#Fedcuts#

1.09k View

103 Discuss

For the first time in 11 years, The Federal Reserve cut interest rates Wednesday.

The Fed dan Dampak Kebijakan Suku Bunga Akhir 2025 ke Pasar Forex

Pasar kini menghadapi ketidakpastian tajam menjelang keputusan suku bunga The Fed Desember 2025. Data ekonomi yang tidak lengkap akibat government shutdown AS, tekanan inflasi yang masih tinggi, dan perbedaan pandangan di internal Federal Reserve menciptakan dilema kebijakan nyata bagi investor dan

Fed Cuts 25 bps — Powell Signals “No Guarantee” for December

The Federal Reserve met market expectations last night, Wednesday, October 29, 2025, by cutting its benchmark interest rate for the second time this year. The Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 basis points (bps), bringing the target range down to 3.75%–4

📈 Market analysis: JPMorgan Forecasts Strong 8% Growth for S&P 500, Lifts 2025 Target

JPMorgan raised its 2025 S&P 500 target to 6,500, up from its prior 2024 estimate of 4,200, citing U.S. economic strength, AI growth, and consumer resilience. It forecasts 10% earnings growth, with Fed rate cuts expected to sustain market momentum. 📘Read the full analysis here: https://www.kvbp

"Berkah" dari The Fed yang Bikin Trader Sakit Hati

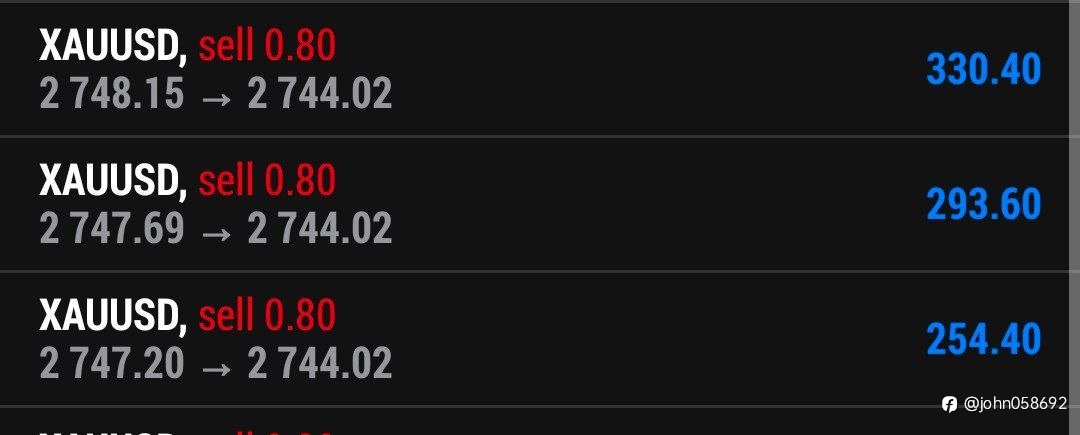

The Fed akhirnya memotong suku bunga! Tapi bagi trader, momen pengumuman adalah chaos total Kenapa Bisa Gitu? Pasar sudah lebih dulu naik karena anticipasi kabar baik (buy the rumor). Pas kabar beneran keluar, malah pada jual semua buat ambil untung (sell the news). Alhasil, harga jeblok dan

- Crypto recovery services :Are you a victim of loss crypto Text me directly to recover immediately

ECB Cuts Rates Again – What’s Next for the Eurozone? 🇪🇺

🟢 Rate Cut: ECB drops interest rates from 3.40% to 3.15%, with the deposit rate now at 3.00%. 🟢 Reason: The eurozone economy struggles with weak growth, political drama, and global trade jitters. 🟢 Market outlook: More rate cuts might be coming soon, as inflation is expected to settle at 2% by ea

🚨Fed cuts rates by 0.25% amid ongoing progress against inflation 📈

The Federal Reserve cut interest rates by 25 basis points to 4.50%-4.75% due to inflation control and a cooling labor market. This smaller cut follows a 50-basis-point reduction in September. Fed Chair Jerome Powell noted that the labor market is less inflationary now. With Donald Trump’s election,

🇺🇸 US Interest Rate Decision: How Will the Election Impact the Fed’s Next Move?

🟢 Rate Cut: The Federal Reserve lowered the federal funds target range by 25 basis points to 4.5%-4.75%, following a 50 basis point cut in September. 🟢 Data-Driven Decisions: Chair Jerome Powell emphasized that the Fed will continue to assess incoming data and economic risks on a meeting-by-meetin

🚨Fed cắt giảm lãi suất 0,25% trong bối cảnh tiếp tục kiểm soát lạm phát 📈

Cục Dự trữ Liên bang (Fed) đã giảm lãi suất 25 điểm cơ bản xuống còn 4,50%-4,75% do kiểm soát lạm phát và thị trường lao động hạ nhiệt. Mức cắt giảm này nhỏ hơn so với việc giảm 50 điểm cơ bản vào tháng 9. Chủ tịch Fed Jerome Powell cho biết thị trường lao động hiện ít gây lạm phát hơn. Với việc Don

🚨Powell ám chỉ Fed sẽ tiếp tục cắt giảm lãi suất, nhưng lộ trình không được định trước 📊

Chủ tịch Cục Dự trữ Liên bang Jerome Powell cho biết Fed sẽ tiếp tục điều chỉnh lãi suất theo hướng trung lập hơn, nhưng nhấn mạnh rằng các quyết định lãi suất trong tương lai sẽ phụ thuộc vào dữ liệu kinh tế và được thực hiện từng cuộc họp một. Mức lãi suất trung lập không kích thích cũng không kìm