© 2026 Followme

Liked

Liked

Liked

Profit by Following

148.28

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,627.93/4,613.53

- Volume Sell 2 Flots

- Profit 2,880.00 USD

Liked

Liked

Profit by Following

196

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,421.07/4,423.07

- Volume Buy 20 Flots

- Profit 4,000.00 USD

Liked

Liked

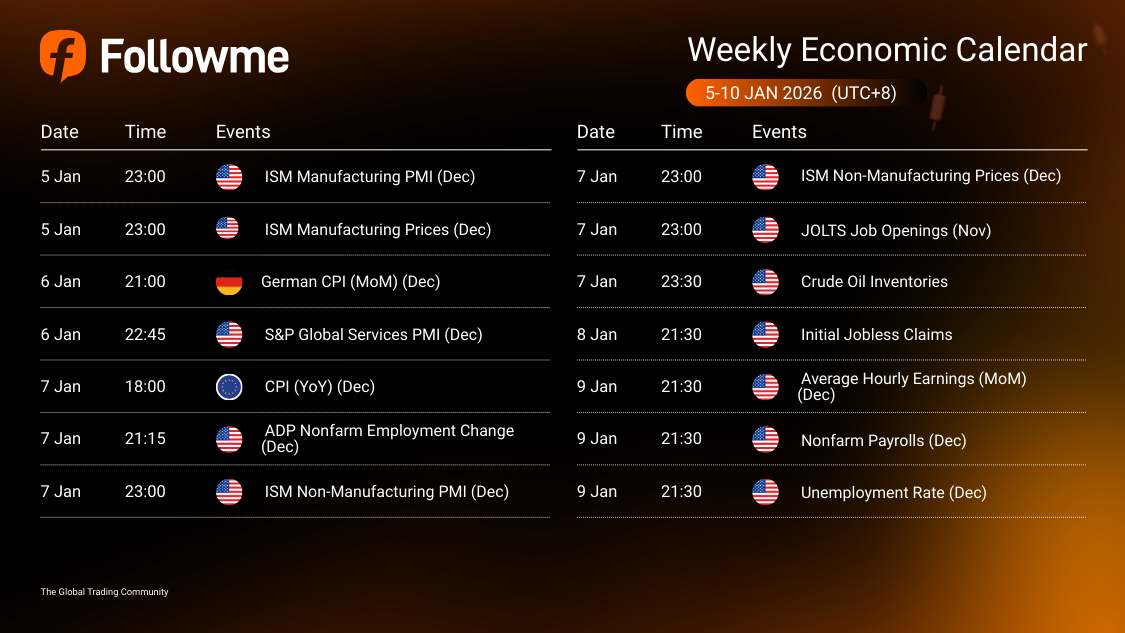

Weekly Economic Calendar: Week of January 5-10, 2026

Weekly Economic Calendar: Week of January 5 - 10, 2026 (GMT+8) This week’s macro calendar is driven by U.S. growth + labour risk and Europe’s inflation prints, with key releases that can swing USD pairs, EUR crosses, rates, and broad risk sentiment. Expect the sharpest moves around the U

Liked

More Than 10,000 Victims Prove One Truth: Guaranteed Profits Are Never Real

As someone still early in my trading journey, reading about how tens of thousands of people were pulled into this scheme honestly scares me. When you’re new, hearing about 100% annual returns can sound like a dream, especially if it’s presented through multiple companies and struc

Liked

Liked

Profit by Following

370.8

USD

- Symbol XAU/USD

- Trading Account #2 20027151

- Broker KVB

- Open/Close Price 4,484.36/4,492

- Volume Buy 0.15 Flots

- Profit 114.60 USD

Liked

CADJPY Elliott Wave: Blue Box Buy Setup Explained

Hello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in CADJPY. The forex pair completed this correction precisely at the Equal Legs zone, referred to as the Bl