© 2026 Followme

Liked

- Smart Forex Trade :🔥 Accuracy + Profit = Results. Check the performance😉🤮

Liked

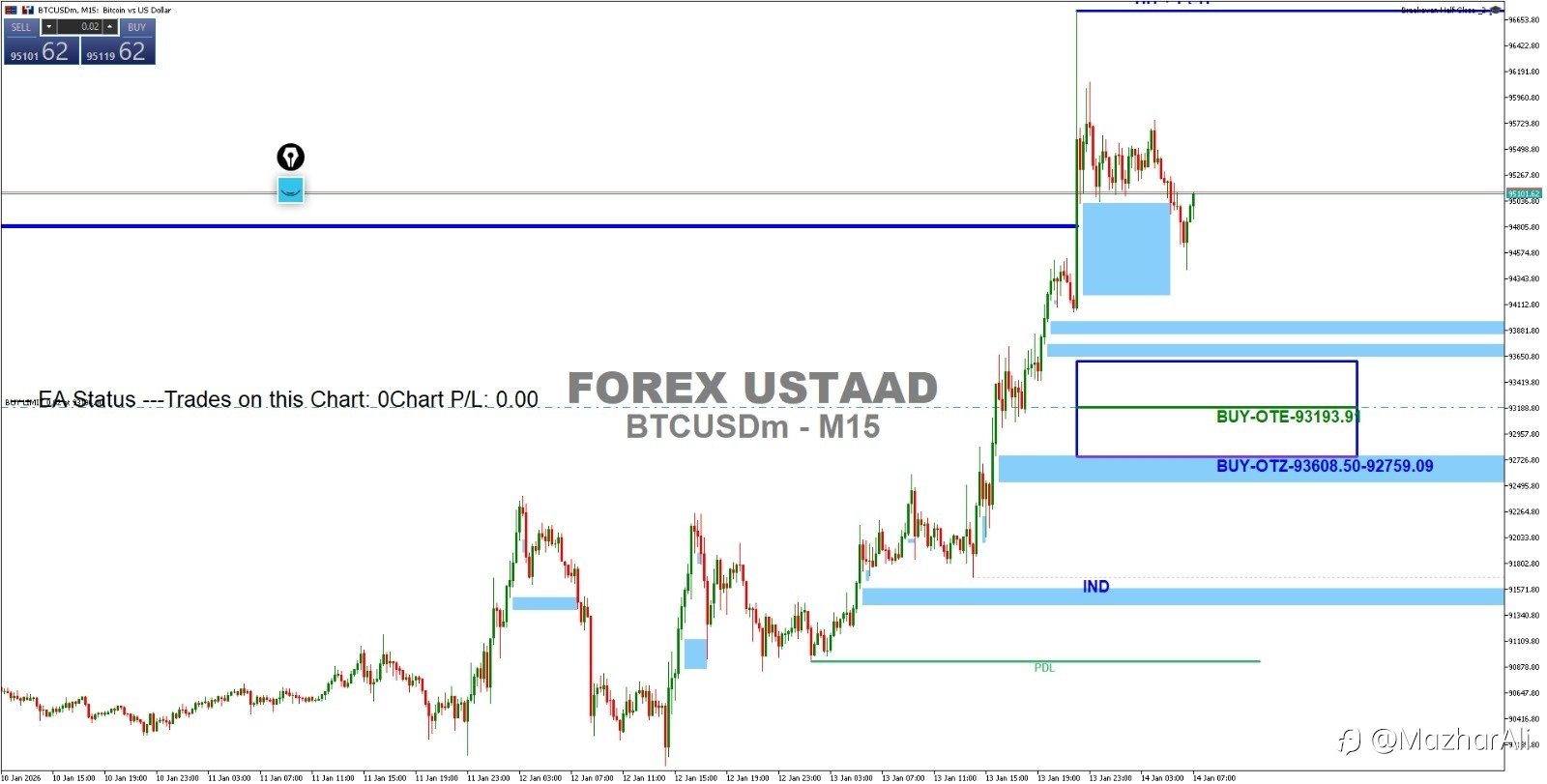

BTCUSD M15 Analysis

🔄 Market State: Neutral & Ranging The signal indicator shows a perfect balance of 62 SELL vs 62 BUY signals, suggesting the market is in a tight consolidation phase on the 15-minute timeframe. No strong directional bias is present in the short term. 📊 Key Dynamic Level Price is currently inter

