Sea of red

Dumping PPI upswing, S&P 500 gave up Thursday‘s Nasdaq outperformance with ease, too much ease – both key supports (5,235 and 5,207) failing, and a close below the CPI low of 5,180 (rounded) is sealing the short-term outlook as bearish – with no more trips to 5,270s. That‘s out of the question, and has nothing to do with Mideast war drums.

Banking earnings didn‘t impress markets either – but I told you that the outlook for earnings is to slow down in Q2, and companies guiding (inordinately) lower, will be punished as the stock market gets more selective. Higher rates are biting all banks simply, and XLF took a dive below its own 50-day moving average Friday already. What good is an upleg without financials?

So, after the break of these three levels, and not even coming for retest of 5,180 from below, the outlook is bearish even if both S&P 500 and Nasdaq closed at their 50-day moving averages – meek bounce or sideways pause at best and then continued decline lower in this week (data starting with manufacturing, retail sales Monday and housing Tuesday) to targets given in the stock market analysis below where I talk select ratios too. It applies as well to Russell 2000, with Jul rate cut odds practically even with keeping them where they are (no, two rate cuts odds by Jul can be absolutely disregarded).

Even the real assets, precious metals spike felt suspicious, and I duly warned of move lower starting – the price action on hourly wasn‘t pretty in either gold or silver. Even oil followed the same pattern, with only copper recovering before the close. Again, more commentary in the individual chart section – I‘ll just say I would be very careful about jumping too fast back into these inflation trades, and I‘m looking also at XLE and Bitcoin.

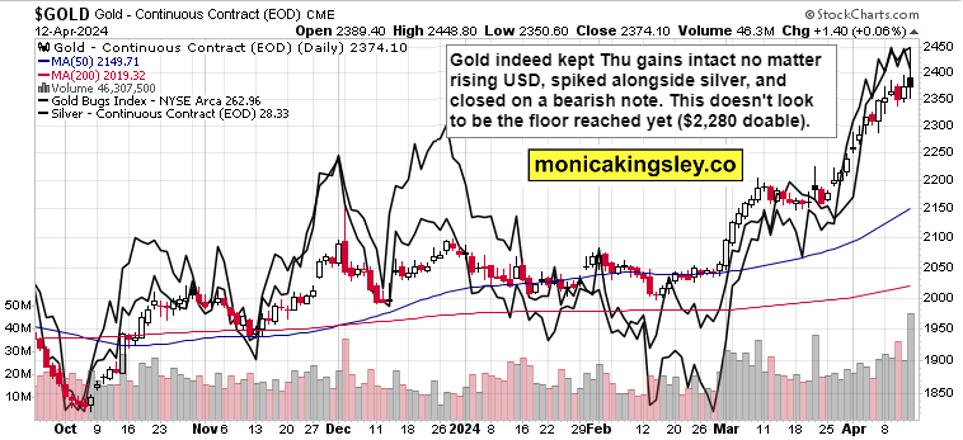

Gold, Silver and Miners

The sky is not so clear for gold now, thanks to the volume Friday‘s candle can be considered as reversal of short-term fortunes. And that concerns of course silver more so than gold, and miners too. Retracing all the Apr gains is possible, and it would shake the confidence of precious metals investors, providing in the weeks rather than days ahead another good swing entry point on the long side.

Source: www.stockcharts.com

Latest rise in CME margins has to be absorbed, and helped fuel gold‘s slide, and that will make the selloff relatively short-lived unless gold in China and India follows lower, which it doesn‘t look to be the case.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.