In this era when people all over the world are keen on making money, any kind of opportunity to make a fortune can attract countless fans. The financial market is no exception, take the most popular one - Bitcoin.

In 2020, people are crazy about cryptocurrencies like Bitcoin, which also brought a fire to the relevant industrial chain like virtual currency mining machines. There are also some non-mainstream industries, such as sneaker investing and blind box craze, etc. These are just the tip of the iceberg.

Today's young people are proficient in all kinds of financial management and are obsessed with "making money", even no less than love, work.

Dreams are beautiful, but the reality is often cruel! Do you really know how to invest and trade? By occasionally checking the trading accounts and notes in the community, we feel that it is necessary to talk about the inside story of investment and trading to help everyone recognize some facts and risks.

The Gap Between Reality and Dream

The account you think of or dream of maybe like this

But the reality may be like this. You don’t know the actual result until the end is reached. Only survivors know what it means.

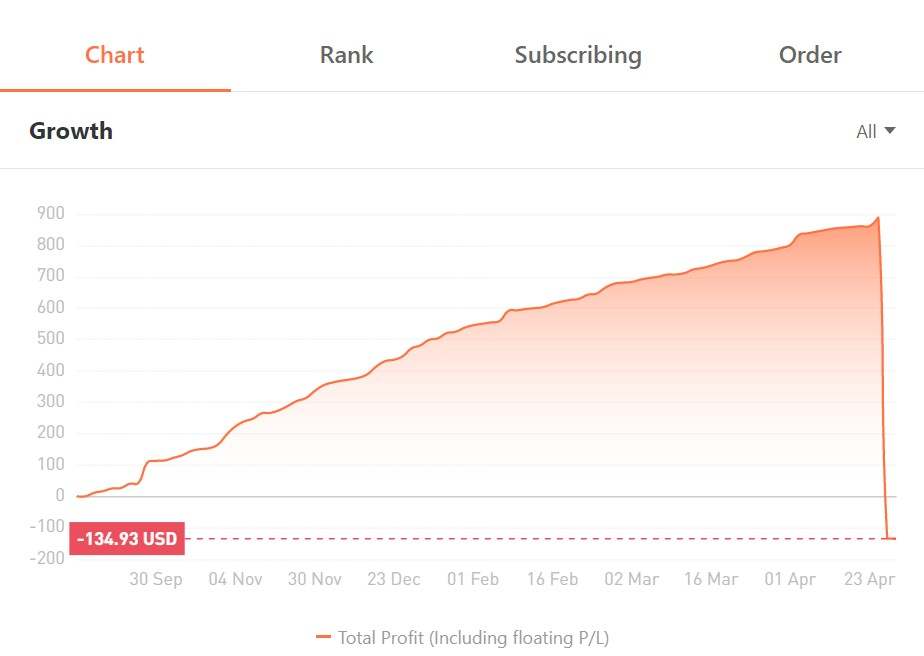

Maybe like this, working hard to make a profit, but suddenly fall to the bottom

Or more like this, roller coaster-style ending, nothing is gained

Several Typical Forex Trading Enemies

Recently, many community users have posted about the huge losses in their investments. We will not judge whether they are true or not. We are here to talk about some common trading mistakes

1. Trading large positions, going against the trend, and holding a losing trade for too long

Significant losses often come from trading large positions and holding loss positions for too long. The direct cause for liquidation is the unreasonable position, many people are accustomed to liquidation, some laugh at themselves while others are proud, most people understand the truth but don't take warning.

Major profits are made by sticking to it, and major losses are due to holding floating loose orders for too long. Manage the position at all times, try to keep your account at a safe, small position, and follow the trend so that you can go further and longer.

2. High-Frequency trading

Before trading, have you ever asked yourself the purpose of your trading? To get rich quickly, to make money continuously and steadily for a long time, or to rush for quick success and trade for the sake of trading? How many of you trade frequently just to work for brokers?

Experience has proved that frequent trading tends to make mistakes more easily, not only has it brought great psychological pressure, but also reduced the quality of life. The trading itself is supposed to provide a better life, instead of disturbing life all the time. Take proper rest, after all, life is still going on.

3. Blindly confident and follow the crowd

It is good to have a goal in trading. But if you think that making money is easy by seeing others making money, then you are wrong. Not seeing the risk is always the biggest risk.

How many people have taken their trading skills in simulated trading for real? How many people are great when imitating, but terrible in practice. In front of those talented and experienced, don't trust your wisdom and luck too much. The market won’t have mercy on anyone who goes against it.

4. Highly leveraged trading

Finally, we want to talk about highly leveraged trading. As we all know, foreign exchange trading itself is highly leveraged, which not only lowers the threshold for ordinary people to enter the market but also enlarges the profitability of trading. This is a good thing, but why do most people still lose money? Needless to say, high leverage is often accompanied by high volatility, especially gold, Bitcoin. No one can always profit, when you wish for high returns, don't forget, high risks are waiting for you.

If you really want to give it a try, learn more about this market, the Swiss franc black swan, the Pound flash crash...It is best not to affect your basic living expenses.

Trading is to improve your life. Don't go bankrupt for the sake of changing your fate! Never get online loans and loan sharks, and never use a gambling mentality to do leveraged transactions! !

Investment Traps

With the improvement of people's knowledge of wealth, more and more attention is paid to the impact of inflation, and more and more people are beginning to pay attention to investment and financial management.

