76655

Short

Long

38.99%

61.01%

1W

-2.12%

1 MO

-3.31%

3 MO

-4.81%

6 MO

-5.65%

What Is The US Dollar Index And How Can You Trade It?

What is the US Dollar Index? The US Dollar Index (DXY, DX, USDX) measures the value of the United States dollar relative to a basket of other currencies, including the currencies of some of the US’s major trading partners. The Dollar Index rises when the US dollar gains strength compared to the othe

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

- Jenny Claude :Trade with Mr Anthony M Lucas on facebook 👉 Anthony M Lucas or WhatsApp 👉 +44 7576 723901 for more winning profits. 💯Legit

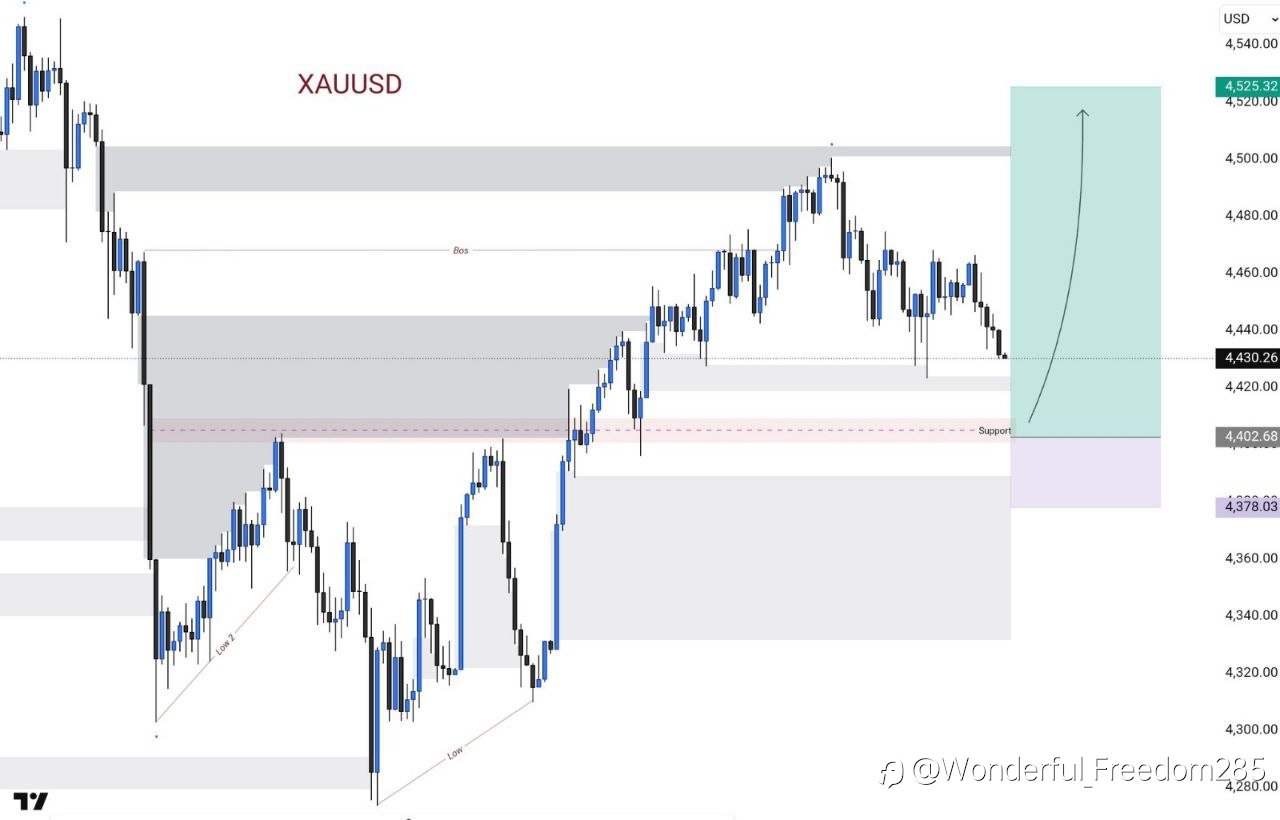

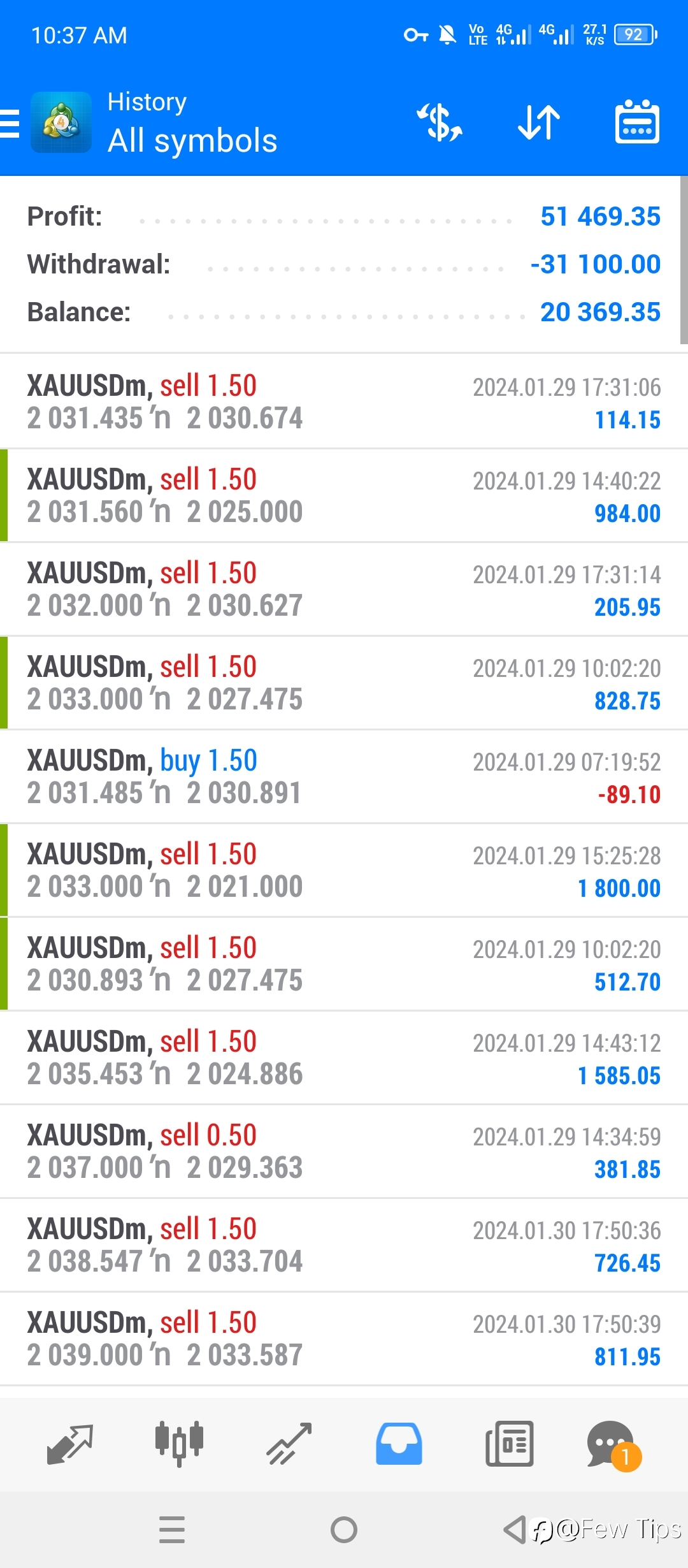

