© 2026 Followme

Liked

Australian dollar makes fresh multi-month highs after dovish FOMC

AUD - Australian Dollar

The Australian dollar was the greatest beneficiary of renewed risk appetite overnight, as US equity markets were buoyed by the FOMC’s dovish monetary policy statement. The AUD has round-tripped from 0.6980 to touch 11-month highs of 0.7063 before retreating into this mornings

Liked

Possible trend shift in AUDJPY – going short

#AUD/JPY#

The Tidal Shift Strategy has just sold AUDJPY at 73.016. The system recommends entering this trade at any price between 72.615 and 73.417. The signal was issued because our Speculative Sentiment Index has hit its most extreme positive level for the past 145 trading hours at

Liked

FOMC Meeting June 9-10: No end in sight for accommodative stance

The June 9-10 FOMC meeting statement provided a very dovish perspective on the economy. It reinforced the severe damage from Covid-19 to both economic activity and the labor market.

Key points

The statement maintained the perspective that the pandemic will weigh heavily on economic performance in t

Liked

US two-year yield is down 140 basis points on YTD basis

While the US two-year yield is currently trading six basis points higher than recently hit record lows, it is still down over 140 basis points on a year-to-date basis.

The sharp losses could be associated with the coronavirus-led economic downturn and Federal Reserve's unprecedented stimulus-respo

Liked

USD/JPY remains positive above 107.00 after Japan GDP, Fed’s Powell

USD/JPY stays firmer after Q1 2020 Japan GDP.

Fed’s Powell defies the use of negative rates despite flaunting the central bank’s ammunition power.

US-China tussle, virus update weigh on the market’s risk-tone, Powell’s cautious optimism pleases the risks off-late.

Virus/trade updates will enterta

Liked

Liked

Cycle Trading: Assuming leadership

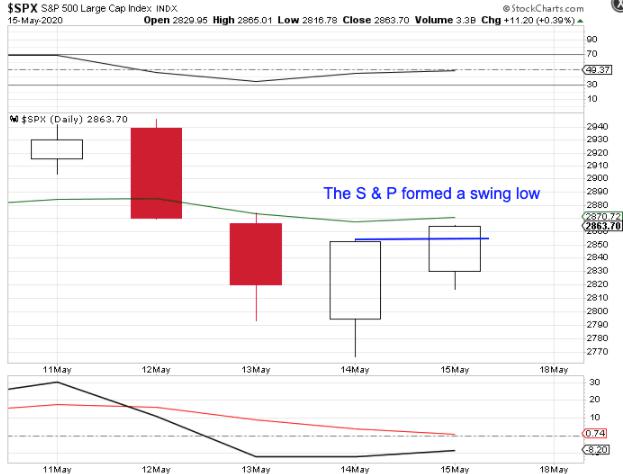

Stocks are seeking their daily cycle low

The S&P formed a swing low

The Dow formed a swing low

The Nasdaq formed a swing low and closed above the 10 day MA.

The Banks have yet to form swing low

The Semi's have yet to form swing low

Not only did Biotech form a swing low, they cl

Liked

Liked

FX, Gold, & Oil Weekly: The 3 key drivers set to dominate FX macro over summer months

Forex

For the summer months, three main drivers will dominate the FX macro; One, the divergence and relative success of lockdown 'exit strategies'; Two, sub-zero interest rate policies; Three, how far the combination of US election risk and blame game on coronavirus leads us down the trade war slop

Liked

Liked

Gold extends four-day winning run, hits new 7.5-year high

Gold jumps to the highest level since November 2012.

Fed's Powell again rules out negative rates but says more stimulus may be required.

Renewed US-China tensions may be drawing bids for the yellow metal.

Gold jumped to a fresh 7.5-year high on Monday even though Federal Reserve's President Je