© 2026 Followme

Liked

Liked

Liked

الدليل الشامل لدراسة الدكتوراه وشروط دراسة الطب في مصر

هل تطمح إلى بلوغ أعلى المراتب في المجال الطبي؟ هل تحلم بارتداء المعطف الأبيض والتخصص في أعرق كليات الطب، أو تسعى لنيل درجة الدكتوراه التي تمثل قمة الإنجاز العلمي؟ 🩺 إن مصر، بتاريخها الطبي العريق الذي يمتد لآلاف السنين، تفتح أبوابها اليوم لتحقيق هذا الحلم. هذا الدليل هو خارطتك لفهم كل ما يتعلق بالدر

Liked

Liked

Liked

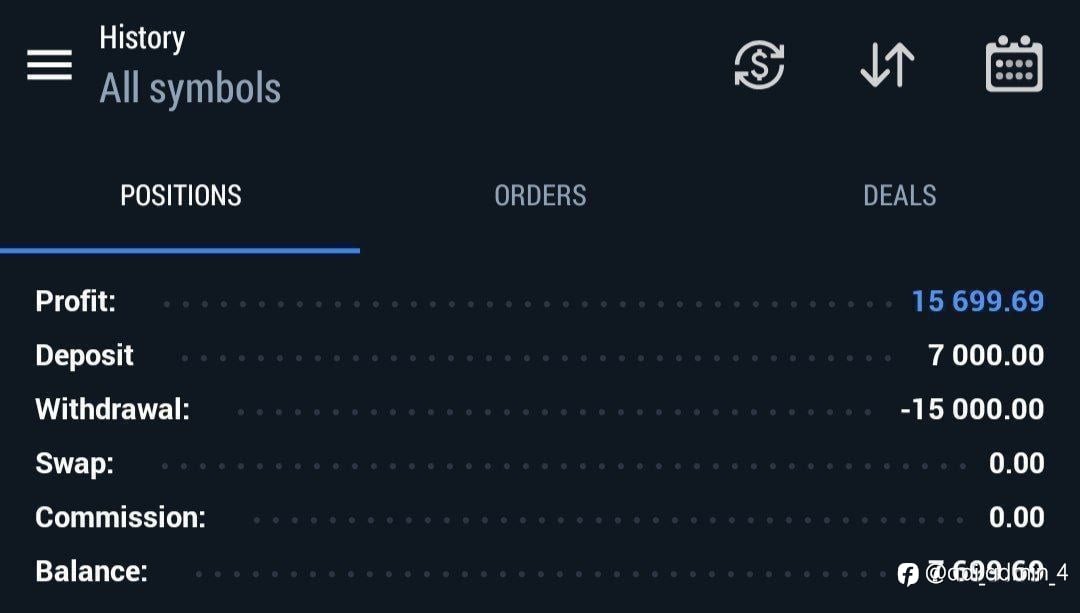

Profit by Following

494.32

USD

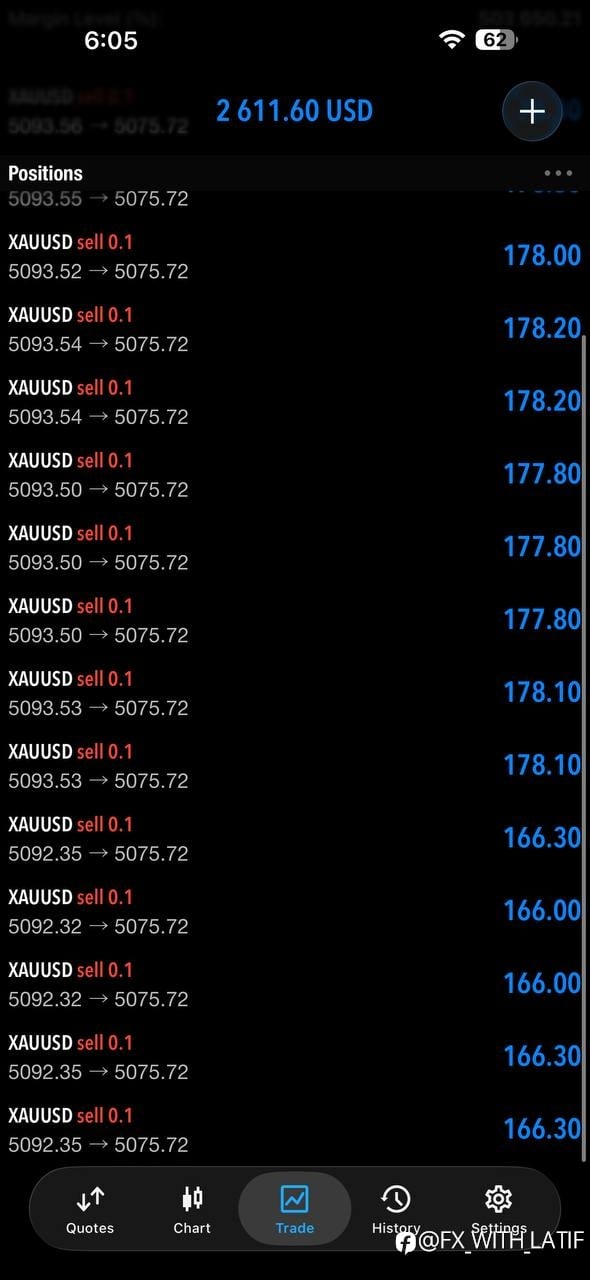