XAUUSD Update

Gold holds strong near 4400 support, reacting from a higher-TF demand zone. The recent dip looks like a healthy pullback, not a trend change. 📈 Bullish above 4400 🎯 Targets: 4480 → 4520 → 4560 ⚠️ Below 4380 weakens the bias Geopolitical risks & USD uncertainty keep gold supported on dips.

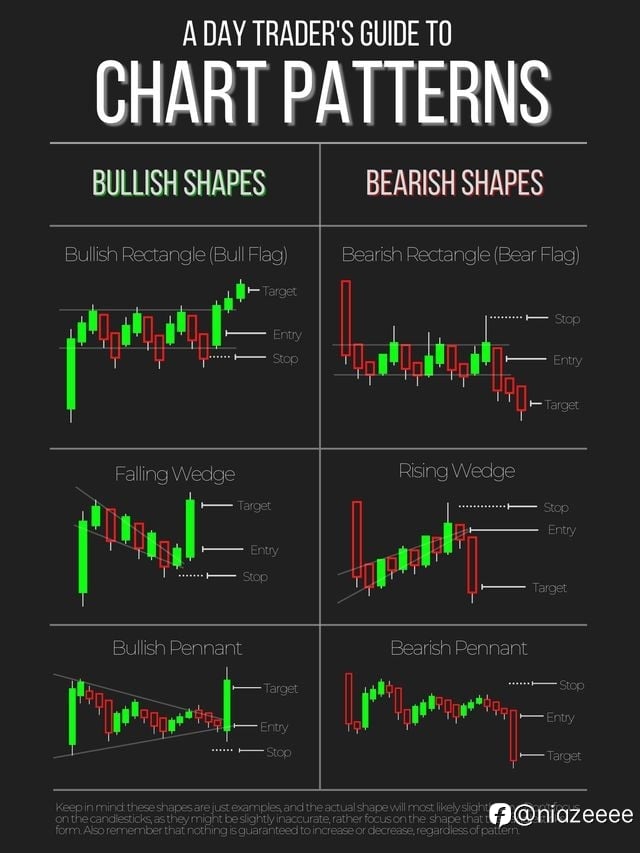

Top 5 Indicators Every Beginner Trader Should Know

💡 Indicators are your toolkit in the markets. They cut through the noise, highlight key patterns, and help you make more confident, informed decisions — especially when you’re starting out. 🔢 Moving Averages (MA) 🔵 What it does: Smooths price action to reveal the overall trend. ✅ Use it for: Iden

