Gold price keeps achieving the positive targets – Analysis - 09-03-2022

Gold price provided additional positive trades and approach our next target at 2075.00, and the chances seem valid to continue the rise and surpass this level to open the way to achieve more gains on the intraday and short term basis, noting that the next station reaches 2100.00$ barrier. Therefore,

注意:补税补到USDT头上了?外汇人你还敢裸奔?谁又中招了?

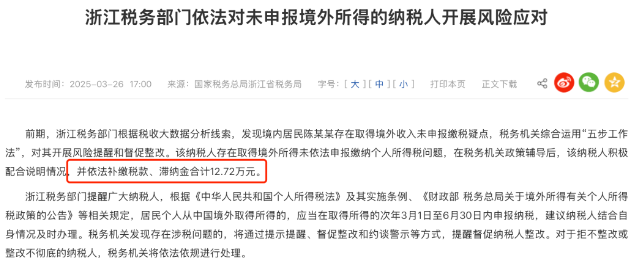

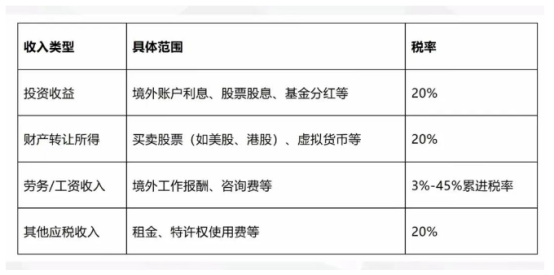

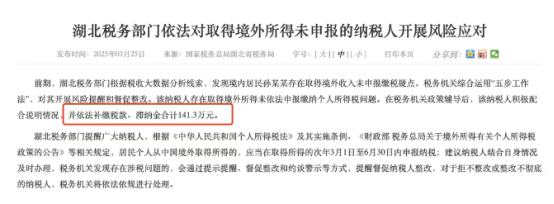

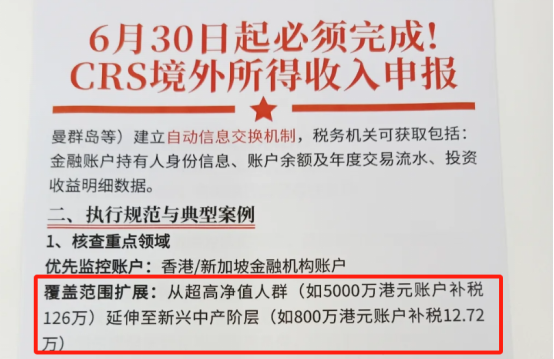

谁又中招了?这两天你们应该都听说了。起因是一个“低调但爆炸”的案例:浙江陈某伟因为交易USDT赚了钱,被要求补税12.72万元!对,你没听错,USDT——那个大家常用来转币、套利、跑平台的“稳定币”,现在也进了税务局的监控雷达。 回顾一下官方给出的说法:陈*伟通过境外交易平台买卖USDT,2022-2024年间累计净收益63.6万元,并未在年度所得税中申报,按照20%税率补税12.72万元! 这说明什么?数字货币在税务监管上,已经不再是灰色地带。 我们再来复盘一下几个细节: 补缴税种:财产转让所得 → 统一按照20%税率征税;不能抵扣亏损:上一年亏,下一年赚,也要照缴;补税+滞纳金:一旦被查,

- GordonPiskS :外汇人,赚够600万移民吧😎

- AGu8 :钱太多就会被土匪盯上

- xiaokkangg :我们这种穷鬼。看不上的

Midday update for Gold 09-03-2022

Gold price shows some bearish bias affected by the strength of the intraday bullish channel’s resistance that appears on the chart, and it might lean on this channel’s support line around 2020.00 before resuming the bullish trend again. Until now, the main bullish trend scenario still expected unles

Gold price keeps its negative stability – Analysis - 11-03-2022

Gold price tested 2002.00 level and kept its stability below it, accompanied by witnessing clear negative signals through stochastic, waiting to motivate the price to resume the correctional bearish trend, which targets testing 1960.00 as a next station. Note that breaking the mentioned level will e

Gold price draws negative pattern – Analysis - 14-03-2022

Gold price managed to touch our waited target at 1960.00 and found solid support there, and by taking a deeper look at the chart, we find that the price forms double top pattern that might push the price to achieve more bearish correction in the upcoming sessions, which its targets might extend to 1

Midday update for Gold 16-03-2022

Gold price settles below 1925.35 level, to keep the negative pressure valid for today, supported by stochastic loss to the positive momentum clearly, waiting to resume the bearish trend that depends on the price stability below the mentioned level, noting that our next main target is located at 1890

Gold price surpasses the resistance – Analysis - 17-03-2022

Gold price approached our waited negative target at 1890.10 yesterday, but it bounced upwards clearly and begins today with additional rise to breach 1925.35 and settles above it, which leads the price to attempt to regain the main bullish trend again, on its way to test 1960.00 initially, noting th

Gold price tests the support base – Analysis - 18-03-2022

Gold price faced solid resistance formed by the EMA50 against the positive trades, to test the support base formed above 1925.35 and still above it until now, waiting to get positive motive that assist to push the price to resume the main bullish trend, which its next target located at 1960.00. Note

Gold price attempts to consolidate above the support – Analysis - 21-03-2022

Gold price faced negative pressure in the previous sessions and attempted to break 1925.35 level, but it begins today above this level, to keep the chances valid to resume the expected bullish trend on the intraday basis, which its next main target located at 1960.00. Stochastic supports the suggest

Midday update for Gold 21-03-2022

Gold price trades below 1925.35 level now, to hint heading to decline in the upcoming sessions, but the positive scenario still valid unless the price close the daily candlestick below the mentioned level, which will push the price to head towards 1890.00 mainly, while the price needs to step above

- illiam947 :hi

Midday update for Gold 22-03-2022

Gold price returns to test the key support 1925.35, and as long as the price is above this level, our bullish overview will remain valid, which its targets begin by breaching 1941.00 to open the way to visit 1960.00 level, noting that breaking 1925.35 will put the price under negative pressure that

Gold price breaks the support – Analysis - 23-03-2022

Gold price ended yesterday below 1925.35 level, to fall under expected negative pressure in the upcoming sessions, supported by the negative pressure formed by the EMA50, waiting to head towards 1890.00 as a next main target. Stochastic current positivity might push the price to attempt to recover a

Evening update for Gold 23-03-2022

Gold price trades with clear positivity to breach 1925.35 level and attemtps to build support base above it, which urges caution from the upcoming trading, as the price heads to rise again and achieve expected gains that reach 1960.00 initially, and we prefer to stay aside to monitor the daily candl

Midday update for Gold 24-03-2022

Gold price fluctuates around the EMA50, settling above it, thus, no change to the bullish trend scenario that depends on the price stability above 1925.35, waiting to get positive momentum that assist to push the price to achieve our main waited target at 1960.00, reminding you that breaking 1925.35

Update: Gold price reaches the target

Gold price rallied upwards to reach our waited target at 1960.00, and we need to monitor the price at this level, as breaching it will extend gold price gains to reach 2000.00 as a next main station, while consolidating against the bullish bias will lead the price to decline and test 1925.35 areas i