Liked

Liked

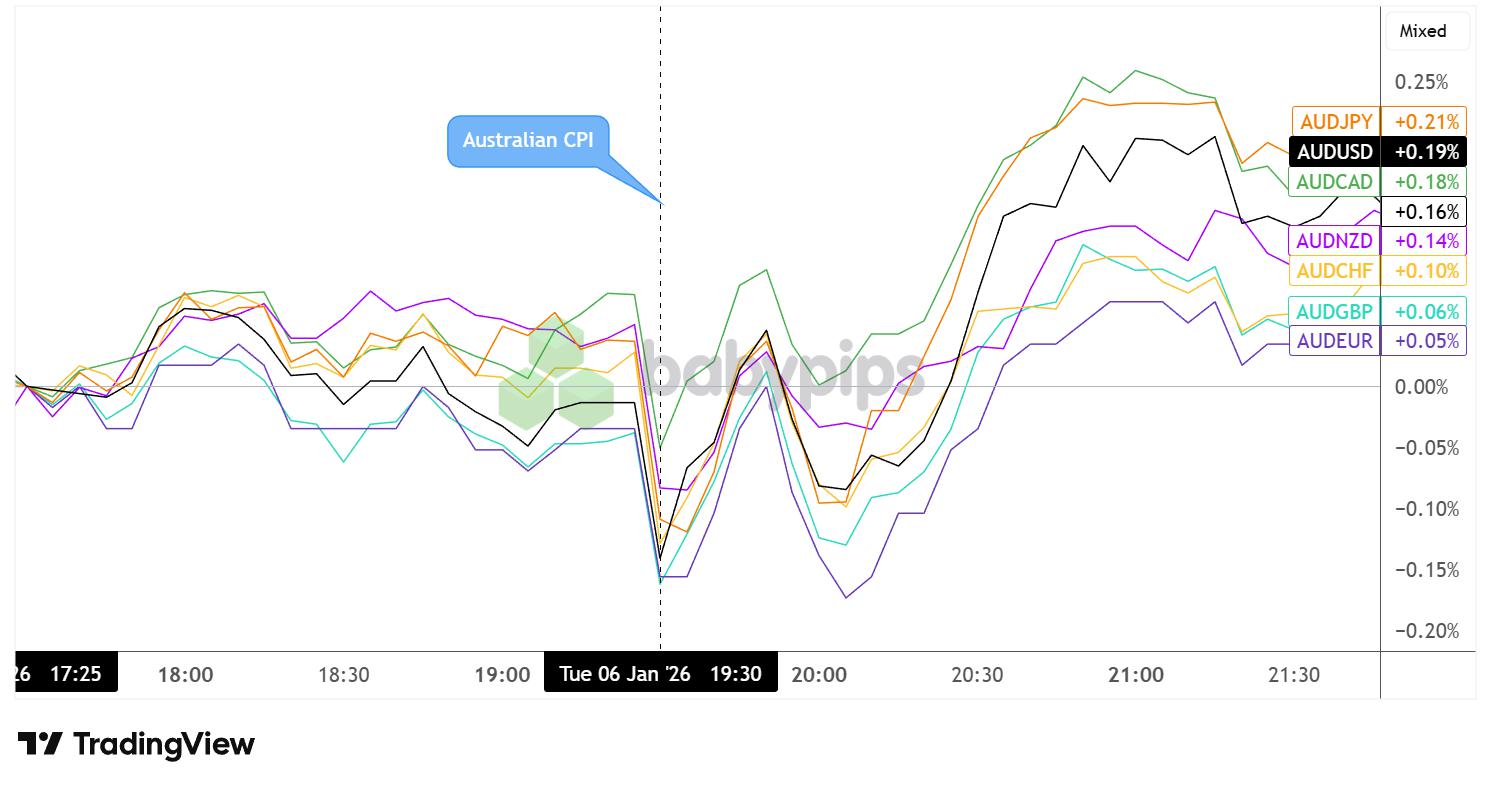

Australian Inflation Cooled to 3.4% in November, But AUD Still Supported

Partner Center Australia’s headline CPI fell from 3.8% to 3.4% year-on-year in November, prompting traders to briefly consider the idea of further RBA easing. November data from the Australian Bureau of Statistics reflected broad-based deceleration in price pressures, with both goods and services in

