The ES can't hold a bid, this correction isn't over

In the big picture, stocks are expensive and bonds are cheap

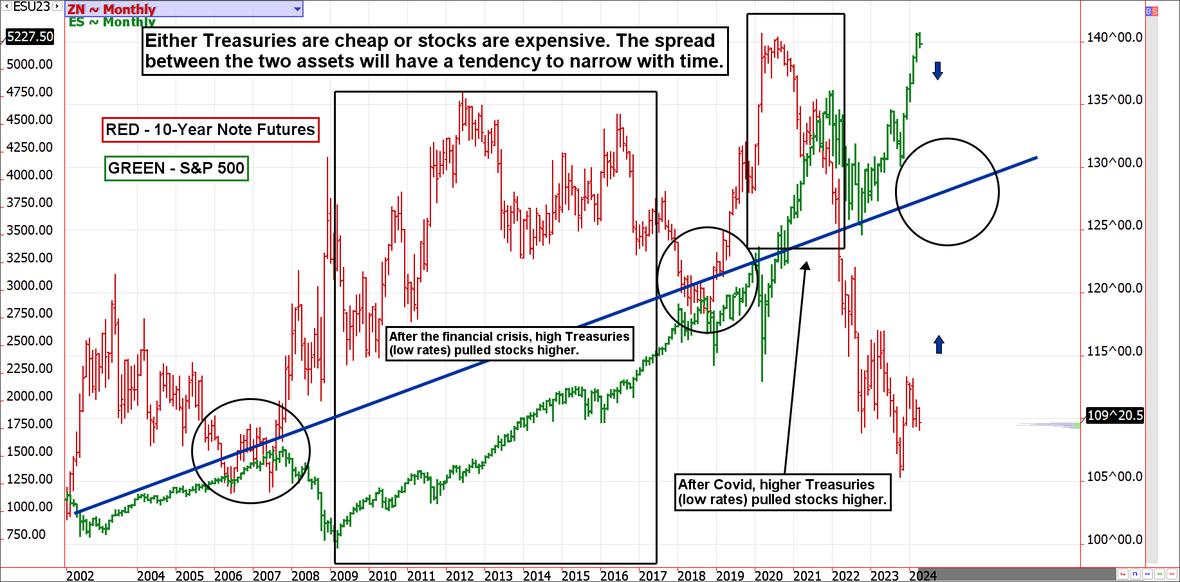

The aggressive stimulus and liquidity injection of 2020 have left us with an environment of aggressive speculation in which market participants chase prices higher without regard to risk. Just like too many dollars chasing too few goods caused inflation, assets have increased in value as too many investment dollars make their way into a handful of assets. The US stock market has always increased steadily over time, but the slope of gains forged in recent years is unnatural. Further, higher interest rates have created competition for investment dollars; Treasury buyers are paid 4.5% to 5.0% interest to wait for the next shoe to drop, at which time they could benefit from price appreciation. Warren Buffet referred to this market cycle as a casino; I live in Vegas and know the house always wins.

Short-term timing is difficult, but in the large picture the spread between equities and fixed income assets is unsustainably wide. The S&P 500 dividend yield is just over a percentage point, so there isn't much of an income risk buffer for investments in equities.

Further, the downside risk in holding stocks probably outweighs the upside profit potential. At the same time, the Treasury markets are at the opposite end of the spectrum. Yields are high, 4.5% to 5% depending on where you are on the curve and prices are highly discounted. Thus, the risk of capital loss is low while the interest income is high.

Treasury futures markets

30-year Treasury Bond Futures

It's hard to believe investors aren't flocking to Treasuries

Treasury traders willing and able to hold to maturity face almost no risk and are paid nicely to wait for the next shoe to drop. At some point between now and the expiration of a 10-year note or 30-year bond, there is bound to be a recession that triggers a large Treasury rally. In short, bondholders get paid nicely while waiting for the next cycle.

The bulls might be out of the woods if the June 30-year bond can close the week over 115.

Treasury futures market consensus:

There are plenty of reasons for investors to buy Treasuries. Will they?

Technical Support: 113'01 and 110'23 ZN: 107'10

Technical Resistance: ZB: 114'31, 116'13, 119'04, 120'18, 122'09 ZN: 109'01, 109'20, 110'12, 110'31, 112'03

Stock Index futures

Rallies are being sold into

Irrational exuberance and complacency seem to have allowed the equity markets to borrow prosperity from the future. It never feels like that is what is happening, but I've yet to see a market with such a steep incline hold gains without a dramatic repricing. In the case of the S&P 500, a more typical trajectory suggests the S&P is fairly valued somewhere around 4500 but the natural price range lies between 4900 and 3900. In 2021, we saw the stock indices trade similarly out of bounds before prices finally succumbed to gravity. We might be in store for a repeat as the market digests progress.

Stock index futures market consensus:

A weekly close below 5200 should confirm the trend change.

Technical Support: 5000, 4900, 4720, 4576, 4475

Technical Resistance: 5225, 5340, 5400, and 5475

E-mini S&P Futures Swing/Day Trading Levels

These are counter-trend entry ideas. The more distant the level, the more reliable, but the less likely it is to get filled

ES Swing/Day Trade Sell Levels: 5120 and 5175 (minor), 5225, 5340, 5410

ES Swing/Day Trade Buy Levels: 5000, 4925, and 4745

In other commodity futures and options markets...

November 14 - Buy July Corn 5.50 calls near 18 cents.

January 9 - Buy July Corn 5.30 calls and sell the 4.40 puts to pay for it.

January 30 - Risk reversals in June Live Cattle, Sell the 190 call and buy the 165 put.

February 5th - Buy May soybean $12.70 call as a flyer.

February 14th - Buy June 10-year note 114 call as a flyer.

February 16 - Replace March ES spread with May 4900/4700 put spread with a short 5350 call to pay for it.

March 1 - Bullish July soybean spread (buy 12.00 call, sell 12.80 call, and sell the 10.80 put to pay for it).

March 18 - Buy December 2024 cocoa 3600 put, just in case the bubble pops.

March 19 - Buy December Yen 7400 calls near 60 points.

March 25 - September natural gas risk reversals: buy the $3.00 call and sell the $2.00 put to pay for it.

April 2 - Cheap and limited risk play in sugar - Buy the July 21.00 put for about 50 points.

April 2 - Bullish 30-year bond spreads; buy the July 119 call, sell the 122 call, and sell the 113 put for near even money.

April 8 - Buy July hog 98 put and sell the 120 call to create a risk reversal (free trade but unlimited risk).

April 9th - July copper butterflies, buy the 4.20 put, sell 2 4.05 puts and buy the 3.90 put for a total cost and risk of 2.25 or $562.50.

April 16 - Buy July Sugar 21.00 calls.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.