© 2026 Followme

Liked

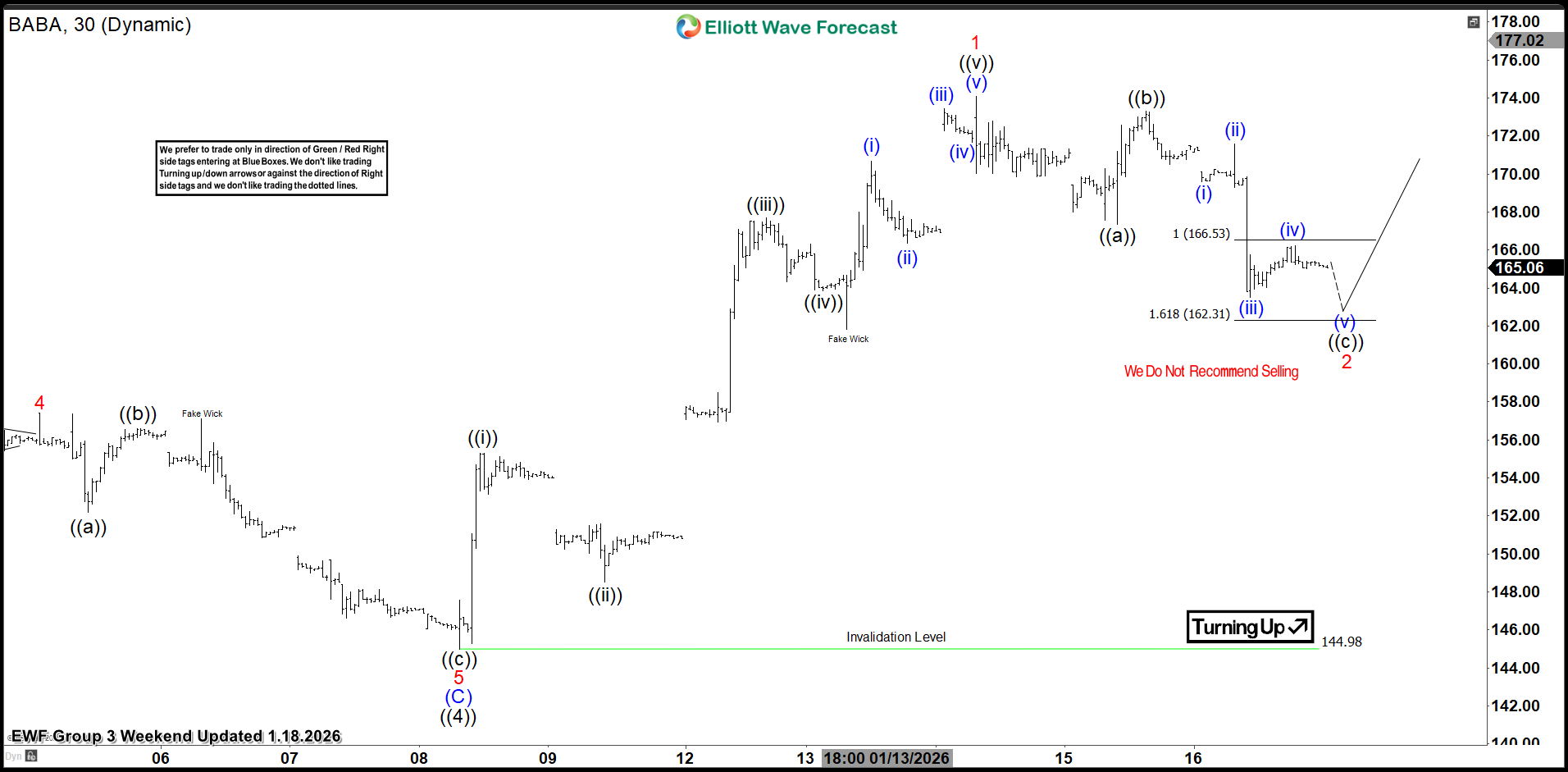

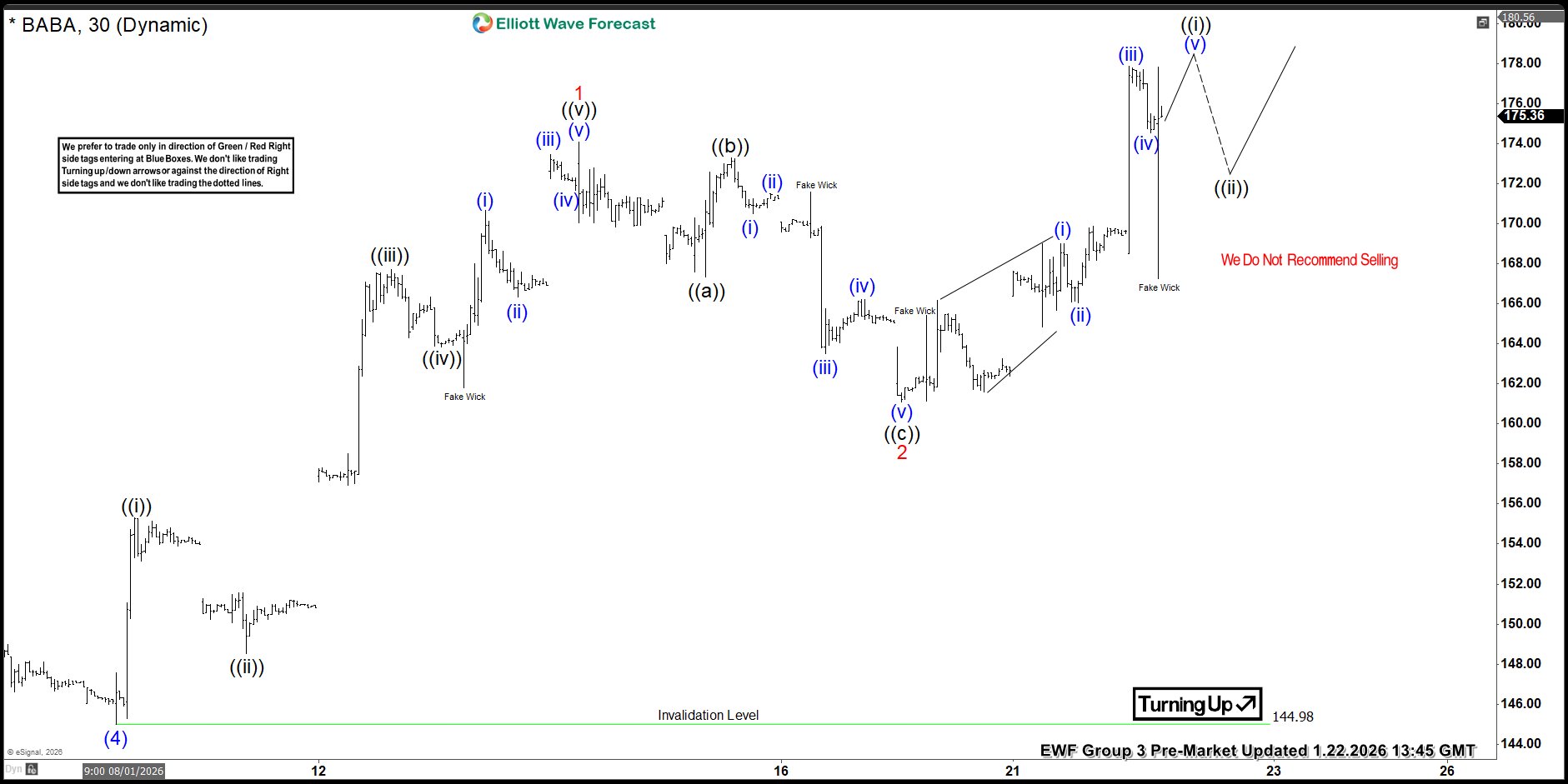

Alibaba Group. $BABA Extreme Area Offering a Buying Opportunity

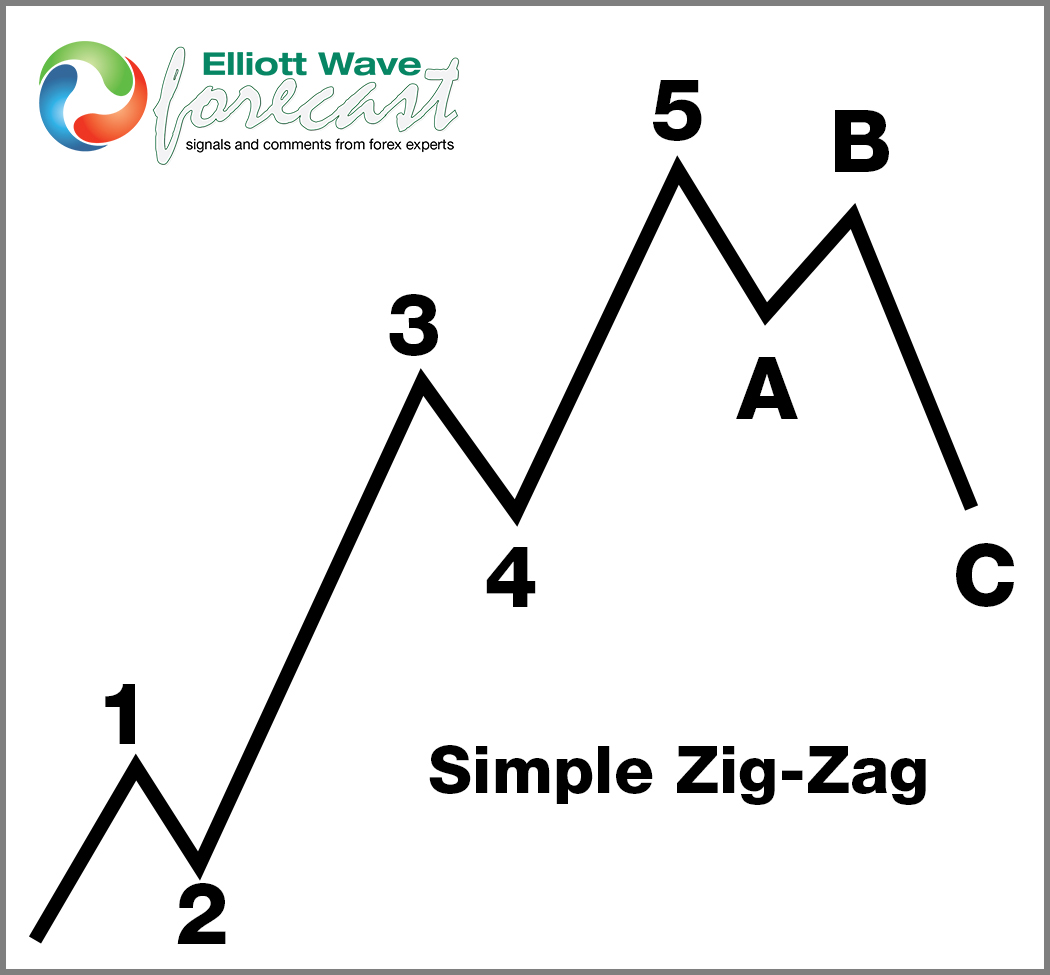

Hello everyone! In today’s article, we’ll review the recent performance of Alibaba Group. ($BABA) through the lens of Elliott Wave Theory. We’ll review how the rally from the Jan 8th 2026 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and d

Liked

SanDisk (NASDAQ: SNDK) Bullish Path Beyond $440

SanDisk (NASDAQ: SNDK) surged over 1000% since its IPO last year and it shows no signs of slowing. Today, we decode the Elliott Wave structure behind its powerful breakout. Consequently, our analysis charts a precise path to higher targets. This technical blueprint reveals a compelling setup fu

Liked

Profit by Following

2,245.32

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,410.89/4,404.63

- Volume Sell 2 Flots

- Profit 1,252.00 USD

What This Market Setup Means for Forex Traders Next

The combination of rising Asian stocks and record-high precious metals points to a broader shift in market expectations. Traders are increasingly focused on what comes next not what has already happened. In Forex, this environment often leads to increased movement in major pairs. A softer Dollar out

Precious Metals at Record Levels Signal a Weaker Dollar Narrative