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,368.24/4,340.5

- Volume Sell 0.5 Flots

- Profit 1,387.00 USD

Liked

Profit by Following

1,572.5

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,461.38/4,411.44

- Volume Sell 2 Flots

- Profit 9,988.00 USD

Liked

Liked

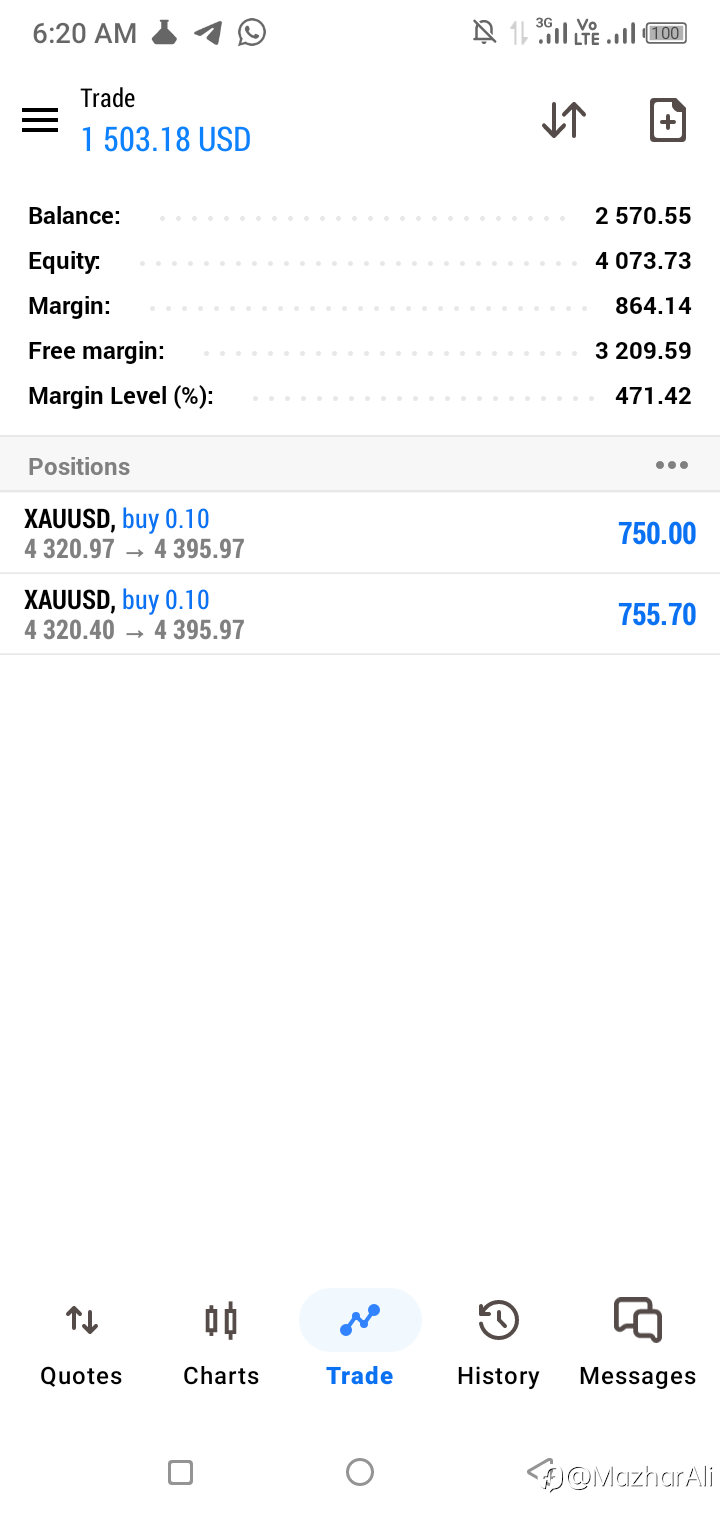

Profit by Following

706.59

USD

- Symbol XAU/USD

- Trading Account #1 8081309

- Broker Windsor Brokers

- Open/Close Price 4,340.19/4,445.44

- Volume Buy 0.06 Flots

- Profit 631.50 USD

Liked