© 2026 Followme

Liked

Profit by Following

151.62

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,592.89/4,578.99

- Volume Sell 5 Flots

- Profit 6,950.00 USD

Liked

Liked

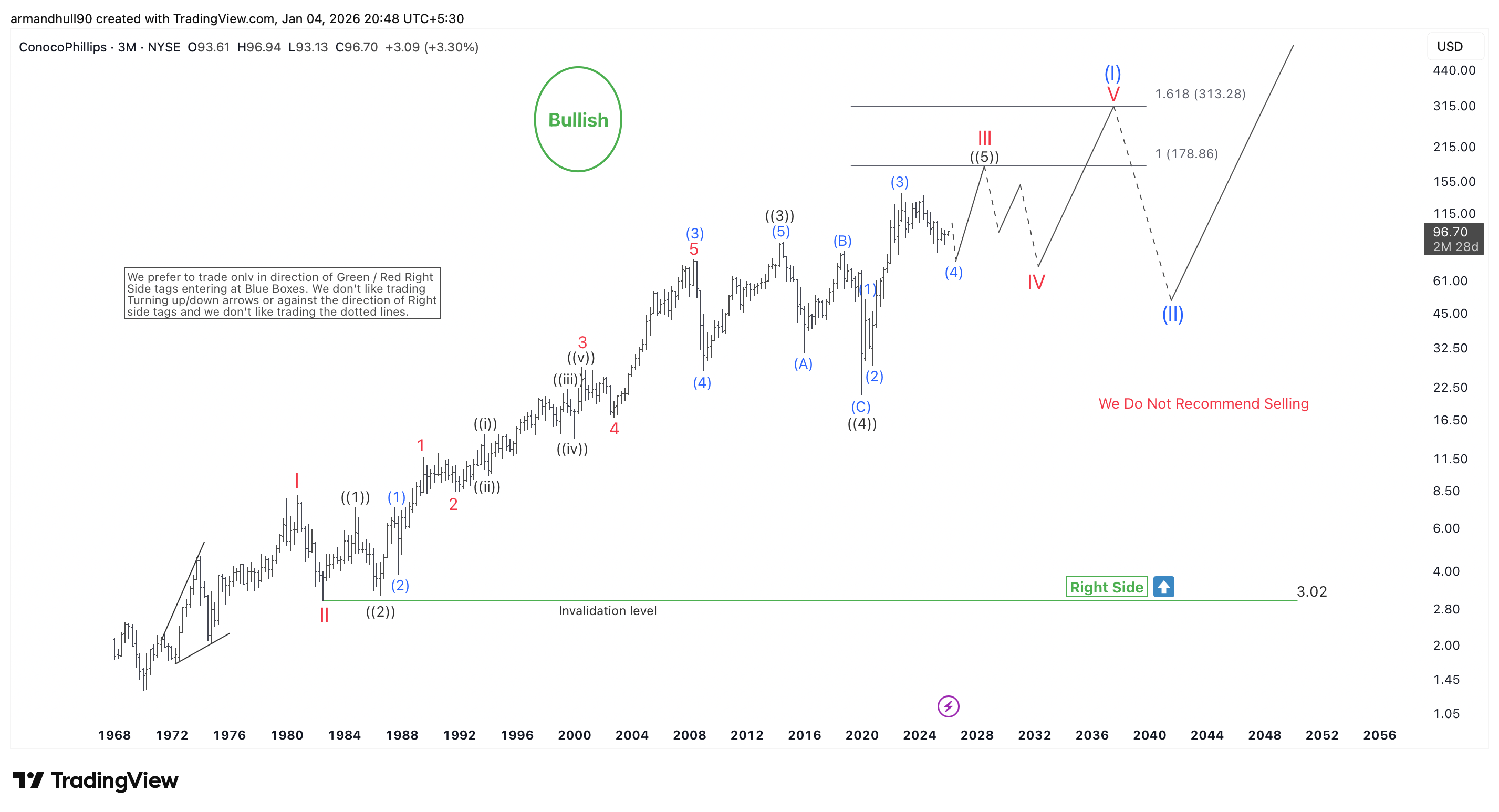

ConocoPhillips (COP) Elliott Wave Forecast: Bullish Trend Eyes $178–$313 Targets

COP Keeps Its Long-Term Bullish Elliott Wave Structure Intact, with Strong Upside Potential Toward Key Fibonacci Targets. ConocoPhillips continues to show a strong long-term bullish trend using Elliott Wave analysis. The quarterly chart shows a clear impulsive rally from historic lows. The Right Sid