While stocks rise, precious metals have been grabbing headlines by pushing into record territory. This move reflects more than simple demand it tells a deeper story about currencies, interest rates, and investor confidence. Gold and silver tend to perform well when real yields fall and the US Dollar

Asian Markets Climb as Rate Cut Hopes Fuel Risk Appetite

Asian stock markets have moved higher as investors grow more confident that interest rates may be heading lower. This optimism is not limited to equities it is spreading across global markets, reshaping how traders view risk and opportunity. At the center of this shift is the expectation that tighte

Liked

What to Watch Next in the Gold Market and Why It Matters

Looking ahead, several key factors will shape the next move in gold prices. Inflation trends remain important, as rising prices can support gold’s role as a hedge. At the same time, central bank signals especially around interest rates will continue to influence gold’s appeal versus yiel

Liked

Fundamental and technical Analysis of Gold

Today is Tuesday, December 23, 2025. Gold (XAU/USD) is currently trading in a highly volatile, record-breaking environment, maintaining its position as one of the best-performing assets of the year. 🌎 Fundamental Analysis The fundamental backdrop remains strongly bullish, driven by

Why Gold Reacts So Strongly to Forex and Market Sentiment

Gold is not just a commodity it behaves like a global currency. This is why it reacts so strongly to movements in Forex markets and shifts in investor sentiment. When confidence in paper currencies weakens, gold often benefits as an alternative store of value. Risk sentiment is another major driver.

Gold Prices at a Crossroads as Markets Search for Direction

Gold prices have entered an interesting phase, moving between optimism and caution as global markets look for clearer signals. Investors are closely watching economic data, interest rate expectations, and currency movements to decide where gold may head next. This uncertainty has kept the gold marke

Liked

Understanding Gold and Silver (XAU & XAG) in the Forex Market

Gold and silver have long played an important role in global financial markets, and today they remain closely connected to the Forex market. In trading platforms, these metals are often quoted as XAU/USD (gold) and XAG/USD (silver), showing their direct relationship with the US Dollar. When investor

What to Watch Next: Fed Signals, Gold Trends, and Forex Markets

Looking ahead, the path of gold prices will depend largely on how the Fed balances inflation control with economic growth. If inflation continues to cool and economic momentum slows, markets may expect rate cuts, which could support gold over the medium term. On the other hand, if inflation remains

Rate Expectations, the US Dollar, and Gold’s Market Behavior

Gold prices often move in response to expectations rather than confirmed decisions. When markets begin to expect that the Fed may cut rates, gold tends to rise in anticipation. These expectations usually come from changes in inflation trends, labor market data, or softer economic signals. At