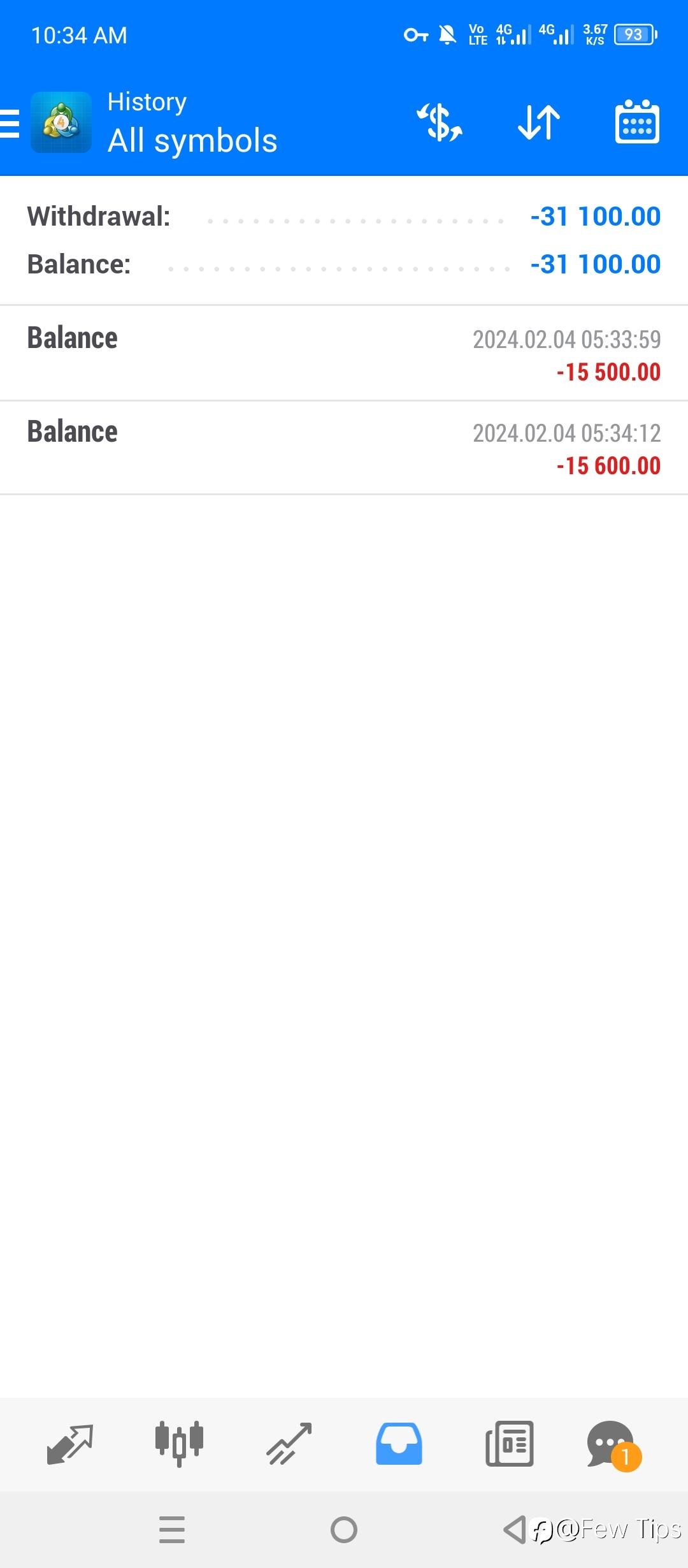

A Letter to Community Users - Risk Reminders about Investment & Trading

In this era when people all over the world are keen on making money, any kind of opportunity to make a fortune can attract countless fans. The financial market is no exception, take the most popular one - Bitcoin. In 2020, people are crazy about cryptocurrencies like Bitcoin, which also brought a fi

- Valentina :This is a warm article

- Inaya :Risk control and lucid mind-setting are the most important factors for a good trader🙋♀️

- Abijah :Always be careful about "good luck"

Best Forex Broker in USA 2022: Top US Forex Brokers List

The foreign exchange market, also known as the Forex market or the FX market, is also one of the global markets that witnesses a trading volume of almost $6.6 trillion every day. Foreign exchange refers to exchanging one currency trading with another for different reasons that include tourism, inter

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

- Important_Rain77 :thank you for being a great fan of mine send me friend request I promise to accept it.........

