Selling focus turns from Dollar to Swiss Franc today, which also drags down Sterling, and to a lesser extent Euro. Dollar stabilized a little bit but there is apparent strength for recovery yet. In particular, commodity currencies are generally stronger while Canadian Dollar shrugs off weaker than expected inflation data. Attention will turn to FOMC minutes later in the session, which is unlikely to provide anything about the next policy move. Instead, investors would be more eager to know how Fed would shape the results of the year-long strategy review.

Technically, 1.0838 resistance in EUR/CHF is now suddenly a focus for the rest of the session. Break will resume the rebound from 1.0602 to 1.0915 resistance. Similarly, Break of 1.2034 in EUR/GBP will extend the choppy rebound from 1.1630 towards 1.2259 resistance.

In Europe, currently, FTSE is up 0.17%. DAX is up 0.33%. CAC is up 0.14%. German 10-year yield is down -0.0151 at -0.475. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI dropped -0.74%. China Shanghai SSE dropped -1.24%. Singapore Strait Times dropped -0.08%. Japan 10-year JGB yield dropped -0.0116 to 0.030.

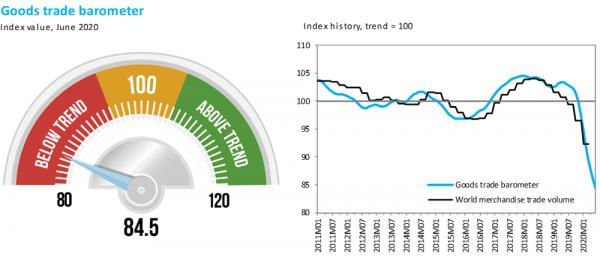

WTO goods trade barometer dropped to record low 84.5

WTO’s Goods Trade Barometer dropped to 84.5, -15.5 pts below baseline value of 100. That’s also the lowest on record dating back to 2007, “on part with the nadir of the 2008-09 financial crisis”.

“Additional indicators point to partial upticks in world trade and output in the third quarter, but the strength of any such recovery remains highly uncertain: an L-shaped, rather than V-shaped, trajectory cannot be ruled out,” WTO added.

Canada CPI slowed to 0.1% yoy in Jul, below expectations

Canada CPI slowed to 0.1% yoy in July, down from June’s 0.7% yoy, even below expectation of 0.3% yoy. CPI common slowed to 1.3% yoy, down from 1.5% yoy, missed expectation of 1.6% yoy. CPI median was unchanged at 1.9% yoy, below expectation of 2.0% yoy. CPI trimmed dropped to 1.7% yoy, down form 1.8% yoy, missed expectations.

StatCan also noted that five of the eight major components rose on 1 year-over-year basis. The slowdown in inflation spans both goods and services, most in transportation component mostly due to air transportation index.

Eurozone CPI finalized at 0.4% in Jul, EU at 0.9%

Eurozone CPI was finalized at 0.4% yoy in July, up from June’s 0.3% yoy. The highest contribution to the annual euro area inflation rate came from non-energy industrial goods and services (both +0.42 percentage points, pp), followed by food, alcohol & tobacco (+0.38 pp) and energy (-0.83 pp).

EU CPI was finalized at 0.9% yoy, up from June’s 0.8% yoy. The lowest annual rates were registered in Greece (-2.1%), Cyprus (-2.0%) and Estonia (-1.3%). The highest annual rates were recorded in Hungary (3.9%), Poland (3.7%) and Czechia (3.6%). Compared with June, annual inflation fell in ten Member States, remained stable in three and rose in fourteen.

UK CPI accelerated to 1.0%, core CPI at 1.8%

UK headline CPI accelerated to 1.0% yoy in July, up fro 0.6% yoy, well above expectation of 0.7% yoy. Core CPI also jumped to 1.8% yoy, up from 1.4% yoy, well above expectation of 1.3% yoy. ONS said clothing, rising prices at the petrol pump, and furniture and household goods made large upward contributions consumer to inflation.

Also from UK, RPI was at 0.5% mom, 1.6% yoy, versus expectation of 0.1% mom, 1.2% yoy. PPI input came in at 1.8% mom, -5.7% yoy, PPI output at -0.3% mom, -0.9% yoy. PPI output core at -0.1% mom, 0.1% yoy.

