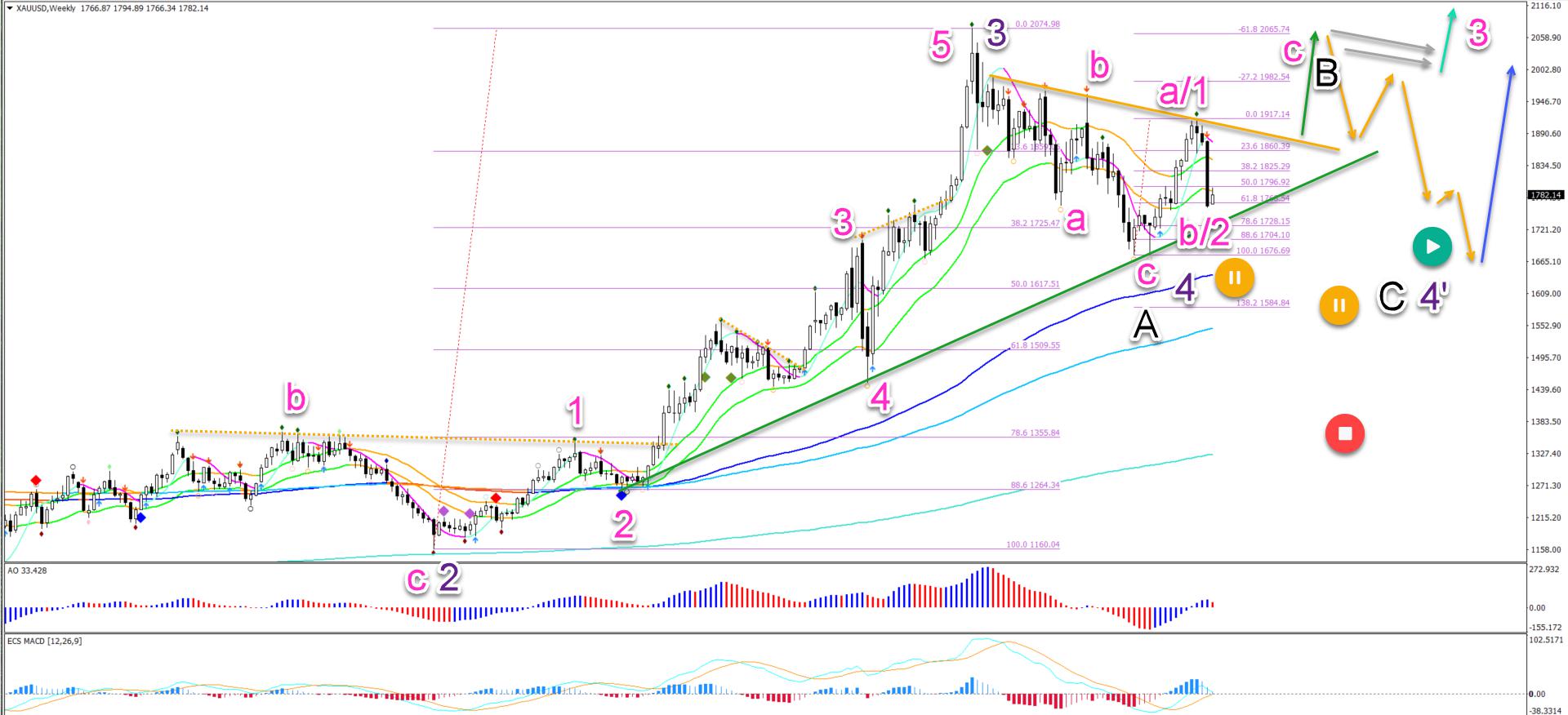

Gold testing 61.8% Fibonacci support after bearish ABC

The XAU/USD chart was unable to break above the resistance trend line (orange) and is now testing the support trend line (green). Price action seems to be building 3 corrective waves down after 5 impulsive waves up. Now an ABC zigzag pattern seems to be taking place in wave 2 or B. The target is the

