U.S. household debt hit record high before unemployment spiked

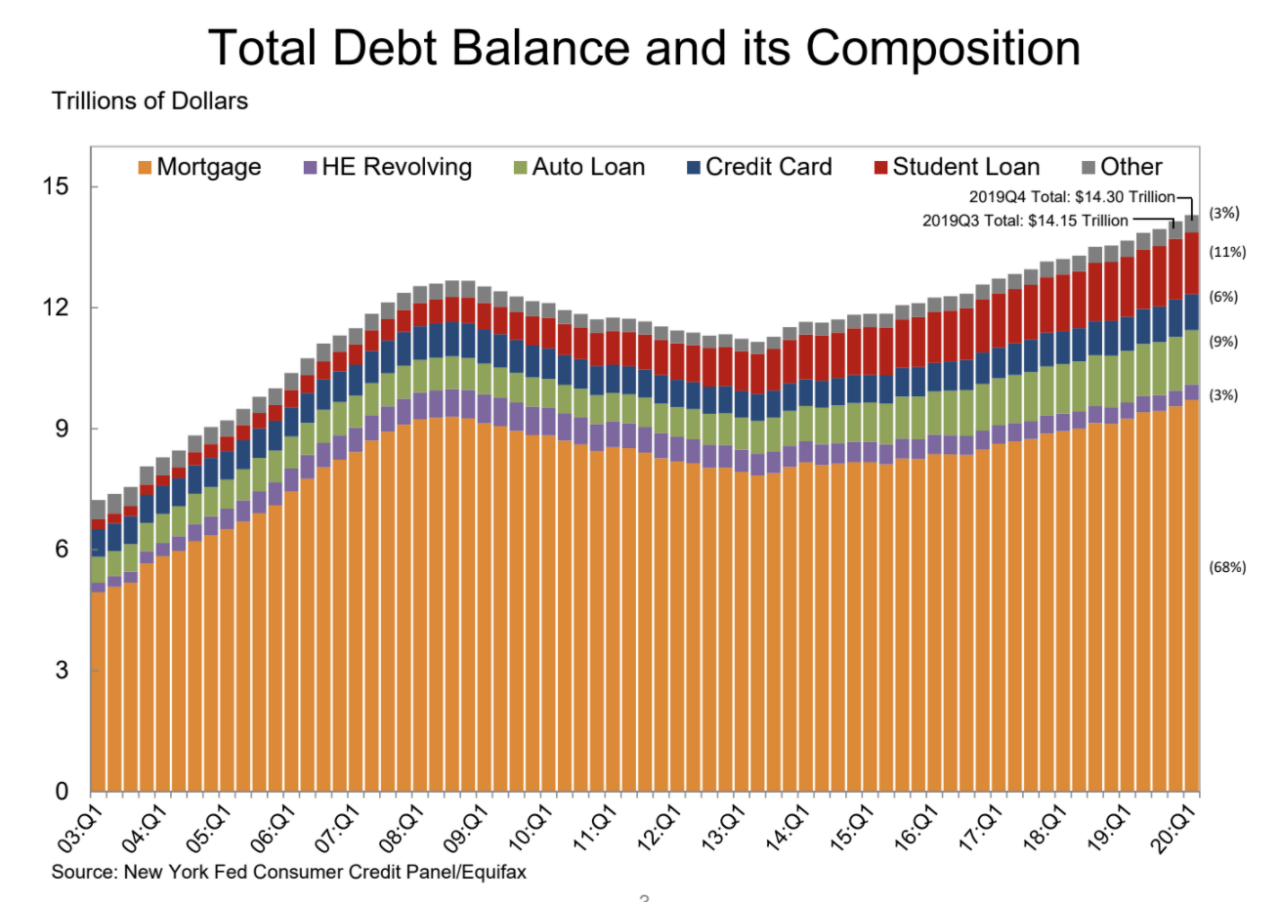

Total U.S. household debt reached a record $14.3 trillion after increasing by $155 billion, or 1.1%, in the first quarter of 2020, according to the Fed’s Quarterly Report on Household Debt and Credit.

The results do not fully capture the economic pain felt from the coronavirus pandemic and widespread societal shutdown: The report noted that “the data do not fully reflect the potential effects of COVID-19 that materialized in the second half of March 2020.” More than 30 million Americans filed unemployment claims between the second half of March and April.

The report, based on “a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data,” found that the total household debt is now nominally $1.6 trillion higher than the pre-recession peak of $12.68 trillion in the third quarter of 2008.

COVID-19 impact yet to be felt in Q1

Housing balances increased considerably, rising by $156 billion in the first quarter, to $9.71 trillion. At the same time, foreclosures were at a low: About 75,000 individuals saw a new foreclosure notation on their credit reports between January 1 and March 31, “remaining low by historical standards.”

