© 2026 Followme

Liked

Wednesday Workshop : Educational Series Part-2 How to Find the DIAGONAL Patterns in Forex and Stock Market Chart Using Elliott Wave Theory

#OPINIONLEADER# #ElliottWaves# #ForexEducation# #forexmarket# #forextrading# #ForexForecast# #PriceAction# Disclaimer : LEARNING ELLIOTT WAVES IS LITTLE BIT TOUGH (FOR ME IN BEGINNING) BUT I TOOK

GBP/USD Forecast: Finding Reasons to Rally

At this point, I have no interest in shorting this market anytime soon because I think the trend is changing for the long term, maybe not in favor of the British pound, but more of an anti-US dollar type of trading situation.

The British pound initially dipped a bit during the trading session on

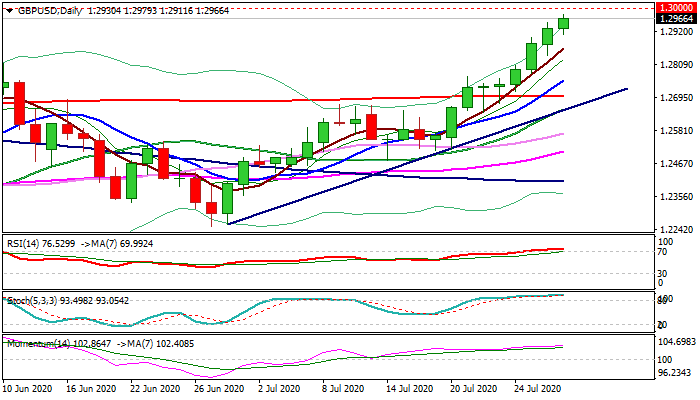

