© 2026 Followme

Liked

Tín Hiệu | Liệu Đây Có Phải Là Một Nhà Giao Dịch Chiến Lược Martin Không?

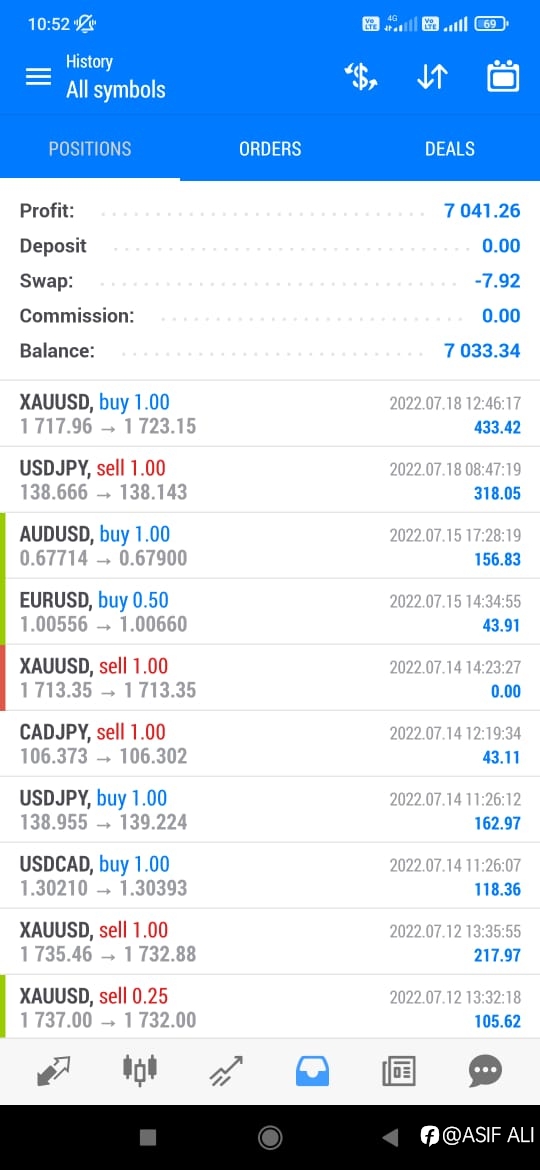

Tên: @angkaryong Quốc gia: Malaysia Nhà môi giới: #BrightWin Global# Nhận xét sơ bộ: Hôm nay hãy nói về một tín hiệu đến từ Malaysia @angkaryong - tài khoản #3 Theo quy tắc cũ, đầu tiên, hãy nhìn vào dữ liệu chính xác. Tỷ lệ thắng 68,98% và tỷ lệ lãi/lỗ 0,98 là khá khả q

Liked

Liked

Liked

Liked

Powell Sparks Buy Everything Rally

#OPINIONLEADER# You had the feeling that Wall Street, with perpetually itchy buy-button trigger fingers, was primed for this FOMC. As expected, the FOMC raised the Fed Funds target by 0.75%, to a target range of 2.25%-2.50%. It was what Mr Powell said afterwards that turbocharged the

Liked

Liked

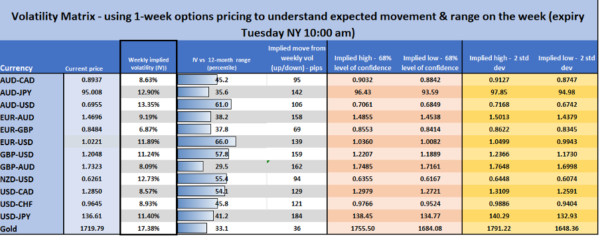

FOMC Preview – Assessing the Balance of Risk for Traders

#OPINIONLEADER# In a world where nearly all central banks are delivering hawkish surprises (certainly relative to their own guidance), it’s the Fed’s turn to step up – one of the many roles as traders is to assess the risk of shock and it becoming a volatility (vol) event and to decid

Liked

Liked

Liked

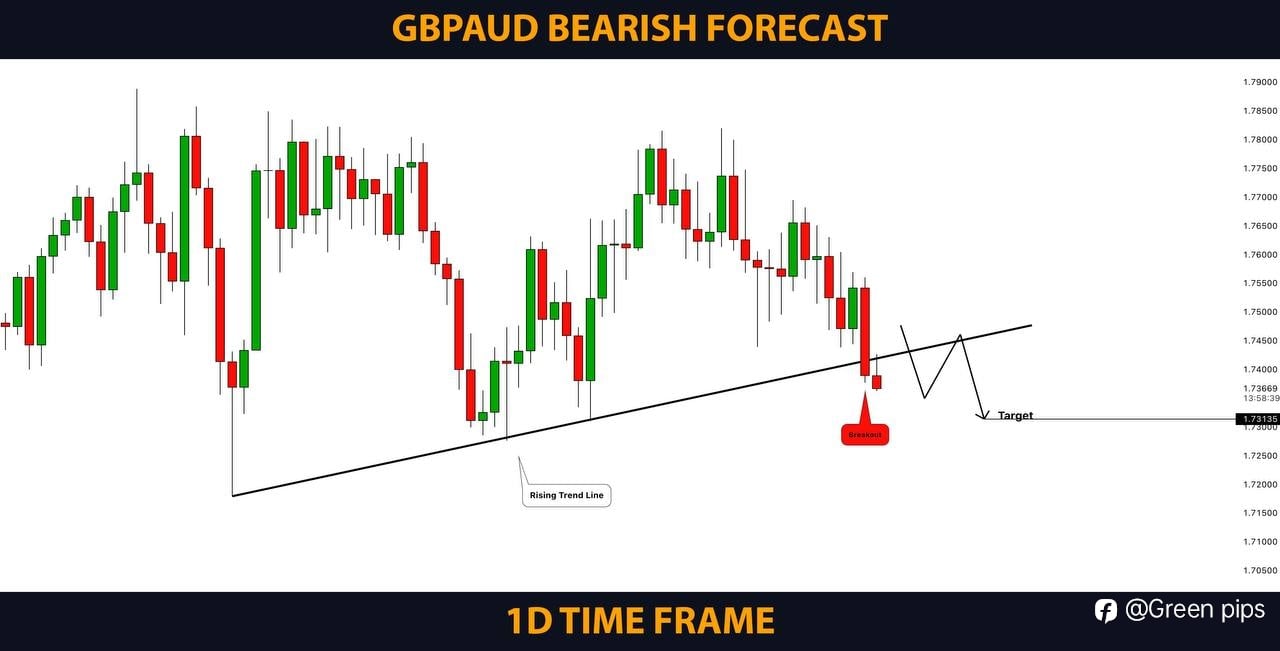

AUDUSD - Bearish Butterfly

A Bearish Butterfly rested in the key resistance zone is usually a perfect setup for me, however, there is some imperfection in this setup. A break and close above the previous Bearish Trendline. This is true, but at least it didn't break and close above previous structure, the finger cross. The nex