Non-housing balances were relatively flat overall.

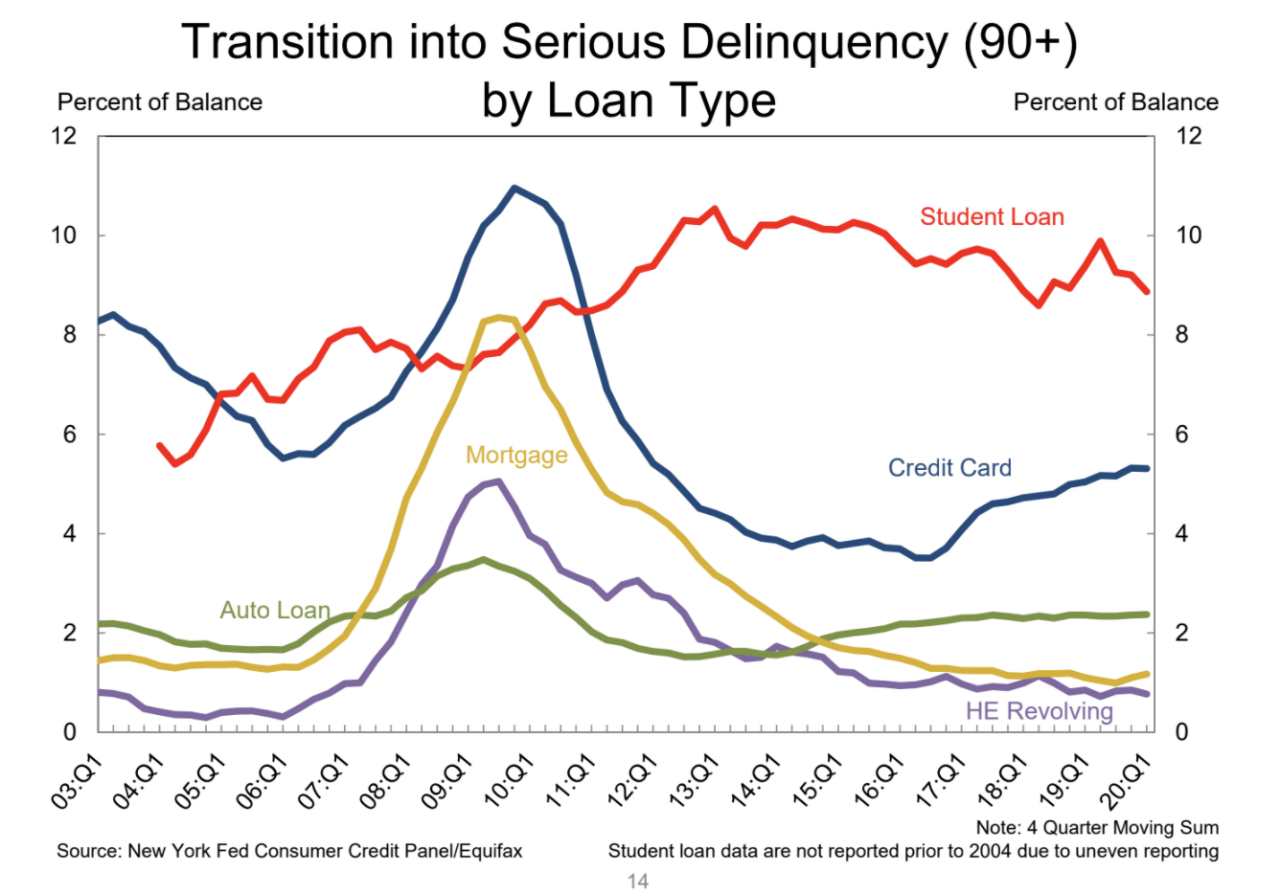

Auto loans increased by $15 billion to total $1.35 trillion. Student loans increased by $27 billion for a total of $1.54 trillion in the first quarter. About 10.8% of those loans were in serious delinquency or default in the first quarter, which was a small decline from 11.1% in the previous quarter.

The rise in both auto and student loan increases were largely offset by the decline in credit card balances and other forms of debt — a $39 billion drop.

“It is critical to note that the latest report reflects a time when many of the economic effects of the COVID-19 pandemic were only starting to be felt,” Andrew Haughwout, senior vice president at the New York Fed, said in a press release. “We will continue to monitor these developments and the broader state of household balance sheets closely as key data are updated and the economic situation evolves.”

The Labor Department is expected to release April’s jobs report on Friday, and economists expect the U.S. to have lost 21.3 million jobs in April, forecasting the unemployment rate to jump from 4.4% to 16%.

Reprinted from Yahoo Finance, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-