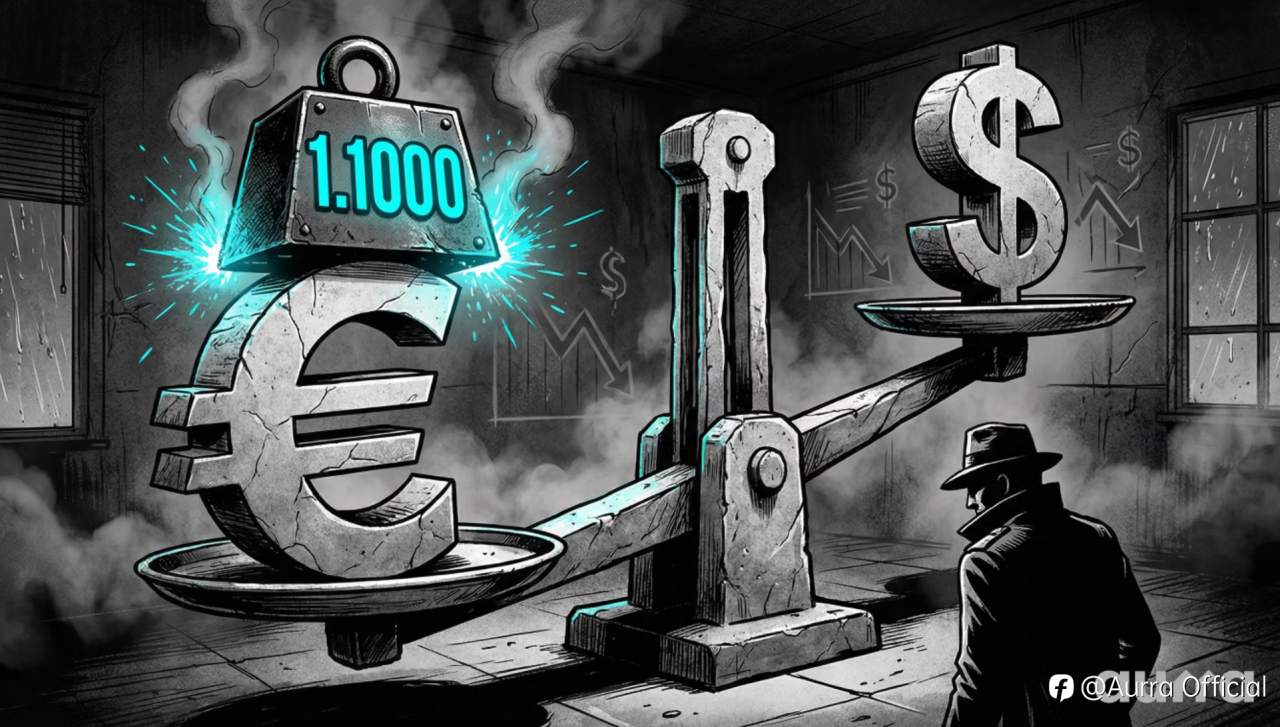

欧美汇率前景:汇率在 1.1000 阻力位受挫

为何欧美汇率上行乏力?交易者应关注哪些重点? 欧美汇率在近期高点附近多头动能减弱,持续维持区间震荡,反映出美元韧性与欧元区前景谨慎乐观之间的拉锯格局。尽管市场对美联储未来降息的预期抑制了美元上行空间,但欧洲央行政策方向及欧元区增长前景的不确定性,仍持续限制欧元的走强。对此,交易者需要保持耐心、精准操作并严格执行风险管理纪律。 欧美汇率当前走势的核心基本面驱动因素是什么?美联储政策如何影响美元走势? 随着市场重新评估美联储潜在降息的时机与节奏,美元持续获得相对支撑。 尽管通胀压力有所缓解,但近期经济数据尚不足以支持市场对激进宽松的预期。这导致美国国债收益率维持高位,从而限制了美元下行压力,也阻碍

原油市场展望:WTI 受供应过剩压制,短期上涨受阻于 62 美元

原油(WTI 与布伦特)为何难以延续反弹?交易者下一步应关注什么? 尽管间歇性的地缘政治消息刺激市场,WTI 与布伦特原油价格仍在区间震荡,难以维持上行动能。价格受制于全球持续供应过剩、需求复苏不均,以及 OPEC+谨慎的产量管理。这一环境导致市场波动加剧,强调交易者需保持策略纪律与严格的风险控制。 原油当前价格走势的核心基本面驱动因素是什么?全球供需格局如何影响油价? 目前,原油价格的主要压力仍来自供过于求。全球库存水平持续高企,而主要产油国更倾向于保护市场份额,而非大幅减产。即便在短期利好刺激下,这种过剩供应仍限制了价格反弹。需求端方面,制造业活动疲软以及主要经济体增速低于预期,也压制了价

Tensions Ignite: The US-Venezuela Standoff and the Shadow of War

As December 2025 dawns, the world watches with bated breath as the United States and Venezuela teeter on the brink of open conflict. What began as economic sanctions and diplomatic barbs has escalated into a naval armada in the Caribbean and veiled threats of regime change. This isn't just a regiona

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 20 Points that can withdraw. Click to know more details about //soci...

- kennyp :Yeah, I am also waiting to see what's the result from the OPEC meeting tomorrow. Between gold and the black gold, I need more coffee!!!

- trandung2980 :chta

Indonesia Stock Market May Regain Thursday's Losses

The Indonesia stock market headed south again on Thursday, one day after it had ended the two-day slide in which it had stumbled almost 65 points or 1.2 percent. The Jakarta Composite Index now rests just beneath the 4,900-point plateau although it figures to bounce higher again on Friday.

The globa