GBP/USD Price Analysis: Bulls remain in control, fast approaching 1.3000 mark

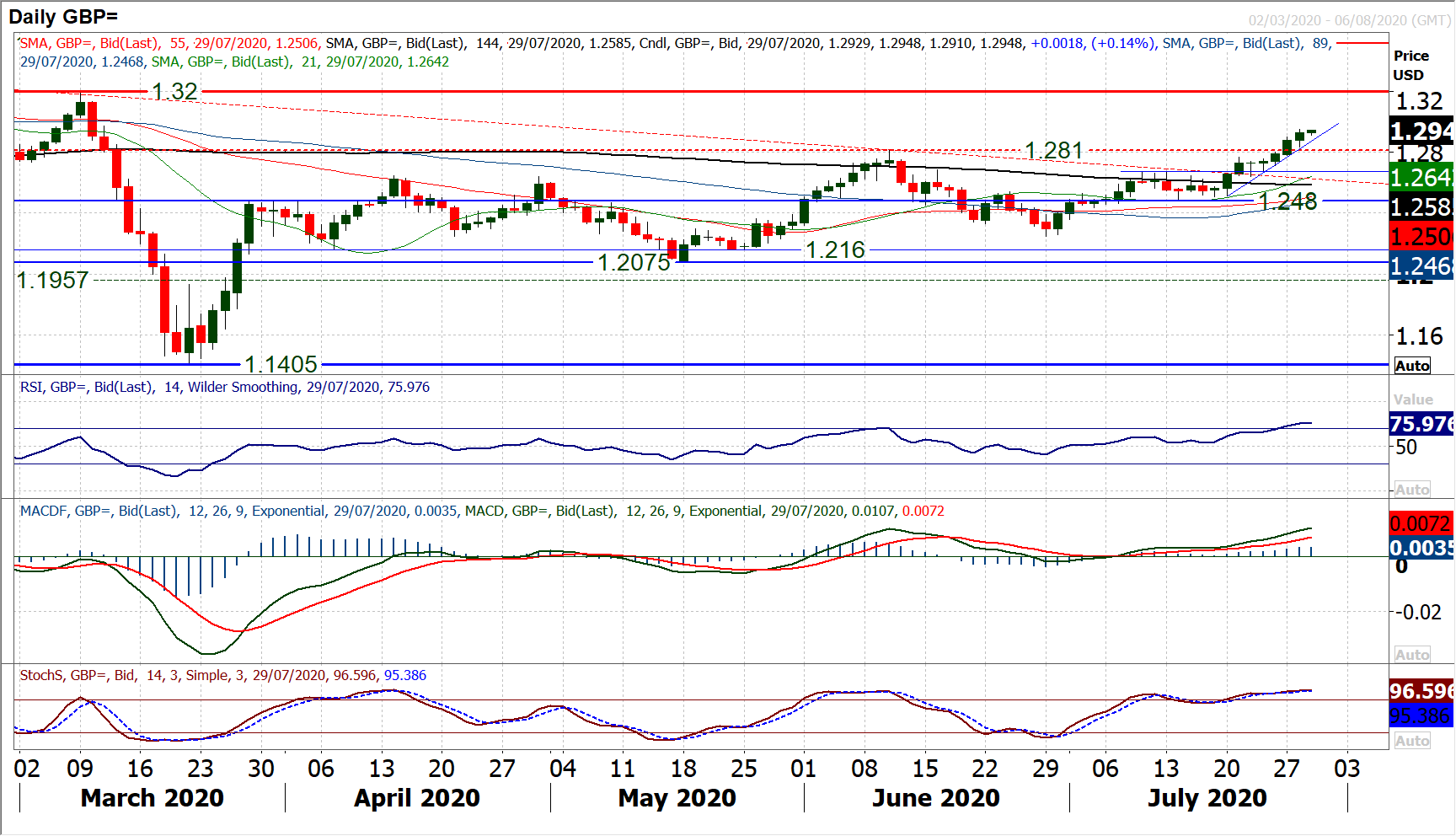

The GBP/USD pair built on its recent bullish break through the very important 200-day SMA and shot to the highest level since March 10 on Wednesday.

Looking at the technical picture, the recent positive momentum over the past three months or so has been along an upward sloping channel, pointing to a

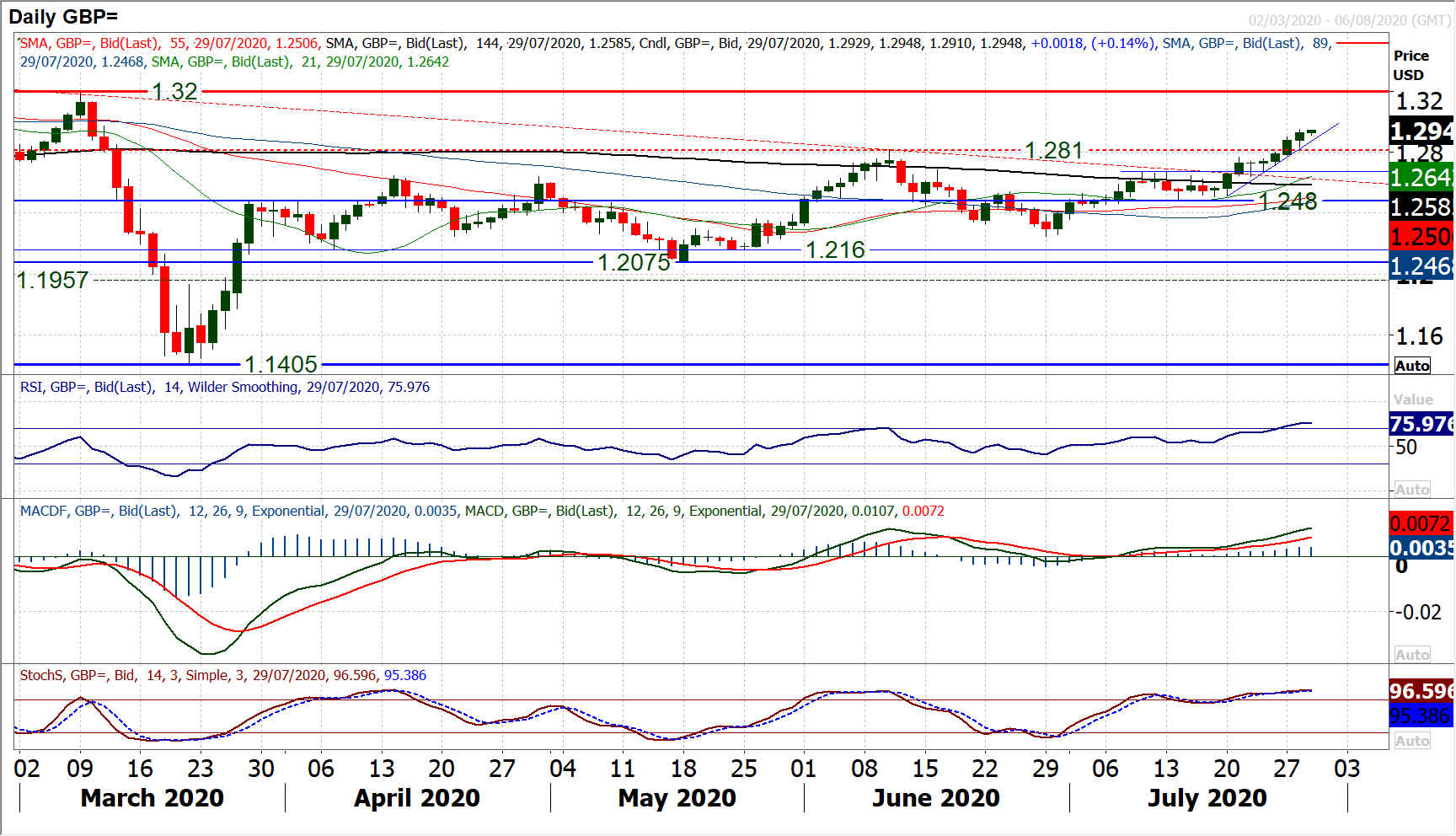

GBP/USD Forecast: Momentum Remains Strong, But Beware FOMC Meeting

The GBP/USD exchange rate has made another push higher in the mid-week session to quote at 1.2968, a new four-month high. Analyst and technical forecaster Richard Perry of Hantec Markets tells clients he continues to favour Sterling but the FOMC event later today could complicate matters.