Liked

Liked

Liked

Liked

GOLD INTRADAY ANALYSIS – DEC 29

Key Levels and Setup 🔑 KEY LEVELS · Target: 4,580 · Pivot (Key Support/Entry Zone): 4,470 · Support: 4,428 📈 OUR PREFERENCE Long positions above 4,470 · Primary Target: 4,550 · Extension Target: 4,580 The trade is valid as long as price holds above the pivot level. A break above 4,550 opens the pa

Liked

Liked

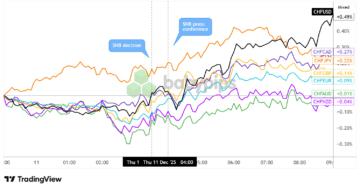

SNB Held Off on Negative Rates Despite Weakening Inflation, CHF Higher

Partner Center As expected, the Swiss National Bank (SNB) kept interest rates on hold at 0.00% during their December meeting, despite inflation hitting the bottom of its target range. SNB policymakers emphasized their commitment to avoiding negative interest rates and signaled that monetary policy c

Liked

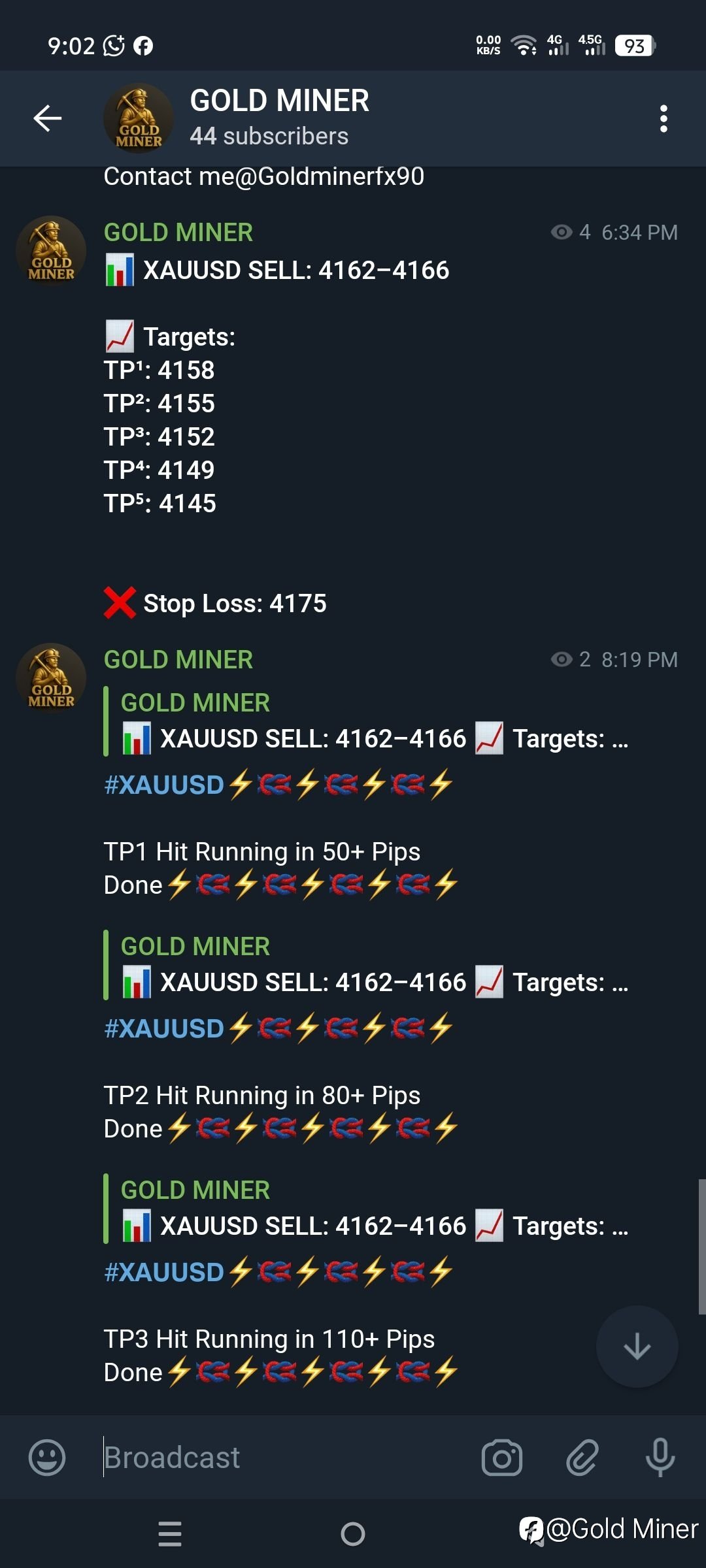

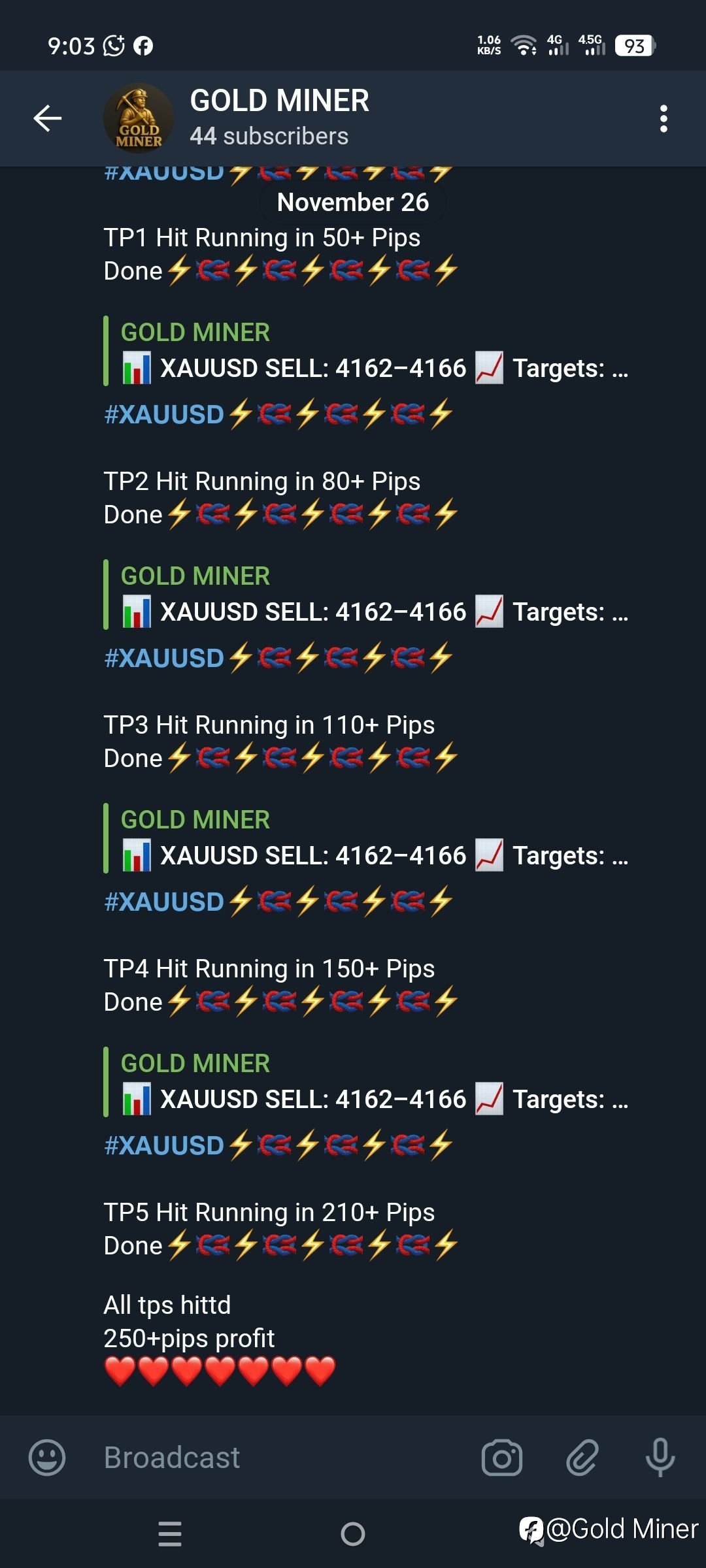

Gold Analysis

Gold (XAUUSD) is trying to rebuild momentum after yesterday’s washout, with price now approaching the $4,200–4,220 resistance band — the zone that must break for any sustained bullish recovery. On the downside, $4,175 acts as the first intraday support, while $4,163 remains the key structural level

Liked

The US Dollar Index Finds Direction in Shifting Interest-Rate Expectations

The US Dollar Index has been moving in response to changing expectations around interest-rate policy. When investors think rates will stay high for longer, the Dollar often strengthens because higher yields attract global capital. On the other hand, when markets expect upcoming rate cuts, the Dollar