© 2026 Followme

Liked

Liked

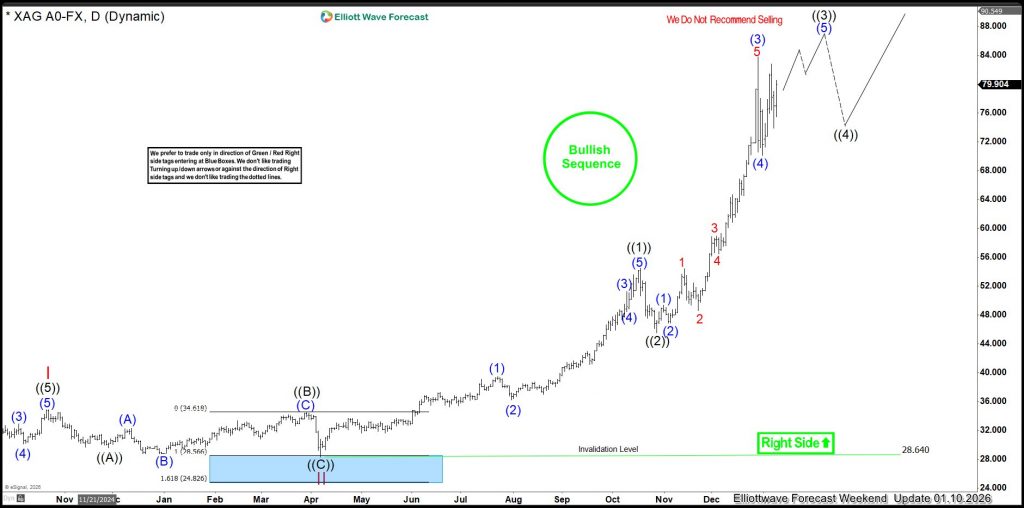

The Elliott Wave Theory and High Frequency Trading

Financial markets have evolved dramatically over time, moving from human-dominated trading floors to highly automated, algorithm-driven systems. Two concepts that represent these different eras are the Elliott Wave Theory and high-frequency trading (HFT), Elliott Wave Theory focuses on mar

Liked

Liked

Profit by Following

151

USD

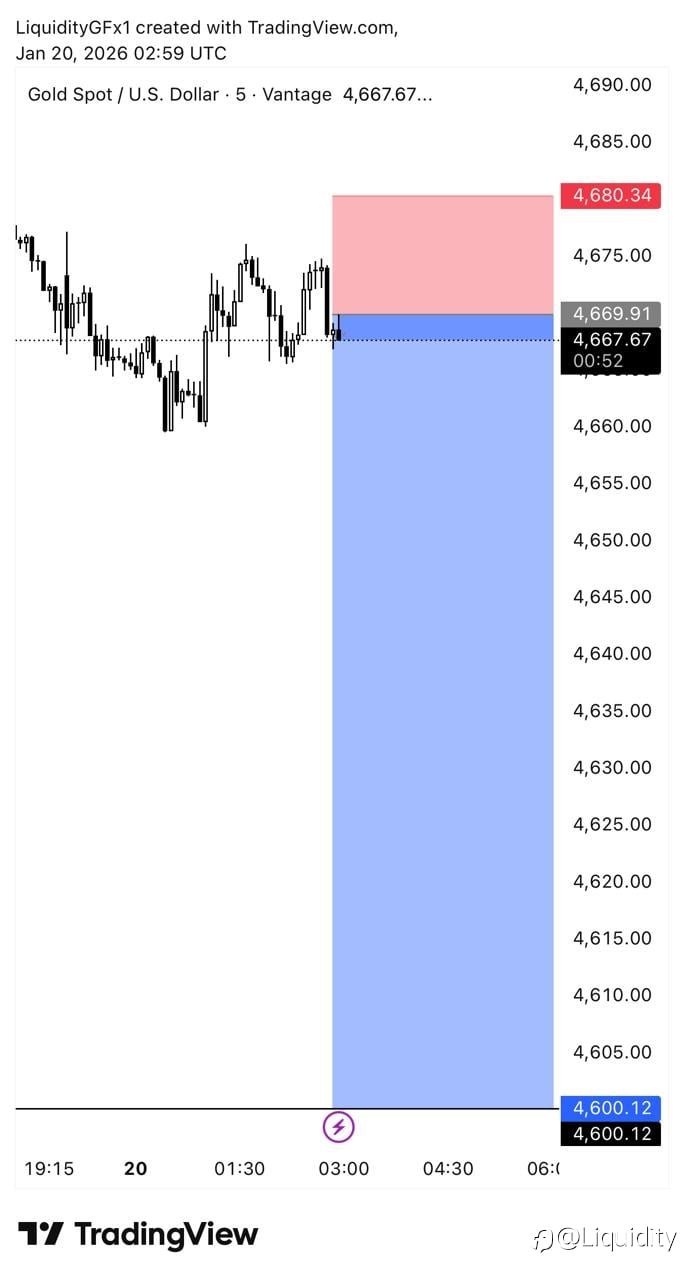

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,421.28/4,422.79

- Volume Buy 20 Flots

- Profit 3,020.00 USD

Liked

Liked

Liked

Gold (XAU/USD) - Technical Analysis

1. Gold (XAU/USD) - Technical AnalysisBias: Bullish (Buy Side favored). The rise in unemployment to 4.6% is the primary driver here, fueling bets that the Fed will cut rates aggressively in 2026. This weakens the Dollar and boosts Gold. Current Price Structure: Gold has confirmed a breakout abo