Liked

أهمية تقديم خبراتك المهنية بلغة احترافية

في عالم يتسم بالمنافسة الشديدة وتسارع وتيرة التغيرات المهنية، لم يعد امتلاك الخبرة وحده كافيًا لضمان فرص أفضل في سوق العمل، بل أصبح أسلوب عرض هذه الخبرات هو العامل الحاسم في كثير من الأحيان. فطريقة صياغة الخبرات المهنية، واللغة المستخدمة في تقديمها، ومدى توافقها مع متطلبات أصحاب العمل، جميعها عناصر

Liked

Liked

Liked

Liked

Liked

Liked

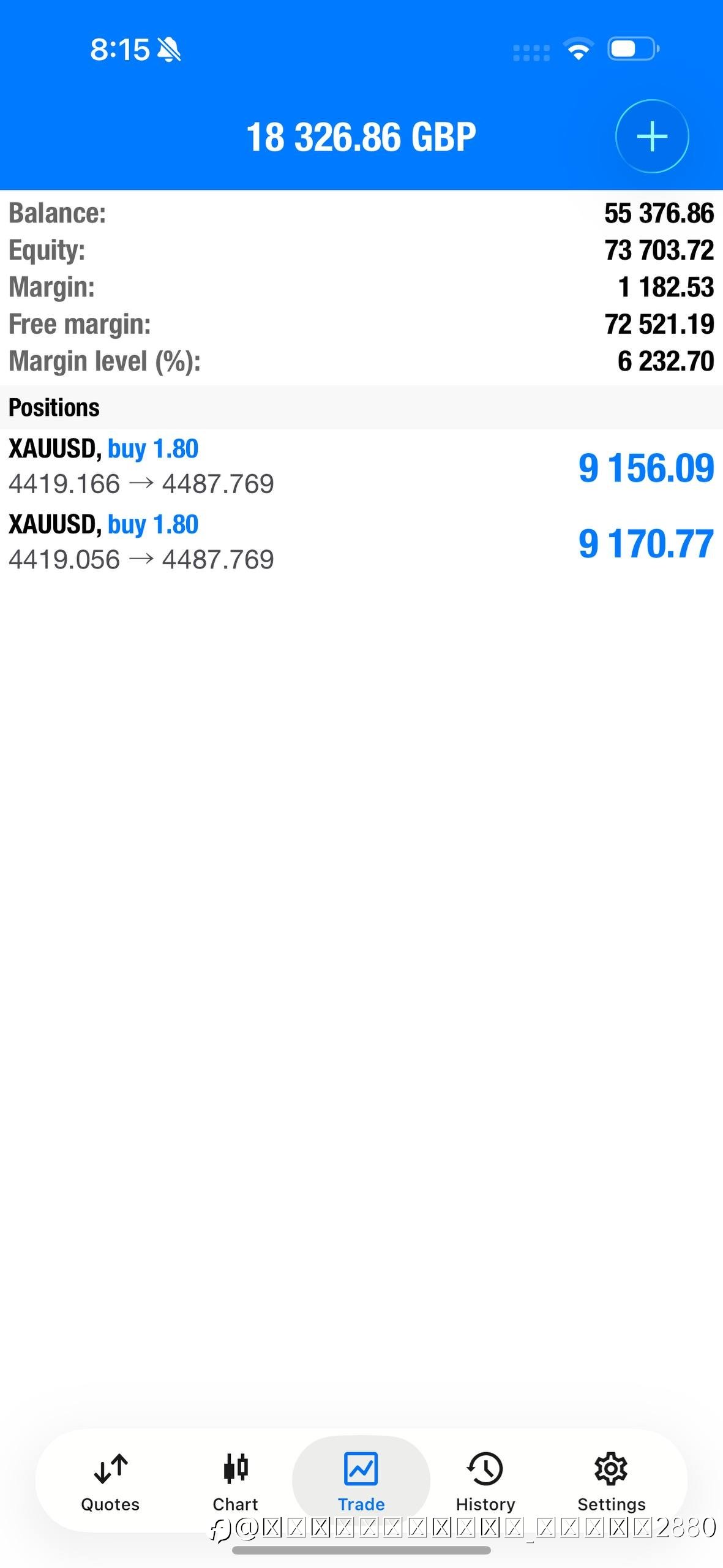

