© 2026 Followme

Liked

Liked

Liked

Dive Into Dollar Weakness: How Long Can It Last?

Partner Center For decades, every U.S. administration, Republican and Democrat alike, has championed the “strong dollar policy.” But Trump has thrown that playbook out the window recently, publicly celebrating dollar weakness as a path to manufacturing revival and export growth. This represents one

Liked

Liked

Liked

Liked

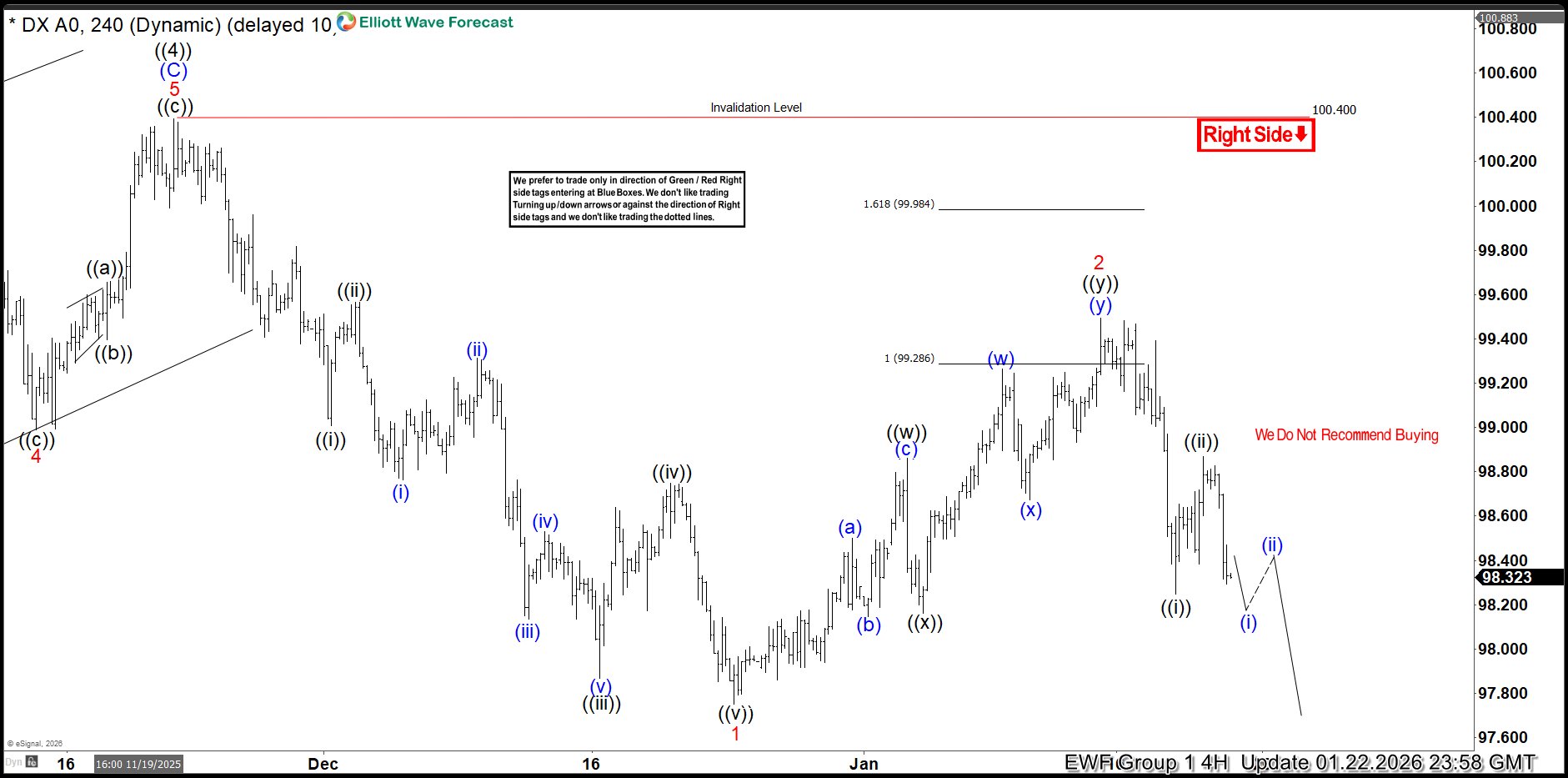

Dollar Index (DXY) Elliott Wave: Forecasting the Decline

Hello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of Dollar index DXY published in members area of the website. US Dollar has recently given us Double Three pull back and found sellers again precisely at the equal legs area as we expected.&

