© 2026 Followme

Liked

DXY: Plenty of US data this week – OCBC

US Dollar (USD) held on to mild gains, amid rise in UST yields and ahead of US CPI (Tuesday). DXY was last at 97.9 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note. Bullish momentum on daily chart intact "Trump announced tariffs over the weekend – 30% on all imports from Mexico an

Liked

EUR unchanged despite trade tensions – Scotiabank

The Euro (EUR) is steady and entering Monday’s NA session unchanged against the US Dollar (USD), holding in remarkably well in the face of trade tensions and the US’s 30% tariff proposal, Scotiabank's Chief FX Strategists Shaun Osborne and Eric Theoret note. Multi-month trend remains bullish "The op

Liked

What Is OTC? A Quick Guide to the OTC Market

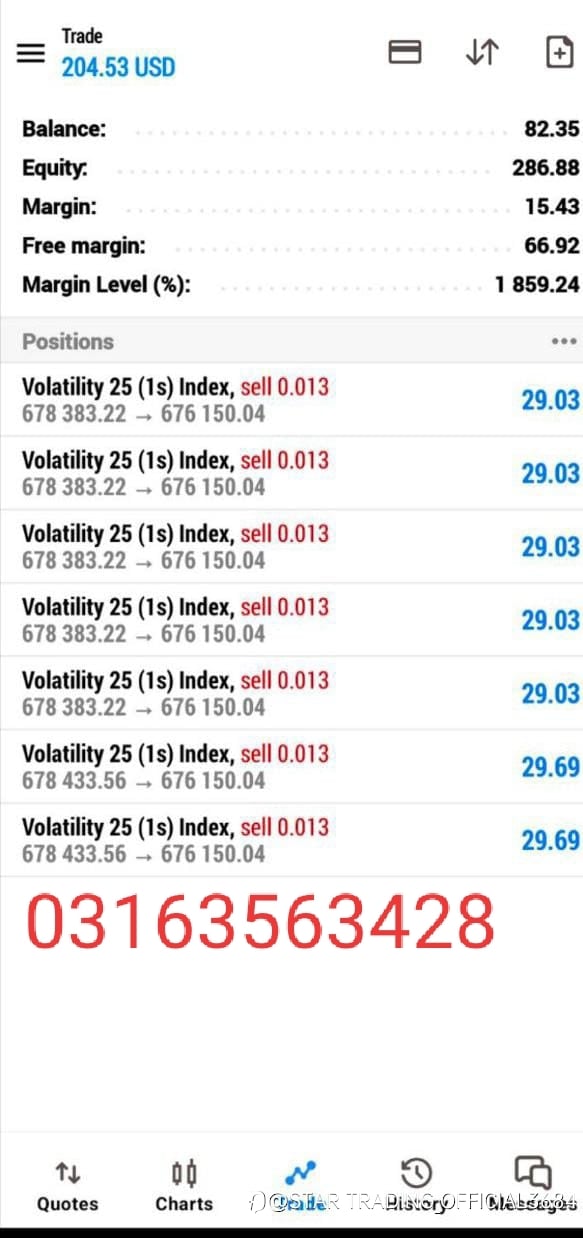

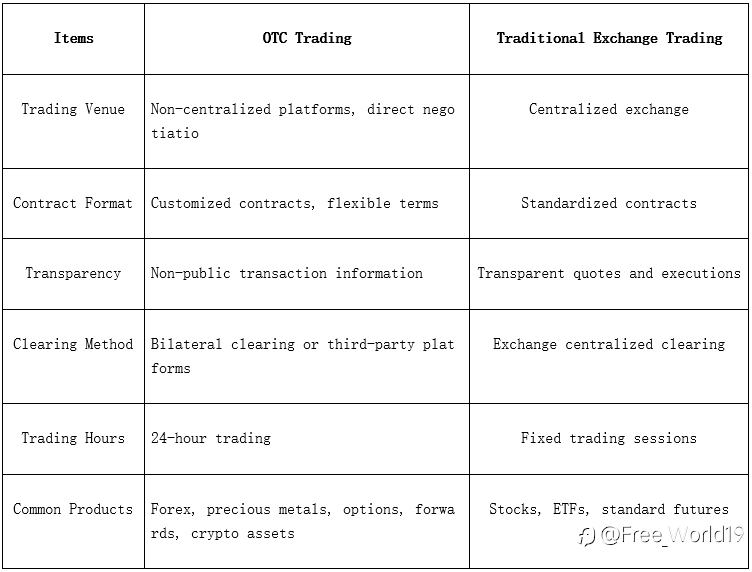

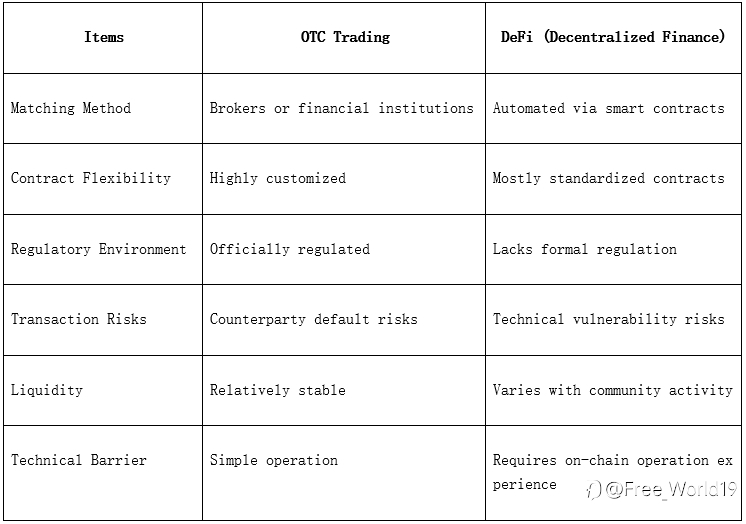

With investment channels expanding, the OTC market is drawing growing attention. But what exactly is OTC? How can investors access this market? This article explains OTC trading in simple terms, helping you take initiative in investments. What Is OTC Market? The OTC market, or Over-the-Counter marke

