Canadian Dollar Outlook: USD/CAD Five Weeks Down, Five Month Low

The Canadian Dollar offensive is attempting a fifth consecutive week with Loonie up nearly 1% against the US Dollar. The move takes USD/CAD back towards a longer-term technical support just lower and the focus is on a reaction at this key slope. These are the updated targets and invalidation levels that matter on the USD/CAD price charts heading into the close of the week.

CANADIAN DOLLAR PRICE CHART – USD/CAD DAILY

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Technical Outlook: In my last Canadian Dollar Price Outlook we noted that the USD/CAD sell-off was approaching near-term support and that, “rebounds should be capped by the monthly open IF price is heading lower on this stretch with a close below trendline support needed to mark resumption of the March downtrend.” A mid-week rebound last week fueled a rally of more than 1.2% with USD/CAD failing precisely at the August open at 1.34 on Friday (high registered at 1.3399).

The pullback keeps Loonie within the confines of a descending channel formation extending off the July high. Daily support eyed at the lower parallel of a long-term weekly slope (blue) / February low at 1.3202 backed by the 88.6% Fibonacci resistance at 1.3152. The broader risk remains lower while below monthly open resistance at the 1.34-handle.

CANADIAN DOLLAR PRICE CHART – USD/CAD 120MIN

Notes: A closer look at Loonie price action shows USD/CAD trading within the confines of a well-defined descending pitchfork formation extending off July highs. Initial resistance now 1.3315/22 backed by 1.3360 with a break below the median-line / 1.3270 needed to keep the focus on the lower parallels – look for a larger reaction there IF reached. A close below 1.3152 would suggest a larger trend reversal may be underway towards 1.31 and beyond.

Bottom line: The USD/CADsell-off is on pace for a fifth week with price once again approaching key support just lower. From a trading standpoint, look to reduce short-exposure / lower protective stops on a test of 1.32 – rallies should be capped by 1.3360 IF price is indeed heading lower on this stretch with a break below 1.3152 needed to mark resumption of the broader March downtrend. Review my latest Canadian Dollar Weekly Price Outlook for a closer look at the longer-term USD/CAD technical trade levels.

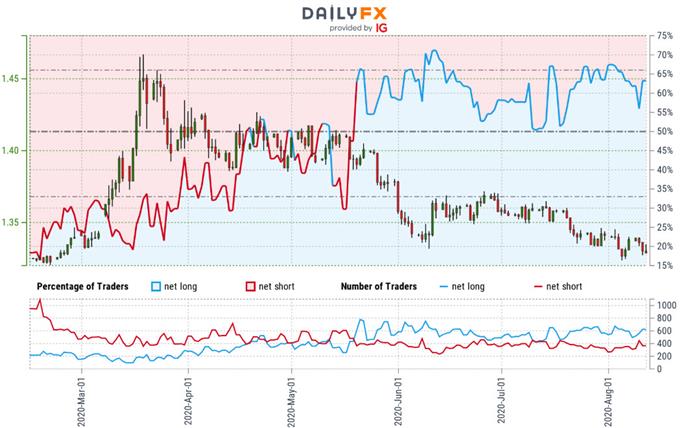

CANADIAN DOLLAR TRADER SENTIMENT – USD/CAD PRICE CHART

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +1.46 (59.41% of traders are long) – weak bearish reading

- Long positions are12.96% higher than yesterday and 7.35% higher from last week

- Short positions are 14.19% lower than yesterday and 7.26% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias from a sentiment standpoint.

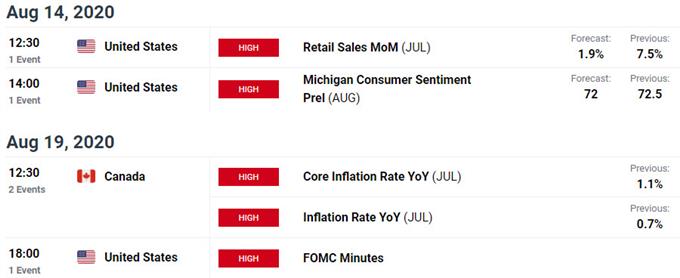

KEY US / CANADA DATA RELEASES

Reprinted from dailyfx, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-