#FedInterestRateDecision#

1.53k View

426 Discuss

The current federal reserve interest rate, or federal funds rate, is 0% to 0.25% as of March 16, 2020.

【Berita】Powell Tahan Bunga, Lawan Tekanan Trump

The Fed kembali mempertahankan suku bunga di level 4,25% - 4,50%. Tapi yang jadi sorotan bukan itu. Ketua The Fed, Jerome Powell, menegaskan: Belum ada keputusan soal pemangkasan suku bunga pada rapat bulan September. Masih Butuh Bukti Tambahan Menurut Powell, inflasi memang mulai turun dalam bebera

- dinianggita :Liat CPI aja dulu

- rioseptian :Tetap, inflasi masih bandel

FOMC preview: Tapering, transitory inflation and dot-plots [Video]

- Overview of market sentiment at the EU open (00:00). - UK CPI data comes in higher than expected (3:13). - Technical look at gold and WTI crude futures (4:29). - UK lockdown extension to be heard in Parliament today (7:22). - China orders State firms to curb overseas commodities exposure (9:09). -

EUR/USD Forex Signal: Bearish Sentiment Ahead of FOMC

Bearish View Sell the EUR/USD and add a take-profit at 1.2050. Add a stop-loss at 1.2150. Timeline: 1-2 days. Bullish View Set a buy-stop at 1.2120 and a take-profit at 1.2200. Add a stop-loss at 1.2050. The EUR/USD price was little changed in early trading as investors started to refocus on the Fed