Japan extended double digit drop in export in July

In non-seasonally adjusted terms, Japan’s exports dropped -19.2% yoy to JPY 5369B in July. The double digit slump extended into a fifth month. Imports dropped -22.3% yoy to JPY 5357B. Trade recorded JPY 11.6B surplus.

In seasonally adjusted terms, Japan’s export rose 4.7% mom in July, to JPY 5118B. Imports dropped -2.7% mom to JPY 5213B. Trade deficit narrowed to JPY -34.8B, better than expectation of JPY 44B.

Also released, core machinery orders dropped -7.6% mom in June, much worse than expectation of 2.1% rise.

Westpac: Victoria contraction to offset recovery in other Australian states in Q3

Australia Westpac leading index rose slightly to -4.37% in July, up from -4.43%. The six-month annualized growth rate, remained in deep negative territory, consistent with recession. Nevertheless, a bottom was likely already reached in April’s -5.61%, while Q2 was already marked the low point in the growth cycle.

Overall, Westpac expected growth in Q3 to be flat. Victorian economy is expected to contract by -9% due to lockdown, which will offset the recovery in other states. It expects economy to grow 2.8% in Q4, on the assumption that Victoria moves through stage 4 to stage 2 restrictions, while other states could avoid second wave of coronavirus infections.

Westpac expects RBA to keep monetary policies unchanged on September 1. The next major event will be the Commonwealth Budget on October 6.

From New Zealand, PPI input dropped -1.0% qoq in Q2. PPI output dropped -0.3% qoq.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9005; (P) 0.9037; (R1) 0.9063;

Intraday bias in USD/CHF is turned neutral with a temporary low formed at 0.9009. Further decline is expected as long as 0.9197 resistance holds. Break of 0.9009 will resume larger down trend. However, considering bullish convergence condition in 4 hour MACD, break of 0.9197 should confirm short term bottoming and turn bias back to the upside for rebound.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). Current development suggests that such pattern is still extending. Sustain trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | -1.00% | -0.30% | ||

| 22:45 | NZD | PPI Output Q/Q Q2 | -0.30% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.03T | -0.44T | -0.42T | -0.41T |

| 00:30 | AUD | Westpac Leading Index M/M Jul | 0.10% | 0.44% | 0.50% | |

| 06:00 | GBP | CPI M/M Jul | 0.40% | -0.10% | 0.10% | |

| 06:00 | GBP | CPI Y/Y Jul | 1.00% | 0.70% | 0.60% | |

| 06:00 | GBP | Core CPI Y/Y Jul | 1.80% | 1.30% | 1.40% | |

| 06:00 | GBP | RPI M/M Jul | 0.50% | 0.10% | 0.20% | |

| 06:00 | GBP | RPI Y/Y Jul | 1.60% | 1.20% | 1.10% | |

| 06:00 | GBP | PPI Input M/M Jul | 1.80% | 2.40% | ||

| 06:00 | GBP | PPI Input Y/Y Jul | -5.70% | -6.40% | ||

| 06:00 | GBP | PPI Output M/M Jul | -0.30% | 0.20% | 0.30% | |

| 06:00 | GBP | PPI Output Y/Y Jul | -0.90% | -0.90% | -0.80% | |

| 06:00 | GBP | PPI Core Output M/M Jul | -0.10% | 0.00% | ||

| 06:00 | GBP | PPI Core Output Y/Y Jul | 0.10% | 0.50% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Jun | 20.7B | 8.0B | 11.3B | |

| 09:00 | EUR | Eurozone CPI Y/Y Jul F | 0.40% | 0.40% | 0.40% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul F | 1.20% | 1.20% | 1.20% | |

| 12:30 | CAD | Wholesale Sales M/M Jun | 18.50% | 8.50% | 5.70% | |

| 12:30 | CAD | CPI M/M Jul | 0.00% | 0.40% | 0.80% | |

| 12:30 | CAD | CPI Y/Y Jul | 0.10% | 0.30% | 0.70% | |

| 12:30 | CAD | CPI Common Y/Y Jul | 1.30% | 1.60% | 1.50% | |

| 12:30 | CAD | CPI Median Y/Y Jul | 1.90% | 2.00% | 1.90% | |

| 12:30 | CAD | CPI Trimmed Y/Y Jul | 1.70% | 1.80% | 1.80% | |

| 14:30 | USD | Crude Oil Inventories | -2.9M | -4.5M | ||

| 18:00 | USD | FOMC Minutes |

Hot

-THE END-