However, no matter what investment you make, you must understand the market well in advance, otherwise, you may lose money forever.

Let us take a look at the inside stories of the investment industry that you may or may not know.

1. Scam forex trading platforms

There are countless Ponzi schemes pretending to be foreign exchange trading, which attract you with a gorgeous appearance, making you feel like a very powerful trader, analyst. Uncover the shell and look inside, they are all fake. Uncountable forex platforms promise you high yield, low pips, high brokerage. No matter how hard they try to appear attractive, they all end up disappearing with your money invested. Here we sum up for you their common characteristics:

-

Abnormal account, deposit required

-

Fail to withdraw, often accompanied with so-called “system upgrade ”

-

Related to illegal tradings, account being canceled

-

Incorrect withdrawal account and require an “Account-Information-Changing” fee

-

Refuse to withdraw for you due to insufficient trading units

-

System error, clear account profits (which means you can gain your profits as you like while not being able to withdraw)

-

Frozen bank account, postponed remittance (anything that stops you from cashing out)

-

The platform being attacked by hackers

It also occurs that some trading agents vanish with your money, or pretend to be other famous agents, or operate on the fake platform. Asymmetric information, insufficient knowledge of beginners give these scammers chances to create traps.

2. Stocks and funds can also be a trap

The stock market is a popular investment category, attracting a lot of attention with its regulated and transparent trading. However, it also requires professional knowledge in order to recognize and avoid scams and traps.

Stock experts of all kinds are trying their best to sell their apps, EAs(expert advisor). The fake analysts hiding in the consulting group can’t wait to racketeer the beginners by “recommending stocks for free”, “recommending promising stocks”,” providing inside information” etc., illegal agents and scammers are everywhere waiting to gain profits in this market.

Even if you are smart enough to avoid these traps, it’s extremely difficult to get rich in the stock market: high volatility, bull-bear market cycle, sector rotation, and tricky concepts... For listed companies, we need to be careful about the inside trading, misleading accounting, acquisition premium for tunneling, senior executives reducing shareholdings, etc. Not only do you need to be vigilant, but also be equipped with professional investment knowledge, financial analytical skills, essential business and management knowledge, and of course, numerous trading skills and experiences.

As for those popular funds, well, they are not guaranteed either. Since February, funds in the stock market continued to fall, especially those best-performing stocks and funds. As a result: Those retail investors who were attracted by the high yield performance are, on the contrary, losing a large amount of money by investing in them. At the online flea markets, “losing money in investment” becomes the most common reason for selling phones, make-ups. Uncountable complots exist in the investment, and it’s difficult to find them out.

3. Other investments and Ponzi schemes

Some physical collection investment is also very common around us, like gold, stamps, all kinds of commemorative coins and famous paintings. We strongly suggest people not collect them blindly or spend a large amount of money on them, on account of their poor liquidity and limited appreciation in the future. To be clear, it doesn’t mean that we don’t advise you to invest in stamps or commemorative coins, it simply means that you need to pay more attention to its potential value. Invest wisely and watch out for your wallet.

Some of you might know about peer-to-peer lending (P2P), which has caused serious harm. Many investors have suffered losses and borrowers are heavily in debt. So, it's necessary to learn how to plan assets wisely and understand the correct concept of consumption. Other investments of this kind are all operated in the same way.

4. The risk of discretionary account operation

Lately, in the FOLLOWME community, we witness some so-called “experienced traders” who post their profit, introduce people to their agency, encourage people to subscribe, promise to operate for others, and share profits, these can all be considered as an act to operate for investors. Firstly, it is hard to define whether it is legal or not because it hasn't been regulated yet in some countries, and few rules and laws are related. If we put aside those illegal platforms, it is the ability and credibility of the trader that should be counted as the most important factor for an investor. As for a trader, the investor could also cause problems such as interfering with the trading procedure, withdrawing suddenly, or reacting strongly against losing any money. Either investor or trader can be a tough nut to crack. In a word, we can’t put too much trust in other people, unless losing money isn’t a big deal for you!

Risk Warning

The emergence of social media allows young people to band together and share with each other, but it also creates a kind of peer pressure. Before, you were surrounded by people who have the same income and same problems as you, so you could tell yourself that all you need to do is to be more patient and work harder to achieve the ideal life; however, nowadays once you pull out your phone, titles like “your fellows, they are abandoning you” pop out immediately. By showing off on the Internet, this tiny amount of people who get rich by investing are presented all of a sudden and make you feel like being left out, so you have to invest, manage your money, get rich and work harder and harder.

For certain young people, pursuing money doesn’t have to do with big houses, fancy cars, and luxurious clothes, it simply represents independence and freedom, which count the most for them. Obsession with investing and saving can be related to fear towards a life full of uncertainty or dissatisfaction with the high-intensity, fast-paced work.

Maybe such an article doesn’t have much effect in preventing people from being trapped, we still carry the hopes that every investment beginner can always be vigilant and realistic. Do remember: there’s no shortcut to success, and there’s no 100% safe investment, if it does, it’s definitely a scam. Investment is actually “the trade-off between profitability and risk”, only by taking the risks can you gain profit, which is the underlying logic of investment, only by understanding this can you become a real trader.

Certainly, besides making as much money as possible, don’t neglect your health and your family. There are so many things worth pursuing other than money, don’t you want to travel around the world when you are still young?

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

-THE END-