We hold a

GBP/USD Daily Forecast – U.S. Dollar Under Pressure Ahead Of Fed Rate Decision

British Pound Enjoys Strong Support

GBP/USD continues its upside move as markets await Fed Interest Rate Decision and commentary from Jerome Powell.

The U.S. Dollar Index, which measures the strength of the U.S. dollar against a broad basket of currencies, has settled near support at 93.5.

This is

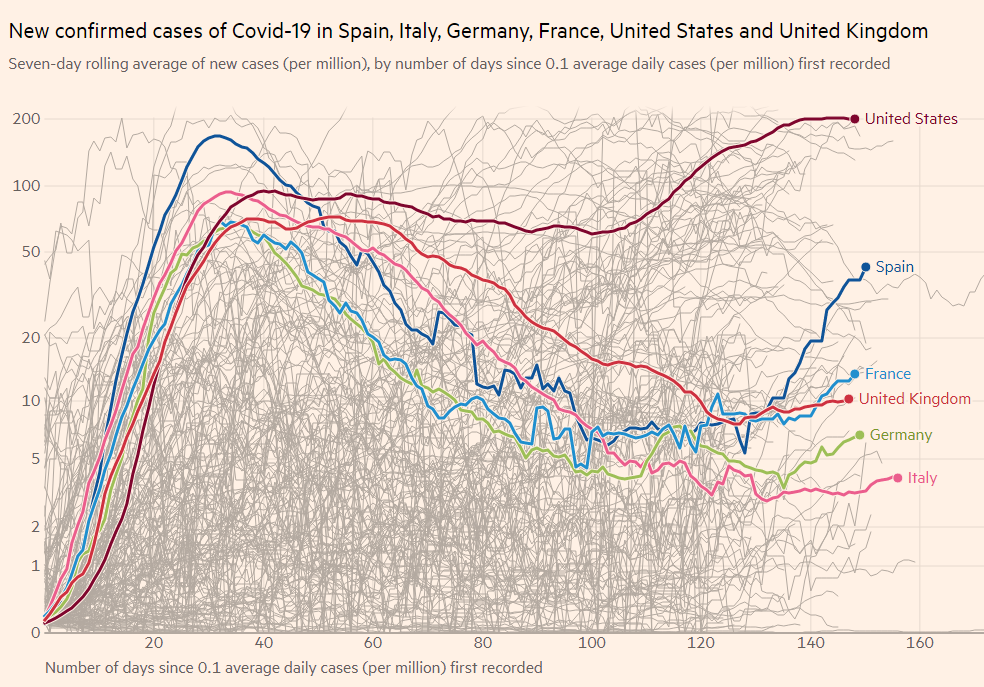

GBP/USD Forecast: Set for a false break above 1.30? Benefiting from dollar weakness has its limits

"I’m afraid you are starting to see in some places the signs of a second wave of the pandemic" – the words of UK Prime Minister Boris Johnson when referring to "our European friends" angered many in the old continent, and especially in Spain.

The UK's decision to advise against traveling to one of E

GBP/USD Down 4 Pips Over Past 4 Hours, 11 Day Up Streak Broken; in an Uptrend Over Past 30 Days

GBP/USD 4 Hour Price Update

Updated July 30, 2020 12:50 AM GMT (08:50 PM EST)

The back and forth price flow continues for GBP/USD, which started the current 4 hour candle off at 1.2981, down 4 pips 0.03% from the last 4 hour candle. Compared to its peers in the Forex, GBP/USD gave its buyers a retur

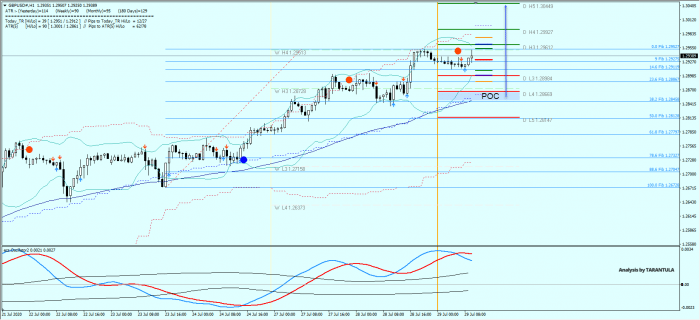

GBP/USD Bulls are Relentless

The POC zone 1.2845-60 should provide bounce for new buyers. If we see a retracement, the POC zone is where buyers are. However, as the trend is strong, we might see a bounce at 14.6 fib. The first target is 1.2961, followed by 1.2992 and 1.3045. If the market gets to DH4 and above, we should see so

