[Forecast] Key Events for XAU/USD this week

Here are the key events that could impact XAU/USD this week: See full calendar (4-8 August 2025) from Followme Official Account here 📍 Tuesday, August 5, 2025 🕙 10:00 ET – ISM Non-Manufacturing PMI (Jul) ➡️ Previous: 50.8 | Forecast: 51.5 📉 PMI trending upward = economic growth = bear

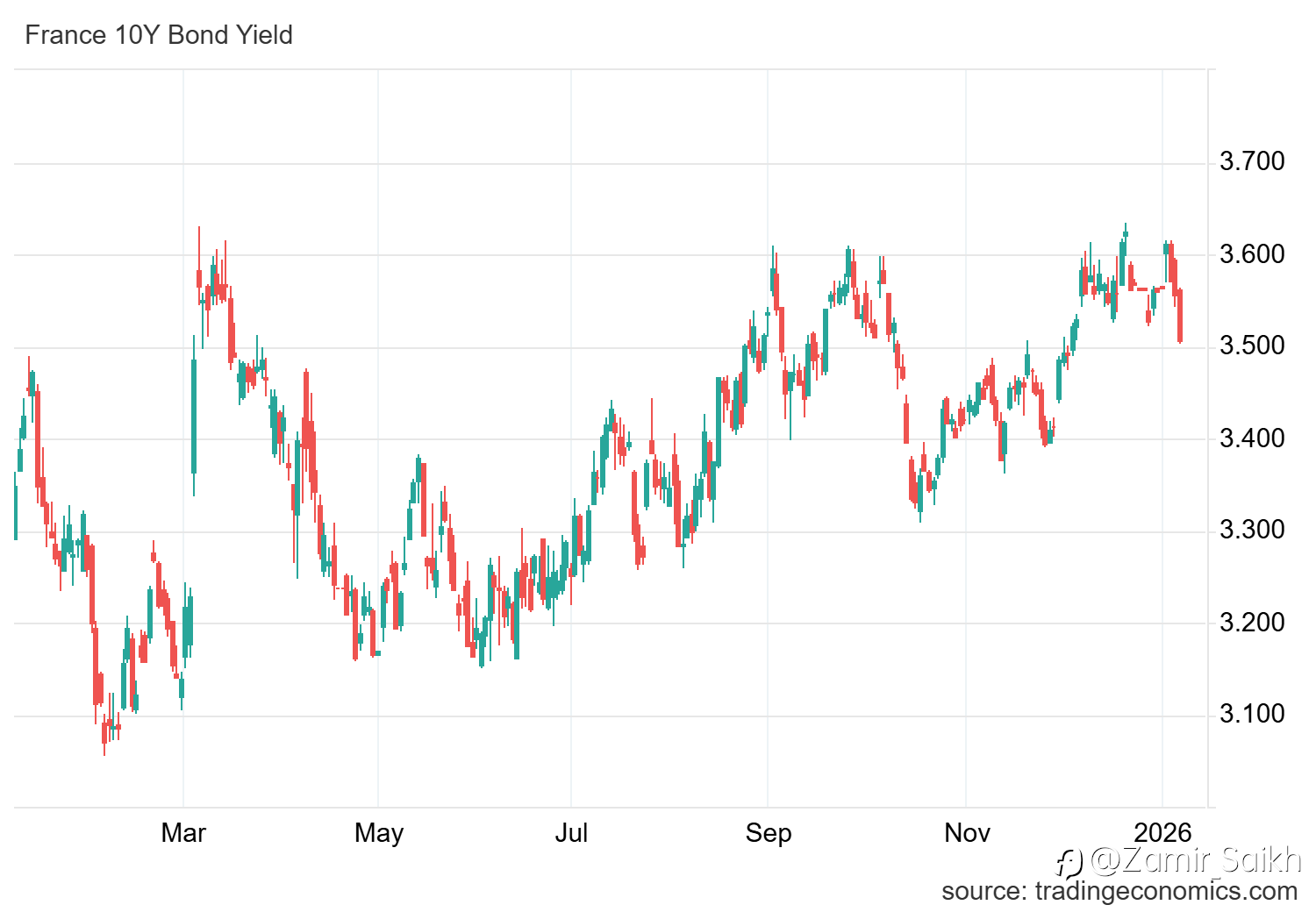

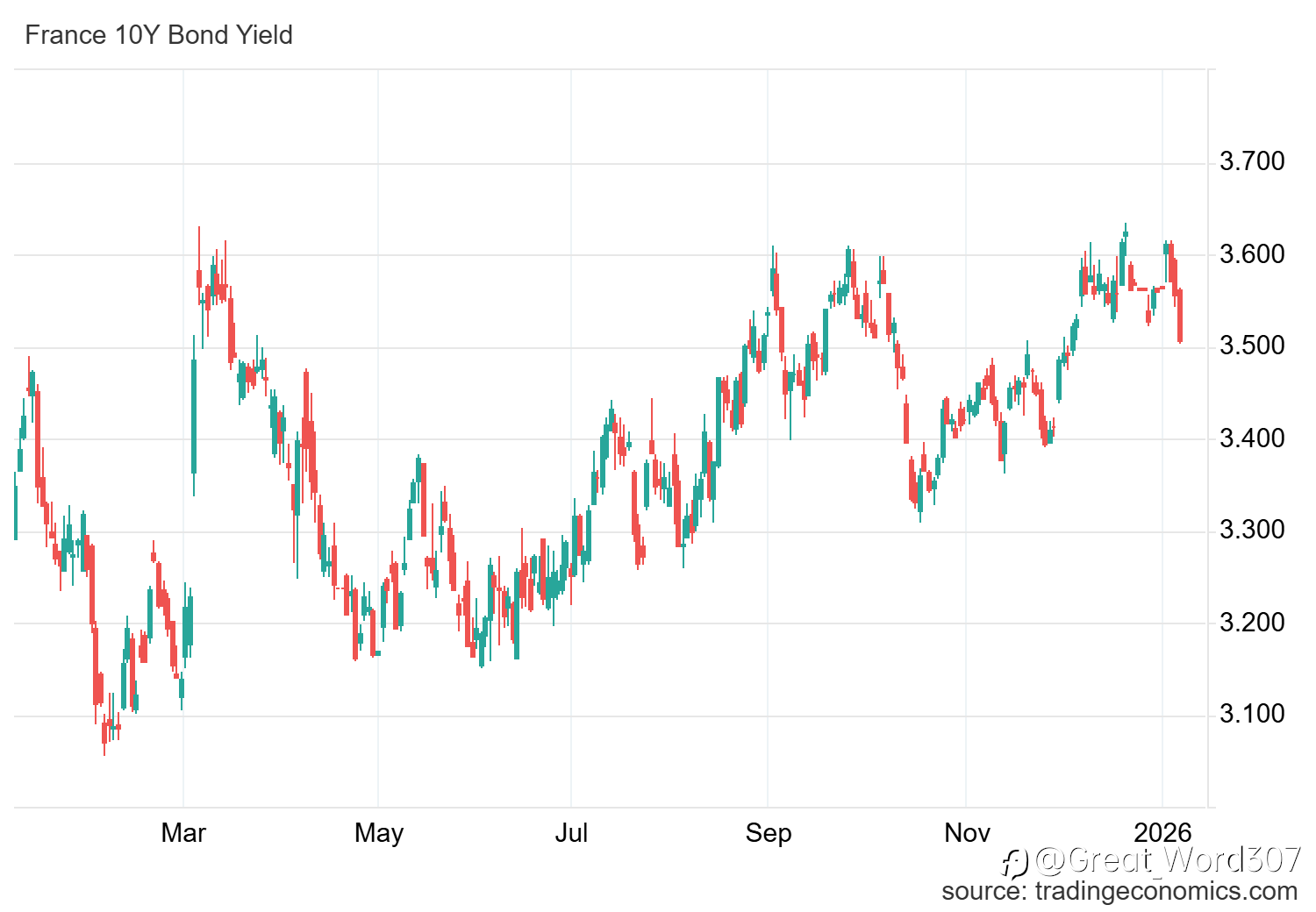

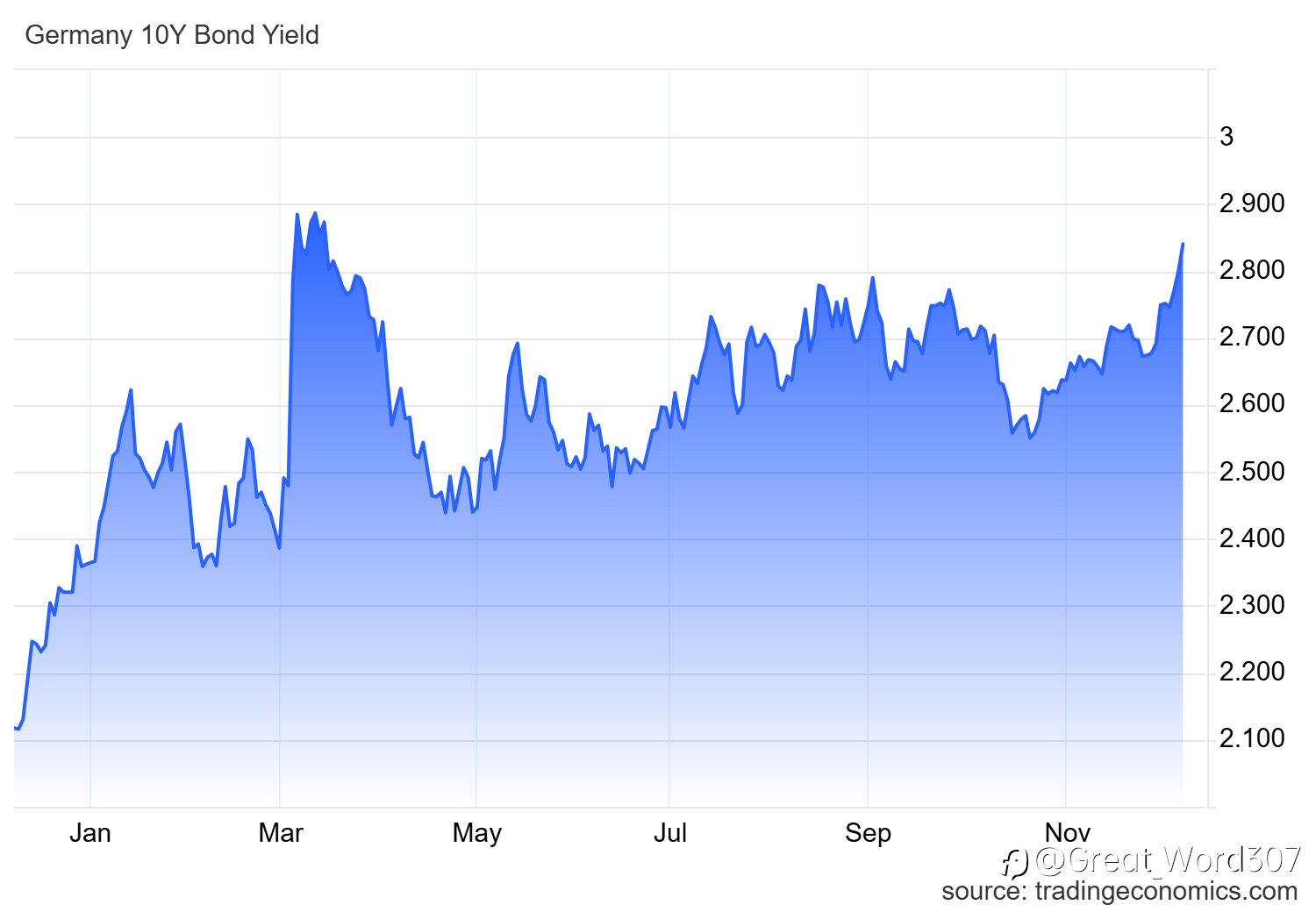

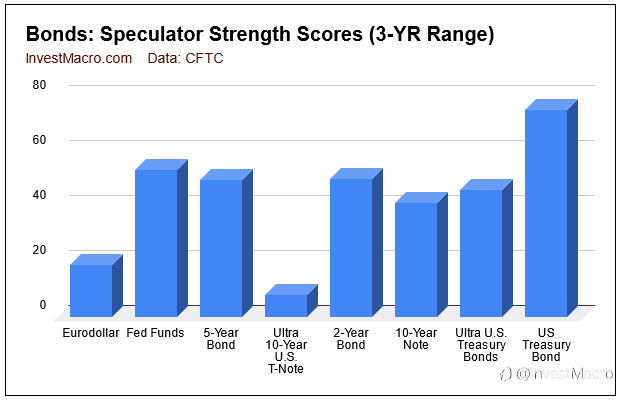

🚨US 10Y Treasury yield on the rise, but bond bears joy could be cut short by July 💰👏🏻