- aflimy :wooew keep it up

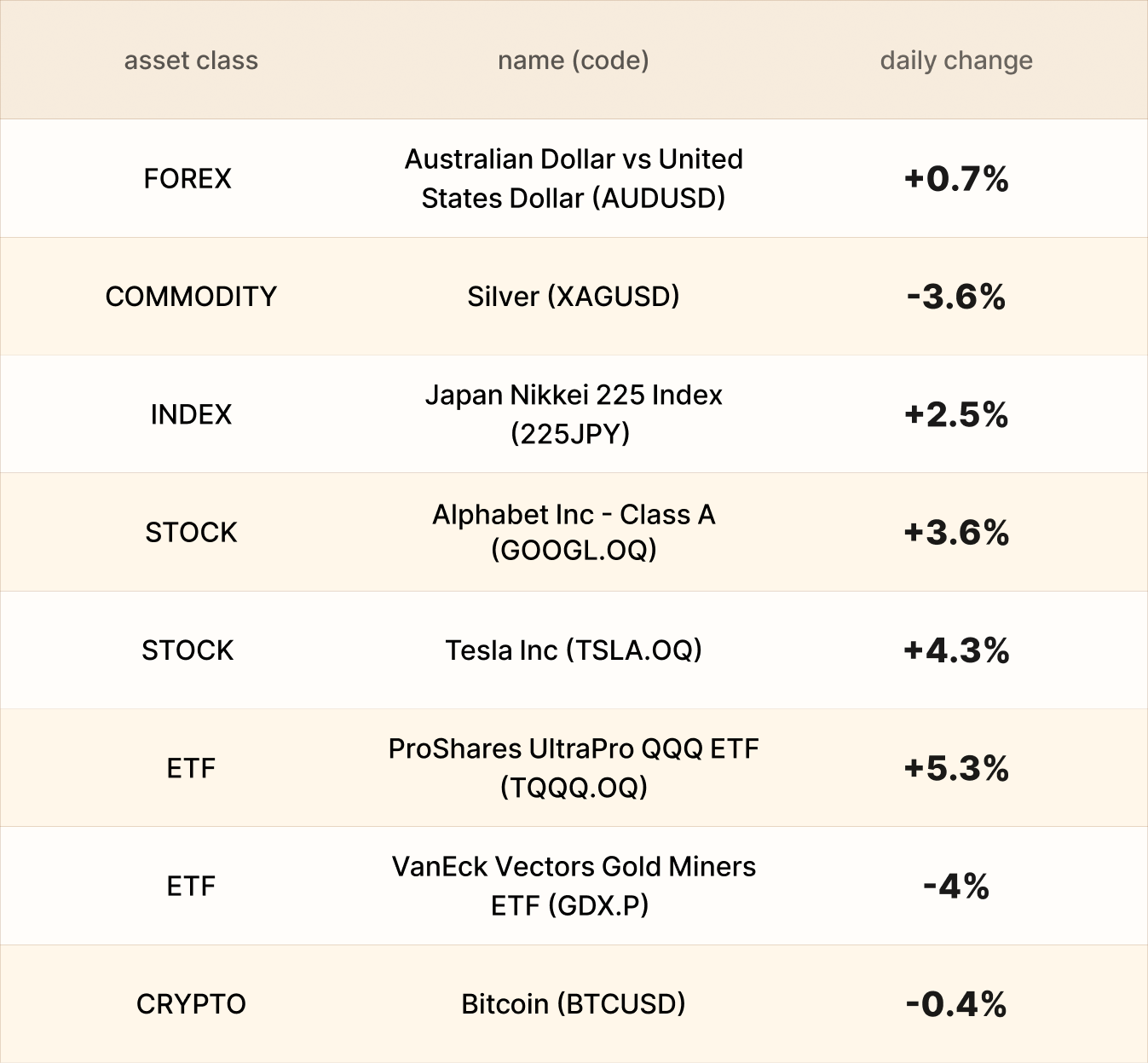

EBC Markets Briefing | Swiss franc up ahead of Fed meeting; gold loses its shine

The Swiss franc strengthened on Tuesday ahead of a slate of central bank meetings that will likely see a Fed rate cut. Meanwhile, all eyes are on Trump's Asia tour, hoping for a trade deal with China. Swiss President Karin Keller-Sutter declined to say whether her country could this year strike a de

Broker News | CMC Markets Renews Rugby Team Blues Sponsorship for 3 More Years

#Industry 01 Q&A Weekly Review - What's Asked This Week? A Q&A Weekly Review keeps traders informed of the latest regulatory status and trading details of brokers mentioned by our users in a given week. 02 CFreserve - Your Investment Might Be At Risk! Financial frauds have always been a conc