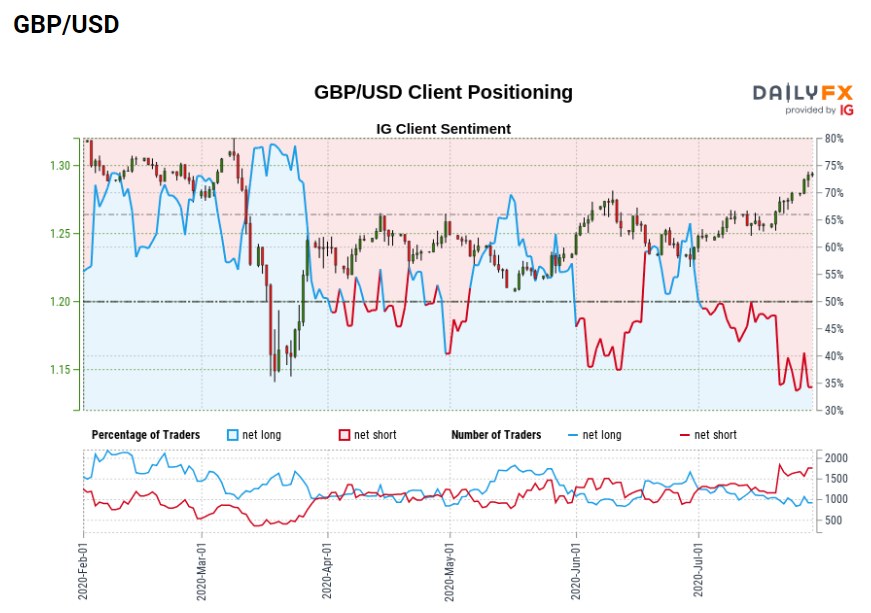

Bullish GBP/USD signal from IG client sentiment data

Bullish signal for GBP/USD

Retail traders are net short GBP/USD and the number of net short traders is growing.

From a contrarian standpoint, that suggests further gains for the pair, which has already moved steadily higher this month.

GBP/USD net short positions high and rising

Positioning da

GBP/USD Edges Higher Towards 1.3000

The British pound sterling continues with this bullish streak. Price action is now close to the 1.3000 handle which could potentially open the way to 1.3122 next.

To the downside, support is found at 1.2813 which could stall the currency pair from further declines. But ahead of the Fed meeting, the

GBP/USD retraces from 20-week top to sub-1.3000 area, US GDP eyed

GBP/USD eases to 1.2985, down 0.10% on a day, while heading into the London open on Thursday. The Cable surged to the highest since March 10 the previous day after the US dollar marked broad losses on the bearish Fed. However, the greenback’s latest pullback joins Brexit woes to trigger the pair’s p

GBP/USD outlook: Bulls approach psychological 1.30 barrier; fed eyed for fresh signals

GBP/USD

Cable extends steep bull-leg into ninth consecutive day and cracks barriers at 1.2970/76 (weekly cloud top /11 Mar high) the last obstacles on the way to psychological 1.30 resistance.Fresh weakness of the dollar in expectations of dovish Fed, push the pound further up and exposed targets at

GBP/USD Forecast: Battling with the critical 1.3000 level

The GBP/USD pair flirted with the 1.3000 level, retreating just modestly from it ahead of the US Federal Reserve announcement, only to surpass it afterwards. Market players had no reasons to buy the dollar as the coronavirus numbers continue to suggest the economic downturn in the country has not ye

Cable bulls are not ready to take profits quite yet

GBP/USD

We hold a broadly negative dollar outlook, but there are still likely to be some retracements within this weakness. On Cable there was a key break higher above $1.2810 on Monday, in a move which continued yesterday as the bulls still saw intraday weakness as a chance to buy. Cable bulls are

Daily technical and trading outlook – GBP/USD

DAILY GBP/USD TECHNICAL OUTLOOK

Trend Daily ChartSideways

Daily IndicatorsRising

21 HR EMA1.2913

55 HR EMA1.2871

Trend Hourly Chart

Up

Hourly IndicatorsBearish divergences

13 HR RSI60

14 HR DMI+ve

Daily Analysis

Resumption of recent upmove

Resistance1.3000 - Psychological res1.2977 - Mar 11 high