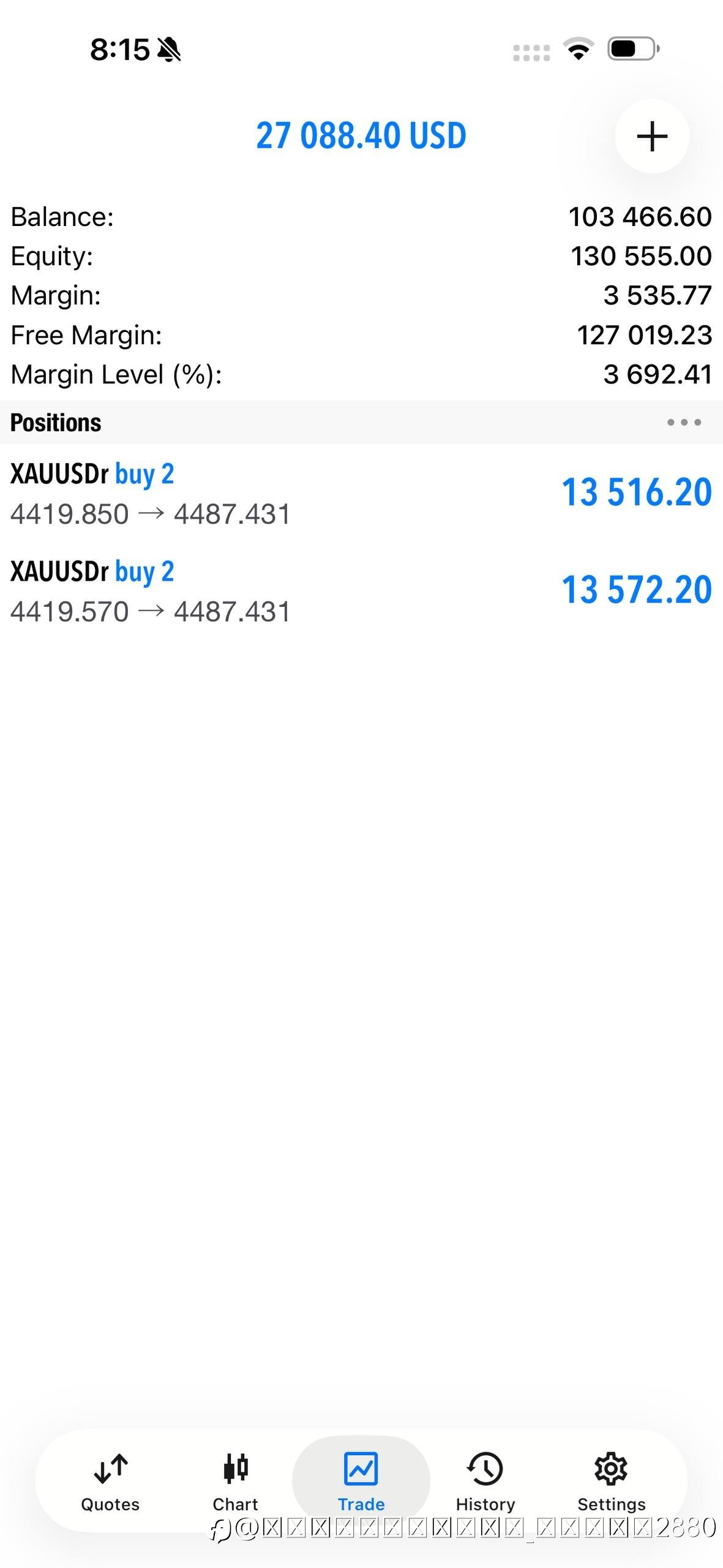

Understanding Gold and Silver (XAU & XAG) in the Forex Market

Gold and silver have long played an important role in global financial markets, and today they remain closely connected to the Forex market. In trading platforms, these metals are often quoted as XAU/USD (gold) and XAG/USD (silver), showing their direct relationship with the US Dollar. When investor

Liked