- EcMarkets直 :EA厉害

- 老了骚不动了四旬老汉 :分享一下ea呗,大神们

00:22:09

- Bitter_Snow9530 :Would you like to earn 200$ daily? Inbox me for more information

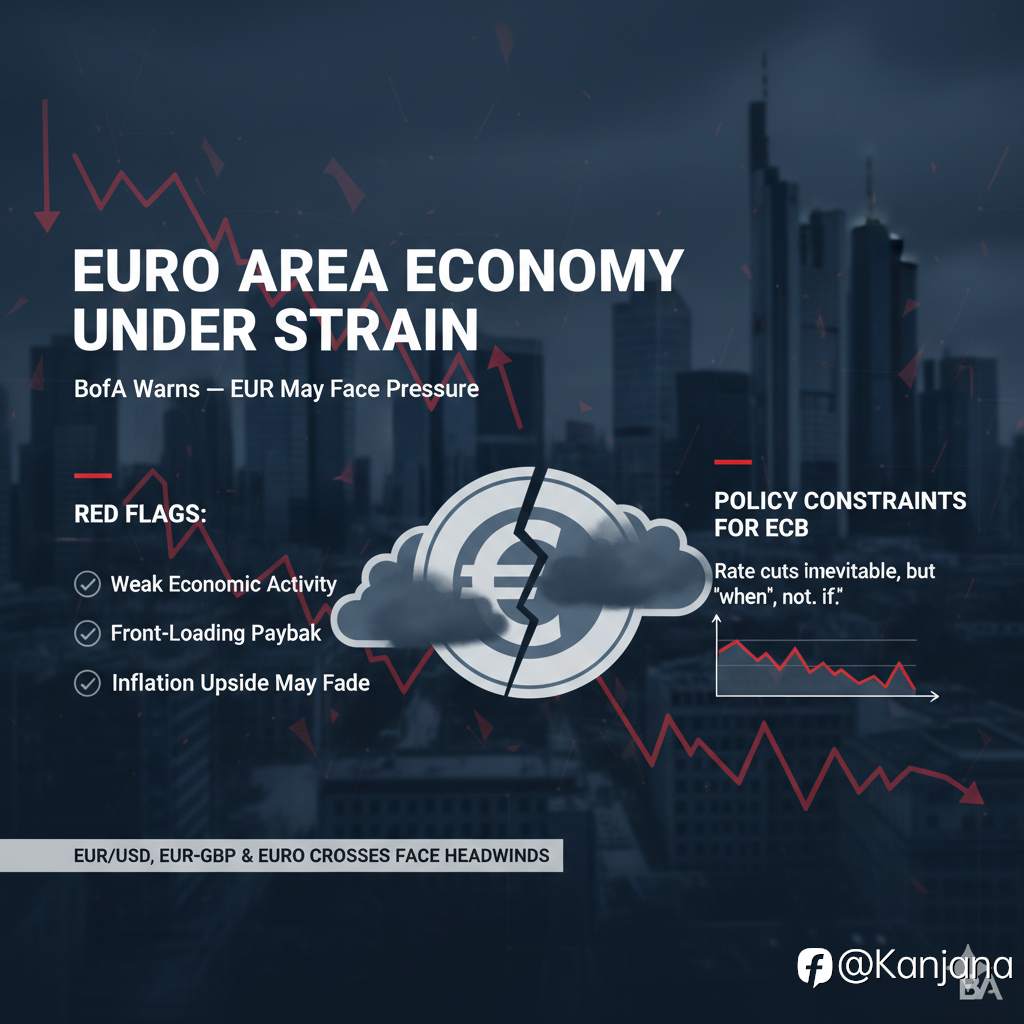

เศรษฐกิจยูโรโซนเริ่มสั่นคลอน! BofA

เศรษฐกิจยูโรโซนเริ่มสั่นคลอน! BofA เตือน “ยูโรอาจเจอแรงกดดันต่อเนื่อง” ธนาคาร Bank of America (BofA) ออกมาเตือนว่า เศรษฐกิจยูโรโซนกำลังอยู่ในจุดเปราะบาง หลังค่าเงินและอัตราดอกเบี้ยที่แท้จริงปรับตัวสูงขึ้น จนกลายเป็น “การเข้มงวดทางการเงินโดยไม่ตั้งใจ” เทียบเท่ากับการขึ้นดอกเบี้ยของ ECB อีก 1–2 ครั้ง