The recent movements in the 10-year Treasury yield have captured attention as it broke out of its established range due to hawkish statements from Federal Reserve officials and weaker Treasury auction results. However, analysts suggest that the grip of bond bears might not strengthen significantly a

美国8月CPI即将来袭!黄金会...🤔

【基本面】 本周一表现平平的三年期美国国债标售,周二350亿美元的十年期美债标售甚至显得强劲,竞购倍数和海外买家获配比都高于近期均值。二级市场美债收益率周二小幅波动,投资者静候周三CPI公布。整体而论,请投资者务必留意今晚20:30美国8月CPI数据,考量美债收益率仍处高位,加上美汇指数仍处于上行走势,黄金以偏空布局为主要思路。 【技术面】 观察黄金日线图,黄金在上冲至1931美元后便开启下跌走势。此外副指标MACD正值柱状体持续收敛并转为负值,加上KD双线下弯且已跌破高位区,这都将有利投资者偏空布局。整体而论,考量基本面因素(美债收益率与美汇指数可能持续上涨),数据上投资者务必留意今晚CP

美国7月非农创3年新低,黄金会...🤔

1. 美国7月非农新增就业18.7万,不仅低于预期且创近三年新低,失业率降至3.5%维持历史低位且低于预期,平均时薪同比增长4.4%高于预期。 2. 美联储官员表示劳动力市场将继续冷却,应考虑高利率水平会维持多久。 3. 有“新美联储通讯社”之称的Nick Timiraos表示这将缓解美联储下次会议的加息压力。 日线级别来看,黄金仍维持上行格局,只要不破前低(1893美元)就有机会形成破底翻(破了前低则可能形成头肩顶看跌形态)。 以4小时级别图而论,黄金确实有可能形成破底翻格局,此外上周五非农数据黄金向下插针假跌破最后收涨形成2B看涨形态,且向下插针的最低位为斐波那契回撤0.66位,这都将有利

BEST DISCOUNT BROKER - Fidelity Review

Photo: Pininterest Recommended for investors and traders looking for solid research and great trading platforms Fidelity is a US stockbroker founded in the year 1946. It is regulated by top-tier authorities like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Autho