© 2026 Followme

Liked

Liked

Why Cryptocurrency Scams Still Work: It’s All About Trust and Manipulation

As someone who’s witnessed countless scams come and go, Taiwan’s dismantling of the crypto-linked investment fraud ring feels familiar, but also deeply concerning. What strikes me about this case is the psychological manipulation involved. Scammers are no longer relying on c

Liked

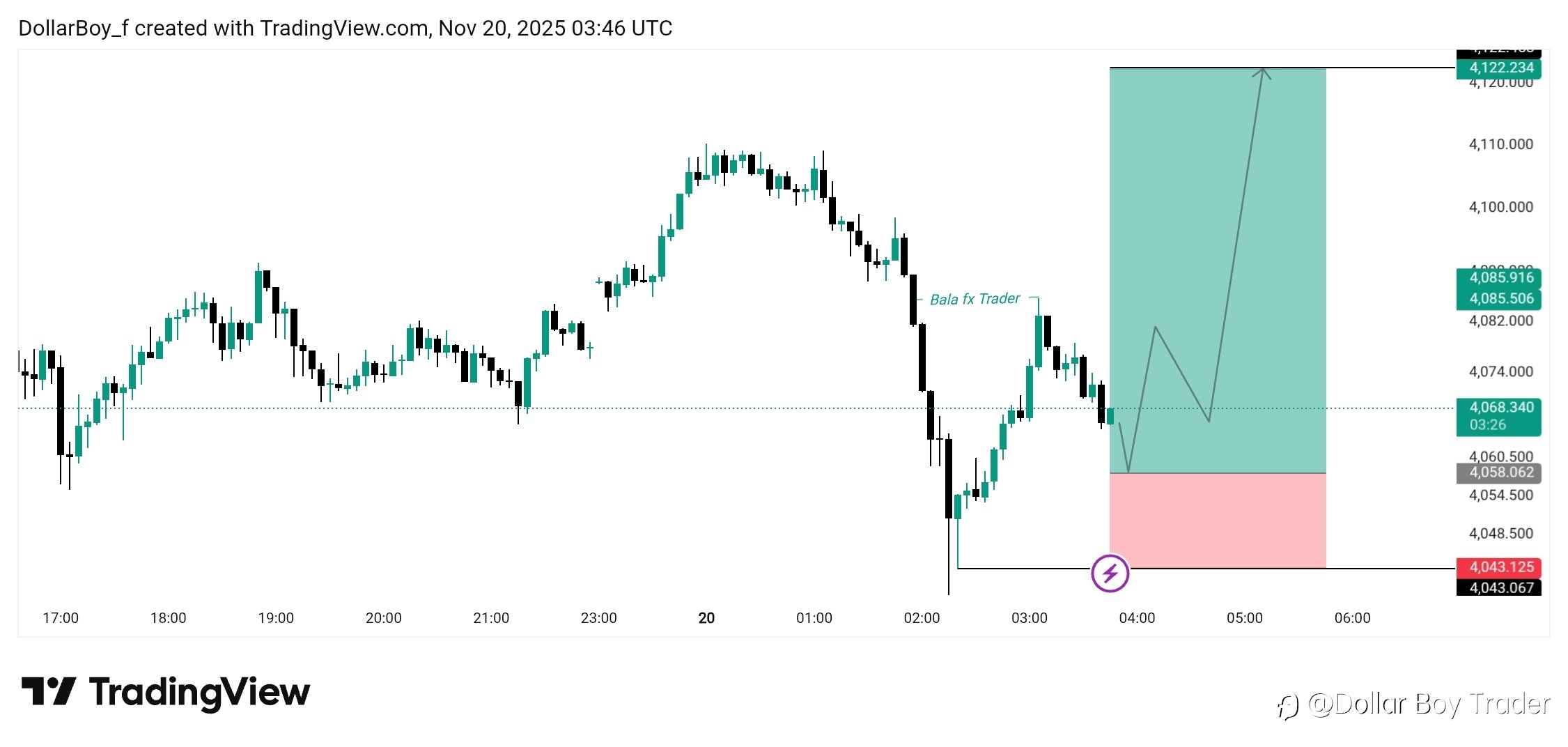

XAU/USD Alert – Gold shines as Greenland tariff talk shakes markets

XAU/USD Alert – Gold shines as Greenland tariff talk shakes markets Gold just rewrote the highs again. A fresh wave of Greenland-linked tariff headlines flipped the market into risk-off mode, sending traders back to safe havens as XAU/USD momentum accelerated. Gold surged on renewed geop

Liked

Liked

2026 Market Crystal Ball: Bold Bets on USDJPY, EURUSD, Gold, Silver, Oil, and Bitcoin

As we close out 2025 with markets in flux, I'm channeling my 15+ years as a pro trader to forecast 2026's wild ride. Trump's policies, Fed pauses, and global tensions will dominate, creating winners in safe-havens and losers in energy. Expect volatility spikes mid-year, but trends favor dollar stren

Tickmill

Liked

Liked

Liked