Liked

مقابر شرعية للبيع… راحةٌ أبدية تبدأ بخطوةٍ مطمئنة – احجز

قد لا نُفكر كثيرًا في الأمر، لكن حجز مقابر للبيع بات ضرورة تنظيمية تضمن الراحة النفسية للأهل في الأوقات الحرجة. نحن نوفّر لك مدافن مجهزة بالكامل، قانونية، ومُراعية لأحكام الشريعة الإسلامية، في مواقع هادئة ومنظمة، بعيدًا عن الازدحام أو المناطق العشوائية. الخدمة ليست مجرد بيع قطعة أرض، بل هي

Liked

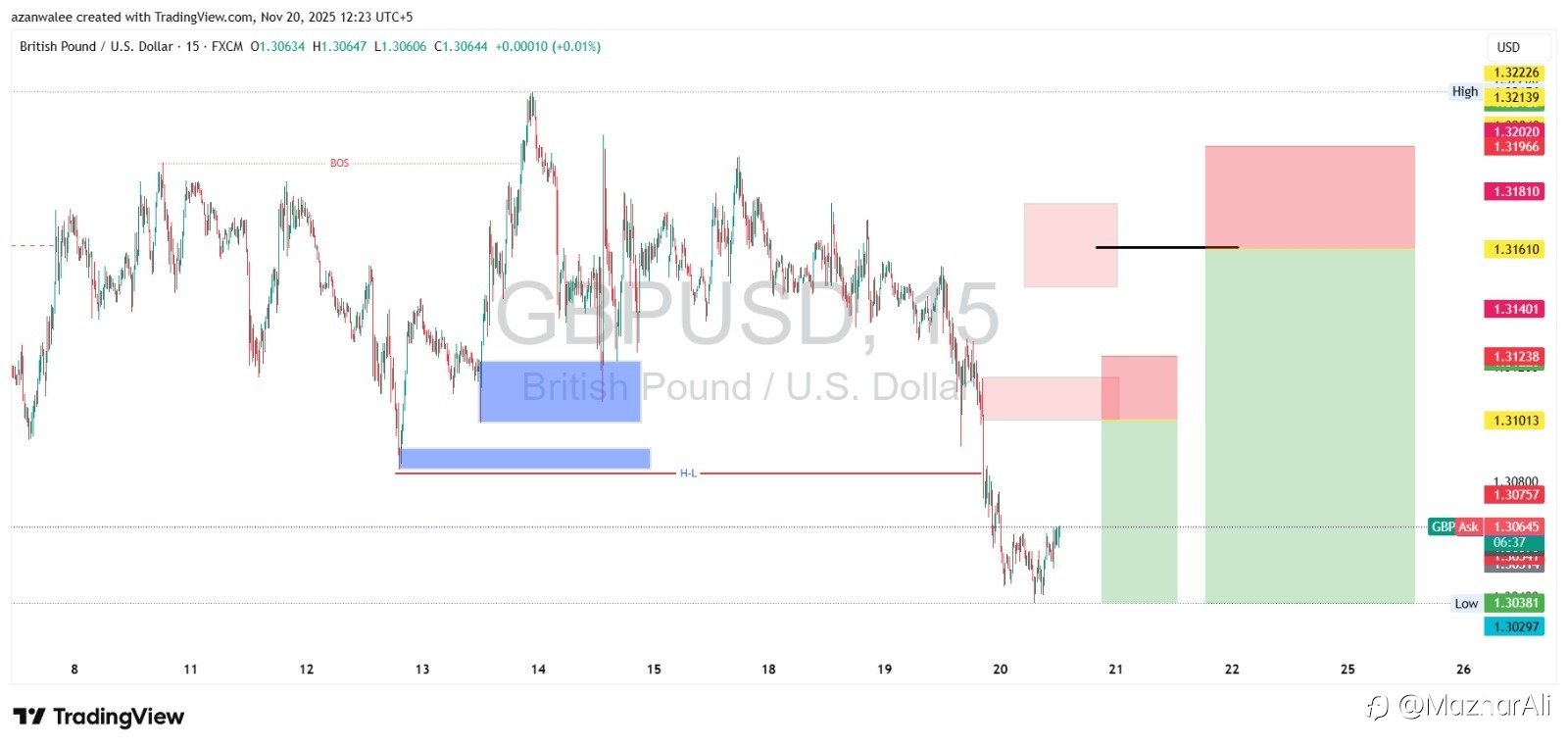

📉 GBPUSD Analysis Market Structure & Trade Outlook (15M Timeframe)

GBPUSDis currently respecting a clear bearish market structure after breaking below the recent Higher-Low (HL) level. The Break of Structure (BOS) confirmed bearish control, pushing price into a new downside leg. 🔻 Market Structure Price has created a fresh lower low, confirming continuation of the

Liked

Profit by Following

444.76

USD

- Symbol XAU/USD

- Trading Account #2 20027151

- Broker KVB

- Open/Close Price 4,052.18/4,066.73

- Volume Buy 0.2 Flots

- Profit 291.00 USD