Oil rises on signs of economic recovery, but new infections loom

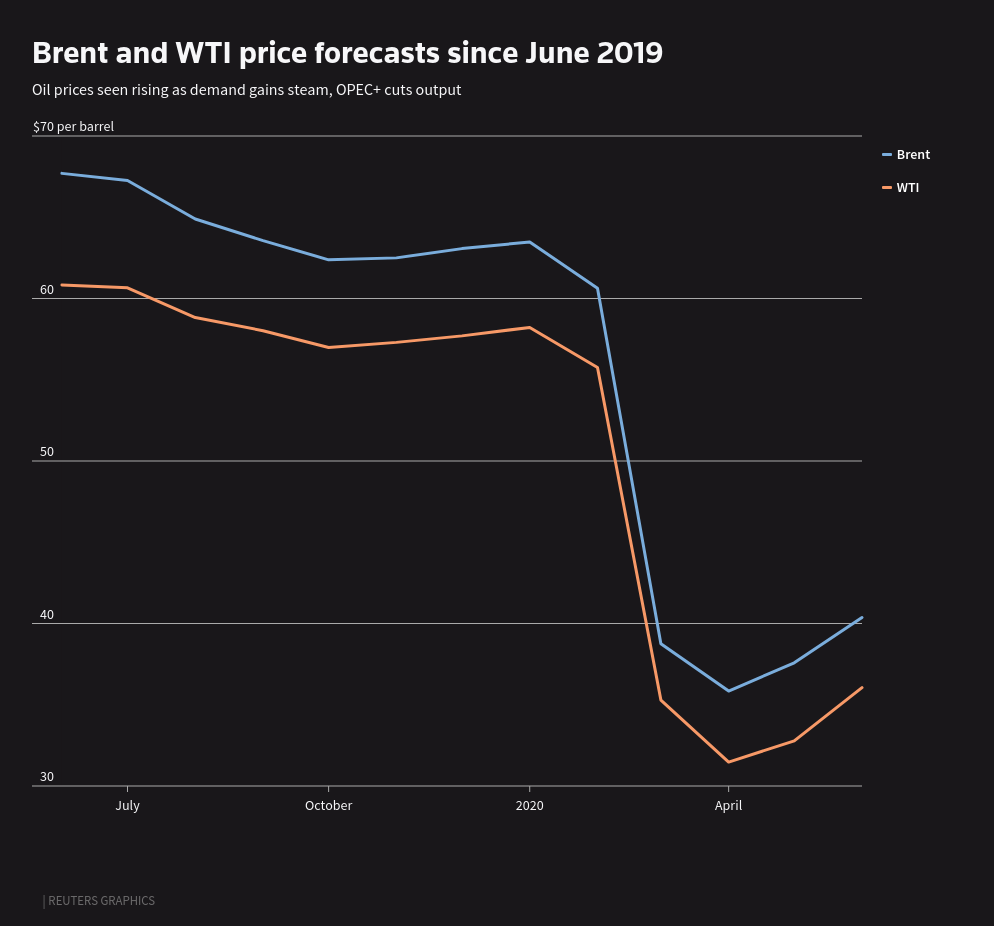

Oil prices rose on Wednesday on a string of positive manufacturing data and a drawdown in U.S. crude inventories, both indicating an economic recovery, however, fears of surging coronavirus infections capped the gains.

Brent crude LCOc1 was up 67 cents, or 1.6%, at $41.94 a barrel at 1336 GMT, and U.S. crude was up 71 cents, or 1.8%, at $39.98 a barrel.

U.S. crude and gasoline stocks fell more than expected last week, while distillate inventories rose, data released by the American Petroleum Institute (API) late on Tuesday showed. [API/S]

“The market’s main concern is demand and how COVID-19 affects it, so any hint that demand is recovering is welcomed with a price boost,” said Rystad Energy analyst Louise Dickson.

Official inventory data from the U.S. Energy Information Administration (EIA) is due out later on Wednesday.

Sentiment was also boosted by improving economic data around the world. In China, the manufacturing purchasing managers’ index (PMI) showed factories slowly gathered steam in June after the government eased lockdowns.

Germany's manufacturing sector contracted at a slower pace in June, while French factory activity rebounded into growth.

However, a surge in infections in the United States and a warning from the government’s top infectious disease expert that the number could soon double took the shine off the positive data.

Figures on U.S. manufacturing activity and private payrolls for June are due later in the day, followed by the Labor Department’s closely watched non-farm payrolls report on Thursday.

Prices were also supported by a drop in output from the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, following an agreement to curb supplies.

“Although there is still the danger of demand outages in view of increased new cases of COVID-19, OPEC+ seems to have the market under control at the moment,” said Commerzbank analyst Eugen Weinberg.

OPEC produced an average of 22.62 million barrels per day (bpd) in June, a Reuters survey found, down 1.92 million bpd from May’s revised figure.

Iraq will reduce crude oil exports from its southern terminals in July, mainly its Basra Light flows, in order to comply with OPEC+ cuts after failing to meet its agreed quota in previous months.

Fuel demand around the world is recovering as lockdowns ease. Tens of millions of barrels of crude and oil products stored on tankers at sea are being sold, shipping sources say.

In India, state-refiners’ gasoline and gasoil sales rose in June compared with May, continuing with a gradual recovery. #CrudeOil##CoronavirusWave2.0##economicindex#

Reprinted from Reuters,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.