© 2026 Followme

Liked

Liked

Liked

3 Key Themes Driving the U.S. Dollar in January 2026

Partner Center The U.S. dollar kicked off 2026 near its weakest levels since October 2025, extending a rough stretch that saw the Greenback lose about 9% in 2025, marking its worst annual performance in nearly a decade. What’s behind this dollar weakness, and what can turn the tide in the coming wee

Liked

The Government’s Checking Account: Treasury General Account (TGA)

Partner Center While the Fed sets monetary policy, the U.S. Treasury controls something equally powerful: fiscal flows via the government’s checkbook. The Treasury General Account (TGA) is the federal government’s bank account at the Federal Reserve, and every change in its balance directly affects

Liked

Liked

Liked

Liked

Liked

Profit by Following

221.07

USD

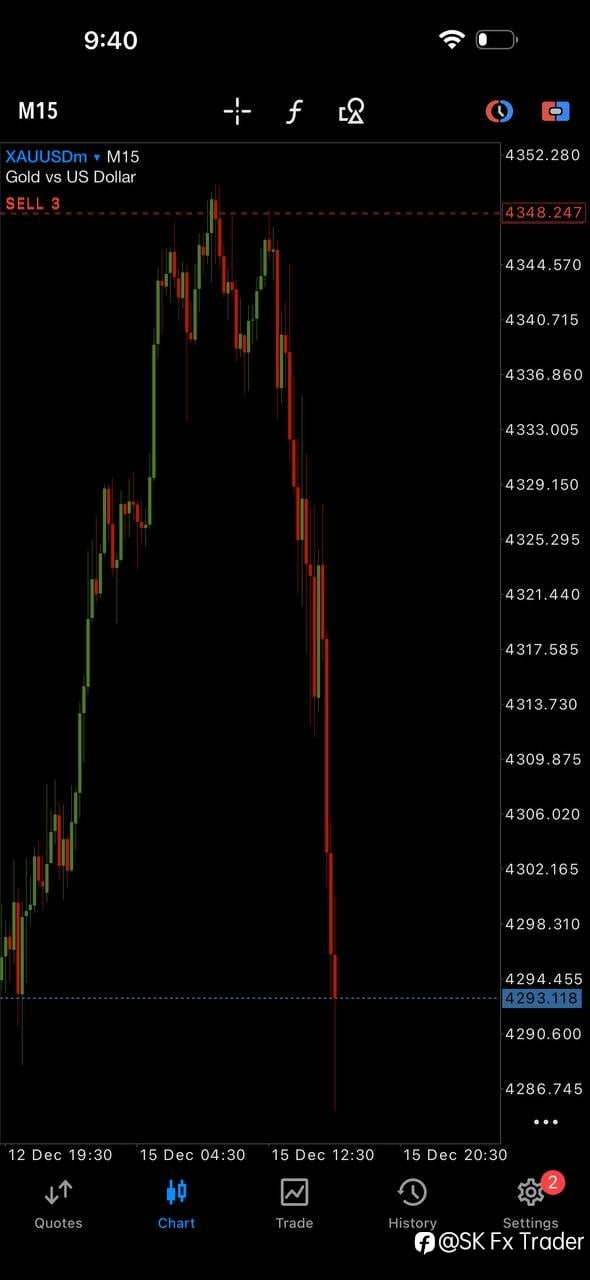

- Symbol XAU/USD

- Trading Account #2 20027151

- Broker KVB

- Open/Close Price 4,238.72/4,231.9

- Volume Sell 0.15 Flots

- Profit 102.30 USD

Liked

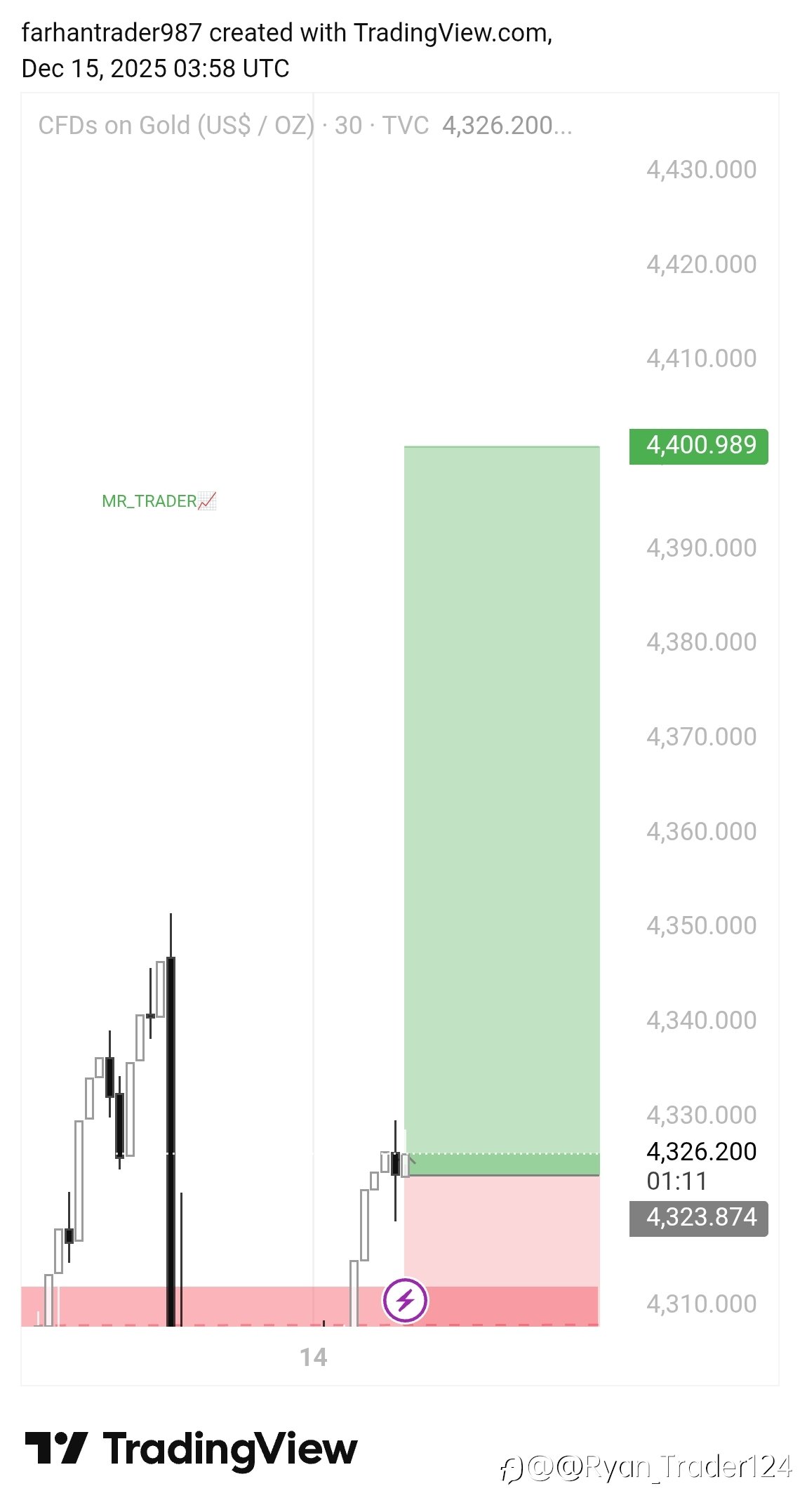

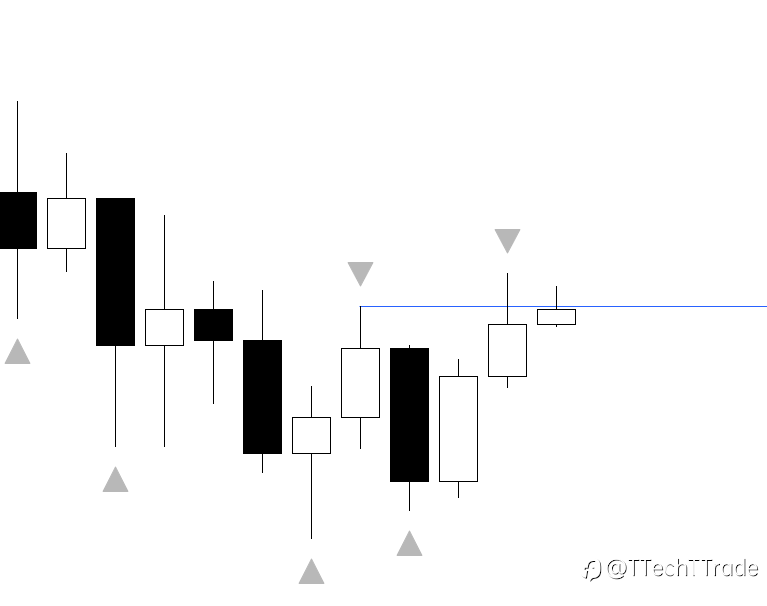

The Capital is rotating from riskier markets to hard assets

* The Nasdaq vs Silver Ratio is screaming the above statement strongly * NASDAQ is in a bear trajectory against silver & expected to further fall 65% priced in SILVER A further downfall in the ratio (Nasdaq vs Silver), indicating 3 possibilities: 1. Either Silver will rise further, with hi