Liked

Liked

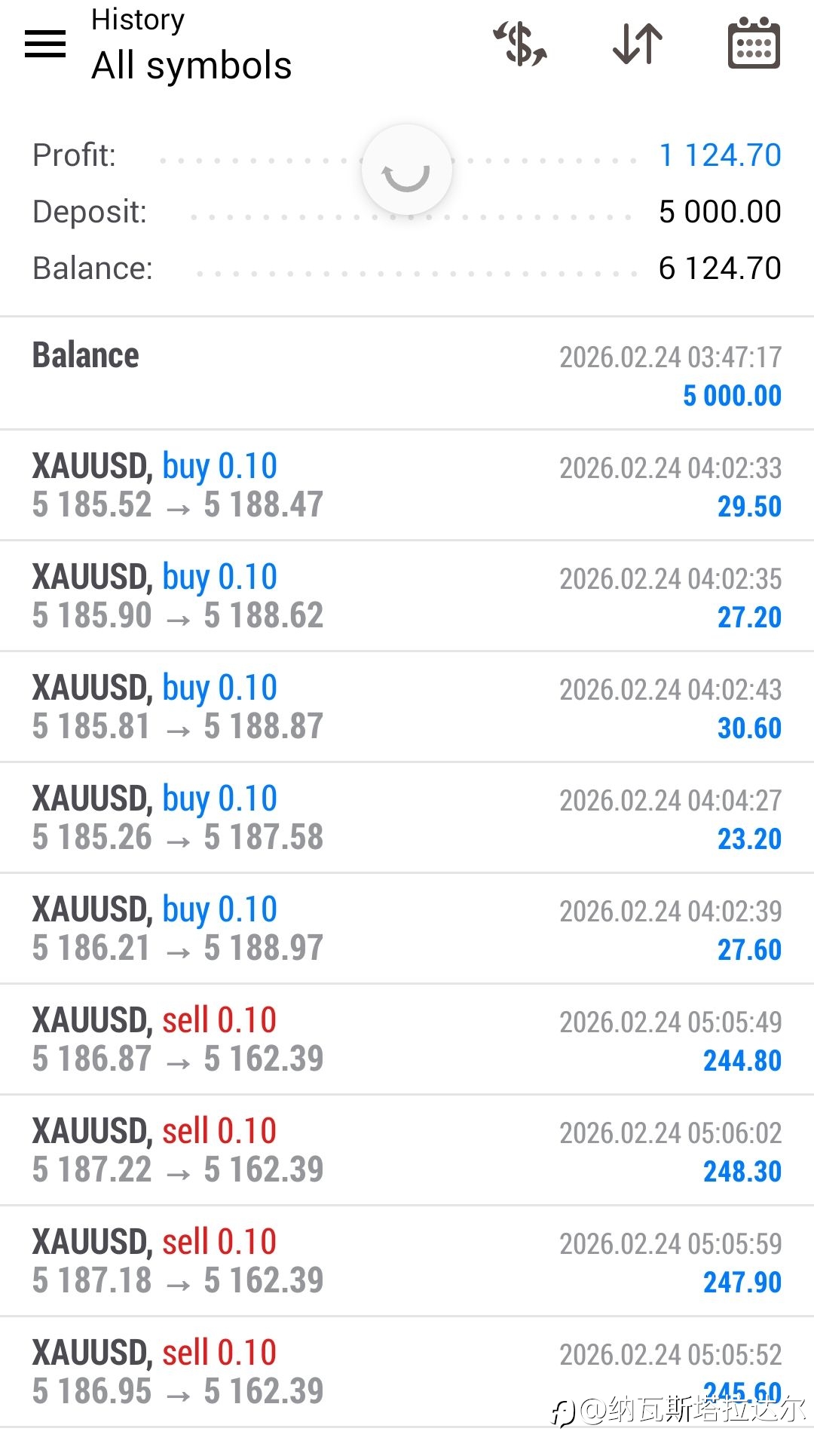

Profit by Following

148.28

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,627.93/4,613.53

- Volume Sell 2 Flots

- Profit 2,880.00 USD

Liked

Liked