After the US close, it’s the Tokyo CPI

Outlook

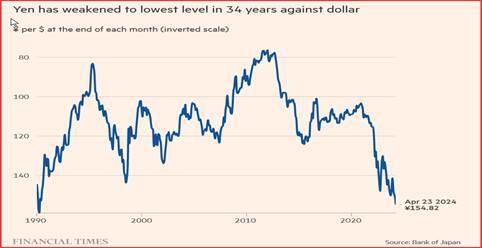

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%, and Trading Economics says the consensus forecast is 2.7% but it offers 2.7%. This looks like how many angels can dance but it’s a big deal in Japan after decades of deflation. The latest highest high is 155.75, the worst quote in three decades.

We dismissed yen intervention talk over the past few weeks, but the day of reckoning may well be upon us. See the chart from the FT. “Historic” levels don’t appear all that often but can have a big effect on sentiment, in this case, in Tokyo. Besides, Mr. Ueda seems to be a little different from the usual BoJ chief. Not too different, but perhaps more of a straight-shooter. You go long USD/JPY at your peril.

Forecast: We may tread water today. The most important data is tomorrow’s consumer income and spending with the accompanying PCE and core PCE. Headline PCE is forecast at 2.6% y/y (vs. CPI at 3.5%).

Remember that it was the March CPI that drove yields up in early April. The WSJ reports just ahead of CPI, the 10-year was 4.652%. Today it’s 4.65%, or no change. “Perhaps an upbeat report on Friday could boost optimism that the Fed might cut rates this year, and help send yields back down.” This now adds another voice to the FT and others pointing out that when you reduce the effect of shelter, inflation is not so bad, if with some sticky stuff.

We hesitate to say this possibility is driving anything, although it may be causing some position-adjustment. But the fact remains, the dollar is softer across the board (except the yuan). There are multiple triggers for the move, including renewed appetite for risk on stalemate in the Middle East, rising Bund yields, chatter about the US economy slowing while some Europeans are thriving, and so on—take your pick.

The outlook is binary. Favorable PCE = yield and dollar drop. Highish CPE = yields stay high, dollar recovers.

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market.

(Help the current White House).

PCE Watch: Conventional wisdom has PCE will rise a bit to 2.6% annualized on higher energy costs. Core is expected to rise 0.3% m/m, about the same as Feb (Bloomberg).

But as we have been writing, some nay-sayers are out in force. The FT, Yardeni and Truflation all indicate that if you modify the awful shelter contribution, which is lower in the PCE (15%) than in CPI (36%) anyway, actual inflation is close enough to the target to make a rate cut plausible. Now the WSJ adds a whisper that this is possible.

Bottom line, it’s still a minority opinion that inflation is not as bad as we think, and the minority view does not push yields. It’s yields and geopolitical uncertainty that are driving the dollar these days. Besides, the Fed does not fiddle with the data it is given, although it probably wishes it could. So, grain of salt.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.