Liked

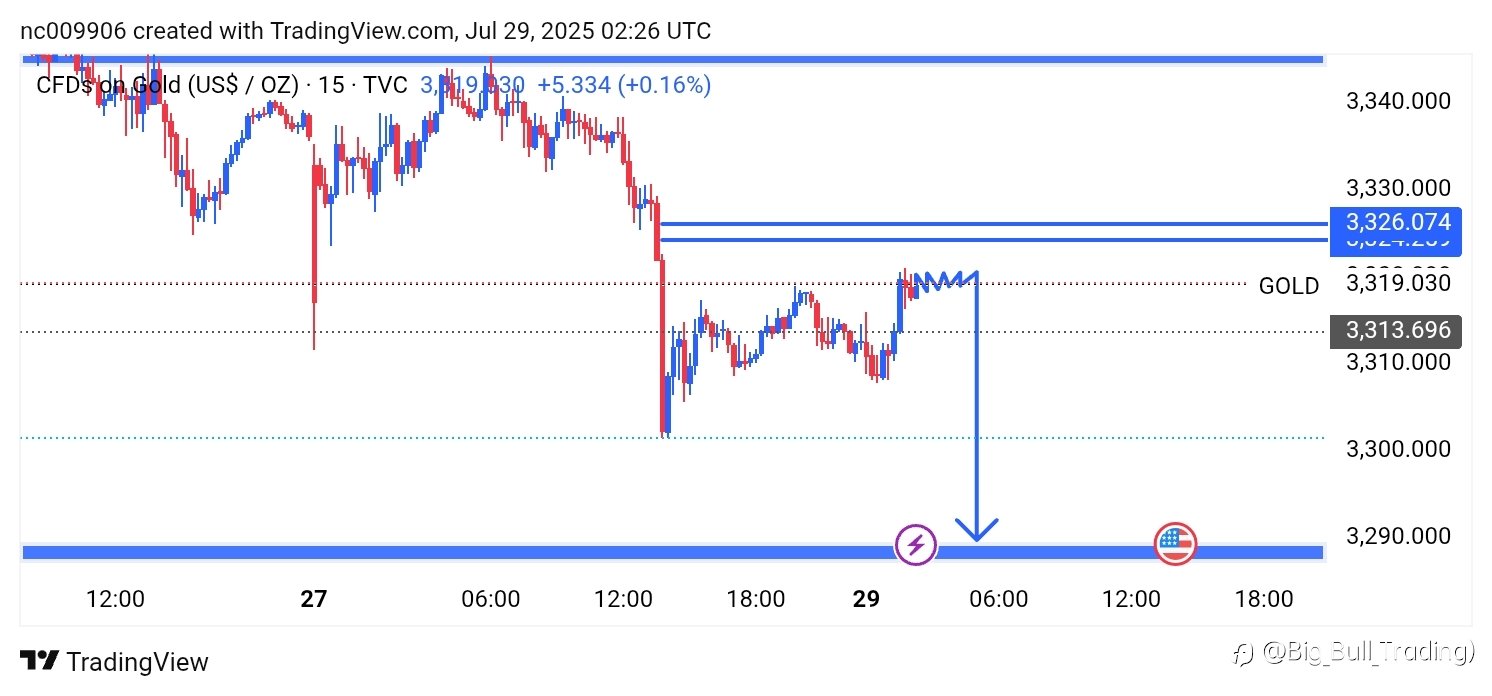

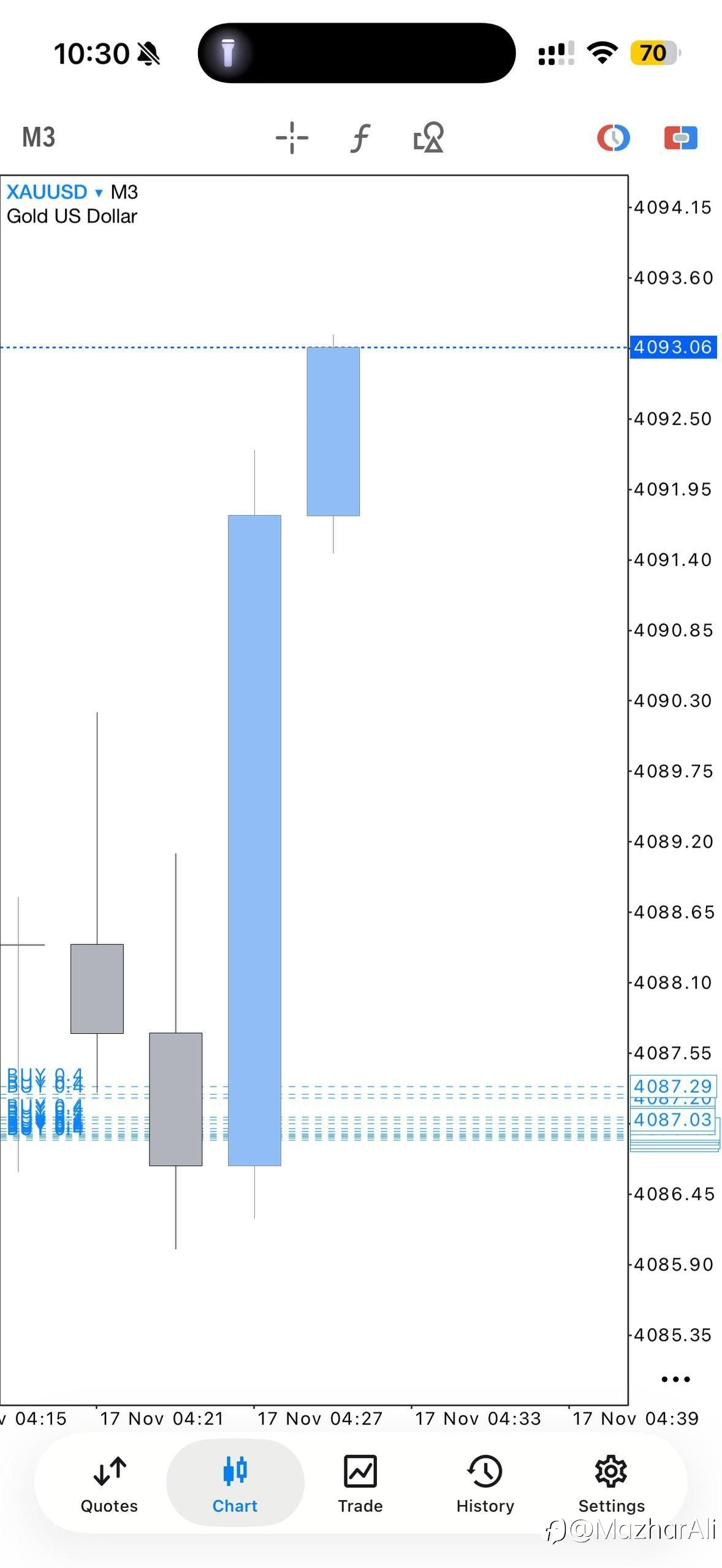

How to avoid taking low probability trading setups [Video]

In this trading video I cover the importance of comparing your trading setups over the long-term. You will learn how to avoid taking low-probability trading setups by comparing multiple timeframe charts and buy-side/sell-side liquidity levels. Share: Analysis feed

Liked

Lagarde speech: If trade tensions resolved in short order, it would clear some uncertainty

Christine Lagarde, President of the European Central Bank (ECB), explains the ECB's decision to leave key rates unchanged at the July policy meeting and responds to questions from the press. Key quotes "Decision was unanimous." "Risk assessment was broadly shared." "Widely shared that we have to wor

Liked

Liked

Federal Reserve Decision and Powell’s Press Conference: Navigating Uncertainty in July 2025

On July 30, 2025, the U.S. Federal Reserve, led by Chairman Jerome Powell, announced its latest monetary policy decision, opting to maintain the federal funds rate at a range of 4.25% to 4.50%. This marked the fifth consecutive meeting with no change, reflecting a cautious approach amid economic unc

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 10 FCOIN that can withdraw. Click to know more details about //socia...

Liked

Liked

Liked

US Dollar Index edges higher to near 97.50 ahead of PMI data, Powell’s speech

US Dollar Index advances amid cautionary remarks from Fed officials.US S&P Global Manufacturing and Services PMIs are expected to ease in September.Cleveland Fed President Beth Hammack cautioned that inflationary pressures are likely to remain in place for now. The US Dollar Index (DXY), which m

Liked

Liked