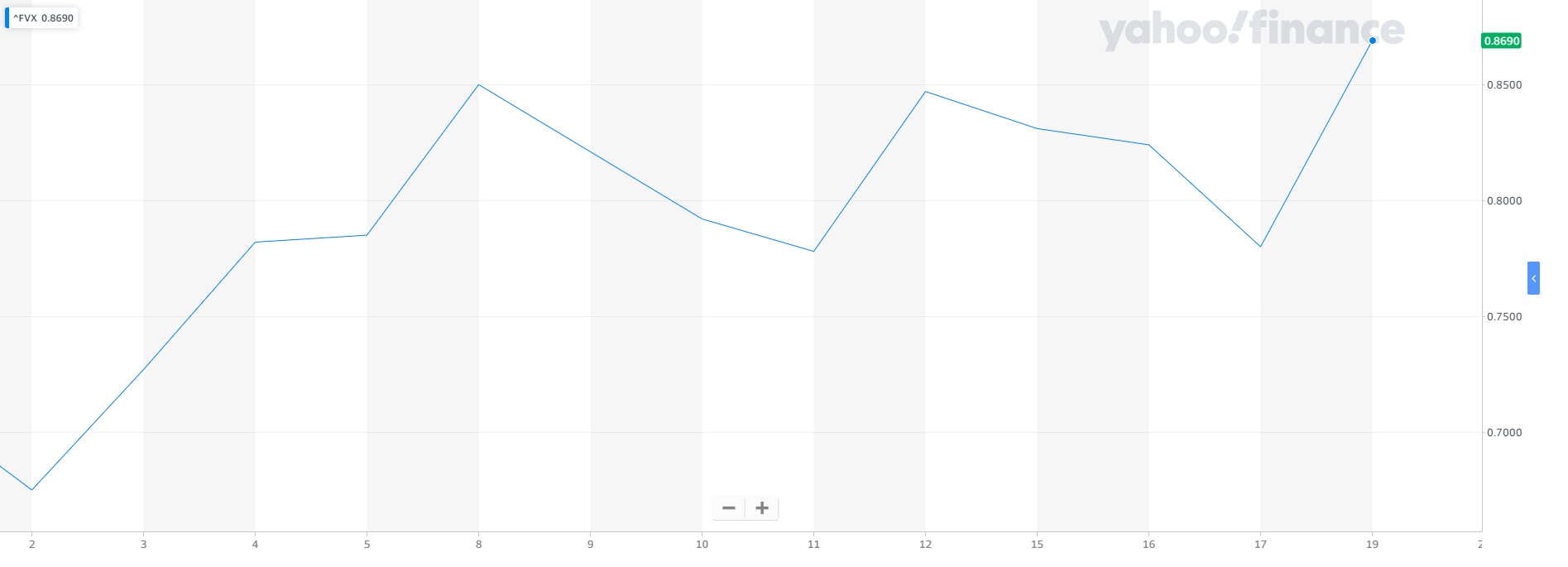

Jerome Powell Refuses to Humor Bond Traders’ Tantrums

The Fed indicates inflation will rise above 2% but doesn't flinch on forecasting rates near zero. Photographer: Daniel Acker/Bloomberg The $21 trillion U.S. Treasury market already set the narrative ahead of the Federal Reserve's decision on Wednesday. Benchmark 10-year yields stormed to the highest

Talk of the Week

Hey traders, we hope you had a great week! This week, these were some of the hot topics raised by FOLLOWME's users in line with the market sentiment, let’s see if you are on the same page: #AstraZenecaVaccine# Countries including France, Denmark, Ireland and Thailand have temporarily

Fed, BoE step back, yields push up

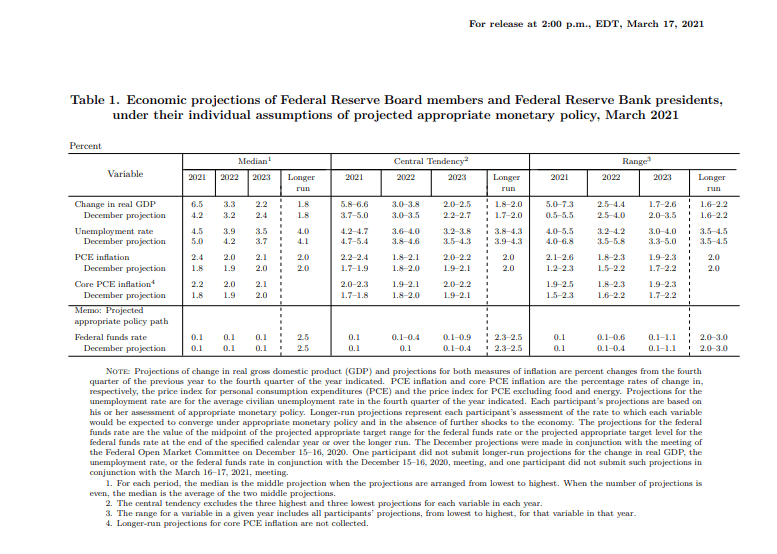

Both of the Federal Reserve and the Bank of England vowed to keep liquidity plentiful and not to taper support in the face of rising inflation until they see prolonged signs of an economic recovery. The FOMC served up a surprise with the majority of the dots flat through 2023. Both USD and GBP fell

Reversing the Fed moves?