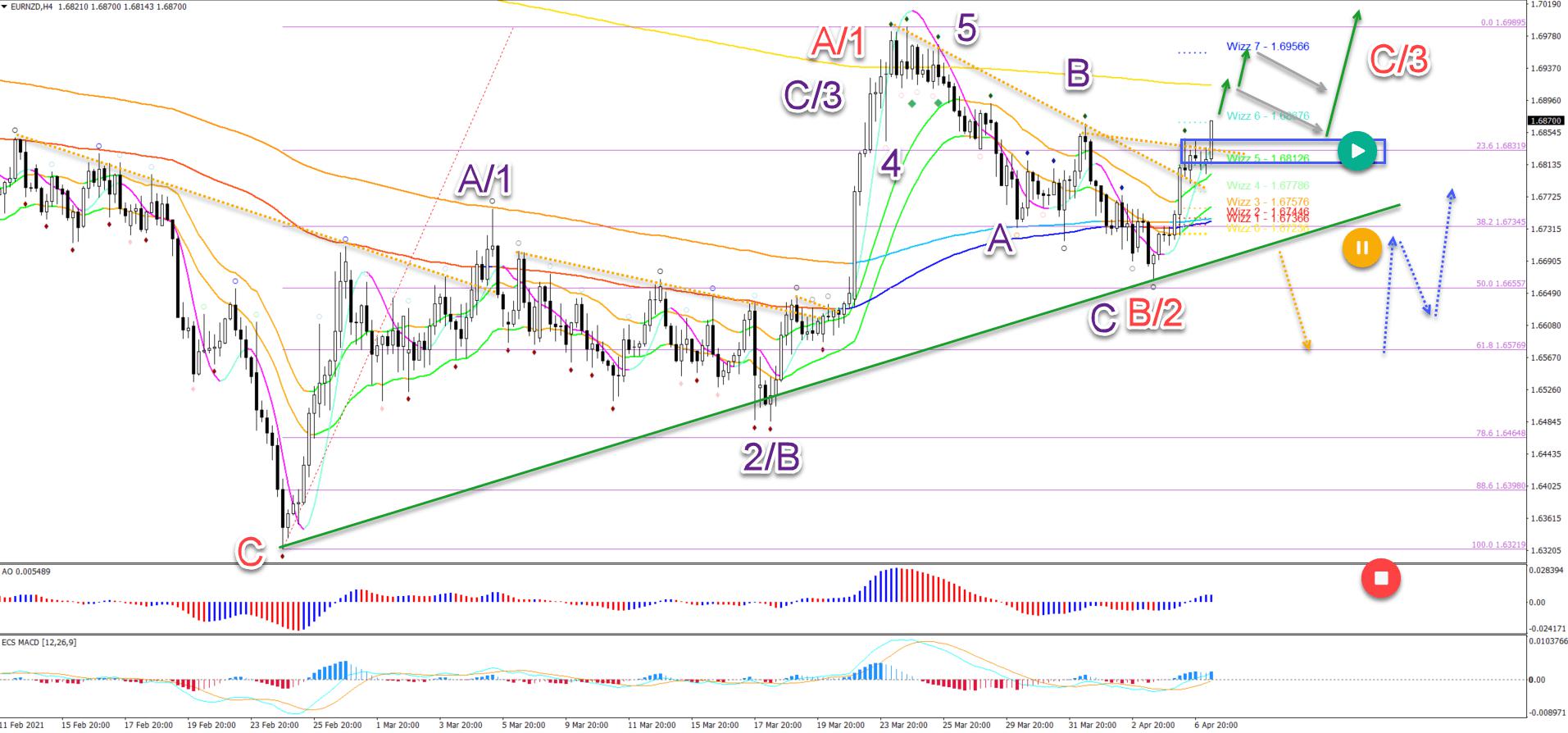

EUR/NZD strong bullish momentum aims at 1.70 targets

EUR/NZD made a strong bullish bounce at the 50% Fibonacci retracement level. The bullish breakout above the resistance trend lines (dotted orange) indicates more upside. This article will review the EUR/NZD price patterns and targets, but also why this particular currency pair offers the best charti

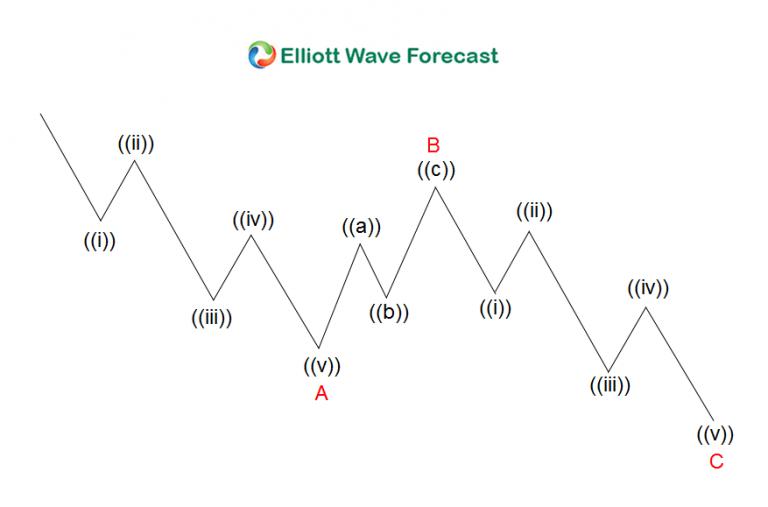

Why double three WXY is a better structure to trade than zigzag ABC

In Elliott Wave, there are several different corrective structures. Two of the most common corrective structures are zigzag ABC and double three WXY. A zigzag is a simple correction that all wavers is familiar with. The subdivision of ABC is 5-3-5, as the graph below illustrates. ABC Zigzag Structur