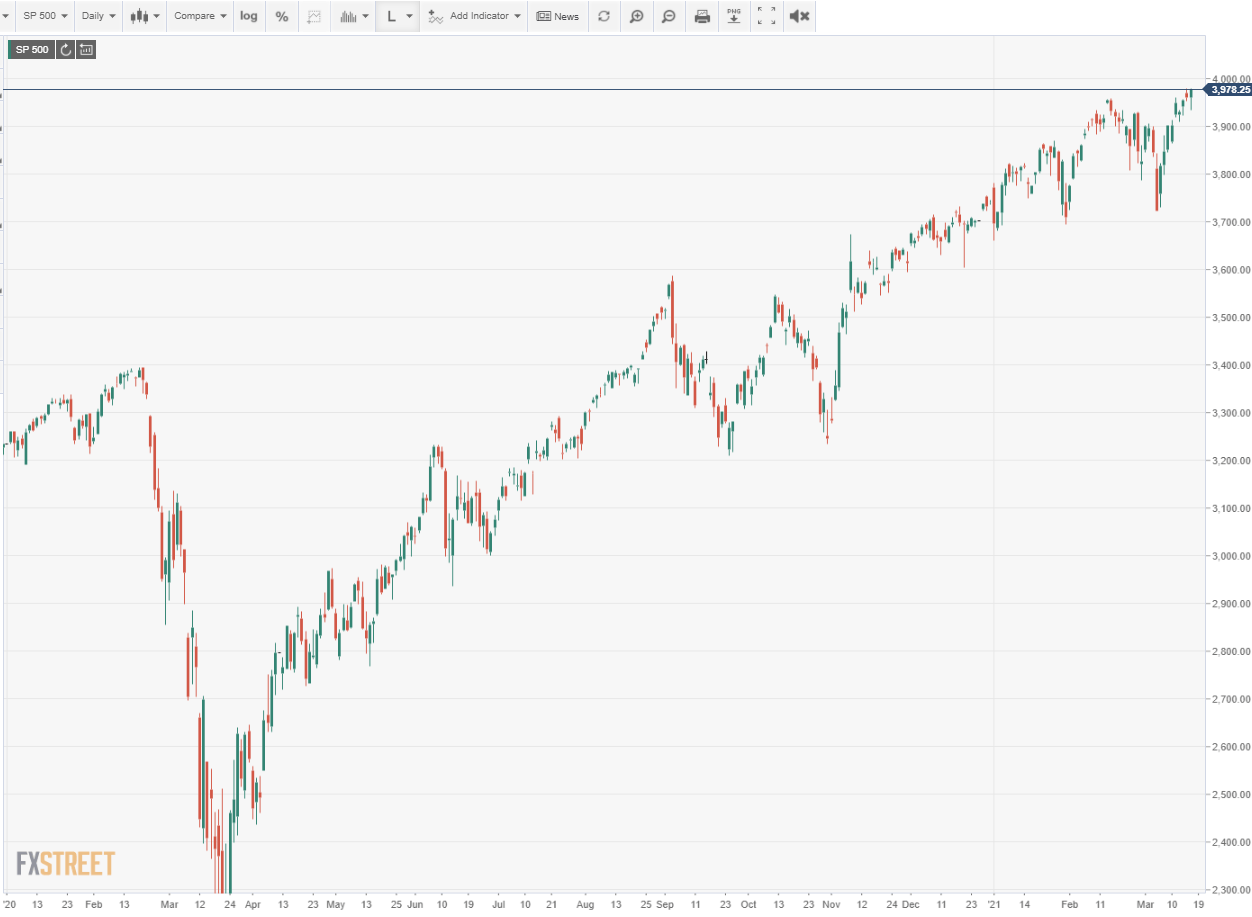

Fed messaging was rightfully interpreted as dovish –" full employment is in effect its single mandate now. Yes, the central bank will tolerate higher inflation, and has prepped the markets for its advent (as if these didn‘t know already). Powell managed to walk the fine line between economic optimis

Powell and the FOMC: Is it really about the fed funds rate?

The Federal Reserve leaves rate and bond policies unchanged. Fed funds consensus shifts but the rate remains stable through 2023. Estimates for GDP expansion, inflation, and unemployment improve. Equities and bond yields move higher, dollar falls. The Federal Reserve executed a deft sleight of hand

Markets await the FOMC meeting with focus on 2023 dot-plot for rates [Video]

- Market sentiment at the European open (00:00). - Review of the FX, equity and fixed income charts (1:55). - France and Italy considering u-turn on Astra vaccine (6:38). - Main points to watch out for in the FOMC meeting (10:30).

Where Did You Gold? - Rebound at Risk as Yields Aim Higher Ahead of FOMC

The recovery in gold prices hangs in the balance as attention turns to the upcoming FOMC meeting.An upwardly revised Fed Funds dot plot could trigger extensive selling.However, hinting at the possibility of YCC or Operation “Twist” could underpin the anti-fiat metal. Gold prices have crept cautiousl